In today's insurance enterprises, data underwrites every decision - from pricing precision and reserving adequacy to regulatory compliance and capital efficiency. Yet even the most data-rich insurers stumble on a deceptively simple question – "which data truly matters most"?

The answer isn't found in a massive catalog or a one-size-fits-all governance policy. It lies in identifying the Critical Data Elements (or CDEs, as we call them) that have a direct measurable impact on the business and managing them with the right level of accountability.

Rethinking Data Criticality

Traditional governance programs treat criticality as an inherent property of the data. Teams document everything, classify exhaustively, and build controls across the board, assuming completeness equals control.

In insurance, however, data criticality is not a technical attribute. It's a business condition. A policy effective date that drives billing cycles or a loss development factor in a statutory filing is far more "critical" than a seldom-used rating variable, even if both sit in the same table. What matters is the business consequence of error, not the data's complexity.

Consider these business impacts when evaluating whether a data element qualifies as critical:

- Does this data feed a regulatory report that could trigger compliance exposure if inaccurate? (E.g.: statutory reserves, regulatory capital ratios)

- Is this data used in investor or board reporting? (e.g.: combined ratio, return on equity, written premium growth)

- Would errors in this data disrupt day-to-day business? (e.g.: claim severity, policy effective dates, producer commissions)

- Is this data used by executives to make key business decisions? (e.g.: pricing optimization inputs, portfolio mix metrics)

Remember, the goal is not to govern everything. It is to govern what drives the business.

Governance Model

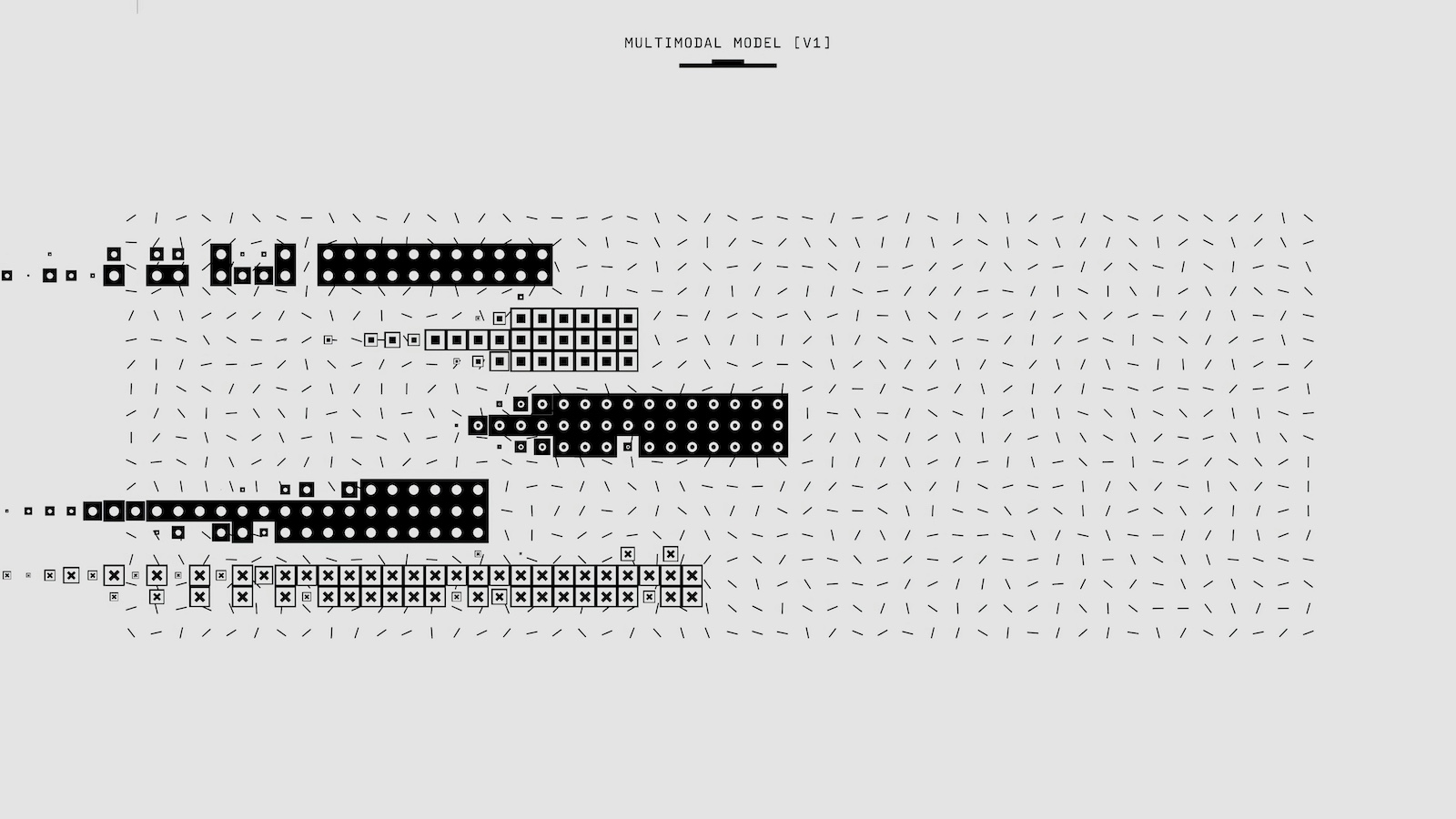

Once identified, CDEs need governance proportional to their business scope and risk. A two-tier approach balances enterprise oversight with domain execution:

- Enterprise tier: Cross-domain, regulatory, and board-level CDEs such as statutory reserves, regulatory ratios, and consolidated financials require centralized standards and coordination across the company.

- Domain tier: Business-specific, operational, and analytical CDEs including underwriting metrics, claims KPIs, and pricing model inputs should be managed where business expertise lives.

This tiered structure prevents both under-governance and over-governance. Enterprise CDEs get the control they require, while domain CDEs stay agile and business aligned.

Pragmatic Implementation

This four-phase framework aligns with how leading insurers already deliver data products and analytics.

- Identify: Begin with your most critical business information deliverables - the reports, dashboards, and metrics essential for operations. Work backward to identify underlying data elements, then apply criticality criteria to determine which qualify as CDEs.

- Prioritize: Sequence implementation based on risk and organizational priorities. Growth-focused insurers might prioritize decision-making CDEs around pricing and profitability, while member-based mutuals may emphasize operational CDEs supporting policyholder service.

- Execute: Integrate CDE management into data product sprints, not separate governance projects. CDE implementation, quality check and stewardship activities become backlog items, prioritized alongside other product features.

- Monitor and Govern: Operationalize the two-tier model with clear ownership and accountability. Enterprise data offices should define standards, quality thresholds, and monitoring frameworks while coordinating cross-domain CDEs. Domain teams manage day-to-day CDE lifecycle, implement quality controls, and provide enterprise reporting on health and performance.

Moving Forward

A well-implemented CDE framework turns governance from a compliance exercise into a business enabler. When governance aligns with value creation, it no longer slows innovation… it amplifies it. For insurers ready to move beyond traditional data governance, focusing on what truly matters - the critical few rather than the comprehensive many -offers a path to both better control and greater agility.