The news of the past month in the insurtech scene has been the WeFox round of financing at a $4.5 billion valuation (based on a $400 million series D round). My first reaction has been to look at which insurance incumbents have a similar market cap today.

Well, my personal opinion is precisely the same as what I said 35 months ago when Root did a round at a valuation of $3.65 billion: "makes no sense." (Root's market cap is now $257 million, down by almost 96% from the IPO).

Let's look at the WeFox business model and financials mentioned in a recent Forbes article, which says: "The WeFox platform connects customers with human brokers who sell policies from outside providers and then cut the broker’s commission. It also provides a handful of its own policies, including auto, private liability and household contents insurance. Those directly written policies accounted for 25% of the company’s $350 million in revenue last year."

WeFox claimed: “We can really make sure that on our own book we only do the cherry picking, meaning we only get the most profitable customers in the lines where we think we can reduce loss ratios and operate more profitably in the market,”

The CEO posted that the total insurance premiums intermediates on the platform reached €1 billion. Llet's assume that is 12 months rolling.) Based on the last FT Partners Insurtech KPIs: Digital distributors trade at 0.3-2,6x their revenues, and full-stack carriers at 0.1-4-5x.

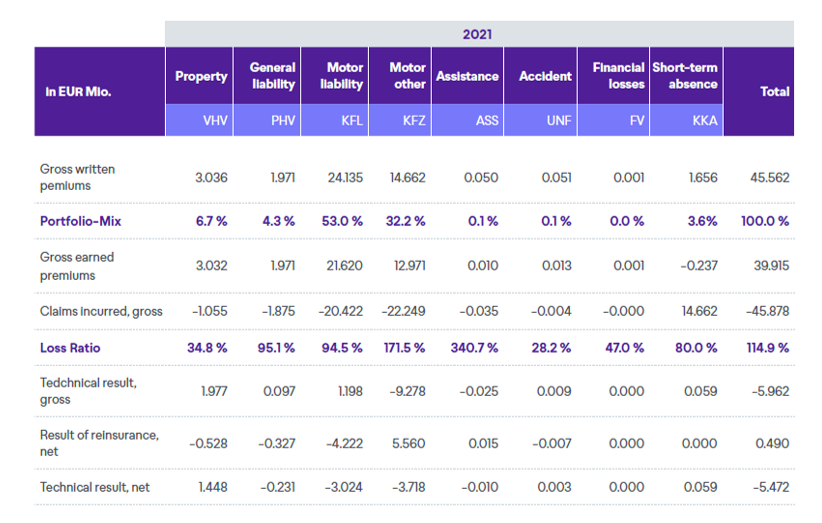

However, I'm more interested in highlighting the sentence about how they get to cherry pick the best risks. On the WeFox website, there is an interesting report about their own insurance carrier WeFox Insurance AG, whose 2021 reported loss ratio was fully 115%!

See also: How to Work With Insurtechs

It seems that insurtechs have serious difficulties walking their talk.

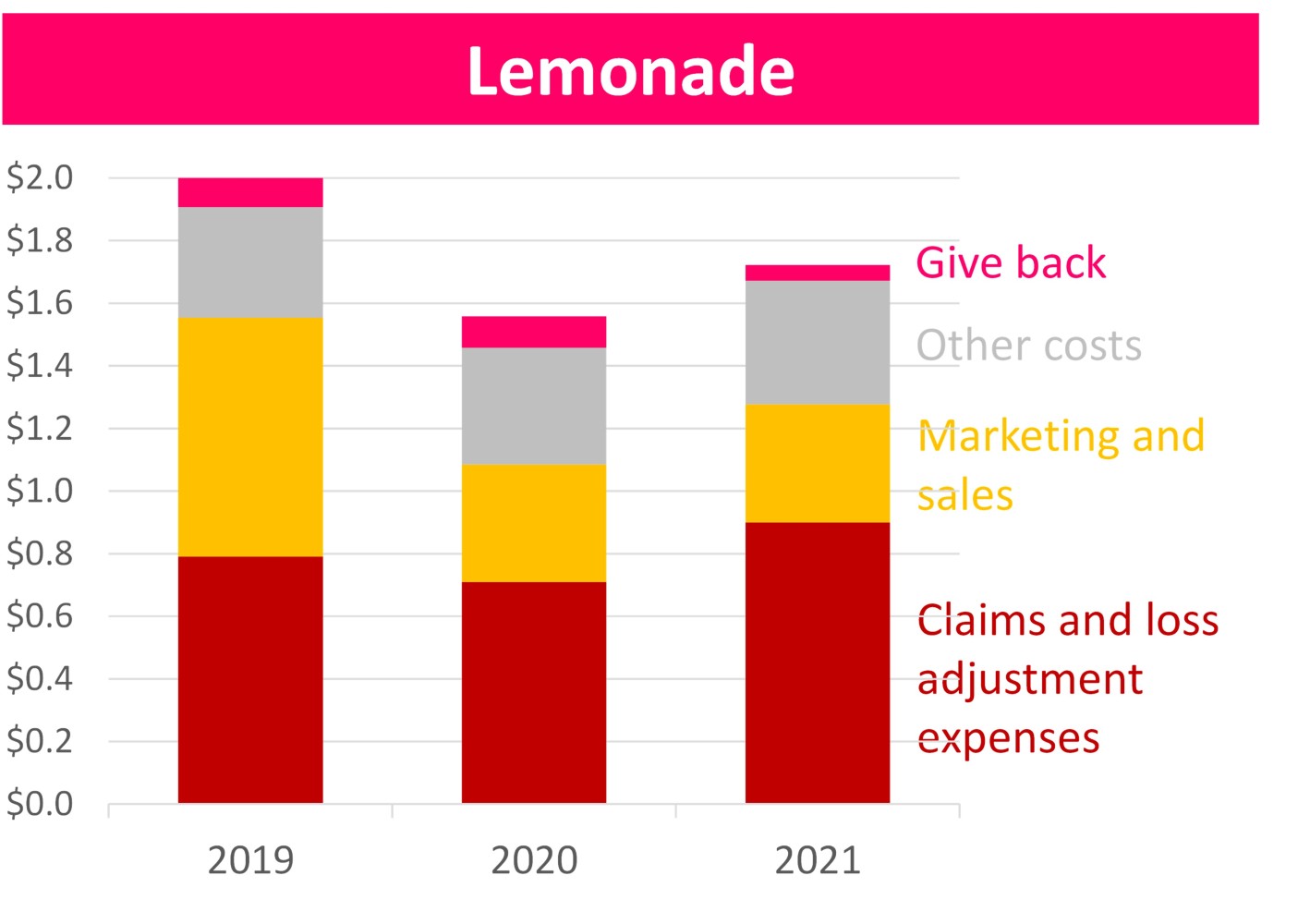

The champion on this problem has always been Lemonade. The first edition of my newsletter was focused on Lemonade, and the headline was "Do you feel betrayed?" They have fascinated minds and hearts with their "give back" mechanism and the iconic slice of pizza approach: "We take 20%". Well, in 2021, they gave back $2.3 million (one cent on each dollar of written premium in 2020), and in 2022 $1.9 million (0.5 cent on each dollar of written premium in 2021).

In the last newsletter edition, I highlighted that the stock-market valuation drop has not been about insurtech, it has been about tech. Moreover, I think we have just seen a generalized haircut on all the assets. Some friends said the "Grim Reaper is coming," and I expect he will select based on the technical profitability.

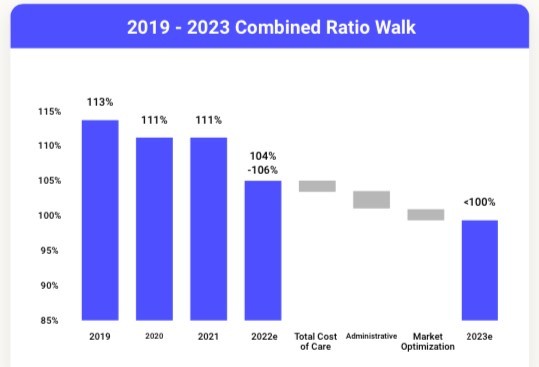

An interesting comparison can be made between Lemonade (-73% since their debut on the market) and Oscar Health (-83%). Both the companies currently have a market cap slightly above $1.1 billion and are burning a ton of cash (Lemonade had $241 million net losses in 2021, Oscar $571 million).

We discussed in the past the unprofitability of the Lemonade business (it cost between $1.50 and $2 for each dollar of premium written) and the absence of a trend of improvement in the technical results of the book:

Oscar seems to show more promising trends (here an interesting and super well-argued comment on Oscar), and - bonus point - at least they are brave enough to explicitly talking about their combined ratio (which is the insurtechs' Kryptonite)

See also: 5 Questions for Matteo Carbone on Smart Homes

Will the new generation of Insurtechs do things differently? Will they keep a balance between top-line growth and the technical equilibrium of their portfolios? Will they walk the talk?

...in 12 to 24 months, we will see

Telematics

Talking about auto telematics, it is becoming clearer that it is a necessary capability for an insurer nowadays. Some incumbents are leading the way. I have had the honor to have Nationwide at the IoT Insurance Observatory over these years and to learn from their successful telematics journey. I had the pleasure of having a thought-provoking exchange with Kelly Hernandez, AVP, personal lines telematics at Nationwide, about this insurtech approach.

Matteo: I had the pleasure to have you present the Nationwide journey with telematics and smart home at the IoT Insurance Observatory plenary session last September. We had the opportunity to exchange thoughts on the usage of these insurtech solutions. I believe the U.S. market is the first globally where telematics started to be seen as a necessary capability for an auto insurer. You lead the program of one of the largest carriers in this market, and I would like to ask you to share your view about the current state of the US personal auto market.

Kelly: Today’s trends are showing us that customization is key; what this means for insurers is that the days of the “one-policy-fits-all” approach to auto insurance are over. As consumer needs change—and we’ve especially seen some drastic change over the past two years--they are looking for carriers that can help them fit their auto insurance coverage to the unique needs of all drivers in their household. The individualized rates that usage-based insurance (UBI) programs can provide is turning into the insurance preference for American drivers in the current market, and we’ll continue to see this even more in the years ahead.

Nationwide quietly started our work on telematics over a decade ago and since then has become one of the leading providers of UBI [usage-based insurance]. There are only a handful of other companies that have invested in UBI solutions the way Nationwide has in the past 10 years, and we strongly agree that it is a necessary capability for an auto insurer. UBI only works when you have data “at scale” to accurately price and process business, so scale really matters. Companies that are not in the game today and haven’t invested are seeing that the pace you must invest to catch up makes it difficult.

Nationwide has two UBI options: SmartRide is a discount program based on safe driving behaviors, which also includes coaching and driving feedback. Additionally, we also offer our SmartMiles program – this is a true pay-per-mile solution that was really made possible due to consumer acceptance of the telematics technology. Through both programs, customers have shared billions of miles of driving data with Nationwide, and we have had millions of customers participate in the programs. We are continuing to leverage the data as we look to advance our programs and create more internal innovations.

When Nationwide started offering SmartMiles in early 2019, we knew there was a segment of customers that would be interested in a program like this. The program started as a solution for low-mileage customers that use public transportation, seniors, students, households with multiple vehicles and those that lived close to where they work.

As a result of the pandemic, we’re seeing consumer driving behavior changing permanently in many instances, with a new segment rising to the top—people working from home. This resulted in a notable increase and a new customer segment that can now benefit from this type of program. Nationwide quickly recognized the increased interest in a pay-per-mile program and rolled out SmartMiles very rapidly, it is now available in 45 states.

We continue to heavily invest in these capabilities with a focus on increasing adoption, rating sophistication, and bringing to market a best-in-class customer experience. We’ve proven with our current programs that we can help drivers become safer, most notably by reducing distracted driving, improving road safety for everyone. We will continue to advance our programs over time, but the future is still unclear—which is the innovating and exciting part for us to be a part of. As a result, our programs are under constant evaluation, and you will continue to see them grow

Matteo: In the past two years, some telematics programs have shown a higher level of opt-in, more significant volumes (that allow for more robust insights), and more material weight of pay-per-mile solutions on the overall volumes. InsurTech Fact & Figures is the headline of this newsletter. Could you share some quantitative aspects of the evolution of Nationwide's telematics programs after the pandemic?

Kelly: A frequently asked question is: Are customers willing to do these types of programs? If you talked to our sales agents, the majority would say yes. They are the ones on the front lines consistently explaining and offering our telematics programs to customers, and as a result we’re seeing over 70% opt to give it a try. Once a customer understands the benefits of the program, they are overwhelmingly willing to participate.

The pandemic very quickly changed driving characteristics and provided a great proving ground for a pay-by-mile program like SmartMiles. When a customer's driving patterns change, their insurance costs automatically adjust with no need to call, click or anything else. The program adjusts to the new driving patterns. As some people are seeing their driving patterns change permanently due to more work-from-home options, this type of program has been very successful in market. Low-mileage customers are (generally) saving over 30% (compared with a traditional policy) while still maintaining loss results in line, if not better than, with our traditional programs. This shows the value of the ability to rate based on how some drive versus fully relying on variables, like age and gender, that try to predict this.

While the pandemic certainly has affected people’s driving habits, another notable issue that Nationwide has observed is distracted driving. As an insurer, we’re now looking at how often people are distracted behind the wheel. When we first reviewed the data, it was extremely alarming. On average, drivers under age 25 actively use their phones 19% of the time while driving. This is six times more than drivers aged 60 and over. Beyond our youthful drivers, in total 45% of every trip taken had a driving distraction, and over 70% of people were distracted at least once while driving each day.

This may seem dramatic but consider what it means if you were driving down the road at 45 mph and lost visibility for six seconds—this is what our data shows happens 13 times a day for the average driver. This is a significant public safety issue, and in 2020 led Nationwide to launch an insight benefit to our customers by providing distracted driving feedback in our SmartRide mobile program.

Drivers were surprised by what they saw and made changes as a result. The exciting part is that we’re seeing that it is changing driving behaviors. In less than a year, there has been a nearly a 10% reduction in everyday hand-held distractions among these drivers. This new awareness-only capability clearly shows drivers are willing to change their behaviors. It also proves that we can impact driving behaviors through our telematics program.

Matteo: From your perspective, what factors have contributed to these changes? In particular, I'd love to know if Nationwide has developed a specific approach to engaging the agents in supporting the diffusion of telematics.

Kelly: Insurance agents are the best resource to help consumers understand the programs and potentially help their customers save money. So, Nationwide has focused on removing friction points to help our agents be successful in understanding and selling these programs.

Nationwide is largely an independent agency carrier, so one of the hurdles to getting customers to adopt telematics is first getting agents to recommend it. We did some research back in 2020 and found that while two-thirds of consumers (65%) said they would try these programs if it provided a discount, only 10% of consumers report participating in one. When we dug a little deeper, we found 67% of consumers had not discussed telematics with an insurance agent. And on the flip side, when talking with agents we found 40% of insurance agents didn’t feel knowledgeable enough to speak on telematics to counsel clients.

We’ve worked diligently with our agency partners to help educate them on the benefits of telematics and how easy and simple the process can be. Some of the views formed may still be based on early implementations. After a decade of refinement and advancements, today’s programs are much smoother and easier for customers to participate in.

Matteo: I've seen in the market a progressive shift of the carriers to the continuous monitoring (form the temporary monitoring), enabling additional use cases. Can you share your view about the future of telematics usage by insurance carriers? How do you see the auto insurance offer at 2030?

Kelly: This is the direction the industry is headed; The future of auto insurance is telematics, and Nationwide is using telematics to modernize insurance protections. It is rare to be able to create the auto product of the future—and that’s exactly what my team gets to do at Nationwide. I am extremely fortunate to have a team of highly intelligent and talented people that are truly re-shaping how we think about auto insurance using telematics.

Nationwide expects the current environment to continue to accelerate interest in UBI options – we believe 70% (or more) of new business will be in our UBI programs within five years. Our offerings will bring forward new capabilities as mobility solutions continue to evolve and will provide seamless solutions that our agents are excited about selling. Our SmartRide and SmartMiles programs will create new ways for Nationwide to connect with our customers and will help them gain control over their insurance premiums. Telematics will provide engaging experiences and value-added services that customers may never have expected from an insurance company. While the future is not fully clear, we know telematics will play a large part in our long-term success.