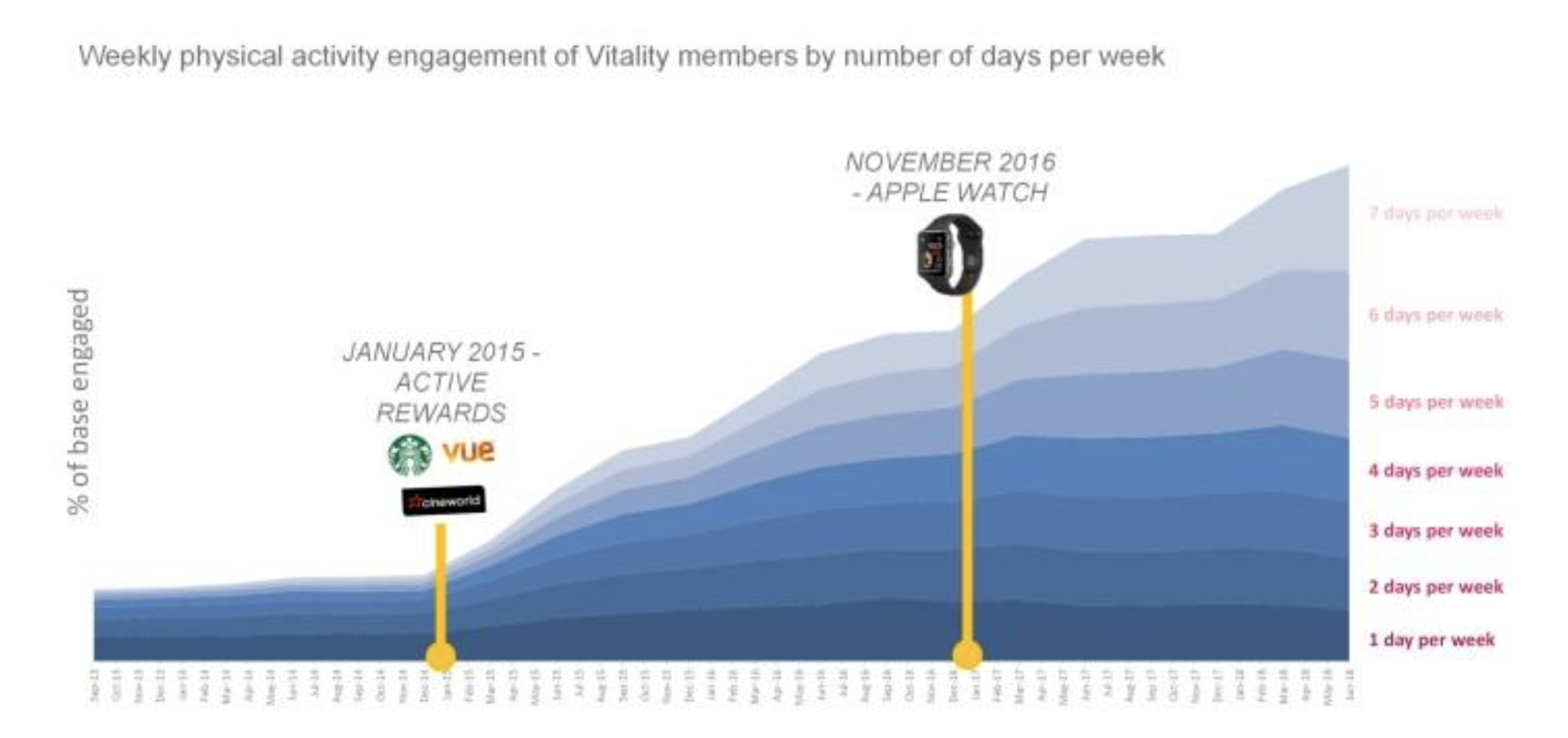

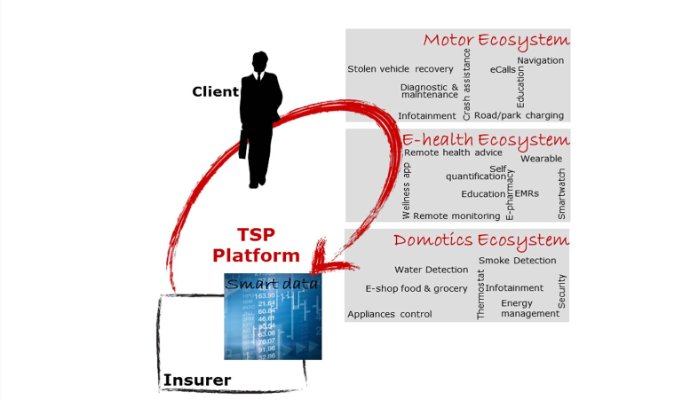

Even a 20% gain in operational efficiency doesn't move the needle enough. The real opportunity is in "connect and protect."

Matteo Carbone

Matteo Carbone is founder and director of the Connected Insurance Observatory and a global insurtech thought leader. He is an author and public speaker who is internationally recognized as an insurance industry strategist with a specialization in innovation.