Once upon a time, insurtechs talked trash about incumbent insurers. Nowadays, they definitely have sweeter words for incumbents.

Lemonade moved from affirming customers' distrust to celebrating a partnership with a "known and trusted for years” incumbent. Similarly, at its last investor day, Hippo dropped the names of previous employers (all well-known Insurance incumbents) of their leadership team members to affirm the credibility of their plans:

As we did recently for Lemonade, (you can read it here), let's dive into Hippo's investor day (here is the entire recording) and quarterly figures.

In a previous edition of this newsletter, I highlighted Hippo's "connected home approach and the embedded component [I like both these elements] and the bloody technical results of their book of business [I don't like them]."

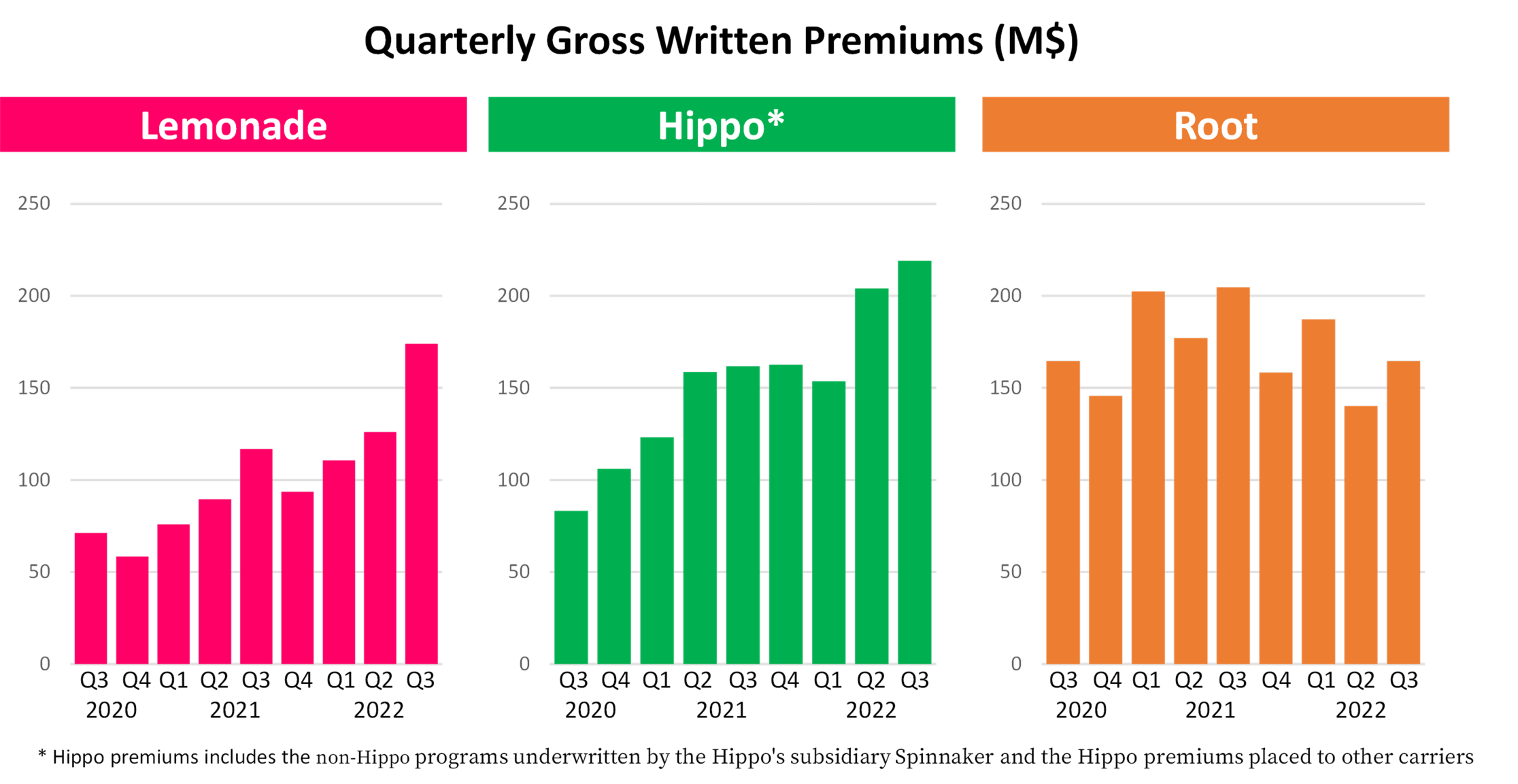

Top Line

The positive signs shown by Hippo in the second quarter have been confirmed in the third.

Loss Ratio

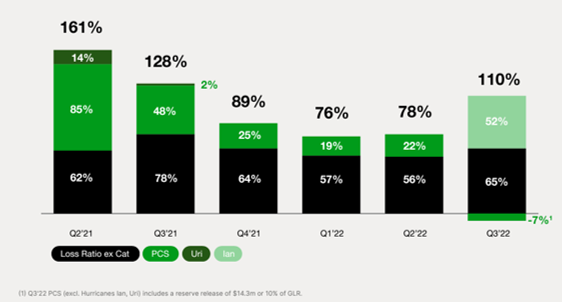

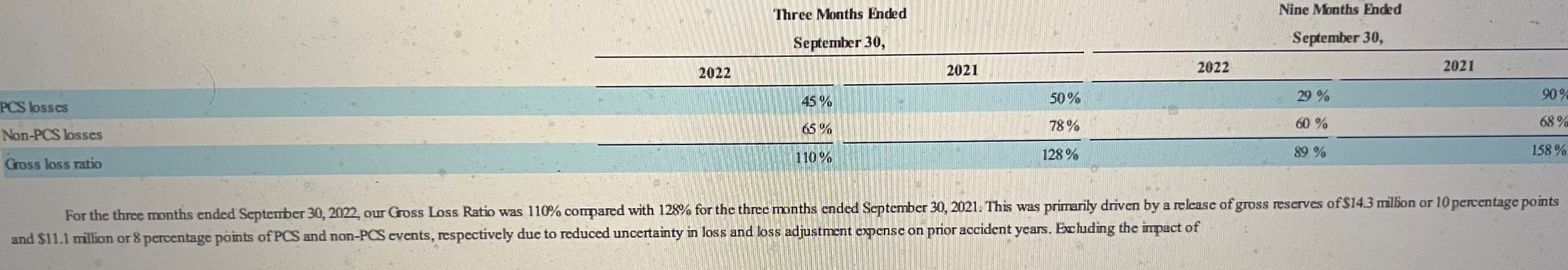

On the claim side, the signs are less positive. Last quarter had a 110% loss ratio, despite seven percentage points of favorable development from claim reserves. The performance was far worse than at the top 10 homeowner insurers even though they had a horrible 98% loss ratio in Q3 '22, according to S&P Global data).

Even acknowledging that the trend is improving from last year, the loss ratio of 89% in the first nine months of 2022 is far from sustainable.

See also: Embedded Insurance Is Everywhere

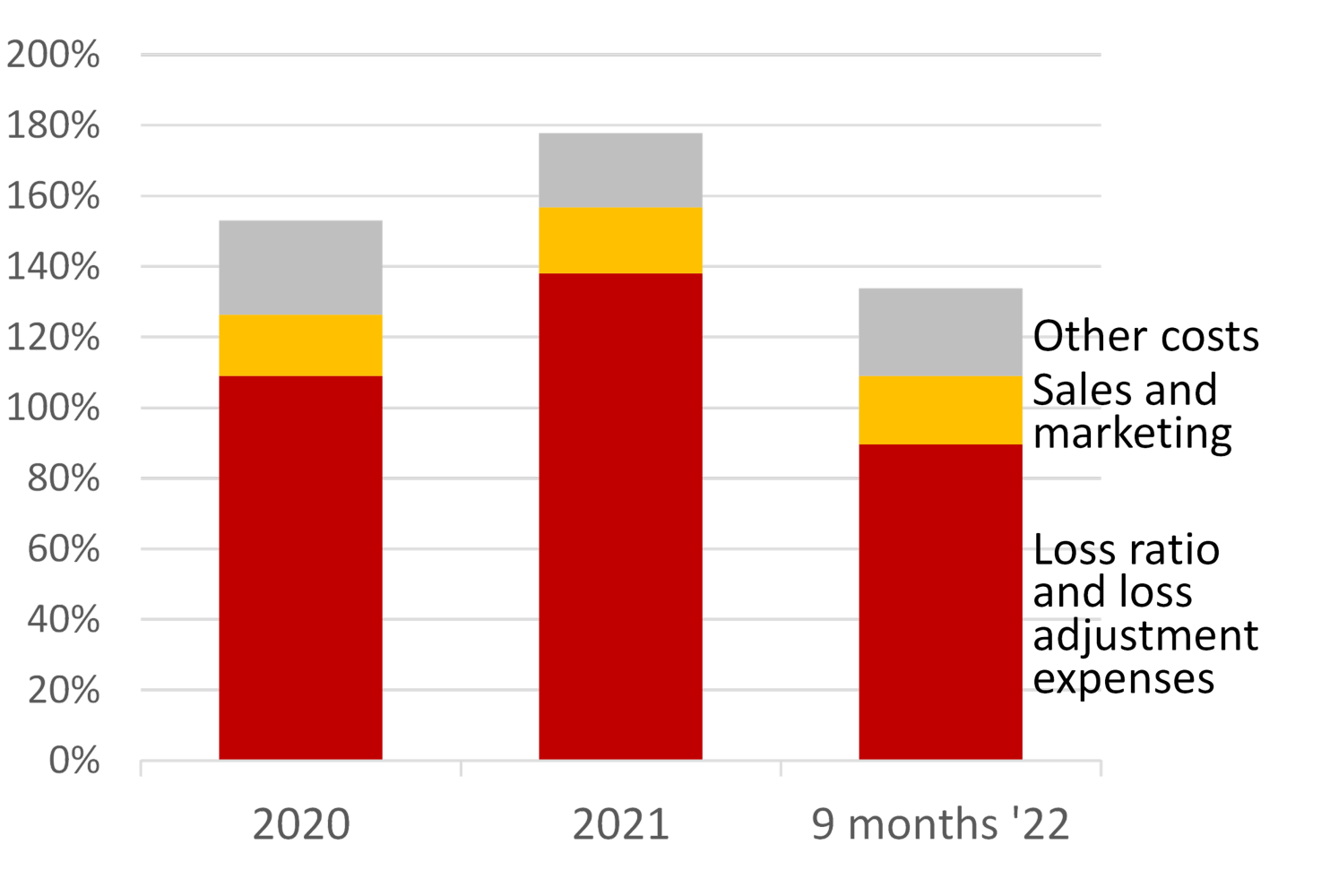

Combined Ratio

And the combined ratio doesn't look good at all... mounting to 138%.

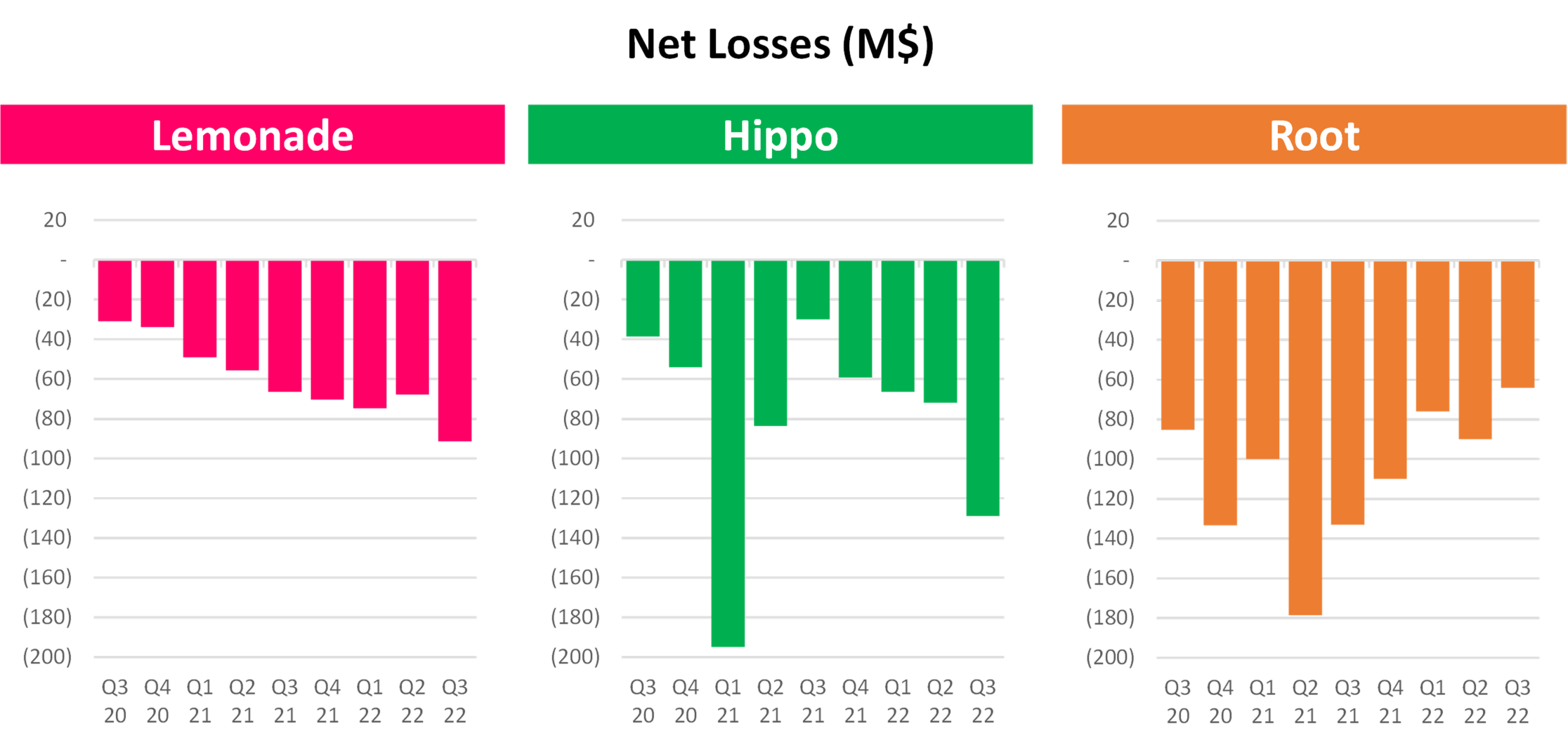

Net Losses

The quarterly losses are still a major concern: $129 million in the third quarter (even if $53.5 million is for goodwill impairment), which brings:

- the cumulative losses for the first nine months of 2022 to $270 million

- the cumulative losses since inception to almost $900 million.

Considering the mounting losses, can a turnaround be quick enough to stop the bleeding before all the cash is gone? In each earnings call, management has reassured investors that they will "reach bottom-line profitability without the need to raise additional capital." However, this is the elephant in the room.

Some of the digital assets presented by Hippo management at the investor day were pretty interesting. Let's look at them:

1) Embedded Distribution. Embedded insurance is the most hyped topic in the sector nowadays, Recently, I commented that "everybody is trying embedding insurance somewhere." However, more people talk about it than are actually selling policies. Well, Hippo performs pretty well with embedded insurance. They created a tech architecture to effectively manage it and an industrialized approach to scale partnerships. About 50% of their homeowner insurance sales in August (maybe they shared this figure just because it was the best month) were from embedded insurance partners. Among these partners, mortgage originators and builders are the best-performing. (It makes sense if you understand the typical behavior of a homeowner insurance policyholder in the U.S.: A survey by the IoT Insurance Observatory a few years ago showed how about 60% of the families interviewed have had the same insurance coverage since they moved to a new home.)

2) Smart Home. This has been an element of Hippo's story since inception. Challenged about the benefits of this technology in some earning calls by analysts, Hippo has talked about acquiring less risky homeowners (more self-selection than a real risk reduction).

I've seen many incumbent insurers doing much more better with he usage of smart home devices. Being a promoter of smart home insurance approaches for a while, I believe their use of this technology is pretty primitive. It is disappointing to hear that the best they can actually do is only to know that a device is still active and to confirm a discount based on that. The IoT paradigm should be used for something better.

3) Home Care and Maintenance Checklist. This tool to engage with the policyholder and influence behavior is definitely more interesting! Initial traction had already been impressive, with half of the policyholders (who downloaded the app) activating Home Care and one-third of those implementing the recommendations. They also implemented a feature to provide a virtual service call. This will probably not affect the loss ratio in the short term but definitely has potential for a return in a few years. (I've already seen positive impacts generated by the usage of QR code-based IoT approaches to promote compliance with safety and maintenance tasks.) Some of the Home Care features seem to be the foundation for monetization. Hippo shared the ambition (even if still has to figure out how) to sell additional services to its customers.

4) Book a pro. Here is the monetization through a platform strategy for home protection services!

One of my 2022 posts that was read the most was about "why should an incumbent buy one of the listed full-stack insurtech carriers?" That was almost a year ago. I was pretty skeptical that there was any rationale for an incumbent.

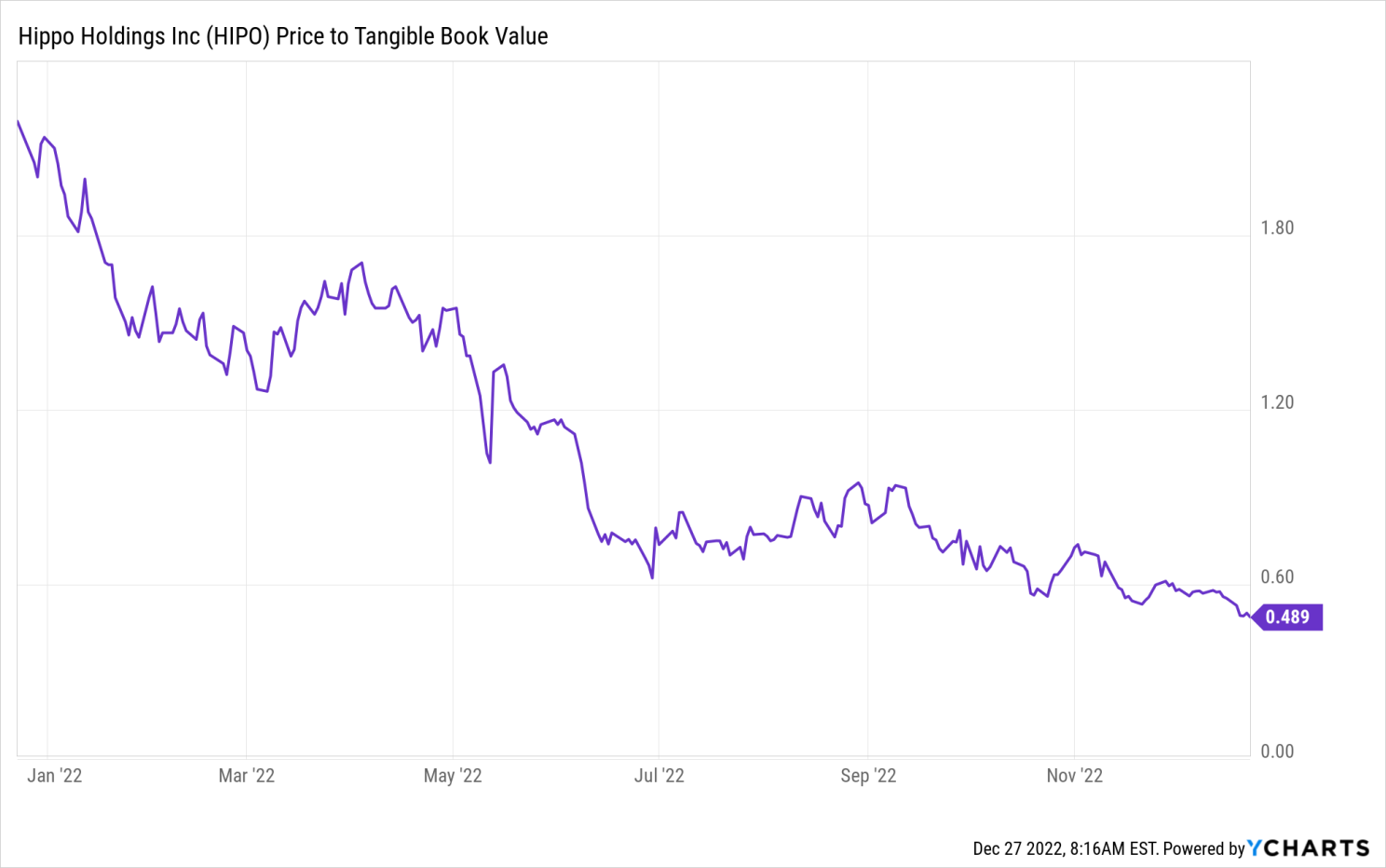

Since then, valuations have dropped significantly. Maybe it is time to consider the opportunity. Hippo's digital assets would generate hundreds of millions of dollars in synergies on the homeowner insurance business of a large incumbent. Moreover, as I write this in late December, Hippo is trading at something below 0.5 their tangible book value. Their market cap is around $270 million (down about 85% in the last 12 months).

I would not be so surprised to see an established U.S. insurance incumbent acquiring them at the current valuation as an answer to the bold innovation moves already done by some of their competitors on homeowner insurance.