KEY TAKEAWAY:

--The 2023 aggregated combined ratio for personal auto insurance is expected to be 106%, but, done right, a telematics program can lower that combined ratio as much as seven percentage points on the entire auto insurance portfolio. Research shows:

- three-point improvement at a portfolio level, achievable within months, via a structured behavioral change program;

- three-point improvement based on improved claims management and increased self-service;

- 0.5 to one-point improvement based on retention — telematics for auto insurance programs can help increase retention by about 20% compared with traditional portfolios.

----------

The U.S. personal auto insurance sector lost billions in 2022, but the right telematics auto insurance strategy can quickly bring a five-percentage-point improvement to your loss ratio.

Due to inflation, driver distraction and slow approval of rate changes, the 2023 aggregated combined ratio for personal auto insurance is expected to be 106%, according to AM Best’s David Blades. To rectify this sorry state, insurers must embrace every opportunity to address this disequilibrium in the personal auto segment, starting with telematics.

Telematics for auto insurance and UBI (usage-based insurance) are potentially industry-changing technologies. But the truth is their impact on profitability has been negligible. In 2022, the U.S. personal auto insurance sector lost billions of dollars and generated a historically bad 112% combined ratio.

While large personal auto insurers have adopted telematics-based programs, they’re only scratching the surface of the potential benefits. Total market penetration of telematics for auto insurance is a fraction of the risks insured.

While much has changed, there’s more that insurers can do to increase adoption. By converting current customers to telematics for auto insurance programs, insurers can carve a fast path to sub-100 combined ratios.

Telematics for Auto Insurance Fills the Current UBI Business Model Gaps

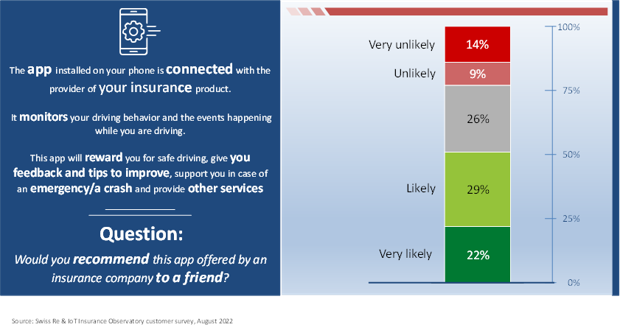

The research shows that most people like mobile-based insurance telematics. When presented with app-based telematics for auto insurance program that provide rewards for safe driving, emergency/crash assistance and other services beyond monitoring driving behavior, more than 50% of U.S. respondents in a recent Swiss Re and IoT Observatory survey (10,000 worldwide/2,000 U.S.-based) said they would recommend the program to a friend.

By many measures, insurance telematics is a success in the U.S. market. According to TransUnion’s “Insurance Trends and 2023 Outlook Report,” the number of people who opted into a telematics program for auto insurance now sits at 60% of those presented with an offer. Some insurers, such as Progressive and Allstate, have achieved UBI penetration rates of 40% to 50% in certain channels.

But even with the increase in adoption experienced by these large insurers, telematics for auto insurance is not pervasive in insurance books.

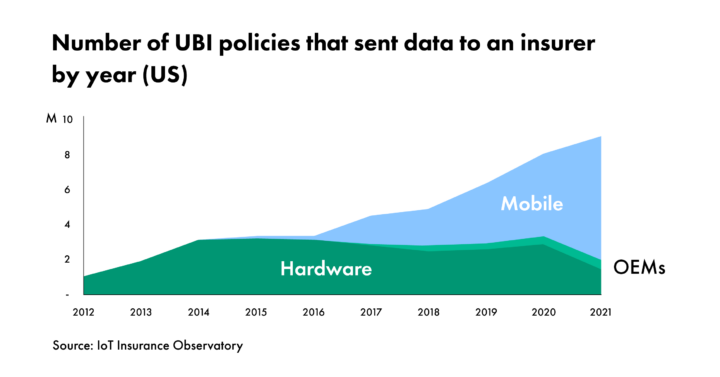

The IoT Insurance Observatory, an insurance think tank that has aggregated data from more than 120 insurers, reinsurers and tech players over its seven annual editions, estimated that about 9 million UBI insurance policies transmitted some telematics for auto insurance data to an insurer in the U.S. in 2021, which translates to total market penetration of about 5% for telematics. Given the amount of time that telematics has been in the market, this penetration rate is very low.

Telematics for Auto Insurance, Success and Switch-and-Save

The current telematics for auto insurance business model is one reason penetration has lagged. Insurers have mainly used UBI products, accompanied by the promise of steeply discounted premiums, to lure customers from competitors. This typically happens at renewal, when policyholders are inclined to compare quotes.

However, only a relatively small portion of people — slightly above 10% — switch carriers at renewal, even when confronted with an increase in premium. In fact, a recent survey by Swiss Re and the IoT Insurance Observatory found that almost half of U.S. policyholder respondents said they’ve been with the same insurer for more than five years.

See also: Video Telematics Transforms Road Safety

A New Telematics Business Model: Value-Added Services for Current Policyholders

Given that inertia, insurers should begin offering telematics to current policyholders, wherever they are in the policy lifecycle.

European insurers, including Fidelidade in Portugal and Generali in Germany, have already successfully introduced mobile-based telematics for auto insurance programs focused on services — that have no impact on insurance premiums — and are offered to everyone in their auto portfolios.

Ohio-based Progressive is following the same path. In a February 2023 earnings call, Progressive sent a clear message to the U.S. insurance industry that it would do the same.

“Over the last couple of years, we’ve experimented with offering a service to detect and respond to major accidents to some of our Snapshot customers to learn if they value the service and to better understand how it could be useful in handling claims,” said Tricia Griffith, Progressive’s chief executive officer.

“[T]here’s a large segment of customers who don’t want their insurance premium to be based on their driving data. That means that if we limit this just to our Snapshot customers, we’d be leaving out a lot of others. So, in March, we plan to start making accident response available to all of our auto customers, not just those who are in Snapshot,” Griffith said.

All Progressive’s policyholders have the telematics for auto insurance services constantly available within the app, regardless of the auto insurance product chosen.

To better understand which services would offer the most value to drivers, the IoT Insurance Observatory and Swiss Re asked survey respondents to pick the services they’d like to include in the app. The three things that U.S. customers want most are rewards, automatic emergency assistance in the event of a crash and anti-theft support. Driver conveniences, such as weather information, car location finder, car maintenance reminders and claims support are also of interest.

Providing these services to all of the customers in the current portfolio is a clear and addressable opportunity. There even examples of tech players, such as Bouncie in the U.S., that are scaling based on telematics for auto insurance services sold to drivers. Insurers such as Discovery Insure sell participation in its UBI program – which includes rewards like vouchers and other perks for safe driving – for the equivalent of $5 a month.

The Urgent Need to Expand Telematics for Auto Insurance Uptake

There is much evidence that frequent, tangible and inexpensive rewards can improve driving behaviors, help drivers avoid accidents and reduce loss ratios. Within the first 30 days of joining Vitality Drive, an incentives-based driver-behavior program from South Africa’s Discovery Insurance, drivers have a 15% improvement in driving behavior on average, according to company research.

Some insurers outside the U.S. have also used telematics for auto insurance data in their processes and achieved benefits such as reduced average claim costs and litigation, increased fraud detection, faster claims processing and improved customer satisfaction.

Moreover, insurers with hundreds of thousands of mobile-based telematics for auto insurance policyholders experienced an increase in customer retention and a decrease in cost for customer service due to an increase in self-service within the app.

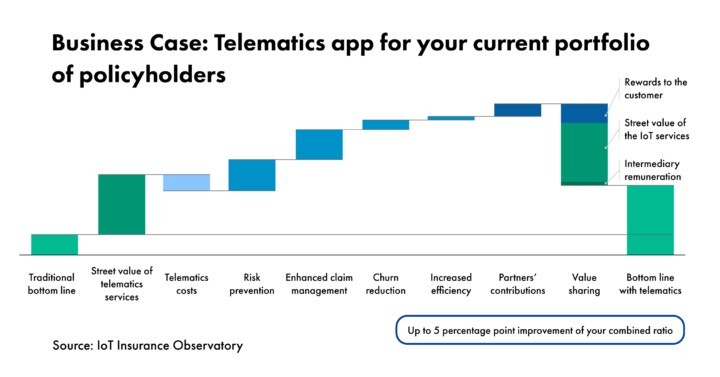

Research by the IoT Insurance Observatory, which has covered more than 80% of the telematics in auto insurance policies worldwide for the past six years, shows that well-executed mobile-based telematics for auto insurance programs have a large and positive impact on combined ratios, and estimated the following as achievable impacts on a U.S. auto insurance portfolio:

- three-point improvement at a portfolio level, achievable within months, via a structured behavioral change program;

- three-point improvement based on improved claims management and increased self-service;

- 0.5 to one-point improvement based on retention — telematics for auto insurance programs can help increase retention by about 20% compared with traditional portfolios

This means that the potential benefit to insurers is as much as a seven-percentage-point reduction on the combined ratio of the entire auto portfolio.

See also: Insurtech Startups Are Doing It Again!

Making the New Business Case Work

Two main challenges that insurers face when expanding their telematics for auto insurance program are cost effectiveness and the IT architecture needed to support continuous monitoring of all their portfolios.

Cost Effectiveness

The benefits described above require a set of digital tools and a structured behavioral change program with rewards. The cost of this new approach includes the telematics for auto insurance software development kit (SDK) inside the insurer’s app for constant monitoring and the IT architecture to manage the data and the reward mechanism – estimated by the IoT Insurance Observatory to be about two percentage points on the insurance premiums.

Adding the telematics for auto insurance SDK into the app of all the policyholders – whichever auto insurance contract they signed – is the best way to quickly unlock the telematics benefits at the portfolio level, which will significantly improve the insurer’s bottom line.

An insurer with millions of policyholders and a strong brand can reach relevant efficiencies and help lower this cost by cutting good deals with retailers for their reward system.

IT Architecture

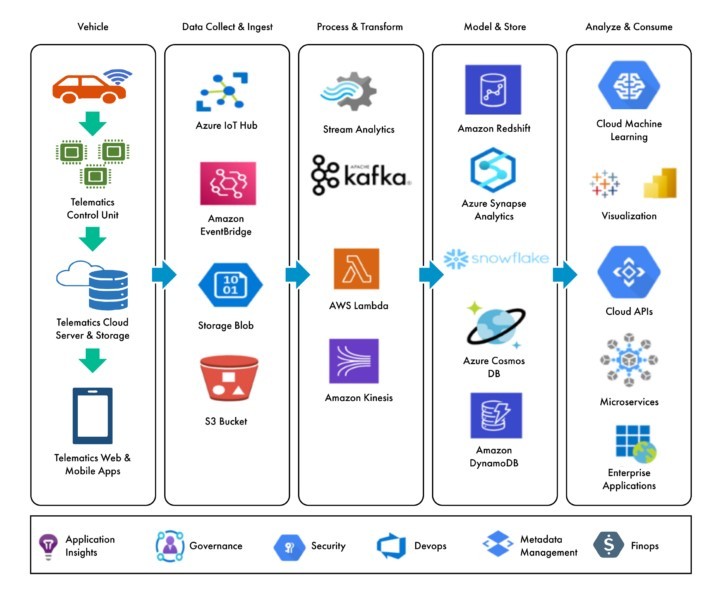

The goal of telematics for auto insurance architecture is to build real-time/near-real-time data ingestion and data processing pipelines to process data from IoT devices into the big data analytics platform for the insurers.

The architecture provides a well-defined data flow process, optimized storage and processing components and consumption workloads for telematics for auto insurance data. This architecture does not aim to ingest data into the core insurance platforms. Rather, it integrates auto insurance data with data from core insurance platforms in a “model and store” data storage for analysis and consumption.

The diagram below depicts the data flow and components that drive the architecture for telematics for auto insurance. The goals of this architecture include:

- Supporting and collecting high-throughput, real-time streaming data from telematics for auto insurance service providers

- The ability to capture data from millions of devices and vehicles on a real-time/near-real-time basis for the entire life of the insurance coverage

- Capabilities to perform analytics on the telematics for auto insurance data to make inferences on driver behavior, promote driver safety, provide incentives, encourage customer retention, etc.

- Provide comprehensive and scalable system-to-system integration capabilities for the telematics for auto insurance data and downstream enterprise applications.

This cloud-based, scalable and robust architecture enables data-driven insights based on telematics for auto insurance data provided by insured vehicles. This architecture strives to support applications that enable business use cases for telematics for auto insurance while providing insights into drivers, vehicles and critical incident response. This will be a foundation for developing insurers’ intellectual property about auto risks in the future.

The key components of the architecture include:

- Vehicle: The vehicle generates and transmits telematics for auto insurance data on a real-time basis, which is stored and managed in a telematics server for real-time data access. The telematics for the auto insurance provider enables transmission of data from their servers to the cloud/MFT infrastructure of the insurer for data processing.

- Data Collection and Ingestion: Telematics for auto insurance data is collected and ingested on a real-time basis using cloud-native services and stored as raw files in the cloud. This enables the collection and staging of raw transactional data for pre-processing. Data access to the raw layer will be enabled in this region.

- Processing and Transformation: Telematics for auto insurance data is enriched, de-duplicated and processed, and key data attributes are selected for transformation to enable modeling and storage of data. This stage enables the right attributes to be selected for use cases to be implemented.

- Modeling and Storing: This critical step ensures that the telematics for auto insurance data is integrated with other critical insurance data elements. These now can include data from core insurance systems for policy, claims and billing, etc., as well as data from external partners, such as MGAs and TPAs, and third-party data, such as geospatial and demographics. The goal is to provide a comprehensive view of data attributes across multiple domains and enable seamless data consumption for visualization, data analytics, system-to-system integration and enterprise applications.

- Analysis and Consumption: This step provides the consumption workloads, which are based on business use cases for telematics for auto insurance. If an insurer offers UBI, this layer handles consumption patterns for enterprise applications. It analyzes correlations with expected claims to define risk models and informs actions on the UBI portfolio. This ensures the applications get the right and accurate telematics for auto insurance data for unlocking the different use cases along the insurance functions.

See also: 4 Ways Telematics Is Improving Car Safety

The current architecture differs from previous telematics architectural patterns significantly, as the use cases for telematics for auto insurance are continuously evolving to meet various business needs. In addition to classic use cases such as UBI and understanding driver behavior, insurers are continuously providing additional services to customers, such as rewards for safe driving behavior, accident response, claims handling, maintenance alerts and mechanical failure diagnostics as part of their telematics for auto insurance offerings. Hence, the data infrastructure needs to be significantly scaled up to meet these needs.

ValueMomentum is seeing customers increase their telematics investments by 30% to 50% to consume, process, store and analyze telematics for auto insurance data. This evolution fully exploits IoT’s potential for the auto insurance business: to continuously sense, understand, learn and act in near-real time. This is a one-time investment to build tech capabilities, and insurers then move into Run-the-Business (RTB) mode after they are implemented.

This architecture helps insurers with two critical business goals:

- As telematics vendors move toward providing real-time streaming data, insurers need this architecture to consume and process the real-time data and to extract valuable insights for the different insurance functions. In addition, this architecture helps insurers scale. For instance, if an insurer wants to expand telematics to its personal and commercial lines portfolio, implementing a cloud-based scalable infrastructure is critical to a successful expansion.

- Providing flexibility on how long the telematics data is stored for a customer. The customer’s preference is to have all telematics data erased when they exit the program. Having a modeled storage layer makes it reliable and easy to identify and remove the raw customer data as per business needs, without missing the intellectual property developed (e.g., risk models).

Expanding Telematics Is Urgent to the Current State of U.S. Personal Auto Insurance

Even after accounting for the cost of setting up the new telematics for auto insurance model, there’s still five percentage points of combined ratio benefit to insurers, representing an extremely precious U-turn opportunity.

Given that insurers obtained on average 1.8% profits over the past 10 years in the U.S. — according to the January 2023 “Report on Profitability by Line by State in 2021,” by the National Association of Insurance Commissioners — offering telematics for auto insurance to policyholders in this new, value-added model can increase profitability by driving down combined ratios.

Even a carrier at the early stages of its digital journey, let’s say with a take-up of their auto app on only one-third of the portfolio, will find the potential profits significant. Moreover, this would be obtained without asking a penny more from the policyholders, providing instead the services customers are asking for.

The technology for telematics in auto insurance is mature, and drivers clearly see benefits in additional services. Insurers with the vision, the will and the skills to act and bring change to telematics for auto insurance in insurance will reap the benefits that come with an expanded market.