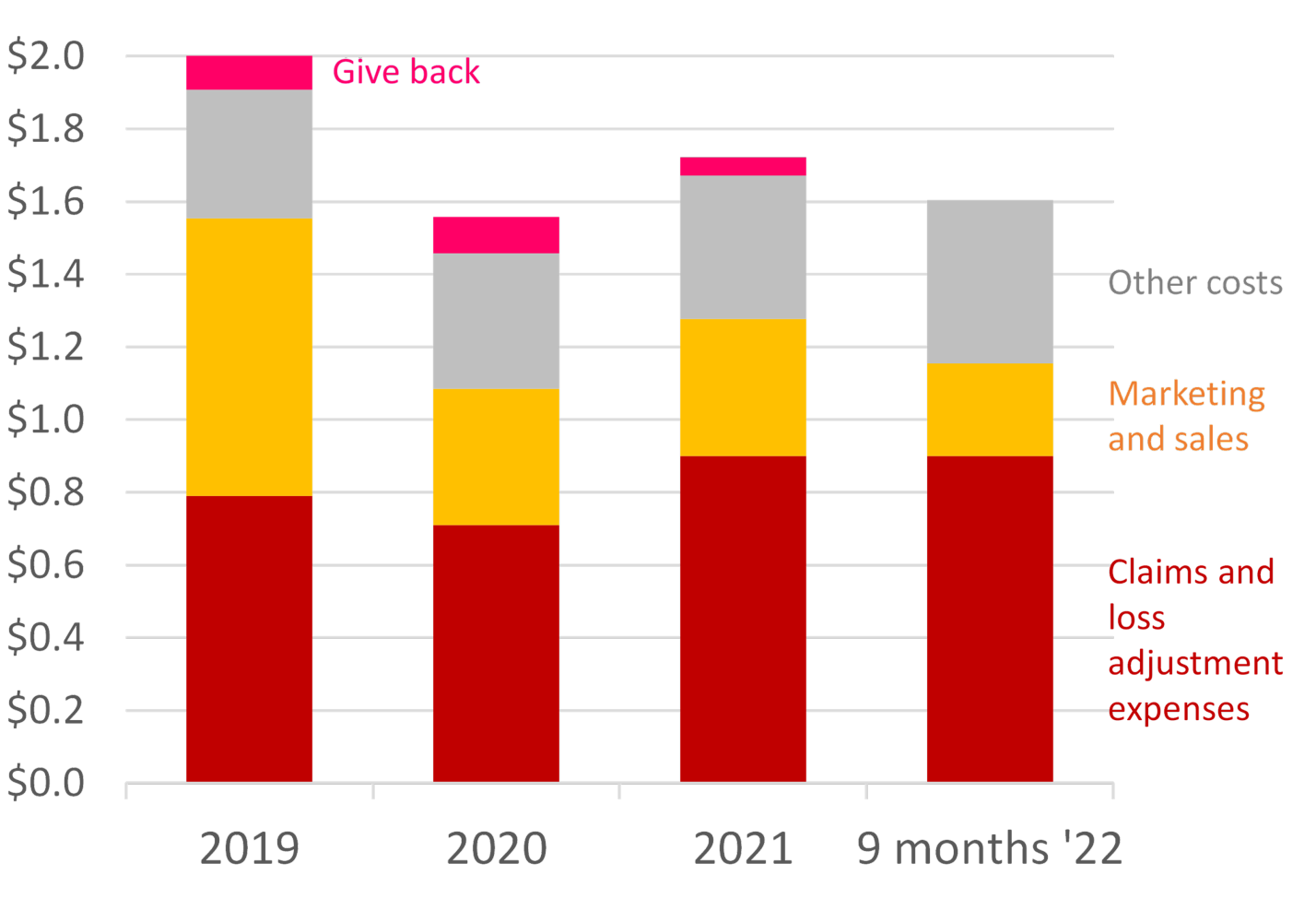

Let's start with the surprises from Lemonade's investor day, before they released their Q3 results. You have heard my frequent ranting about the combined operating ratio (COR) being the insurtech kryptonite. During the investor day, Lemonade's CEO mentioned it not one time, but two times!

However, they have not found the time to represent the value of their COR in the first nine months of 2022. It's 160%.

For each dollar of premium sold, $1.60 is paid out. (AGAIN!)

Let's move to the second thing we learned. In the Q&A at the end of the day, a participant asked to comment on the current churn rate of between 30% and 40%. CEO Daniel Schreiber pushed back, claiming the rate is lower, but in a filing in California, at least, it is above 40%.

Schreiber adds that when a customer churns, you have not lost a customer; instead you created an ALUMNUS.

Steve Anderson and I acknowledged Lemonade's unique Art of Communication in the article: Finally, An Insurance Company Proud of Its Human Agents. One more time, they have demonstrated their mastery.

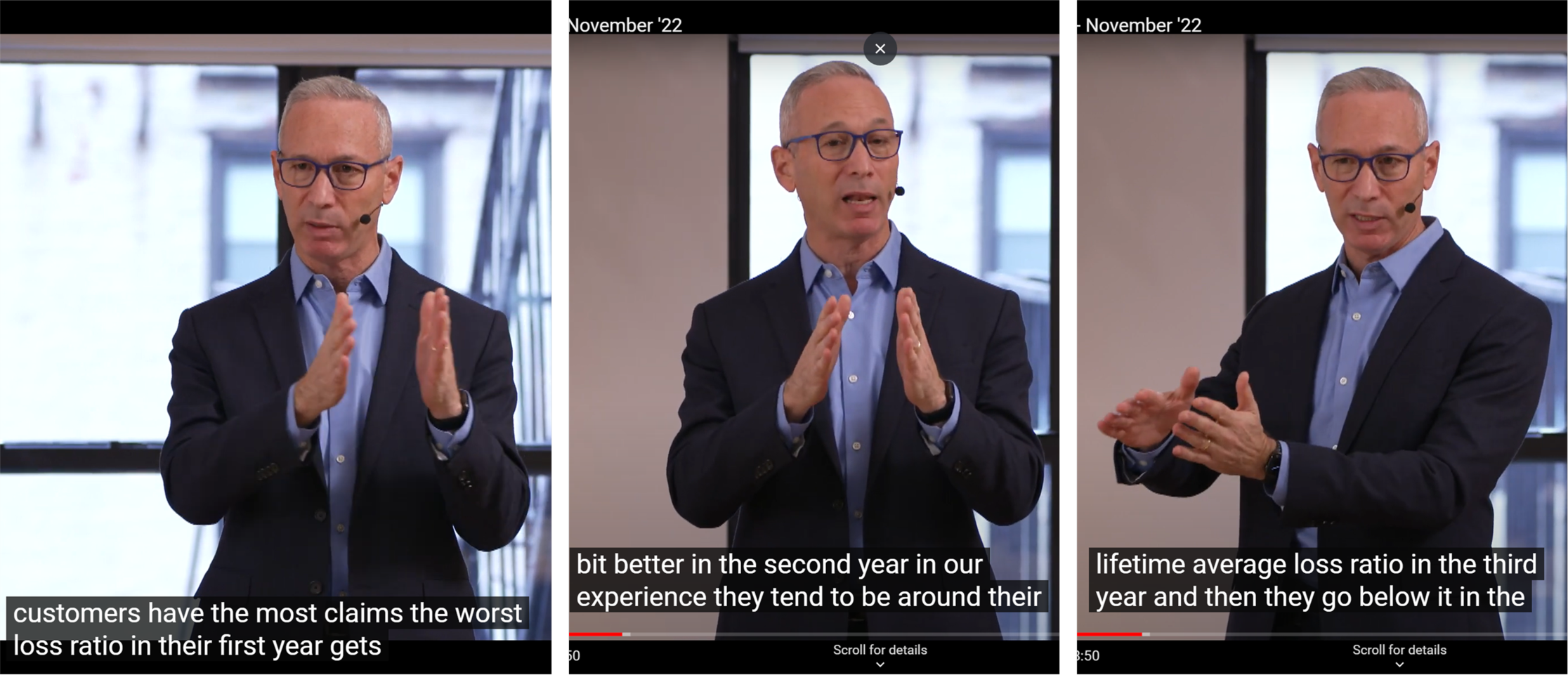

In one of the past editions of this newsletter, I discussed the nonsense of the "seasoned policies" narrative. In this last release of the earning call, Lemonade moved on and didn't mention it. However, Daniel has not moved on; he still believes (or wants his investors to believe) that a policyholder has some claims to submit as soon as he buys a policy but that claims diminish as the policies "season."

The harsh reality is that a portfolio gets better with pruning: you underwrote a portfolio, then you realize part of it is worse than you supposed … and you start to reprice / twist terms and conditions / cancel policies.

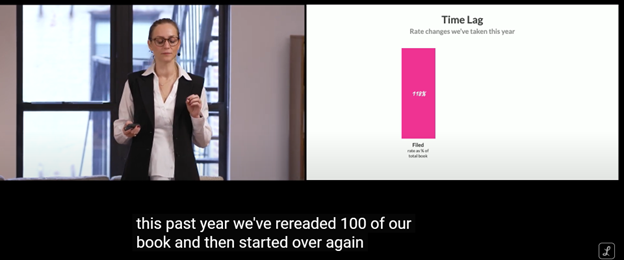

It seems that in California a third of the churn on homeowner insurance policies has been "Canceled by Lemonade." And, as the chief business officer explained, there has been repricing!

Last surprise: the charity giveback, the flagship feature used to win the hearts of many insurance insurance executives and analysts back in 2016 and that was five cents on each dollar of premiums written in 2021. The giveback received 60 seconds at the investor day. (I have already shared my thoughts on the giveback in the first edition of this newsletter: "The insurance professionals who fell in love with their disruptive storytelling over the past six years should feel a little betrayed.")

The European markets that Lemonade entered some time ago (Germany, France and the Netherlands) were not even mentioned during the day.

See also: Lemonade: No Sign of Disruption Yet

Facts & figures about their business

The shareholder letter opens with pretty enthusiastic words: "We're very happy to report on another strong quarter, with both top and bottom lines coming in ahead of our expectations."

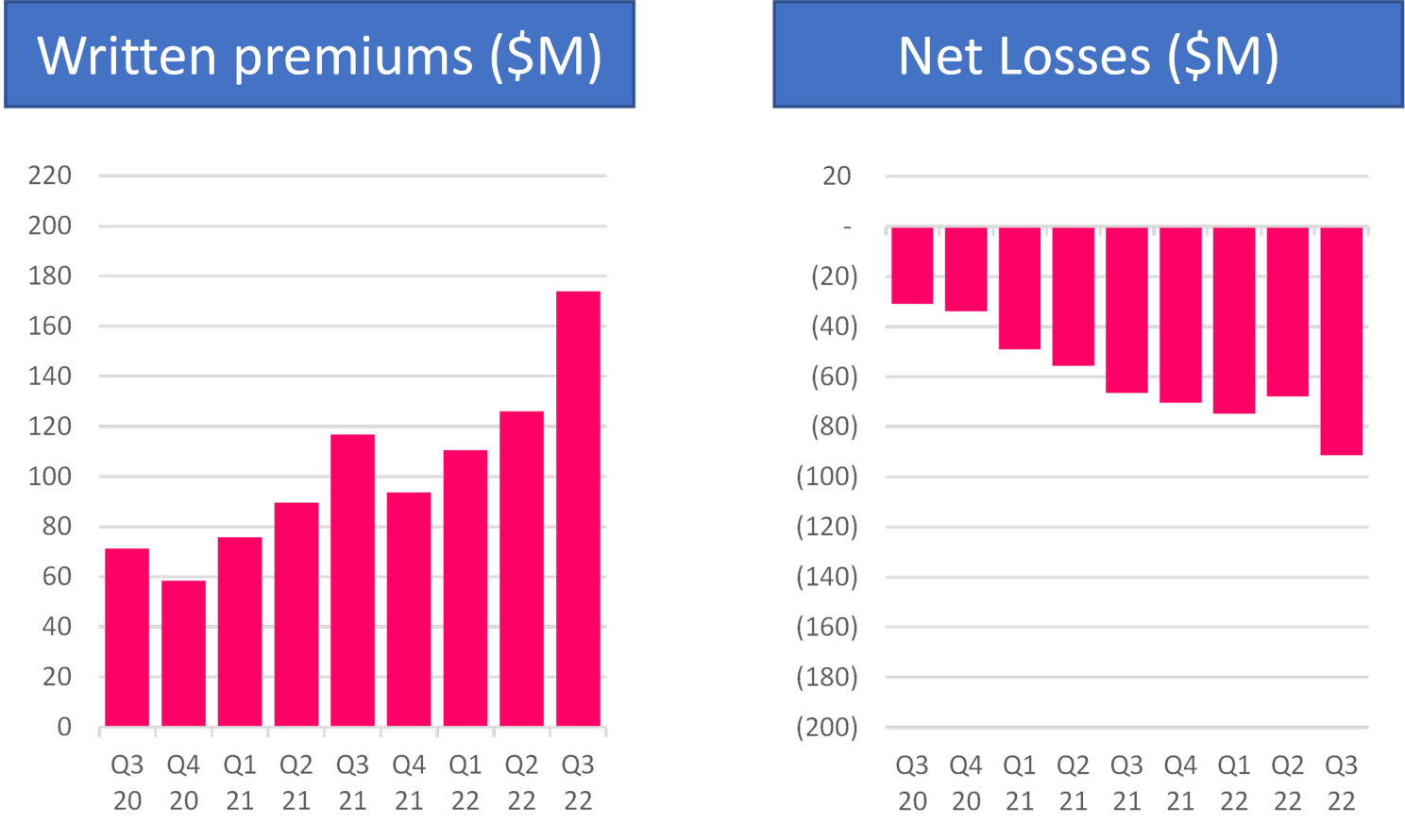

Lemonade's top line was 2.4 times what it was in Q3 '20 -- but net losses were three times the Q3 '20 figure. Moreover, the loss ratio was 94%.

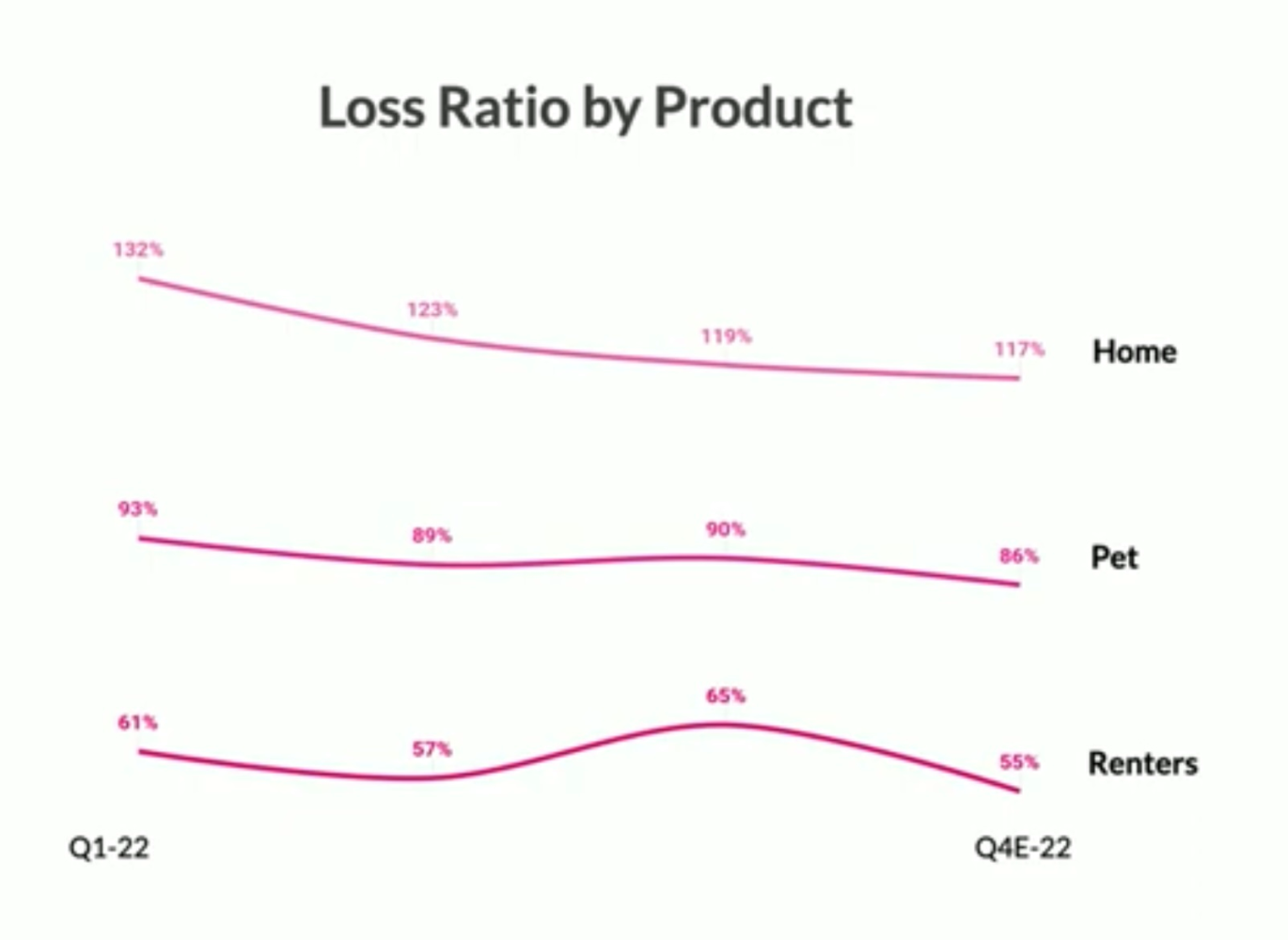

During the investor day, the CFO shared the evolution of the loss ratio by business line, including guidance for the next quarter:

The actual data looks pretty bad. Let's see if they produce this renter improvement expected in Q4.

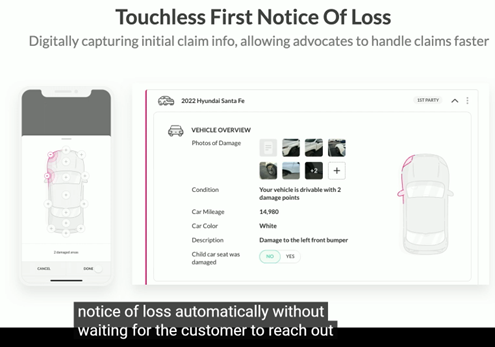

There were no facts, no figures specific to the auto business, where the Metromile portfolio has a three-digit loss ratio. It does seem Lemonade has understood that telematics-based proactive first notification of loss is good, and I agree with them. (There! I said it!)

Here, you can see my recent speech in London about the use of telematics for reinventing the auto claim process.

Ambitions

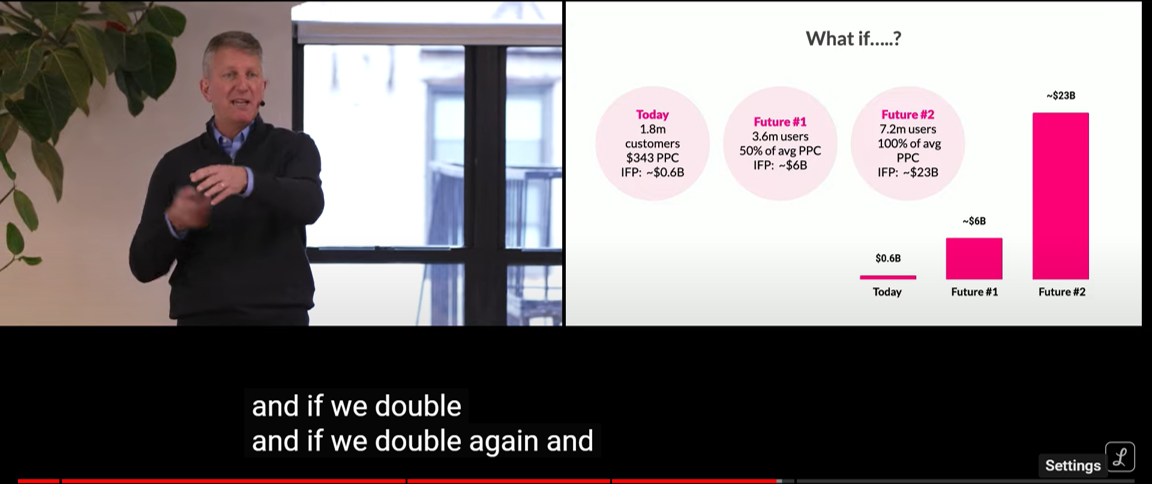

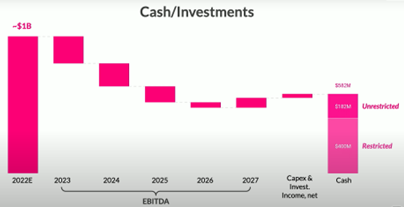

The CFO also shared their ambitions for the next five years:

- Profitable from the half of 2026

- Growing by 20% a year

He also shared a "what if" scenario that basically massages the numbers to send Lemonade to the moon.