Recent developments in technology and the corresponding availability of data can improve risk prevention. A key driver is the Internet of Things (IoT), the growing network of connected devices ranging from consumer wearables to industrial control systems.

According to a recent report by Kaspersky, 61% of enterprises already use IoT applications. So, nearly two-thirds of insurers’ corporate customers can potentially integrate IoT data into insurance services. And a recent study by Aviva revealed that the number of internet-enabled devices in the average U.K. home has increased by 26% in the last three years to over 10.

Insurers can use the newly available data from IoT applications to reduce risks for customers, whether directly – through real-time risk mitigation solutions – or indirectly, by promoting safe behaviors over a longer period.

Prevention services are not new in the insurance industry; for years, insurers have provided consumers with loss prevention advice, and risk-engineering teams advise businesses in commercial lines. Ways to prevent risk, however, are changing. IoT allows risks to be better managed. This can be seen as the very essence of the evolution from pure risk transfer to a "prescribe and prevent" scenario.

See also: The Human Risks in Insurer/Broker M&A

Real-time risk mitigation

Real-time risk mitigation results from the direct use of IoT technology and can either consist of:

- Automated actions by IoT actuators that affect the risky situation without any human intervention, like autonomous driving systems in cars, or

- A warning to trigger some kind of human intervention, such as a water leakage alert that activates an emergency repair service.

These risk mitigation actions can be triggered by the detection of three different situations:

- Missed safety tasks, such as scheduled inspection or equipment that needs preventive maintenance, or a diabetic patient who has left insulin at home or missed a check of blood sugar level.

- A risky situation, such as a frozen pipe; a cold storage door that has been left open; spilled liquids on a supermarket floor; workers without adequate equipment in the workplace; unsafe lifting by an employee; a distracted driver.

- The consequences of an event that has already happened, such as a water leak; an unsafe worksite; an injury; or the failure of a patient to adhere to a treatment. A mitigation action is then initiated by the IoT system.

Real-time risk prevention is most mature in commercial lines, driven by the loss control culture present in commercial insurance. Field inspections by engineering teams are well-established, and enhancing this work with new technologies seems like a natural step.

A few personal auto insurers around the world have integrated real-time warnings in their telematics programs. This live feedback – from line departure warnings to alerts about coming risky intersections – influences driving behavior and allows insurers to reduce expected losses.

Water leakage sensors are one of the most cited preventive services in home insurance. However, as of today, insurers have struggled to introduce approaches that generate substantial demand and a sustainable business case. Finding a sustainable business case in the smart home insurance market is challenging, but innovations should make homeowners the ultimate winners.

Figure 1: Leveraging IoT data for multiple use cases

Bundling risk prevention with other customer services, such as security, has been the most successful approach to date. The sustainable business case is built on a bundle of different services – some sold after the purchase – and on the reduced churn rates built through customer engagement.

Life and health is the least mature field for real-time risk mitigation services. There have been many insurance pilots over the past few years around early detection, care optimization and medication adherence, but only a few examples have scaled to market level. Reasons for the slow adoption include:

- Health costs in most countries are not fully covered by insurers but by a public health system.

- Entering into the medical device space would mean entering into the medical regulatory field.

- Medical advice comes with significant responsibility and requires deep and specialist knowledge.

- Execution at scale needs insurers to deal with many different medical service providers.

Real-time risk prevention services and approaches to them are very heterogeneous. The only common denominator is that all successful services are based on a multi-year journey.

Promoting less risky behavior

The second way to prevent risk is to encourage less risky behavior. Insurers have a role to play in creating a positive safety culture and raising awareness in society.

We can distill a three-pillar concept from the successful examples:

- Pillar one: Create awareness of the current risk level

- Pillar two: Suggest a change in behavior

- Pillar three: Offer incentives for changes in behavior

The sustainable adoption of safer habits for the benefit of all stakeholders can only happen when all three pillars are successfully implemented.

The first two pillars are closely linked and depend on feedback to customers. Awareness of the current level of risk leads to the question: What change will make the activity safer? Before changing our behavior, we need to be aware of our current behavior.

Raising awareness of risky behavior and identifying ways to change it are not enough. There is a need to encourage people to instigate real and sustainable changes in their behavior through rewards.

The customer’s perception of the value of the rewards, their cultural context and frequency and the intersection with behavioral economics are all integral. Changes in human behavior are also instinctive; A combination of behavioral economics and gamification to engage individuals is therefore needed to help to drive behavioral change.

The most mature business line is life and health. Fully individualized suggestions and challenges are provided to customers based on the number of steps registered by their mobile phone or physical activity data from wearables.

In personal auto telematics, customers often receive a detailed analysis of their driving style via a dashboard in a mobile app. Many insurers also automatically display tips for improving the driving score, or introduce contests on specific issues – so-called leaderboards.

See also: Despite COVID, Tech Investment Continues

In commercial lines, IoT data is being used to enhance the activities of the loss control teams and to provide periodic safety insights to risk managers and supervisors of the insured companies.

The real-life case studies on promoting safer behavior afforded the following key findings:

- The reward system needs to be set up to reinforce positive behavior. The reachability of the reward is key.

- There are cultural aspects to incentives. It is important to find compelling benefits and rewards that engage target customers. What works in one country does not necessarily work in another. The rewards must be explicit and tangible. For example, monthly cashback on fuel costs is effective, but a free weekly coffee also materially influences behavior.

- Frequency is key. A yearly premium discount is not enough. Positive engagement must be nurtured on a short-term basis. This mechanism gives people a reason to come back to the platform.

Enablers of prevention services

The integration of technology into prevention services greatly increases complexity. As a result, the enablers for success are the effective business transformation, cultural change and understanding of the corresponding financial management rather than the technology itself.

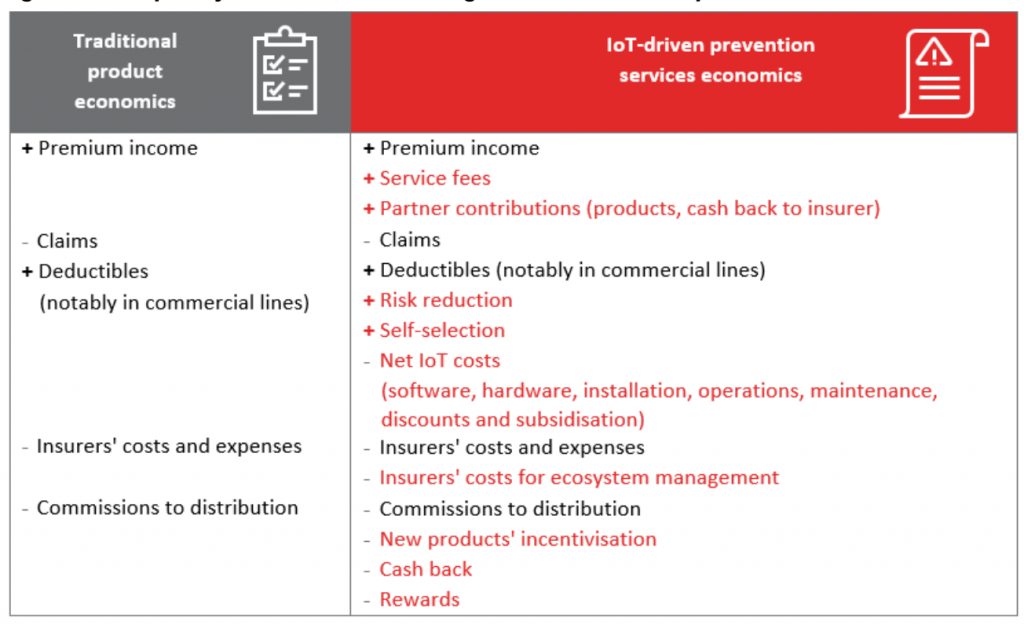

Figure 2: Complexity of the financial management of IoT-driven prevention services

We identified the following as the main success factors:

- C-level commitment

- Development of vision and strategy

- Development of culture and capabilities

- An effective value-sharing scheme with the customer

- Management of new and complex financials

Several new elements need to be considered in the financial management of this new paradigm, such as service fees, partner contributions, self-selection effects and net IoT costs, which are harder to integrate into the economics of traditional insurance products.

The full report from which this article is derived is available here.