Last week, Amazon shut down its U.K. homeowner insurance comparison website, as Google did for its auto insurance site several years ago.

Over the past days, we have primarily heard exactly what was said eight years ago about Google shutting down Google Compare (look at the string of comments under that old post):

- they didn't succeed, but they will be back

- they did well, but not enough for their standard, and they make more money on other businesses

- they come to learn, they did it and they are working on the disruption

- the market was not ready

- the insurance sector is heavily regulated...

What seems missing is any acknowledgment that insurance incumbents, their employees and their intermediaries do their jobs pretty well, and that many of them are even taking essential steps in the usage of (new) data and technology in their core business.

In the last edition of this newsletter, I shared a recent interview with Lemonade's CEO, and I observed how Lemonade's recent storytelling moved to aspects that make more sense. About automation in customer support and claims, I commented: "It would be difficult to find an incumbent who is not working on applying AI to these processes."

One insurer that has already done an impressive journey with AI is Nationwide. Here, you can read my dialogue about it with Jim Fowler, EVP and CTO at Nationwide.

MC: Over the past months at conferences, we have heard comparing the ChatGPT moment to other events in the story. I have heard multiple speakers saying that the ChatGPT moment is less relevant than the discovery of fire for humanity but more relevant than the iPhone or the web. What is your opinion about GenAI and its potential impact on the insurance sector over the next five years?

JF: The changes I’ve seen in technology during my 30-plus-year career have been amazing, and the revolution Gen AI is driving today is the most significant I’ve experienced. Frankly, the world is going to be forever changed – and insurance is one of the industries likely facing the most disruption.

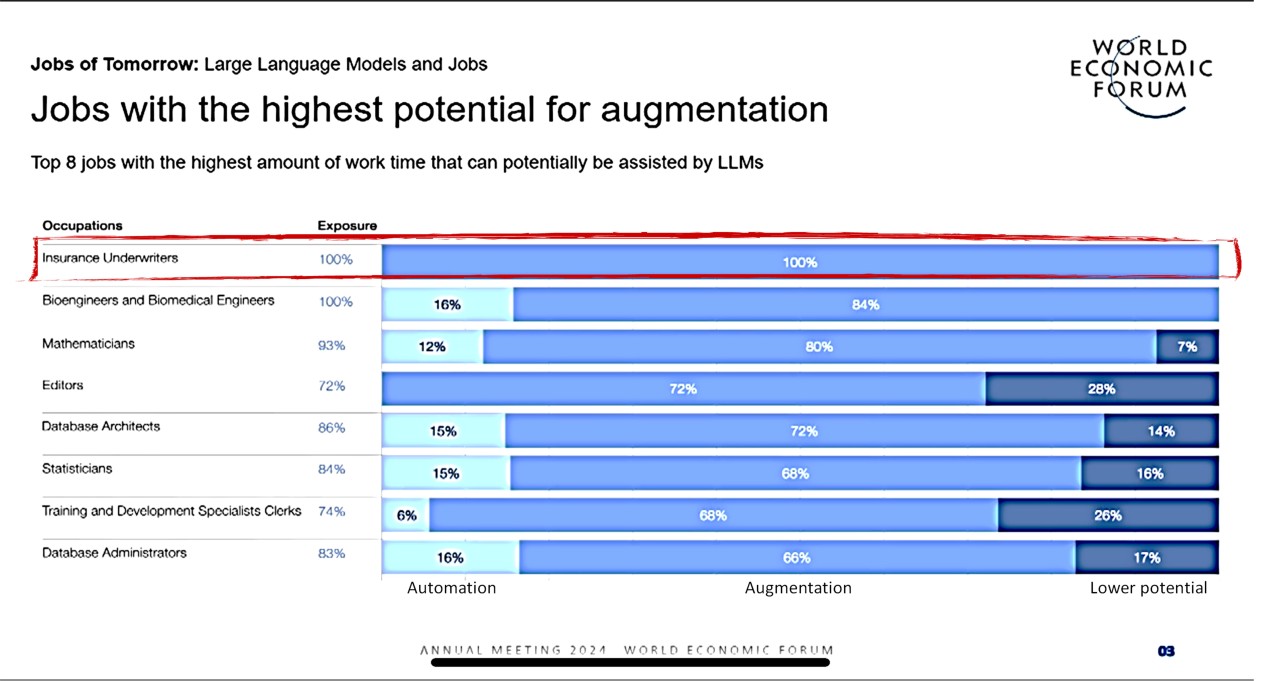

There are clear opportunities coming from AI for companies to find efficiencies in routine, repetitive work. In some respects, everyone is going to need to be a technologist. The underwriter of the future doesn’t just need to know how to underwrite, they need to train a bot or a model how to underwrite.

While there are also AI-powered opportunities for customers to save money, the more meaningful advancements will come when we reach Gen AI’s potential to enhance how we care for customers. AI promises to enable more personalized solutions to protect families and their futures, provide better suggestions to improve our customers’ lives and businesses and supply expanded resources to our teams as they deliver comfort in moments of need. That vision is what’s guiding our approach at Nationwide.

See also: What to Learn From Amazon's Failure

However, over the next few years, our industry will also need to adapt to protecting our teams and customers from those looking to leverage Gen AI to do harm. We’re already seeing people try to generate false images of accidents to file a fraudulent claim or trying to recreate someone’s voice to gain access to their accounts.

Our industry needs to focus on developing new skills and tools – just as much for defense as for offense. We’re doing just that with our red team-blue team approach at Nationwide. The benefits of this technology far outweigh the concerns, and I’m very excited to think about where we’ll be in the future.

MC: I have the impression that generative AI is dropped today into any discussion and paper about innovation, even when other AI models (such as recurrent neural networks, gradient boosted machines or reinforcement learning models) seem to be more adequate to address a specific problem than LLMs. I saw an infographic representing Nationwide’s AI journey of almost 15 years. Based on this successful experience, what is your vision for using the different AI models in the insurance business?

JF: Generative AI, specifically, has received an enormous amount of attention since its inception because it has made the possibilities of AI more tangible and accessible to a much bigger slice of the world. Because of Gen AI, AI isn’t just for technologists anymore.

However, it’s not a one-size-fits-all solution. Nationwide has been using different types of AI since 2010, and there will continue to be a need for a wide variety of tools. We have an AI steering committee that evaluates potential use cases and helps direct toward the best tool, model or analytic to solve the specific problem.

The explosion of AI has been made possible through the improving use of the cloud and data. A key reason that Nationwide has been successful putting AI to work is that we invested heavily to get to single systems of record for all of our businesses. Machine learning tools working with our data have been particularly helpful with risk assessment, fraud detection and claims processing, and these aspects will continue to be critical to our success. Also, our initial use of natural language processing has been promising in analyzing real-time customer feedback.

There’s a world of options for all types of AI, not just generative AI, especially as these tools continue to mature.

MC: In one of your recent interviews, you mentioned how natural language processing allows one to ask questions and obtain answers in a commonly used language. This aspect obviously allows non-tech users to use the tool. Can we foresee a near future where any use case (based on different AI models) has a more intuitive user interface based on natural language processing [NLP] in an organization such as Nationwide?

See also: Insurtech Is at an Inflection Point

JF: In the near future, we can certainly foresee potential use cases within our organization for NLP-driven interfaces to provide a more user-friendly and intuitive experience. Here are some examples:

- Customer interaction: We anticipate that NLP-powered interfaces will become the primary mode of interaction for our customers. This will allow them to engage with us seamlessly, ask questions and receive answers in plain language. For example, customers could ask questions, initiate transactions or seek advice using natural language.

- Employee productivity: We see NLP as a tool that can empower our employees to interact with complex systems and access critical information more efficiently. For instance, analysts can query vast datasets in a conversational manner to extract insights, while customer support representatives can quickly access relevant information to address questions and better care for customers in a time of need.

- Decision support: NLP-driven interfaces will also play a pivotal role in enhancing decision-making processes. Executives and managers can use NLP to obtain real-time insights and recommendations in a more accessible manner, enabling quicker and data-driven decision-making.

- Personalization: NLP can enable us to offer more personalized experiences to our customers and partners. By understanding natural language queries and preferences, we can tailor recommendations and services to meet individual needs more effectively.

While we are enthusiastic about the potential of NLP to help us provide the best possible experiences for our customers, we also acknowledge the importance of challenges such as data privacy, model bias and data quality, which we are keeping top-of-mind to address.

MC: Last, I read about your vision of a bionic enterprise where AI is crucial in augmenting human capabilities. Where are the areas of the organization where you have measured or expect the highest economic impact by using AI? Where do you expect to find the highest one in the next few years?

JF: At Nationwide, we believe AI’s greatest potential is to act as virtual assistants that automate the simple tasks of our associates. This will enable our people to do what they do best and apply their judgment, reason and empathy, to allow Nationwiders to be uniquely human.

We’re experimenting with tools that could support our associates’ work in many different disciplines. We see opportunities to help our technology, sales/marketing, claims and customer service teams provide even more care to our members and partners.

The biggest opportunities for our company will come from the new ideas and strategies these teams can create in the future when they have more time for critical and creative thinking. These new directions, delivered through hyper-personalized offerings for our members and supported by a bionic team of people working hand-in-hand with AI creates a compelling vision for the future for our company.

Even today, we’re starting to implement solutions that a year ago I thought could have taken five or even 10 years to develop. The pace of change is astounding and will lead us to some amazing places over the next few years.

**********

Now, let's go back to Lemonade's current storytelling. Telematics ("continuous streams of highly precise [...] data to us") was one other point touched on as a source of competitive advantage in the interview.

To hear someone claiming that "incumbents cannot for structural reasons" use telematics data well makes me laugh, almost as much as when Lemonade's CEO said in 2022, "When a customer churns, you have not lost a customer, instead you created an alumnus."

Let's look at some facts and figures about personal auto telematics in the U.S.:

- One of the top 10 auto carriers has shown more than 3.5 mllion weekly active users in their telematics app on average over the past 54 weeks (source: Data.ai)

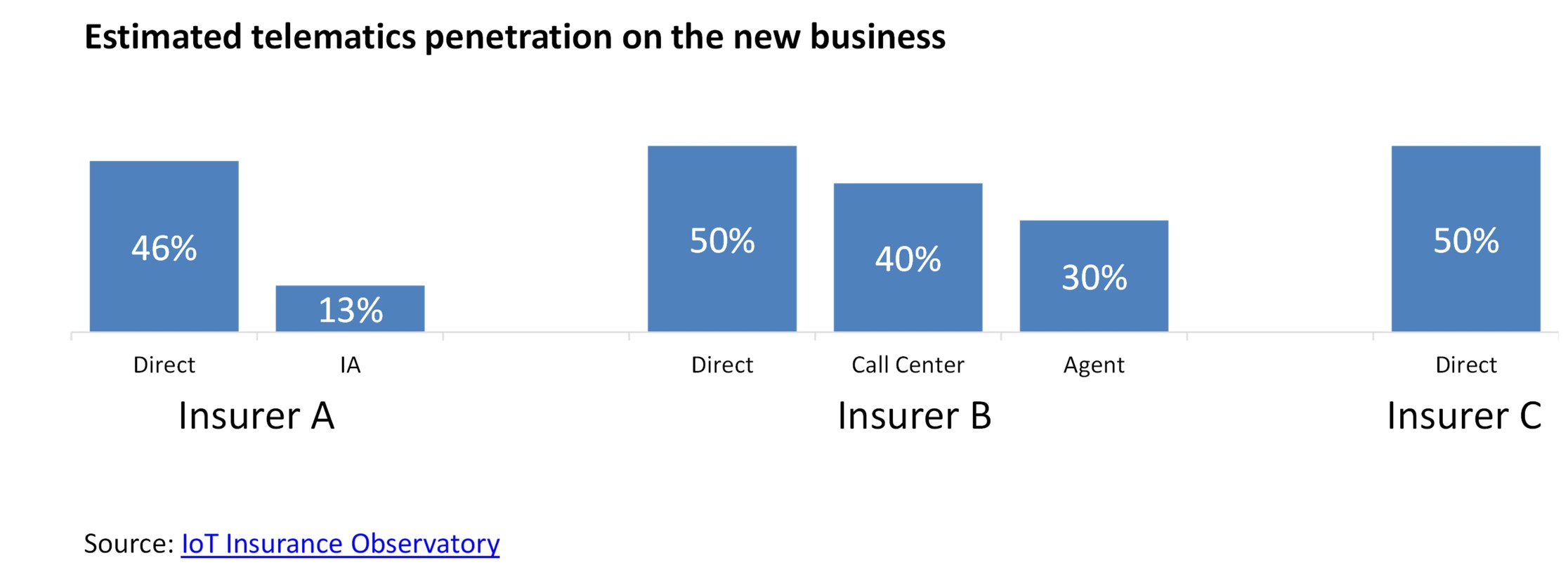

- Customers new to an insurer have a UBI participation rate of 26% on average in the market (and accumulated participation of 17% of auto insurance customers), and many of the top U.S. carriers have astonishing penetration rates (at least in their direct channels)

Some of the U.S. insurance incumbents are using telematics data pretty well!

If we have to criticize the incumbents, we should focus on the limited appeal of the current approaches for their intermediaries and the need to extend the usage of these telematics capabilities to the portfolio of loyal customers already in the portfolio to improve the bottom line materially. The evolution beyond the current switch-and-save approach would be a more extended discussion.

On telematics, Nationwide -- a participant at my IoT Insurance Observatory for many years -- is one of the insurance incumbents leading the pack. I had the pleasure of collaborating with Kelly Hernandez, AVP, personal lines, telematics, at Nationwide, on an article about their telematics capability and the vision for the future of auto insurance. Here are some insights:

- "Nationwide has observed that customers are increasingly willing to share their data through telematics, with a substantial 70% to 80% of direct customers choosing telematics at the point of sale [...] over the past 18 to 24 months, Nationwide has witnessed a remarkable 60% increase in telematics program adoption among independent agents"

- "App interactions increased as much as nine percentage points on days push notifications were sent, and engagement continued several days after"

- "A 10% reduction in everyday hand-held distractions [occurred, proving] that a carrier can affect driving behaviors through telematics programs"

- "For those that have participated in a telematics program, Nationwide consistently sees statistically significant improvement in overall satisfaction, the likelihood to stay with and recommend Nationwide. This is seen in customer retention, as well, which is typically two to three points higher than [for] those that do not try telematics"

- "These results come from a 10-year journey using the telematics data. Nationwide is firmly convinced that telematics is a permanent fixture in the insurance landscape and will persist in its evolution"