KEY TAKEAWAYS:

--If you look at Lemonade as a way of examining what insurtech approaches are working and which aren't, you see that everyone, including incumbents, must use data and technology for risk selection, pricing accuracy and automation. Most have already started.

--State Farm's vision abut a platform play and the smart home strategy represents an area that is frequently ignored and could be fertile territory.

----------

In the 2023 third quarter, Lemonade showed:

- Losses: $62 million loss this quarter (about 10% less than in the previous two quarters), and only $6 million of cash burned from operations (after the $97 million burned in the last two quarters)

- Top line: $213 million written in the quarter (17% more than the previous quarter and 22% more than in the '22 third quarter) and almost 78,000 customers added (highest increase since Q3 '21, without considering the Metromile acquisition)

- Sales and marketing: The top-line growth has been achieved by investing $24 million, which is 11% of the written premiums. In Q3 '22, marketing expenses were $33 million (37% of premiums).

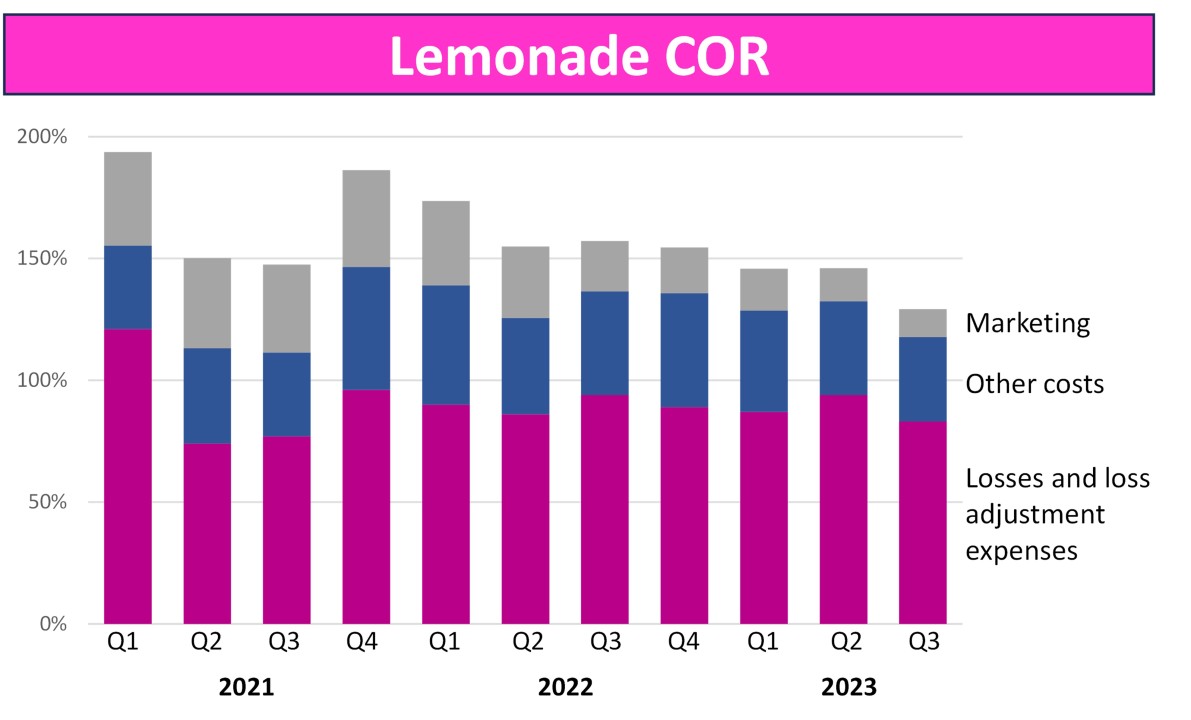

- Loss ratio: 83% (the lowest since Q3 '21)

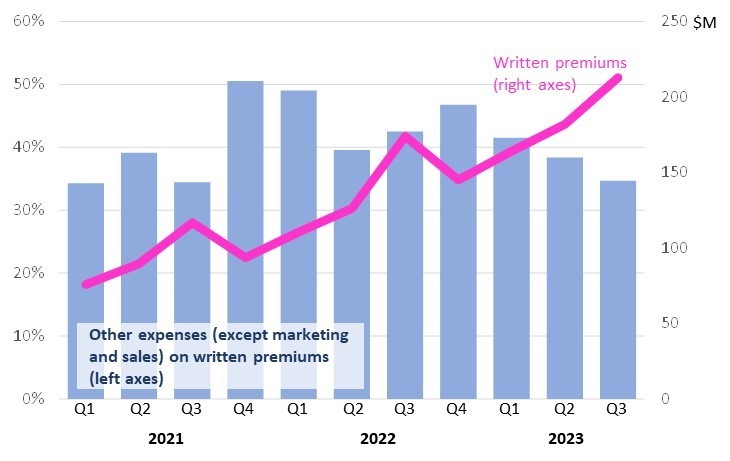

- Other expenses: 35% of written premiums (the best level since Q3 '21)

We are still talking, though, about a gross combined ratio of 129%.

After an eight-year journey that has burned more than $1 billion, with many seasoned insurance executives hired, these results are the bare minimum that we should be able to expect. But I'm actually more interested in observing their insurtech approach and understanding if there is anything they are doing that can be relevant for the insurer of the future. Moreover, is there anything they're now doing that incumbents have missed?

See also: Insurtech Startups Are Doing It Again!

Why am I more interested in the insurtech approach and tools, instead of the venture per se? Because I'm advising on innovation at insurance incumbents -- 10 of the top 25 global P&C insurers currently are members of the IoT Insurance Observatory -- and each day I'm discussing the future of our sector with them.

Let's look at the key insights from an article I just wrote with a State Farm executive:

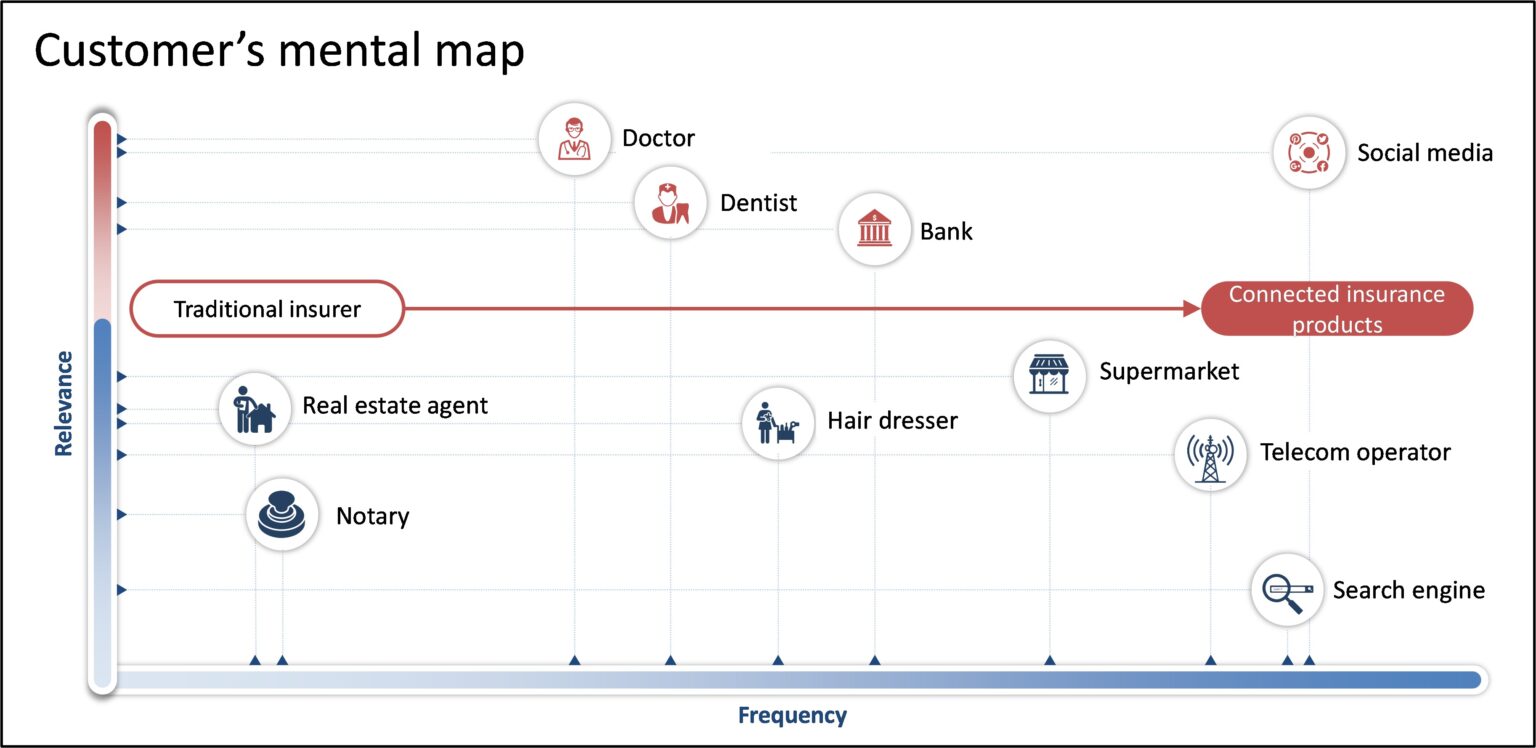

- "State Farm envisions a future where virtually everything within the sector is interconnected based on the belief that a platform-based approach to insurance is the best way to capitalize on the availability of data and create a seamless customer experience."

- "State Farm is looking to reinvent the insurance industry once again, by leaning into a model that doesn’t just price, protect and recover. State Farm is proactively seeking ways to integrate experiences and predict and prevent loss."

- "Connected cars, connected homes and connected self are at the heart of this vision for the future. State Farm is committed to progressing in these spaces as it looks toward the next hundred years of industry leadership."

- "State Farm is keen on the smart home and what it means for the carrier’s business. [...] In this scenario, the execution of a thoughtful smart home strategy may not be a nice-to-have goal. Rather, it may be essential to remain competitive."

- "Smart home technology has the potential to forge novel homeownership experiences and strengthen customer relations. This constitutes a relevant motivation for embracing IoT in the realm of home insurance."

- "Central to the State Farm vision for smart homes is the aspiration to transition from recovery to the ability to help predict, intercept and prevent losses, relying upon products like ADT and Ting. [...] State Farm harbors the ambition of preventing 20% of losses related to fire, water and theft (which account for approximately two-thirds of all homeowner insurance losses)."

- "Insurers with the ambition to remain relevant must possess the capability to master connected platforms, specifically those related to IoT."

See also: Lemonade's 'Synthetic Agent' Nonsense

Haven't you started yet your smart home insurance journey? What are you waiting for?

Now, let's observe Lemonade's journey and its insurtech approaches.

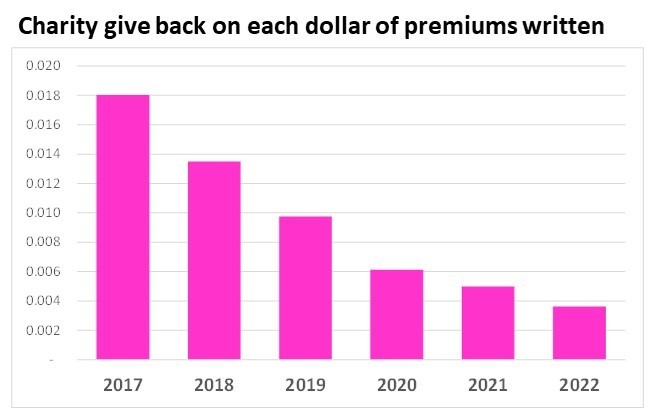

At the outset, Lemonade was all about charity giveback, behavioral economics... and storytelling. None of these has made any dent in their insured risks and has yet to disrupt any segment of the insurance market.

I remember a discussion at a roundtable at the 2018 Annual North America Re/Insurance Conference where I challenged this storytelling, asking if Lemonade really believed that fewer people would submit a claim because there was this charity giveback mechanism.

However, this nonsense has progressively faded in their storytelling and even in the premiums (last year, less than two cents for each dollar of premiums went to charity).

Here is what I said in the first edition of this newsletter: "the insurance professionals - who have fallen in love with their disruptive storytelling over the past six years - should feel a little betrayed."

But let's talk about the current storytelling. There is an interesting interview by @Neil_X10 that covers the key areas they're betting on. (You can enjoy the full two-hour interview here.)

Basically, the issues are risk selection and pricing accuracy. I think everyone in the insurance sector agrees.

Less agreeable is the comment from Lemonade's CEO about being able to "predict risks in ways that incumbents cannot for structural reasons." Well, U.K. personal line carriers (incumbents!) have mastered for years targeted advertising to drive risk selection, and Progressive (incumbent!) has built its journey on superior segmentation and pricing accuracy in the U.S.

The ability to attract and retain good risks doesn't yet seem like an actual Lemonade capability... it's more of an ambition.

I think everyone in the insurance sector agrees even on the need to improve efficiency, applying automation in customer support and claims. It would be difficult to find an incumbent that is not working on applying AI to these processes.

Looking at the current level of expenses (other than marketing and sales), Lemonade doesn't seem efficient (yet), and it has not improved over the past three years even if the size of their business in 2023 increased more than three-fold compared with 2020.

See also: AI and the Future of Independent Agents

Efficiency seems more like an ambition for Lemonade, not a reality.

The current Lemonade's insurtech approach makes much more sense than back in the day, even if they seem far from delivering it.

Using data and technology for risk selection, pricing accuracy and automation is a must for the insurer of the future. But there is consensus around this, and a large part of the incumbents all around the world have already started investing in it.

State Farm's vision about the platform play and the smart home strategy represents an area that is frequently ignored (or denied after some first rough and unsuccessful attempts), and it is a fundamental area for any personal line insurance carrier in the future.

IoT is a necessary capability, not a nice to have!