Insurtech has come of age. Just last week, we saw:

- Travelers acquiring Trov

- Lemonade and Root publishing their financials.

I love numbers, and I've crunched insurtech financial numbers for the past few years, so let's have a look.

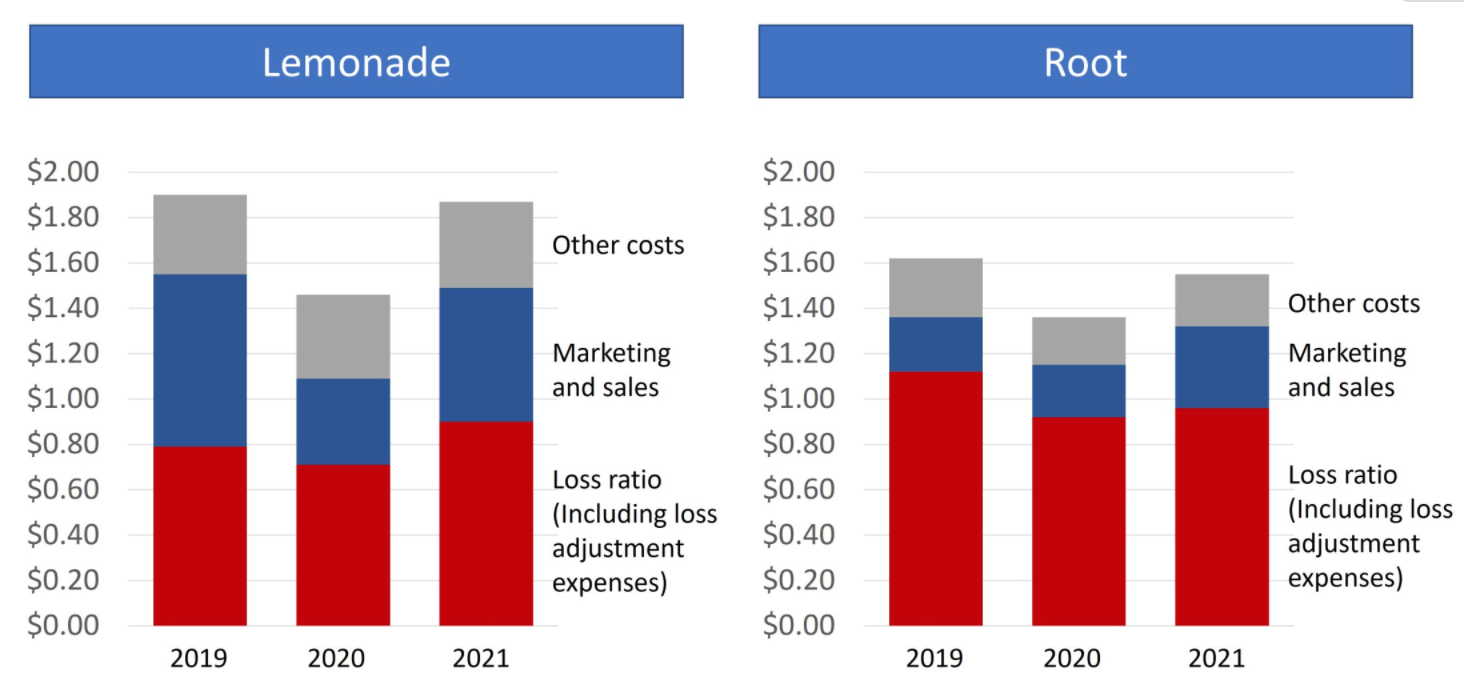

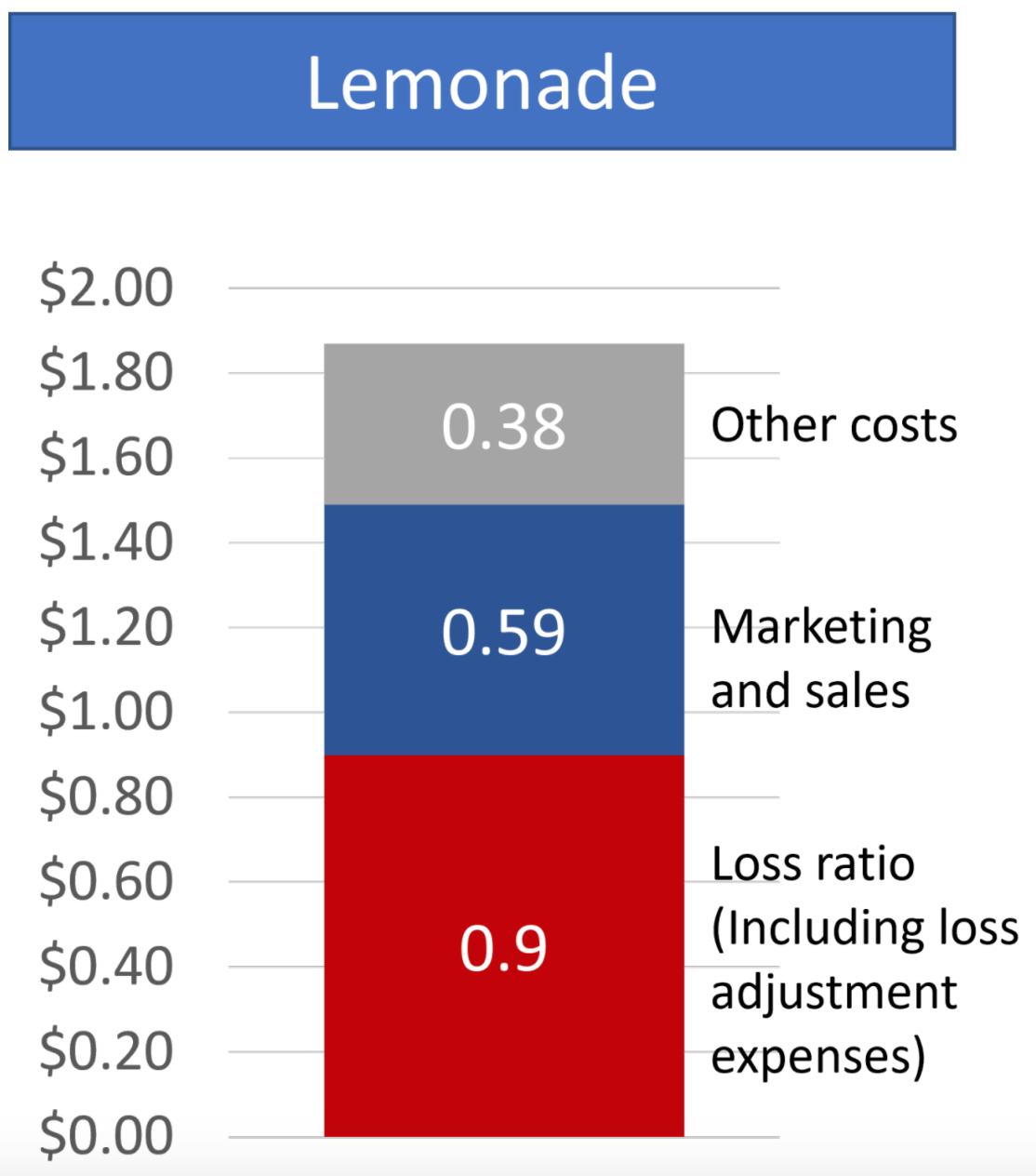

Lemonade has written almost $370 million in premiums (showing 42% growth from 2020), and Root has written more than $740 million in premiums (showing 20% growth from 2020). However, both these full-stack insurtech players have run an insurance business with a combined ratio (gross of reinsurance) above a 150% combined ratio in 2021. This means that, for each dollar of premium paid by the client, the companies' risk transfer approaches a cost of more than $1.50.

Almost the same has happened over the past three years.

How it started

We all remember how Lemonade has fascinated insurance professionals:

Lemonade CEO interview in 2017:

"Insiders agree: 'At least 40% of what insurance carriers receive in premiums is paid out in claims. So if Lemonade is 80% cheaper it must lose money on every policy.’ That is not true. Renters insurance covers personal property, not real estate. The expected loss is therefore significantly lower and so should the corresponding premium be. Unfortunately, the enormous overheads incumbents have, make low-premium products impossible. Their minimum premium reflects their high costs rather than your low claims.”

"We apply behavioral economics to neutralize the adversarial relationship, the conflict of interest, between customers and their insurance provider. We take 20%, and the rest (80%) goes to paying claims, and this includes our reinsurance. If less than the 80% is used to pay out claims, for instance 75%, the 5% unclaimed money is donated to charities chosen by customers. The maximum amount that can be given back is 40%. Lemonade gains nothing by refusing a claim. This way, we are reinventing insurance from a necessary evil to a social good."

See also: 10 Insurtech Trends at the Crossroads

Moreover, on their blog:

"That changes everything. Insurers typically make money by investing premiums ('float') or by paying out less in claims and expenses than they took in premiums ('underwriting profit'). Lemonade relies on neither. We collect premiums monthly, so the money earns interest in your bank account, not ours, and we return unclaimed money at year’s end in Lemonade’s Giveback.

"Knowing you’re not in conflict with your insurer, and that you embellish claims at the expense of a cause you believe in, may change your behavior, too, setting off a virtuous cycle. Ultimately, we’re after a new Nash equilibrium, one where aligned interests breed trust, resulting in a product that is inexpensive, hassle-free and lovable."

Over these years, I've been pretty skeptical about this storytelling:

And I have challenged the sustainability of their financials a few times.

They didn't like my analysis so much.

How it's going

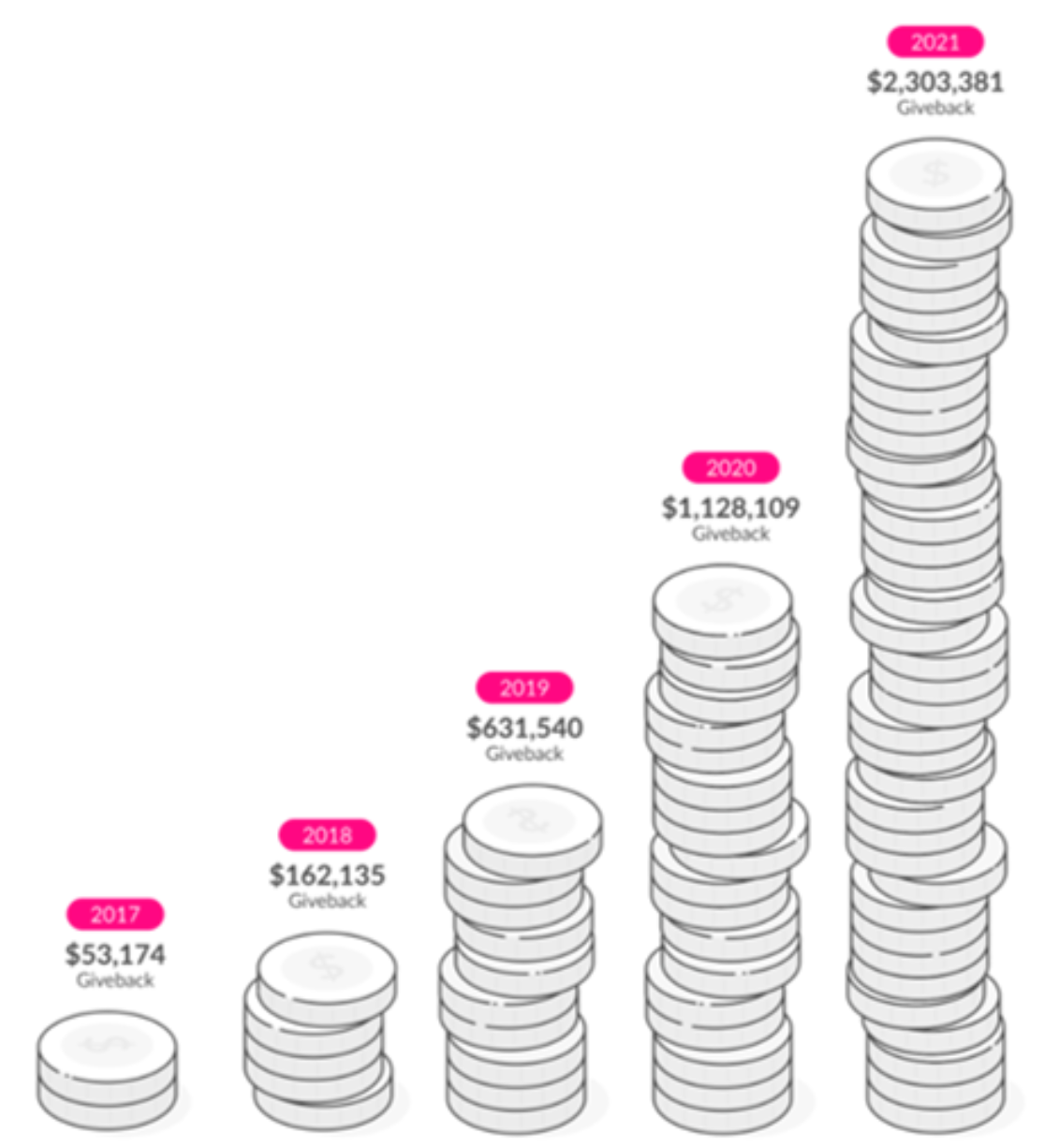

Let's start with the giveback:

A giveback of $2.3 million accounts for one cent on each dollar of written premium. Pretty different from the expectation given by the iconic pizza slice that characterized their storytelling back in the days.

See also: Game-Changing Trends in 2022 for the Future of Insurance

Let's look at the financials. For each dollar of premium, claims cost 90 cents, including the loss-adjustment expenses. (It seems that old claims have been under-reserved; we could discover in 12 months that even the current year reserves are not adequate). To acquire this (underpriced?) business, Lemonade invested almost 60 cents in marketing for each dollar of premium. All other costs add almost 40 cents.

It doesn't seem that behavioral economics, charity and storytelling have made any dent in the insured risks.

So, all the insurance professionals who fell in love with their disruptive storytelling over the past six years should feel a little betrayed. I see a fantastic team driving a superb marketing machine with a cool front-end... but no sign of disruption yet.

To subscribe to Matteo's LinkedIn newsletter, click here.