The commercial auto insurance landscape is facing an inflection point. While fleets rapidly embrace telematics technology and generate unprecedented amounts of driving data, a surprising disconnect persists between insurers that desperately need this information and fleet operators that possess it. According to SambaSafety's 2024 Telematics Report, this gap represents the industry's greatest challenge and its most significant opportunity.

Perception Versus Reality

One of the report's more notable findings reveals a fundamental misunderstanding that's stalling progress: 75% of commercial insurers believe convincing fleets to share telematics data is their biggest hurdle, while 74% of fleets that don't share data say it's simply because they were never asked. This communication breakdown prevents meaningful partnerships from forming.

The issue becomes even odder when considering fleet readiness. Currently, 80% of fleet respondents monitor a large portion of their vehicles, and satisfaction scores average four out of five for their telematics providers. These fleets aren't resistant to technology—they're already deeply invested in it. What's missing is the bridge between their data and insurers' analytical capabilities.

Emerging Technologies at the Forefront

So much more than GPS tracking, the telematics landscape is rapidly evolving beyond GPS basics. The telematics report from SambaSafety shows that while 77% of fleets use GPS tracking, over 50% have adopted camera systems—a significant shift toward more refined risk assessment tools. These cameras aren't just operational aids; they're becoming critical legal defense mechanisms against nuclear verdicts, which peaked at a median of $23.8 million in 2023, according to the Institute of Legal Reform (ILR).

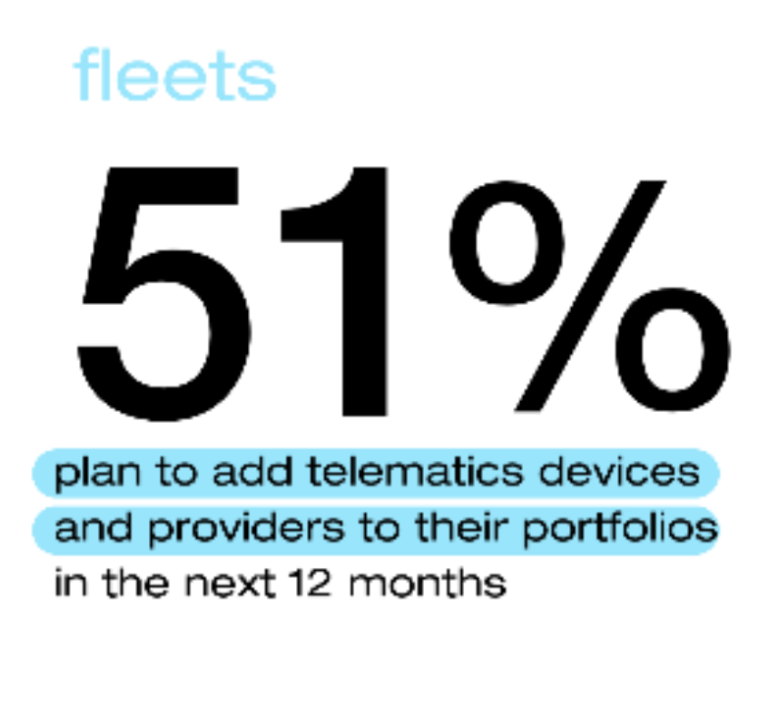

More tellingly, 51% of fleets plan to add new telematics devices or providers in the next year, creating an expanding universe of data sources. For insurers, this presents itself as an opportunity and hurdle to undertake. The challenge lies in accessing this data and developing the infrastructure to ingest, normalize and analyze information from multiple providers and device types.

In recent conversations, artificial intelligence and advanced analytics have become key differentiators for competitively assessing risk. As the report notes, "The growing capabilities of AI and its ability to gather insights will drive commercial lines insurers to prepare their data infrastructure and expand their telematics experience." Insurers leveraging AI to transform raw telematics data into actionable risk insights will gain a significant competitive advantage.

Infrastructure Reality Check

There's a growing infrastructure gap today that is daunting for many insurers. Only 25% of commercial insurers categorize themselves as fully capable of handling large amounts of telematics data, while over 33% acknowledge their infrastructure needs enhancement. This technical readiness challenge is compounded by resource constraints—58% of insurers cite lack of resources as a primary barrier, up dramatically from 32% in 2023.

The solution for insurers involves building strategic partnerships, which are becoming increasingly popular. Carriers recognize they can't produce everything in-house, regardless of capabilities and size. Whether partnering with data aggregation, risk scoring, benchmarking or training content, successful insurers use external partnerships as building blocks for capability expansion.

The Path Forward to Transformation

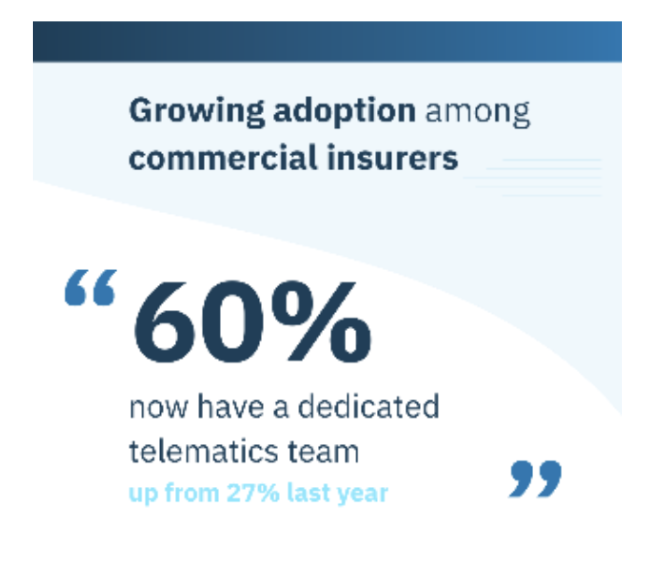

One of the most encouraging trends is the rise of dedicated telematics teams. The percentage of commercial insurers with dedicated telematics teams jumped from 27% in 2023 to 60% in 2024. These teams are taking a multi-disciplinary approach, with loss control leading the charge (47%), followed by underwriting (23%) and business line units (23%).

This organizational evolution reflects telematics' expanding role beyond simple data collection. Modern telematics teams handle vendor management, business function training, data preparation, risk pricing and segmentation—essentially becoming the central nervous system for data-driven insurance operations.

To capitalize on the telematics opportunity, insurers must focus on four key areas:

Share: Move beyond simply requesting data. Explain how, as an insurer, you will use the data and what benefits fleets will receive. Create feedback loops that provide fleets with actionable insights from their data.

Provide incentives: Develop financial incentives that align broker and policyholder interests with telematics adoption. Current programs often lack sufficient motivation for widespread adoption.

Prepare: Invest in data infrastructure, analytical capabilities and strategic partnerships— the volume and variety of telematics data will only increase.

Communicate: Foster transparent dialogue between insurers, brokers and fleets. Many adoption barriers stem from misunderstanding rather than fundamental resistance.

The Strategic Advantage

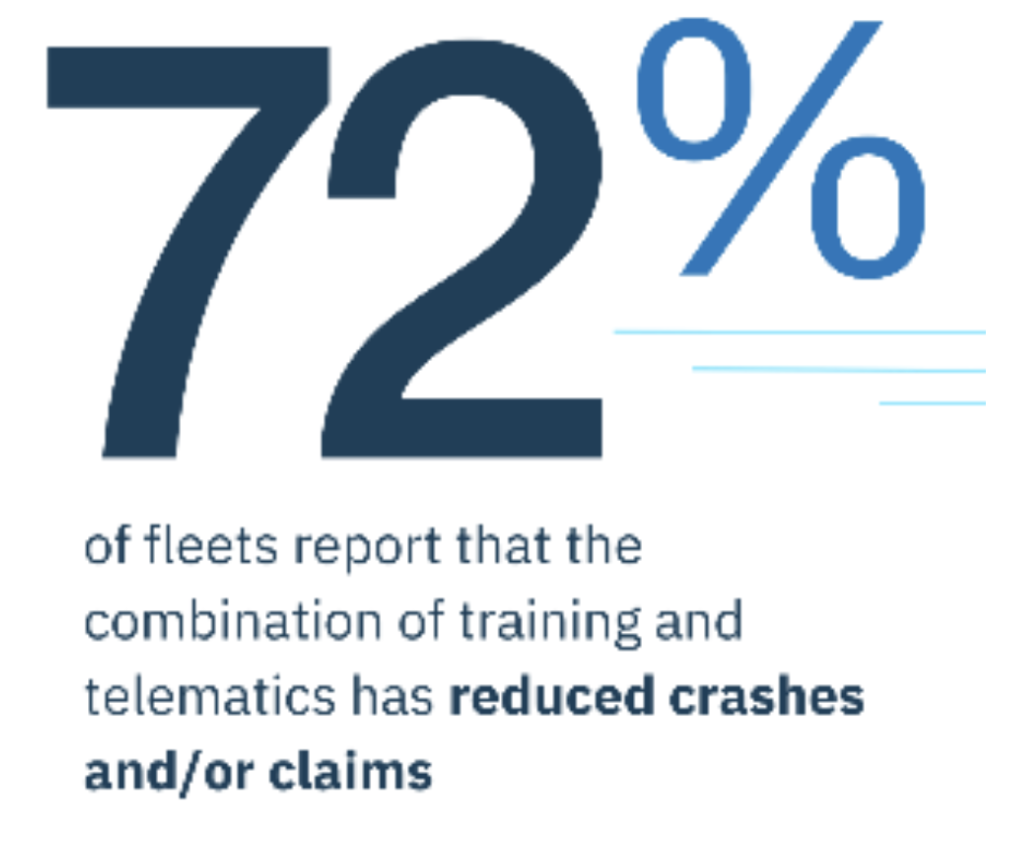

Commercial auto profitability continues to decline, with increased litigation, distracted driving and claim severity threatening sustainability. Telematics offers a proven path to risk reduction—72% of fleets report reduced crashes and claims when combining telematics with training programs.

The question isn't whether telematics will transform commercial auto insurance but rather which carriers will emerge as leaders and which will struggle to catch up. With 82% of commercial insurers already having some level of telematics adoption, the race is on to convert experimental programs into competitive advantages.

The data makes it clear: Fleets are ready, technology is maturing and the benefits are proven. Industry leadership is needed to bridge the communication gap and unlock telematics' full potential. The insurers that act decisively today will shape tomorrow's commercial auto landscape.

SambaSafety and the IoT Insurance Observatory are gathering insights for the 2025 Telematics Report. You can participate in the 2025 survey here.