Accelerating P&C product and rate filing is critical to meet dynamic market demands and regulatory requirements. Traditional processes are constrained by manual handoffs, fragmented data, and slow approvals, resulting in delayed product launches and constrained profitability. This article explores how data, GenAI, and Agentic AI can transform rate filing—enabling parallel execution, automated testing, and intelligent workbenches for competitive analysis.

By adopting best practices in architecture, automation, and governance, insurers can compress cycle times, enhance pricing sophistication, and improve compliance. The approach outlined empowers carriers to respond swiftly to market shifts, optimize risk management, and gain a decisive edge.

Problem Statement: What?

Property and casualty (P&C) insurers in the United States face a complex and fragmented regulatory environment when filing new products or rates. The average time to approve rate filings has increased by 40% nationwide (for the period from 2018 to 2024 for homeowners' product). The result is delayed market response, constrained profitability, missed opportunities to reflect a changing risk posture (for example: In California, Proposition 103 limits insurers to base rates on historical losses rather than current and predictive/forward looking models).

While these regulatory complexities add to the delays of rate approvals, insurers also face internal challenges. These are magnified by fragmented data assets affecting rate development/indications, weak/limited integration of policy administration systems and rating engine, manual scenario generation & validations across rating workflows, too many handoffs, and manual state filing preparation.

Understanding Regulatory Complexity in State Filing

The regulatory complexity arises from several related factors:

1. State-Based Regulation and Legal Diversity:

Insurance regulation is primarily state-based, with each state legislature enacting its own rating laws, standards, and filing requirements. These laws may be based on NAIC model laws (e.g., prior approval, file-and-use, use-and-file, flex rating), but significant variation persists in definitions, processes, and compliance expectations across states. Insurers must navigate a patchwork of statutes, administrative rules, and case law, often requiring tailored filings for each jurisdiction.

2. Multiplicity of Filing Types and Entities:

Filings may pertain to rates, rating rules, policy forms, underwriting rules, or combinations thereof. Entities making filings include insurers, advisory organizations, and third-party filers, each subject to different rules and authorities depending on the state and product category.

3. Rigorous Data and Actuarial Standards:

Regulators require extensive supporting data for rate filings, including historical premium and loss data, actuarial analysis, and justification for rating factors. Standards mandate that rates must not be excessive, inadequate, or unfairly discriminatory, but interpretations and required methodologies (e.g., loss ratio vs. pure premium methods, credibility standards, catastrophe modeling) vary by state. Data quality, segregation, and rate adjustment protocols are scrutinized, and regulators may require multi-year data, trend analyses, and loss development triangles.

4. Procedural Complexity and Review Process:

The filing process involves multiple steps and stakeholders: filers must ensure completeness and compliance with state-specific requirements, often using tools like SERFF for electronic submissions. Reviewers conduct detailed checks for statutory and regulatory compliance, issue objection letters for deficiencies, and may require hearings or amendments. The process is iterative, and delays often result from incomplete filings or back-and-forth correspondence.

5. Policy Form Review and Public Policy Considerations:

Beyond rate filings, policy forms are subject to rigorous review for compliance with mandated provisions, prohibited clauses, readability standards, and consistency with pricing memoranda. States may require additional documentation, such as actuarial memoranda or advertising materials, and enforce unique requirements for specific lines of business.

Internal Challenges in Rate Change Management

Rate change management in P&C insurance is challenged by fragmented data sources and limited clarity/disjoint in data/business requirements for rate development & analysis. Insurers must reconcile information from underwriting, claims/loss history, reinsurance, and market trends, which demands extensive data wrangling and preparation. Latency in accessing third-party data and manual handoffs between product, actuarial, and IT teams further slow the process, leading to rework and misalignment.

The absence of integrated platforms for hypothesis development, rate workups, and filing results in inefficiencies and extended cycle times. Compliance steps are repeated for each state, and technical requirements for integration are often relayed indirectly, compounding delays. Manual testing and architectural gaps—such as non-stateless rating engines and scattered product management logic—impede data-driven decision-making and actuarial rigor.

Dislocation analysis, a key actuarial process, is time-consuming due to sequential, repetitive workflows and limited automation. The challenge is to quickly identify segments with disrupted rates and adverse loss ratios, as variable-by-variable reviews are essential but time-consuming. Without robust analytical capabilities, targeted adjustments are delayed, increasing regulatory risk and reducing pricing effectiveness.

How to bridge the internal challenges?

To accelerate and improve product/rate filing for Personal Auto & Property, insurers must deploy targeted interventions across dimensions such as Planning & Communication, Platform/Architecture, Data Controls & Trust, Validation, and rate filing intelligence—ensuring each stage of the value chain is robust, data-driven, and responsive to market and regulatory demands.

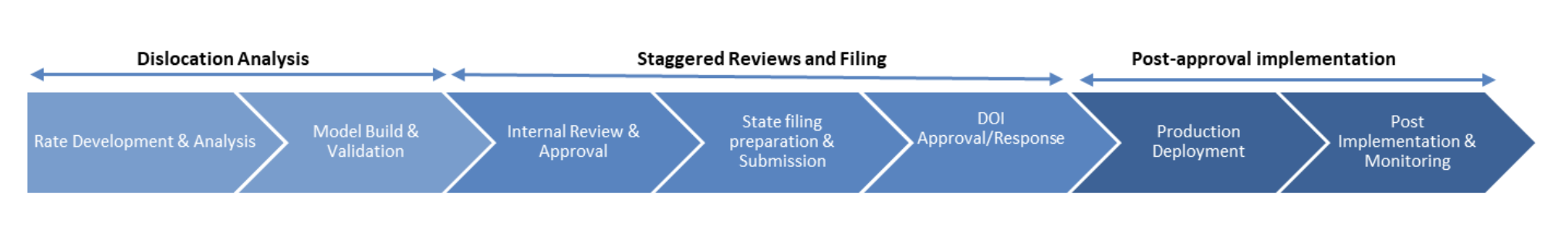

• Planning & Communication: Product / Rate filing has a direct correlation to business or product strategy. Considering its significance and the complex nature of the regulatory, it requires well-architected planning and execution. More often the challenges or delays are due to siloed interactions, lack of integration, gaps in business & IT/data requirements, delayed communication etc. across teams (product management, IT, Data, Actuarial, State filing etc.). Creating a digitized & integrated master rate change plan (by state, LOB, change complexity, filing type, etc.), workflow assignments and tracking ensure timely communication, transparency in timelines, dependencies etc. and enables identifying the choke points to improve execution. For example, Shift left the production IT activities related to configuration and build (i.e., before DOI approval/state filing, pre deploy with future effective dates toggled off until approval). Use emergency change approvals for minor rate updates and enforce strict SLA/OLA for signoffs to cut internal wait times.

• Platform/Architecture: Significant data engineering and configuration effort spent during Dislocation analysis and Post approval implementation. Address duplicate efforts spent in dislocation analysis and implementation (post rate approvals) by choosing appropriate rating engines (e.g.: Akur8, Earnix) with integration accelerators and compatible with modern policy administration systems.

• Data Controls and Trust: Automated data pipeline to ingest information, third-party data from near real time sources (telematics, IoT) on loss characteristics, use of CAT models for rate filings to assess risks like wildfire in California (as part of sustainable insurance strategy) to aid rate factor selection and an Assumptions Data Hub to capture UW assumption, Pricing assumptions, loss data etc., helps to build agility. Similarly, replacing legacy /excel-based models for rate filings with python/modern platforms such as hx Renew for central, version-controlled environment helps to improve collaboration, simplification and drive accurate filings.

• Automated validation: Leverage pricing tools/platforms such as hx Renew to automate scenario analysis (what-if") scenario analysis, automate the assessment of the impact of model changes and changes to assumptions, automated validation rules. Also, pairing provisional rate implementation with automated regression and CI/CD, improves response time via elastic rating engines and enhances rate monitoring, compliance, and traceability.

• Rate filing intelligence – Build & leverage rate filing intelligence powered by insights from SNL insurance product filing datasets (from S&P Global Market Intelligence) to understand market strategies, industry trends, analyze filings/factor changes of peer insurers, insights wrt objections, approval/response timelines of DOI etc. Harnessing these insights provides a feedback loop wrt product strategy, planning & execution adaptation to market conditions and decision-making.

Potential Benefits

Adopting integrated interventions such as master rate change plans and disciplined workflows, modern rating engines and platforms, reducing/eliminating excel based rating models, third-party data integrations, CI/CD and automated regression, market aware rate filing intelligence and effective change management—can significantly increase throughput of rate changes, strengthen rating traceability, reduce refiling/rerating cycles, and leverage richer third-party data for more responsive pricing, improving conversion, loss ratio resilience, and agility to market shifts.

The Way forward

To accelerate rate filing and product launches, insurers should assess their implementation strategy across the dimension such as people, process, technology and data, to evaluate their performance and outcomes. By operationalizing some of the relevant interventions listed above, insurers can compress cycle times, respond swiftly to market shifts, and optimize risk management. Now is the time for industry leaders to champion these changes and drive better outcomes.