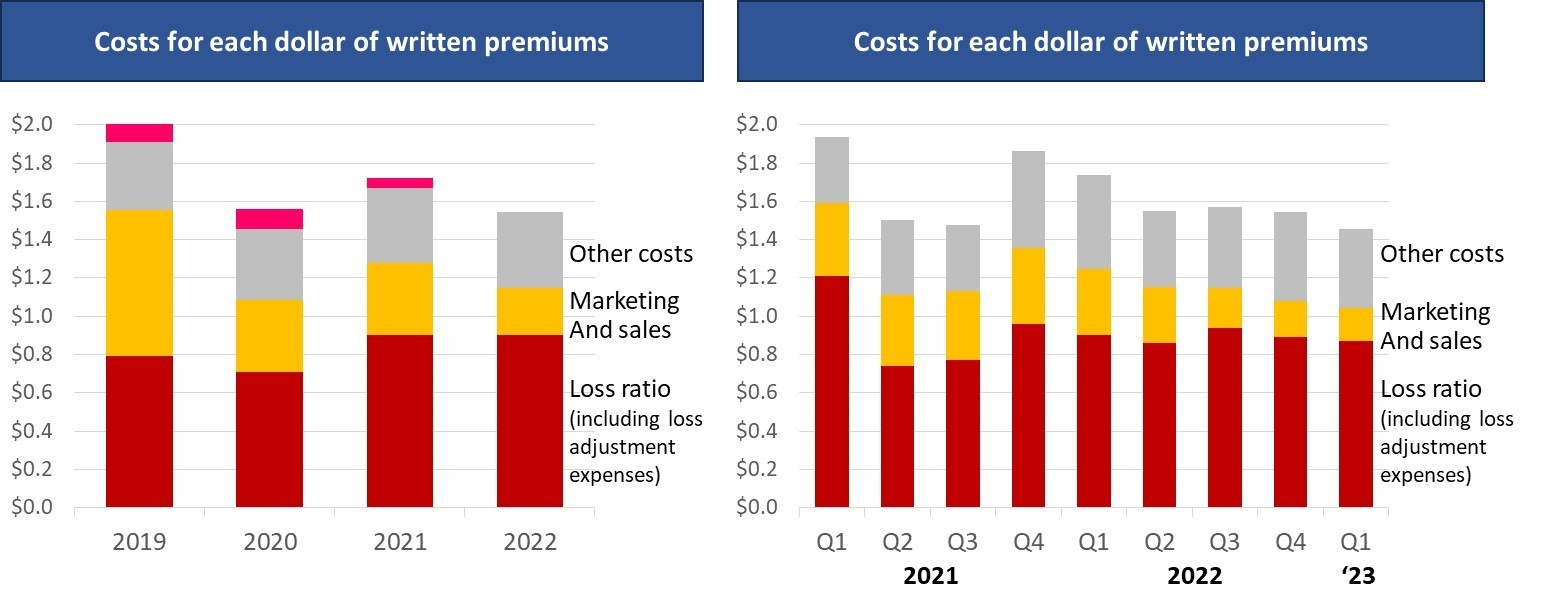

Recently, Lemonade entertained us with their last pyrotechnic: "the synthetic agent." That follows a long list of shining and exotic concepts, which have been as essential in their DNA as their bloody combined ratio (for each dollar written, they have consistently spent more than $1.40).

Let's talk about some of these magnificent pearls:

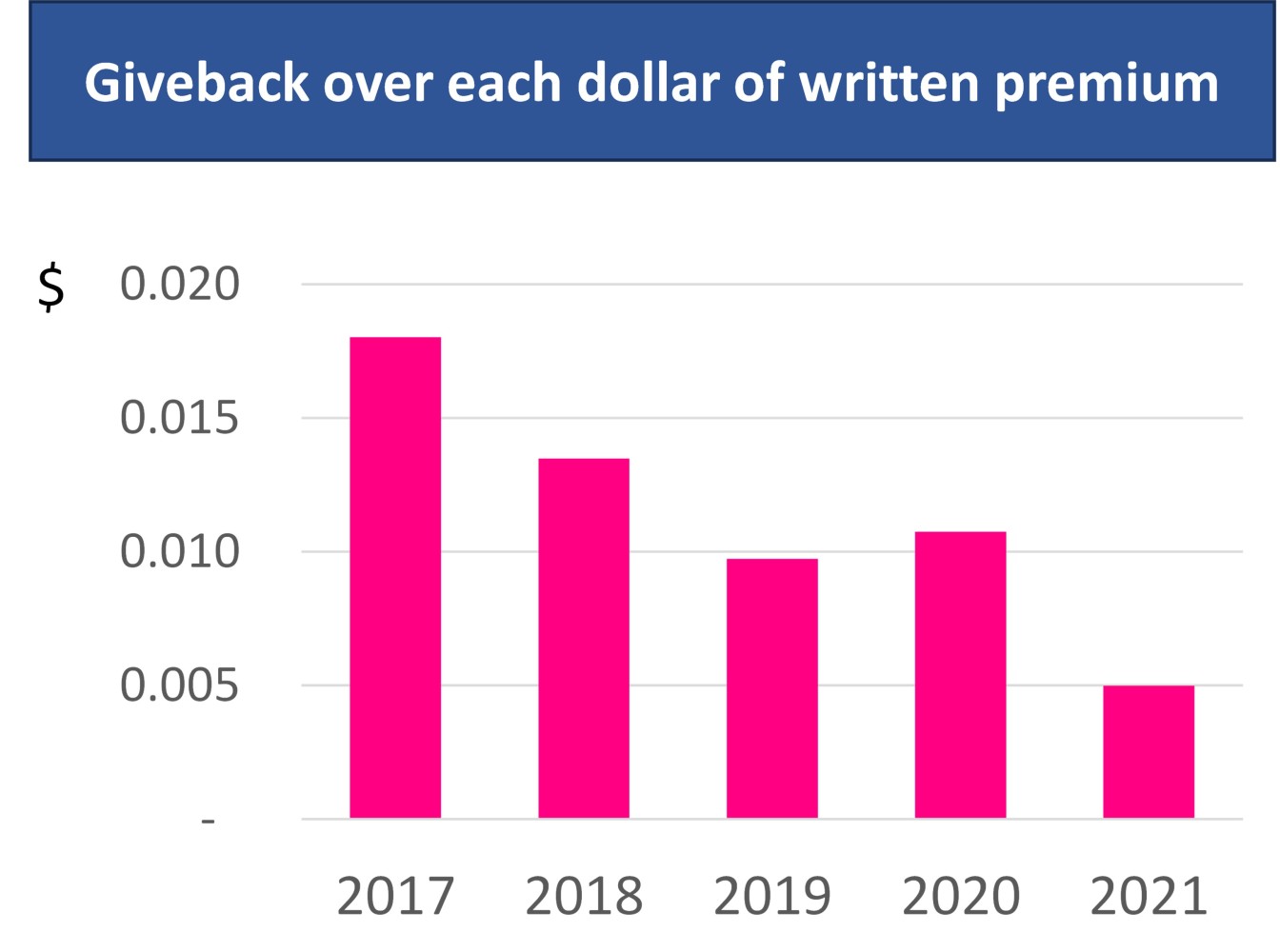

1. Charity giveback. The storytelling, "Lemonade takes a flat fee and treats the rest of the money as yours, not ours," and their iconic slice of pizza have fascinated insurance professionals.

The hard reality: Last year, half a cent for each dollar of written premium in 2021 went to charity. The charity giveback has merely been crumbs of the pizza! I'm sure many insurance incumbents are donating a higher percentage of their premiums.

See also: Insurtech Startups Are Doing It Again!

2. Claim settlement world records. It was a Christmas gift in 2016, and in June 2023 their PR team did it again 👇

3. Alumni. At the 2022 investor day -- in answer to the question about the 30% to 40% churn rate -- Lemonade disclosed that it doesn't lose policyholders, they create alumni! Standing ovation for the guts to claim this!

4. Seasoned policyholders. The investor day was full of pearls! CEO Daniel Schreiber described portfolio pruning as "seasoning."

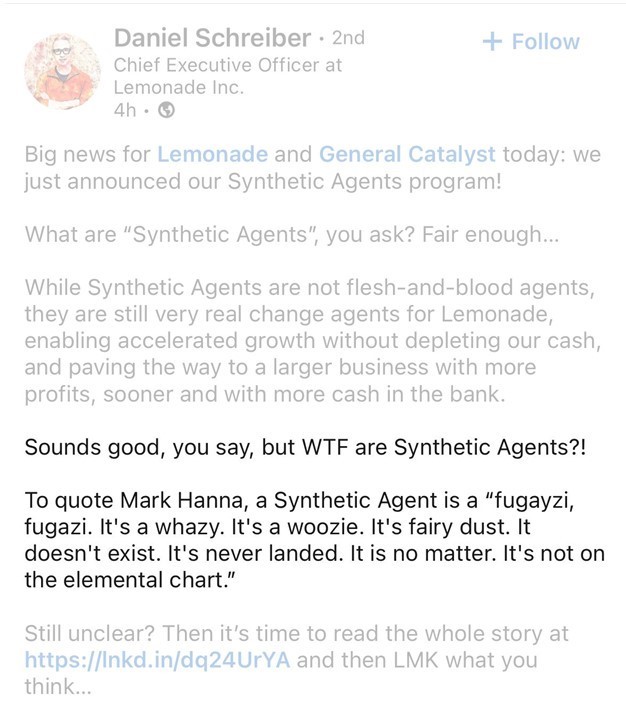

5. The synthetic agent. This is the most recent creation. A lender receiving a 16% interest rate is presented as a (synthetic) agent. The same day, Daniel gave one of the most honest comments I have ever seen from him:

His second explanation has been definitely more polished: "It may be tempting to dismiss synthetic agents as "good old-fashioned debt that's been given a glossy makeover. [...] Here are four key differences that make all the difference: 1. Cash Flow Synchronization vs. Fixed Schedule [...] 2. Adaptive vs. Static [...] 3. Operational Freedom vs. Restrictions [...] 4. Their Risk vs. Our Risk [...] ."

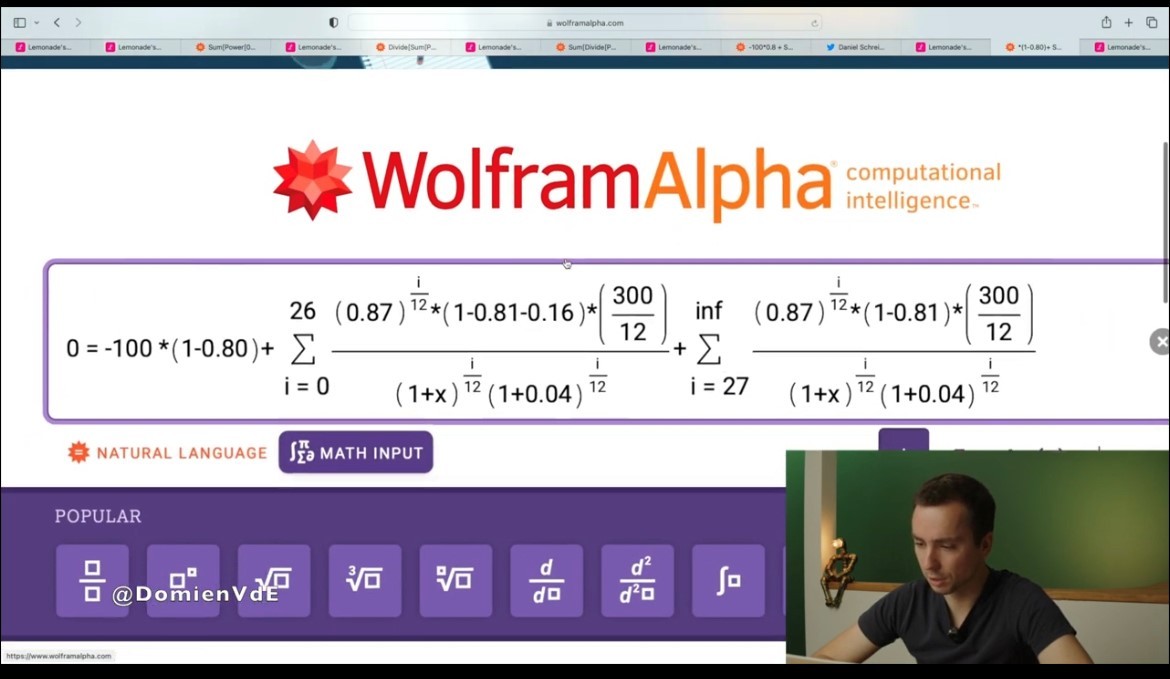

For my fellow actuaries reading this edition of the newsletter, you may enjoy the video below from some Lemonade fans.

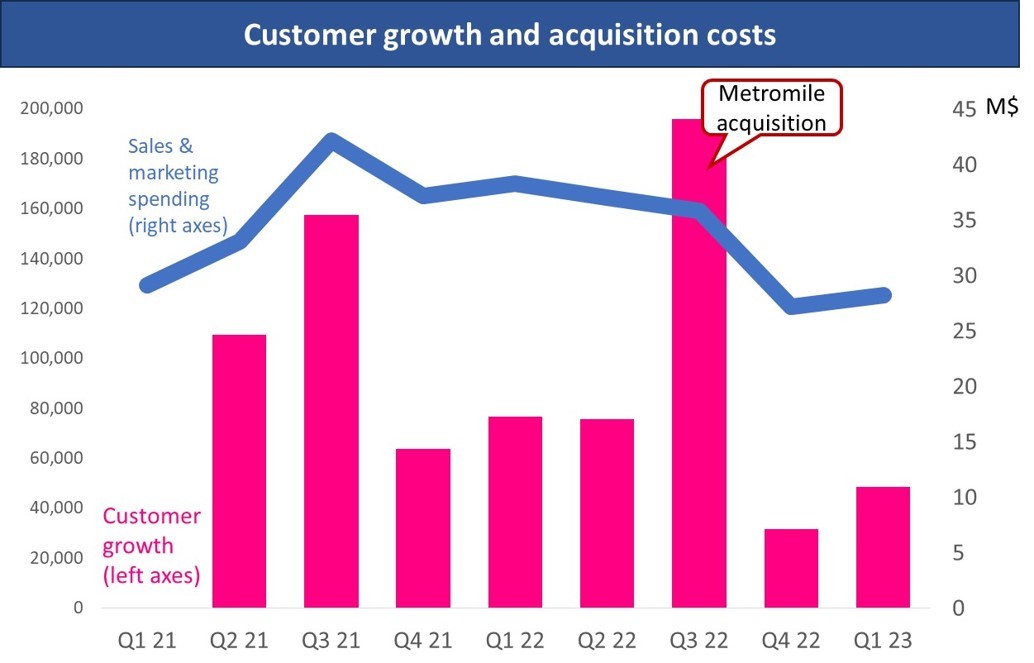

Let's look at Lemonade customer growth and their marketing expenses (the Metromile acquisition at the end of July '22 should be pro rata reflected in the Q3 '22 data and entirely in the Q4 '22).

Customer growth from the end of Q1 '21 to the end of Q1 '23

At the end of Q1 '23, their customer base reached 1.85 million (compared with 1 million at the end of Q1 '21), but the growth has significantly slowed (excluding the quarter when Metromile was added). Total marketing costs stayed around $36 million until Q3 '22 and have been reduced below $30 million in the last two quarters. This sales and marketing spending has to deal with replacing the ALUMNI, and not much is left to grow the customer base.

The synthetic agents are supposed to provide that growth, but the interest paid will be on top of the already bloody combined ratio.

See also: How to Know If You Need Telematics

Talking about agents -- the real ones, humans selling policies, serving policyholders along the policy lifetime and being remunerated for doing so -- I desire to remind you of their important role. In Kyle Nakatsuji's beautiful words: "Agents deliver what we've come to call 'curated value.' They work on the customer's behalf to gather information, source options curate a selection process and validate choices. This gives the customer confidence they are seeing their real options (transparency), getting a good price (affordability) and getting the right coverage (value), all while doing less work themselves (convenience)." Amen!

My beloved insurance incumbents, the poor performances shown by the new kids on the block (who pretended to be the good guys disrupting the bad insurers) and their exotic blah blah blah shouldn't justify any reduction in your innovation efforts. There are clear demonstrations in any insurance business lines that the higher the level of innovation, the higher the financial performance (growth and technical results).

I'm talking about usage of data and technology to transform the way your organizations work. These insurtech-based business transformations require multi-year journeys and C-level sponsorship, unfortunately without any shortcut. However, the prize for this insurtech effort is clear: superior financial results!

I discussed this transformative power of technology and data in driving growth, improving customer experiences, and enhancing risk management a few weeks ago with my friends at Infosys. To see the fireside chat between Karam and me, click here.

Last, a Tesla surprise:

You know I've always challenged the common enthusiasm about using OEM data for an auto insurance telematics program. (Here are my thoughts about it!) My main point has always been the impossibility of building a sustainable business case on a constant flow of data from a connected car due to the OEMs' greed.

So, my suggestion to insurers has always been to go with an aftermarket solution (app, hardware or even a camera in some situations) and not wait for an affordable OEM data stream. I still believe this is the best way to address the telematics opportunity on your portfolio!

However, on a small fraction of your insured portfolio, you can now start using OEM data at ZERO cost! Tesla has exposed APIs with open data, totally free. You have it here: Tesla Open Telematics Data.

You need only to design a compelling value proposition able to win the customer inertia!

Looking forward to seeing your new value propositions based on this free telematics data!