The new kids on the block (#insurtech startups aiming to be disruptors) have not made a dent and for sure will not kill insurance incumbents. So, why should an insurer innovate? Because technology and data are incredible opportunities to lower the loss ratio and improve return on equity. (Do you remember my Insurtech 4Ps?)

Let's look at auto insurance. Root (the new kid on the block) once upon a time was a telematics-based unicorn, but it has never used telematics data well. Nowadays, they have given up on telematics (their latest storytelling is about embedded), and their market cap is about $50M (in March 2022, it was about $500M).

By contrast, Progressive (with a market cap of $81B) presented their 2022 results on Feb. 28 and dedicated all their earning call to telematics, providing tons of food for thought for anyone working on auto insurance in the U.S.

Below, I'll analyze nine key takeaways (with facts and figures) from this earnings call, exploring the future of auto insurance. (Spoiler: The future will be telematics-based! And you will get the reason for the headline of this newsletter edition.)

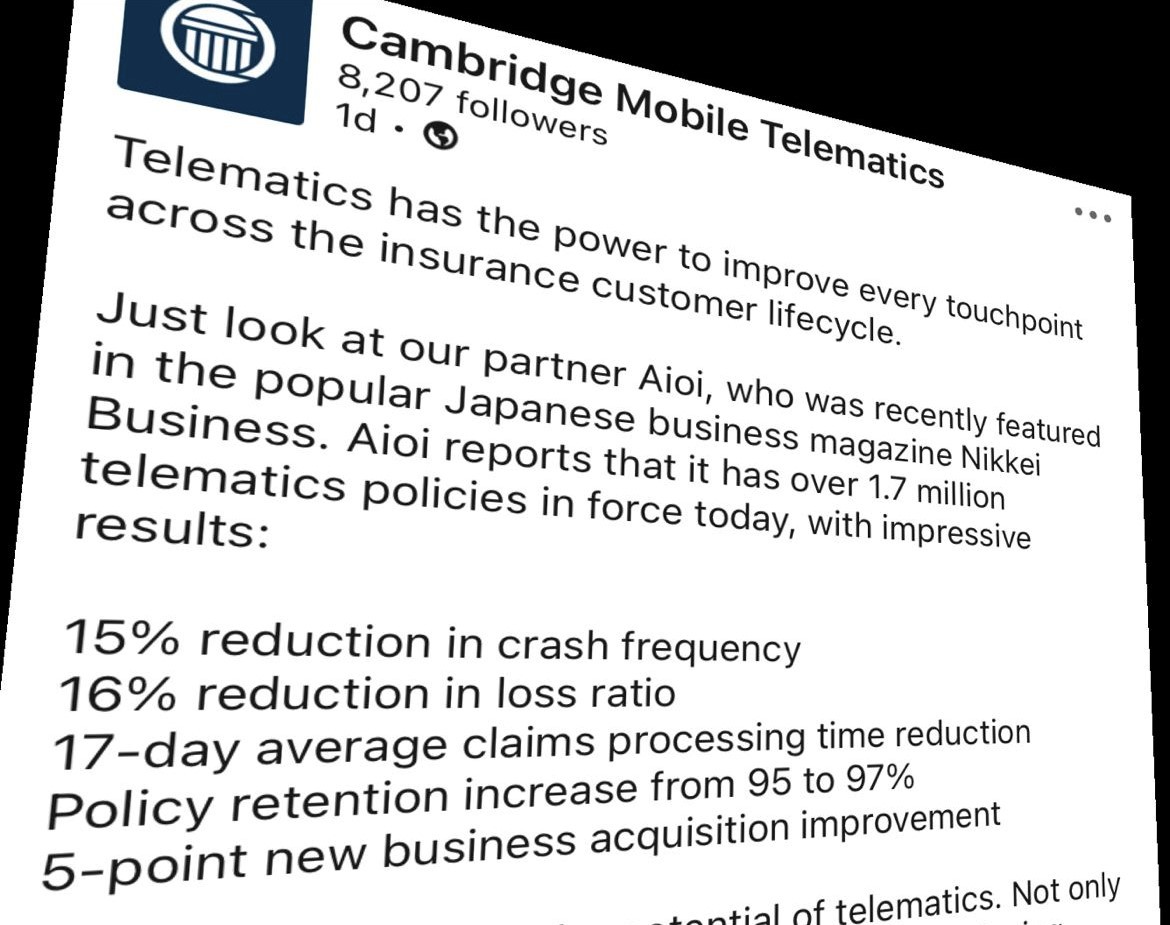

Mobile-based telematics has made it feasible to apply this technology in any insurance market worldwide. Here, you have a recent example of the success at Cambridge Mobile Telematics in implementing telematics in Japan. There is no such thing as "a market not ready for auto insurance telematics," only telematics programs that are not good enough.

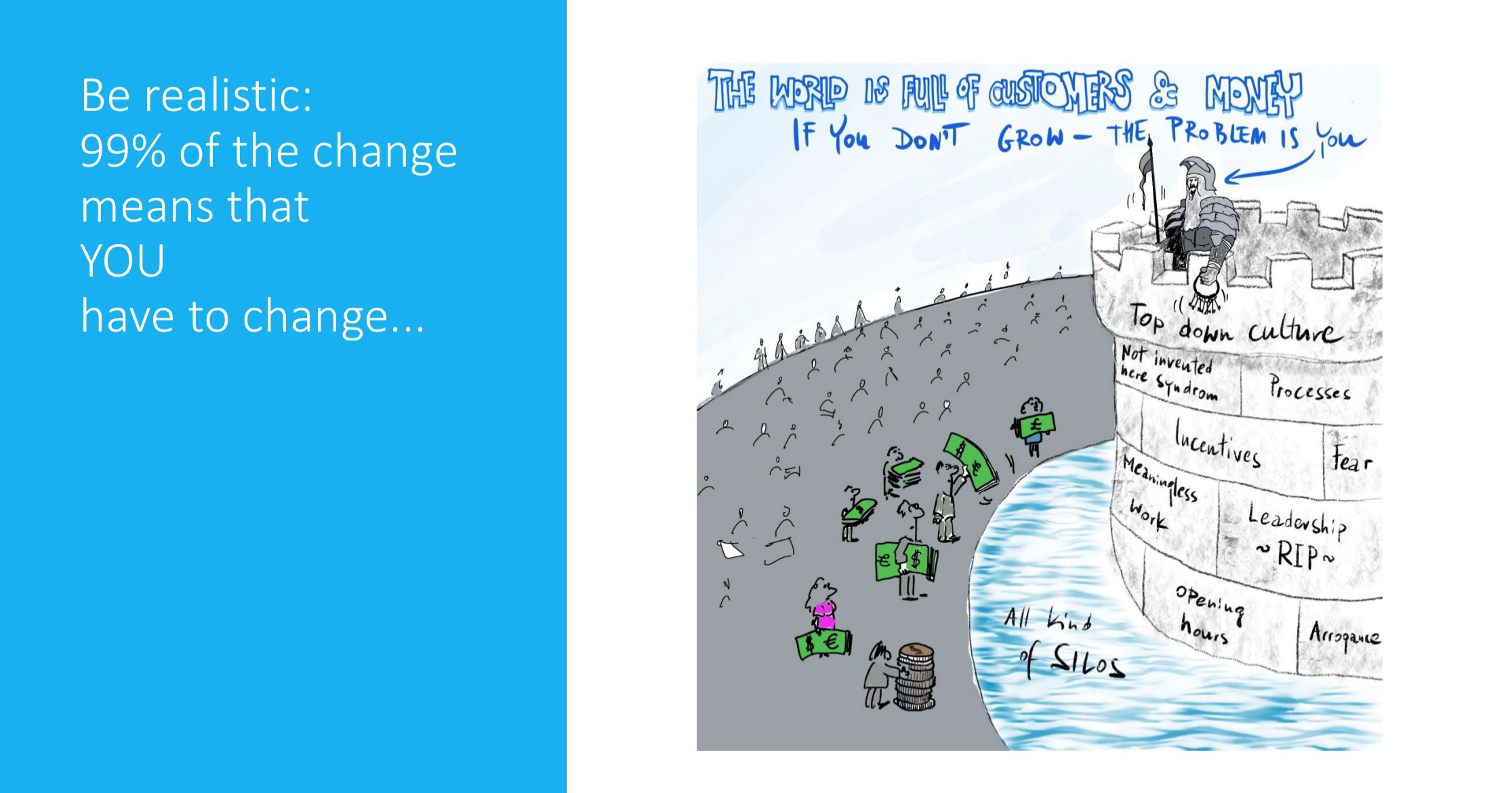

Are you working at an auto insurer that has not yet figured out how to use telematics capabilities to make more revenue, improve driver behaviors, price risks more accurately and retain more customers? You are leaving relevant opportunities on the table! You are leaving behind more than 10 percentage points on your combined ratio!

Source: Jan Myszkowski Oct '22

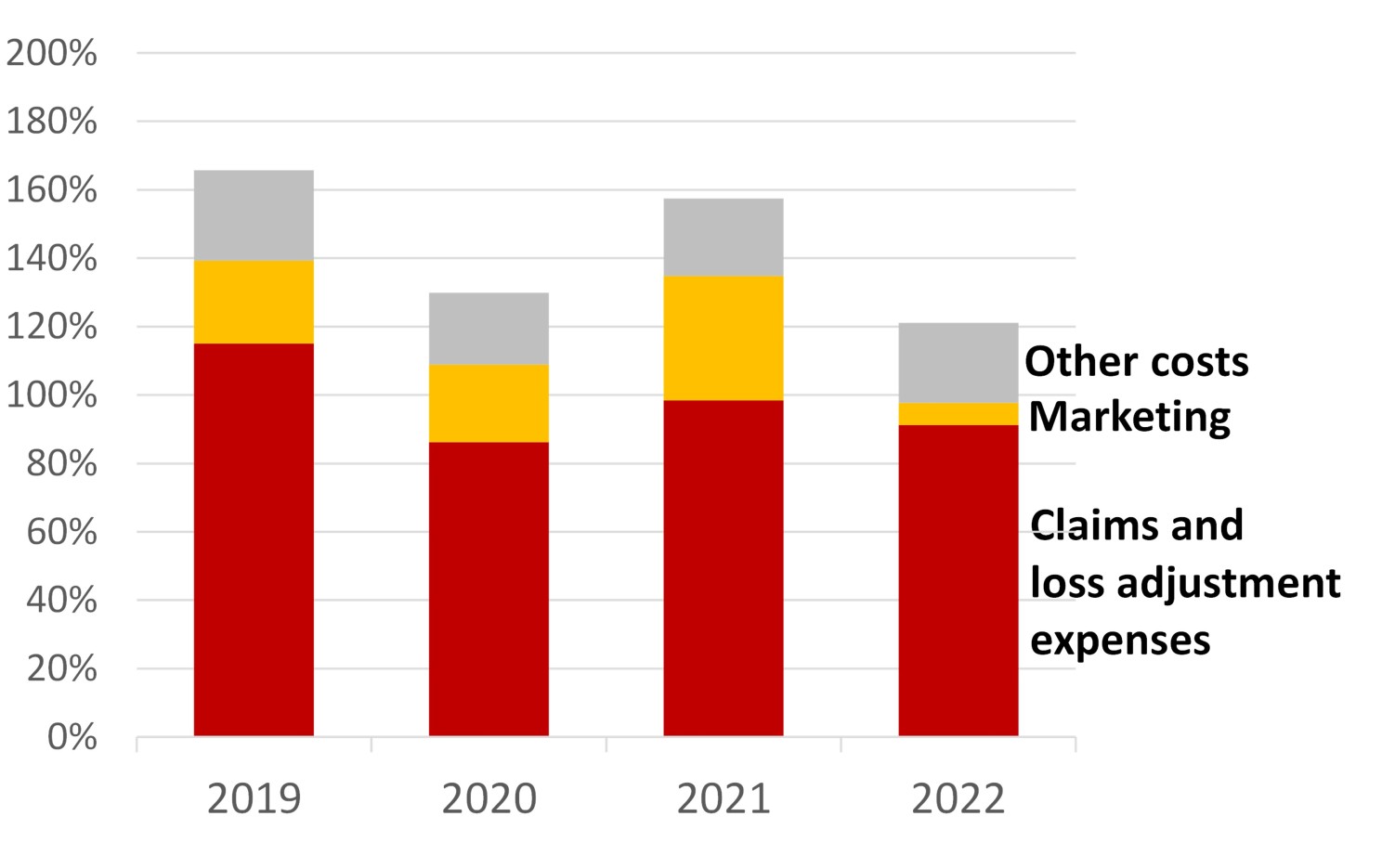

Let's take a quick look at Root's facts and figures.

- '22 gross written premiums $600M (vs $743M in '21)

- '22 loss ratio (including loss adj. expenses) 91% (vs 99% in '21)

- '22 combined ratio of about 120% (vs 157% in '21)

- '22 net losses $298M (vs $521M in '21)

Basically, Root has cut marketing expenses, reduced new business (more unprofitable than renewed and already pruned business) and reduced overall costs in line with the shrinking of the top line.

A year ago, I wrote: Root is not using telematics data well for pricing and risk selection. Moreover, they have even denied the usage of telematics data for claim management and for changing driver behaviors.

See also: It's Time to Get Back to Basics

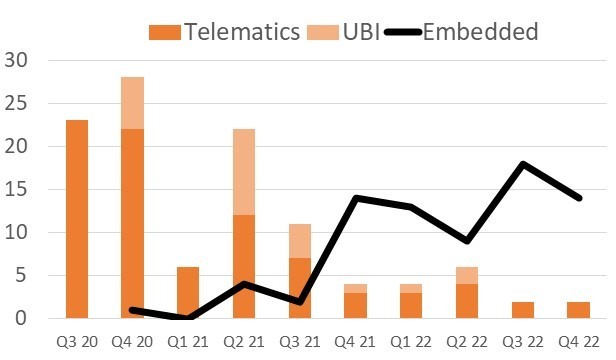

They realized it and pivoted to the new buzzword: embedded insurance. Below are the mentions of "telematics" ("telematics" + "UBI") vs "embedded" in their quarterly shareholder letter:

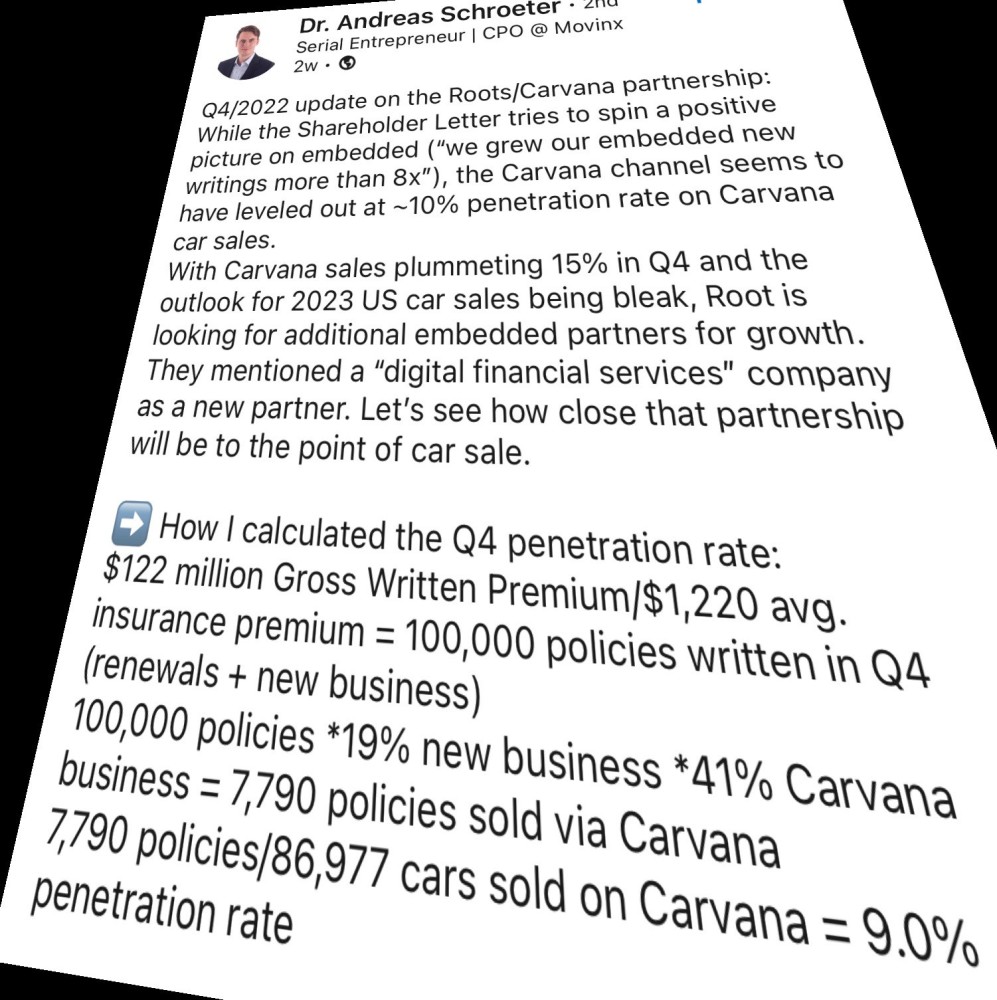

Embedded insurance (with Carvana) represented 41% of new business in Q4 '22 (vs 3% in Q4 '21). That should represent about 9% penetration on cars sold by Carvana.

Wrapping up: They don't have their act together and haven't developed adequate telematics capabilities, and their market cap is an infinitesimal fraction of the money they raised. (Their IPO valued them at about $7B in '20.)

Does this mean telematics doesn't work? No! Absolutely not! Progressive's story, words, figures and acts demonstrate that it works well.

Progressives' earning call gave nine key takeaways for the future of auto insurance:

1. Auto insurance is your most relevant business line and is here to stay, and you have to innovate it

(Do you remember my "rumors about the death of personal auto insurance have been greatly exaggerated"?)

Progressive showed innovations (introduced over the years) and announced many further changes in their telematics-based approach. Progressive's CEO didn't talk about it on the stage of a conference; she dedicated the full Q4 earning call to this innovation journey.

They are not doing it because it is cool to be innovative. You can feel the C-level commitment to using technology and data to do the auto insurer's job better. They are innovating because it contributes to achieving their strategic goal "to grow as fast as possible while delivering a calendar year 96 combined ratio" and represents a concrete opportunity to increase their return on equity! We are talking about the second-largest U.S. auto insurer, with a personal auto loss ratio 10+ percentage points better than the market average in 2022 and a total shareholder return constantly in the top 10 insurers worldwide for the past two decades.

They took this insurtech approach (telematics) seriously and are obtaining terrific results on their most relevant business line. So why are you still ignoring/denying it?

2. The future of auto insurance is telematics-based

This 86-year-old carrier has been a pioneer in using telematics data since 1996, and has constantly invested in developing its telematics capabilities. Progressive has clearly talked about where they see economic value in using it:

- "Segmentation is a key facet of our competitive prices pillar, and nowhere is that more evident than in our investment and usage-based insurance products"

- "UBI is our most predictive rating variable, and it provides unparalleled rate accuracy"

- "It's about segmentation and matching rate to risk"

- "The program systematically helps us retain lower-risk drivers"

- "Our claims representatives have seen that telematics data can help them settle claims more quickly and efficiently"

- "Offering a service to detect and respond to major accidents [...] customers have consistently told us that this kind of service is something that they really do value"

(Here is an old (gold) paper published with Swiss Re back in 2017: Unveiling the full potential of telematics )

Customers are ready in any market (a recent survey -- done by the IoT Insurance Observatory together with Swiss Re on 10,000 policyholders in nine different markets -- shows a high and consistent level of acceptance: Only a fifth dislike the telematics approach!) Regulation is not an absolute barrier in any market (only a constraint that would influence the execution of the program). And mobile-based telematics removed the old barrier: The telematics hardware was too expensive in some international markets where the annual insurance premium is below $200. The size of your company is not an excuse, either: You don't need to be a 20M policy carrier; there are international telematics success stories from players with less than half a million policyholders. In every market, you can find tech players and system integrators that allow smooth execution in your organization.

It is 2023, and there are no more excuses. What is your reason for still leaving on the table all these percentage points on your combined ratio?

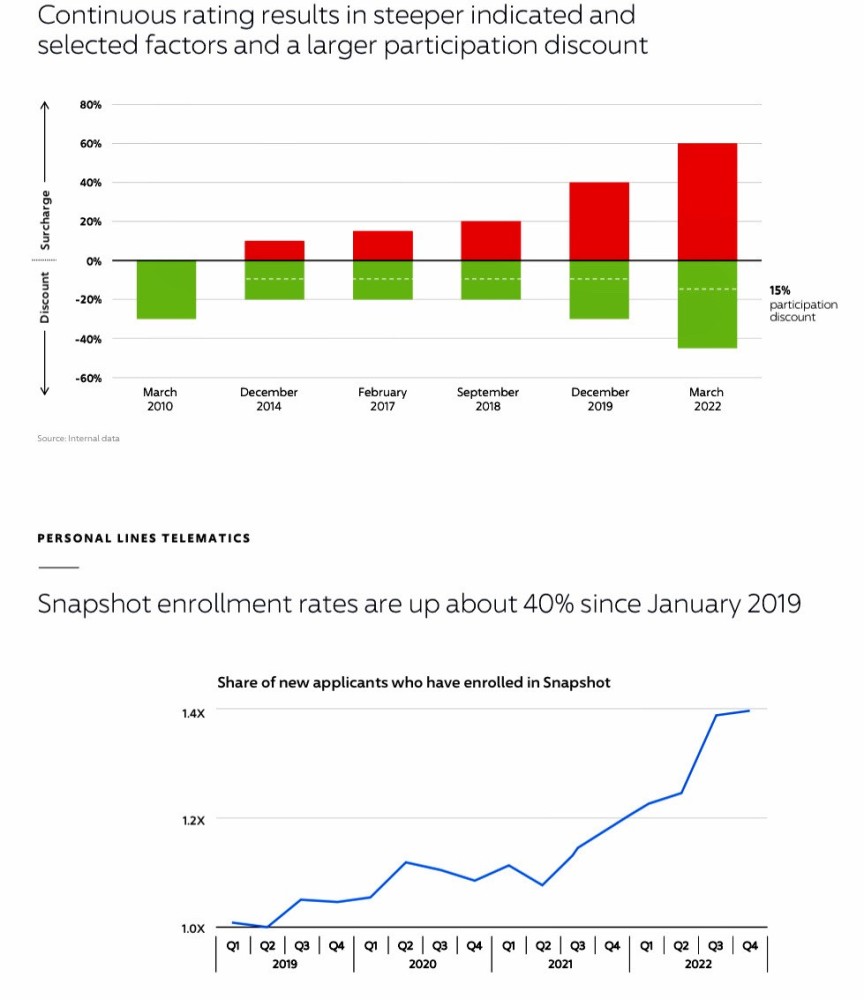

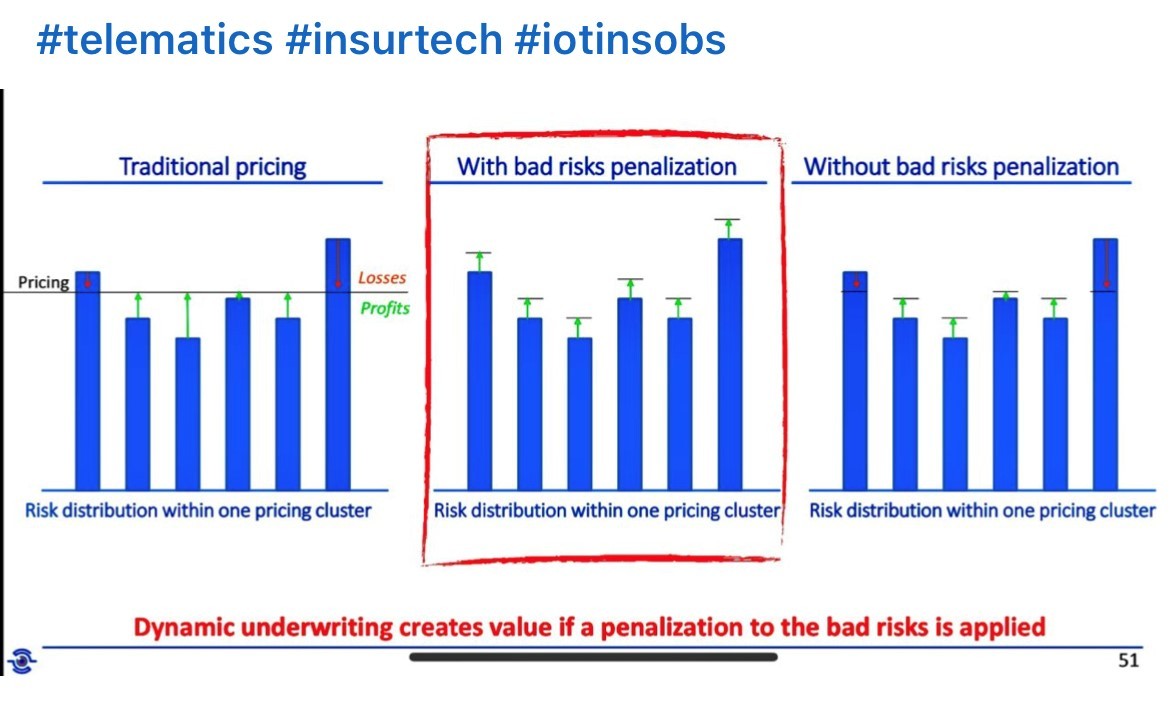

3. Surcharge bad risks

Progressive explained well why it is necessary to surcharge bad risks to create value through more accurate pricing, and how it works:

- "Participation discount is larger now, at 15% instead of 10%"

- "We've increased the size of the maximum potential discount to 45%, and the maximum potential surcharge to 60%"

- "75% of customers still receive a discount, and only about a fifth receive a surcharge"

- "Renewal rates for the safest drivers who are earning the biggest discounts are about 6% higher than average, while they're about 16% lower for the riskiest drivers who aren't receiving a discount"

- "We had deployed this new continuous model in 12 states, representing over a quarter of our net written premium, and plan rollouts to most of the rest of the country during 2023"

- "Early on, we weren't pricing to the full curve. So, we understood that a lot of people should be receiving surcharges and that some people should be receiving bigger discounts. [...] I think we are now very close to or almost completely pricing to that curve with the data we have today. [...] we continue to advance the size, continue to pull additional data elements [...] our segmentation game is never ending. We're always trying to continue to advance to find additional data to use that can keep us with a gap between us and the competition"

Telematics Innovation at Progressive (Feb '23)

How many times have you heard at conferences or read in articles that customers don't want to be monitored, don't accept the idea of being surcharged and would massively switch if you surcharge them? Progressive's "the share of our personal auto customers participating in Snapshot has moved steadily upward" seems a definitive answer to these doubts.

Putting together the information from this earning call with the previous ones, It seems that the telematics penetration on the new business is above 46% in the direct channel and about 13% through the agent channel.

4. All the policyholders must have a telematics app whatever the product chosen

This has been the most substantial and most surprising message in Progressive's earning call:

- "We know that despite how times have changed, there's a large segment of customers who don't want their insurance premium to be based on their driving data"

- "That means that if we limit this just to our Snapshot customers, we'd be leaving out a lot of others. So, in March we plan to start making accident response available to all of our auto customers, not just those who are in Snapshot"

(Do you remember the telematics predictions Harry Huberty and I dropped a couple of years ago?: "It will be the norm in the U.S. personal auto market for customers to download their insurer’s app on their phone to be insured. This app will continuously use the smartphone’s sensors to deliver a superior customer experience regardless of what product a customer chooses: pay-per-use, telematics-based renewal pricing or a policy with a traditional rating based only on traditional variables such as age, credit score, etc.")

Progressive has started monitoring all policyholders to create value for both the customer and the insurer,

5. Wrap services around the insurance contract

Their talk about services: "We'll use data from the sensors on the phone to detect when a serious crash is likely to have happened. We'll reach out to the customer to confirm the accident and to see if they need help. If we don't hear from a customer at all, and it seems particularly serious, we'll request that the police conduct a well check to make sure our customer is OK. Since we know the customer's location from the telematics data, we know just where to send them. [...] This adds value to the customer's relationship with us and can become another reason to choose and to stay with Progressive. Additionally, while other insurers offer crash detection to their UBI customers, we'll be making it available to all of our personal lines auto customers, whether they're in Snapshot or not. Third, we're deliberate about dispatching EMS."

- Honestly, we have merely scratched the surface of the service opportunity ("continuous is a little bit more expensive [...] we're excited about and what Jim talked about, the excitement about it is the services that we're going to provide, especially in some of the claims examples") in the earning call

- However, Progressive has only just started with the continuous monitoring approach. ( "Our most recent addition is continuous monitoring, which began its rollout in the summer of 2022")

- I'm pretty confident they will fully understand the service opportunity in the coming years

6. The IoT paradigm gives tremendous value to claim handlers (and mobile-based telematics data is good enough)

- ”Having this telematics data available, we're able to get their claims started more quickly and able to handle it more efficiently”

- ”Within two minutes of the impact, we reached out to our customer […] That agent dispatched an ambulance and a tow truck […] it took only 10 minutes from the time of the accident to when we had a claim in our system”

- ”This customer had this accident just two days after buying their policy […] we can see from the telematics data that the crash happened where and, importantly, when our customer said it did […] very confident that this loss did occur after and not before the customer purchased the policy”

"Over the last couple of years, we've experimented with offering a service to detect and respond to major accidents," and "We'll use data from the sensors on the phone to detect.” Do you really think that Progressive would have released this feature to all their policyholders if they had not been super-confident with their mobile-based crash detection?

I told you this in my first LinkedIn article back in 2014:

- “Emergency services with automatic claim detection or buttons for direct-dialing the assistance center”

- "Act more proactively […] make the whole process faster and more efficient, by anticipating: the actual verification of the claim (anticipating the first notice of loss); the direct contact with the client for claim description”

7. Telematics is a capability, not a product

My friend Pete Frey highlighted in an article we wrote together in 2021: "Telematics adoption should be seen “as not just launching a program but actually building a business capability within your organization. The biggest difference as you switch your perspective from program launch to capability building is that you look at building buy-in, understanding and expertise across the organization while launching the program." In an interview with Forbes in 2020, I shared: “building the capability to master the IoT insurance paradigm is an achievable target, and it doesn’t require tens of millions of dollars. However, governing this journey and transforming the way an insurance company does business will require a multi-year commitment and strong leadership.”

I had a couple of meetings in the last few months where two different insurers (both listed) gave me the clear feeling they didn't get it and will not obtain any result from telematics. At least, not with the current leadership teams.

In the meeting with one of the insurers, their main question was: "Can we hope someone will bring us a driving score already calculated? This way, we will have not to deal with app, devices and telematics data". The second insurer (bigger and with an international presence) opened the discussion by saying "for us, telematics is only about claim management. Can that app give us the same data as this device?".

See also: Embedded Insurance Is Everywhere

What have we heard in Progressive's earning call?

- "Getting into telematics is not easy. [...] It's not just as simple as adding a new rating variable. It takes broader and sustained effort, new capabilities and investments"

- "I'd like to tell you about how we've built on that long history in telematics that Tricia discussed"

- "Its efforts and investments over the past 20-some years has established a lot of these capabilities or learnings that we can leverage"

- "We're going to continue to evolve and continue to advance our competitive advantage when it comes to pricing and telematics"

- "I'd like to share some exciting news that doesn't involve using telematics data to more accurately rate policies but instead builds upon our telematics heritage to provide a valuable service to our customers"

- "Invested in a process of continuous improvement in our UBI products"

- "In parallel to our efforts in personal lines, we were developing UBI for commercial auto products"

A competitor’s product can be replicated in a few months, but capabilities require time to be built and internalized in the organization. A capability gap is going to require years to be closed. The sooner you start your telematics journey, the better.

8. You don't need to wait for OEMs or beg for their data

When you talk to an insurer struggling with telematics, it is frequent to hear the belief/hope/illusion that connected cars will change everything, that OEM data are the inevitable end game, that OEM data will allow insurance telematics to take off and that this will happen soon.

What has Progressive said?

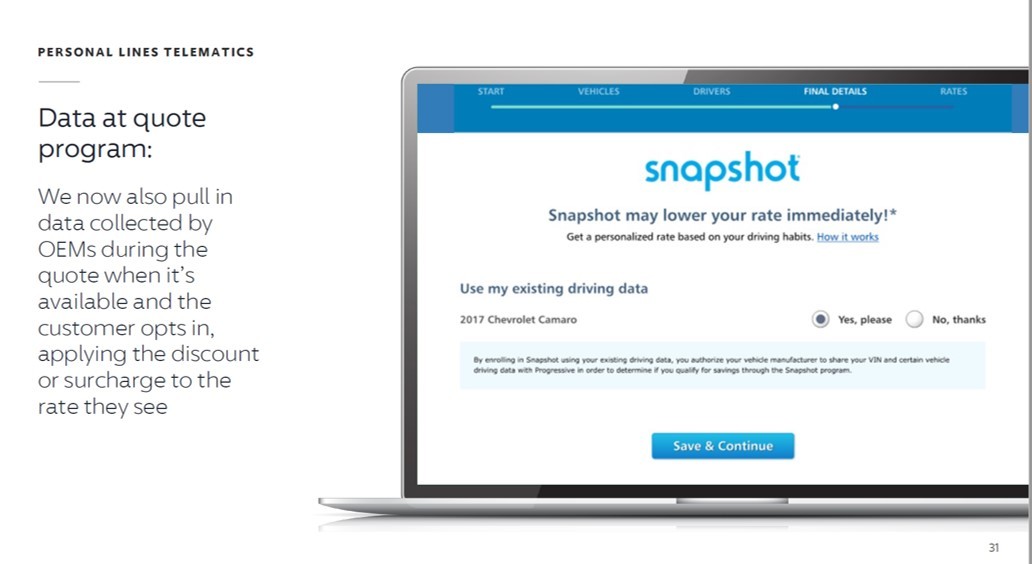

- "Working with data collected by automakers. [...] They've been working to show the value of these programs to their customers so that they'll sign up to share that data with them"

- "And we've been able to tap into that. When a customer comes to us to quote and their driving data is available, we'd ask the customer if they'd like us to use it to determine their price. They say yes, we bring that data in and apply the UBI discount or surcharge to their quote immediately, again, pushing that rate accuracy to where it matters most, the new business quote"

- "This isn't common yet, but we're excited about the opportunity it represents"

- "The framework we're talking about depends upon vehicles with cellular connection. [...] Some, you know, are still working on it. So, it's -- and it does take a while for the fleet to turn over. So, it's very focused on a few OEMs and the most recent model years. [...] So, we expect that this population will grow over time"

Basically, we are talking about customers asking for a quote from Progressive, and already have a driving score generated by their connected cars. This is a specific use case that doesn't happen too frequently yet (but will be more frequent in the future). Progressive is happy to use (and pay for) this additional information at the point of quotation.

Telematics Innovation at Progressive (Feb '23)

I'm pretty aligned with this vision. There are not a lot of data today (insurers insure all the cars in use today, not only the new sales), OEM data can be helpful for some specific use cases (that don't require a lot of data), and a few times you are even able to find sustainable business care considering the high cost of this data.

However, many of the telematics opportunities require continuous monitoring and can be addressed better with the insurer's mobile app.

Here a recent conference where I talked about OEMs and insurers VIDEO

9. [MISSED] To change behaviors is an incredible opportunity for an insurer

Driver behaviors can be changed, and the most effective way is through frequent and tangible rewards. Over the years, a material part of the IoT Insurance Observatory's research has been dedicated to this use case (in the different insurance domains, not only personal auto). I've seen best practices obtaining up to three percentage points on their combined ratio changing driver behaviors. Last year, in the March edition of this newsletter, I interviewed Anton Ossip (Disovery Insure's CEO), who built a great telematics program focused on changing driver behaviors: Vitality Drive. A broader perspective on behavioral change can be found in the paper I published with the Geneva Association in 2021: From risk transfer to risk prevention

This issue is totally missing in Progressive's talk, and it is a pity because to apply it on all the portfolio (point 4 above) is a fantastic opportunity. I'm sure we will hear even this in Progressive's earning call within two or three years.

This earning call should be read again and again by everybody working on auto insurance. A lot of food for thought.

My advice in a nutshell: Be more like Progressive and less like Root.