Despite the buzz around digital transformation, a staggering 74% of insurance companies still use legacy systems to carry out their daily operations.

Hindsight has been the guiding light of risk management. Underwriters have used backward-looking data to evaluate risks, and loss events have been the driver of policy adjustments.

However, this method is now rapidly losing ground, thanks to the revolution of AI and IoT.

The current climate of volatility, looming cyber threats and supply chain fragility have created a world of escalating risks requiring more than a basic reactive model. Insurer needs something smarter, a more forward-looking approach that deeply involves tech in risk strategy.

That's where the Internet of Things and artificial intelligence are driving change. Forming the heart of the future of insurance risk management, their combined powers transform static risk profiles into dynamic systems that are capable of predicting, detecting and even preventing losses in real time. Powered by machine-learning algorithms, these systems don't just flag risks -- they consistently learn and adapt so insurers can be one step ahead of the risk lifecycle.

In this article, we will explore how AI and IoT are redefining the insurance landscape with advanced technologies like real-time risk scoring and hyper-personalized coverage.

We'll also discuss practical uses, hurdles to implementation and what insurers like you need to stay ahead of the curve.

The Evolution of Risk Management in the Insurance Industry

Once upon a time, risk management was a manual process, heavily dependent on spreadsheets, static questionnaires, and actuarial tables. But there's been a dynamic shift since then, ushering in brand new processes of real-time data analysis and algorithmic decision-making.

On the surface, it might seem like an optional shift. It is anything but.

As regulatory bodies demand greater transparency and faster reporting, customers are seeking more personalized support and responsive coverage. This massive shift makes the proverbial one-size-fits-all policies obsolete.

Armed with data-driven risk models instead, insurers can now easily leverage the insights that structured and unstructured data provide to make swift and accurate underwriting decisions. This data can come from anywhere -- be it financials and claims history or telematics and weather feed.

With predictive analysis, you can now keep an eagle eye on trends before they escalate. You can also adjust policies on the basis of real-time exposure and behavior with dynamic underwriting.

Calling these innovations revolutionary will be no understatement. The convergence of AI and IoT has transformed risk from something to price and transfer to a process that involves anticipation, monitoring and management.

The era of the retrospective stance is over as the age of forward-leaning approach takes over with AI and IoT in the driver's seat.

Role of IoT in Real-Time Risk Detection and Prevention

The Internet of Things or IoT might be best-known for connecting devices. But its not-so-glamorous role of helping insurers detect, assess and mitigate risks in real time is just as critical.

Devices such as telematics in vehicles, wearables, smart home sensors and industrial IoT create a continuous loop of feedback between insurers and insured assets.

How do these devices and their always-on data stream change the game? Take smart thermostats. These can spot a frozen pipe before it bursts. Meanwhile, telematics can identify high-risk patterns from a person's driving behavior even before an accident takes place. Industrial sensors can prevent workplace accidents by flagging faulty machines. Each data point can prevent critical loss.

That's why insurers now rely on IoT for multiple tasks, including sharing more alerts and building nuanced risk profiles so premiums can be adjusted in a dynamic fashion. In fact, IoT has also been instrumental in lowering costs associated with insurance claims processing by up to 30%, per Mordor Intelligence.

However, there's a technical issue, and that involves figuring out how to leverage large datasets. Sensor data can be unstructured - not to mention high-volume.

This is where custom-built software platforms can help. These solutions are capable of ingesting large amounts of data from diverse sources -- both processing and integrating them with legacy systems in real time to save you a ton of time, money and hassle.

With custom software in place, you can tap into the full potential of IoT, thus turning reactive claims into proactive risk management.

AI-Powered Risk Scoring and Underwriting

There's no doubt that IoT has revolutionized risk management -- but so has AI. With AI, you can make sense of the massive, fragmented data streams that keep pouring in from internal systems, connected devices and third-party sources. Plus, fast and smart underwriting is possible with AI.

While underwriting traditionally depended on backward-looking data, AI shifts it to the present by processing real-time data -- contextual, environmental and behavioral -- to generate dynamic risk scores unique to each profile.

As a result, pricing is now not probability-based, relying on historical cohorts. Instead, it reflects real exposure.

Take the recent insights released by McKinsey which show that insurers that use AI in underwriting have witnessed loss ratio improvements of up to 5%. That's not all. They have also seen expense reductions of 10%–15%. And this is just the beginning.

Personalization is another major advantage when it comes to AI insurance models. You can use AI to gather lifestyle factors and wearable data of your customers to craft personalized plans for them with dynamic premiums that adjust to their real-time behavior.

Property insurers can use AI to determine occupancy trends and environmental risks when drafting plans -- a granularity level that was impossible in the days of manual underwriting.

Consequently, with the advent of AI, insurance policies are now not only highly customizable but also very adaptive to changes. Moreover, AI can trigger early interventions, adjust coverages and flag anomalies before the commencement of a renewal cycle.

The presence of AI in insurance might seem futuristic, but incumbents and startups are already leveraging AI-based underwriting engines to prevent fraud and improve accuracy while keeping personalization as the basis for all liaison.

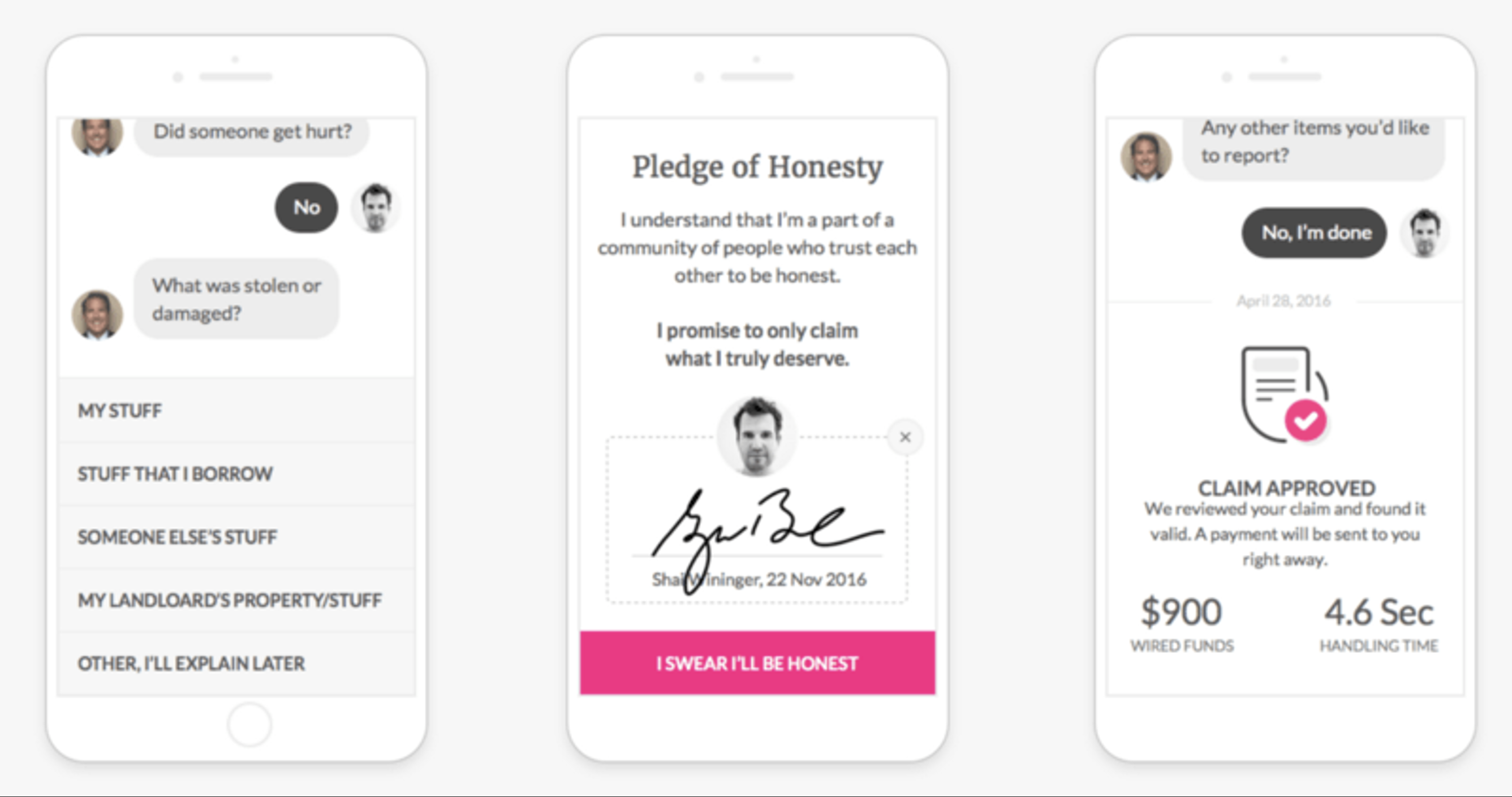

Lemonade uses AI bots and behavioral data to assess risk in real time, settling some claims instantly while reducing loss ratios and operational costs.

Addressing Ethical and Operational Risks in AI Integration

As with anything new, challenges abound with the integration of AI and IoT into the mechanisms of the insurance sector. But none of the threats arise from policyholders. Rather, it's the system itself that poses risks, ranging from algorithmic bias to data privacy and regulatory scrutiny.

You see, IoT devices are responsible for collecting data -- location, behavior, even biometric information -- that can be classified as strictly personal. Use of such information without clear boundaries can be considered a breach of trust and a liability. Thus, for insurers, it is critical to protect the data and have stringent rules for using that data in underwriting, pricing, and claims decisions.

However, that's not the only AI hurdle.

Most AI models can be likened to black boxes -- which means they often make decisions that cannot easily be backed by an explanation. This can put the fairness and accountability of such decisions into question, especially when it comes to sensitive tasks like claims automation, where transparency and equity are a must.

As for regulation, jurisdictions around AI are getting tougher. Auditability and model governance are now standard practices. As an insurer, you must guarantee your system can be monitored, tested and documented for any inherent biases.

The message is clear: Without the ethical use of AI, insurers and agencies can land in hot water.

While having a well-governed AI system can boost compliance, it can also serve as a competitive differentiator -- helping insurers build trust in a world where speed with fairness are paramount.

Building a Future-Ready Risk Management Infrastructure

By the year 2027, the global insurance market is expected to reach $9.8 trillion. That's a CAGR of 12% between 2022 and 2027.

With such rapid growth in store, retrofitted tools or patchwork systems for risk management just won't do. The shift from a reactive strategy to a proactive one requires a solid infrastructure that is equally agile, intelligent and purpose-built.

The first step is to rethink your existing tech stack. Your legacy system can likely process only batches of data instead of the continuous loops that emanate from AI engines or IoT devices.

The result?

Data silos, stalled workflows and zero opportunities for intervention. Either you need to modernize these systems or build custom integrations around them to stay viable. It's the only way.

Going down the custom software solution route will offer you the flexibility to centralize disparate data sources without ripping out your core system. As a consequence, you can automate decision-making and enable modular upgrades that help your company with underwriting, claims, and compliance workflows.

That said, infrastructure isn't simply about redefining your tech stack. It's also about ensuring seamless collaboration.

As a forward-looking insurer, your aim should be to track specialized vendors you can partner with to co-develop tools that suit the operational model of your company. Such strategic alliances can benefit your business by bringing domain expertise, speed and long-term innovation to the table.

To be ready for the future, you must choose wisely. You want your risk strategy to lead in the years ahead, not lag.

Final Thoughts and Strategic Recommendations

Don't treat AI and IoT as just another tech tool that comes and goes. Instead, think of them as the switch that lets you alter your entire risk management strategy from the ground up. Both are key to accurate forecasting, faster response times and loss prevention.

With AI and IoT working together for you, you get an insurance model that benefits carriers and policyholders alike.

However, if you want a competitive advantage, being an early adopter is the only way to go. You need to be willing to address ethical risks that arise as you modernize your infrastructure by investing in the right partnerships.

The path ahead for senior insurance executives is dotted with specific tasks:

- A thorough assessment of where and how your reactive models are falling short

- Prioritization of AI and IoT use cases that offer long-term scalability and near-term wins

- Modernization of legacy systems with custom platforms that enable real-time integration in a seamless fashion

- Formation of strict governance frameworks that foster a culture of fairness, auditability, and compliance

The future of risk management is here.

But the real question for CXOs and underwriting leaders like you is: Are you ready to evolve your risk infrastructure, or are you willing to lose your competitive edge?

The choice is yours.