Eighty percent of people love personalized solutions, and that includes for insurance.

For decades, insurers have been relying on generalized risk models and broad demographic assumptions to design their policies. But consumers today want more than just general policies. They want plans that suit their unique lifestyle, habits, and needs. Traditional one-size-fits-all policies are no longer relevant to them.

And now, with the entrance of AI, insurers can uncover huge amounts of data and read patterns.

Let's dive deep into this.

What Is Personalization in Insurance?

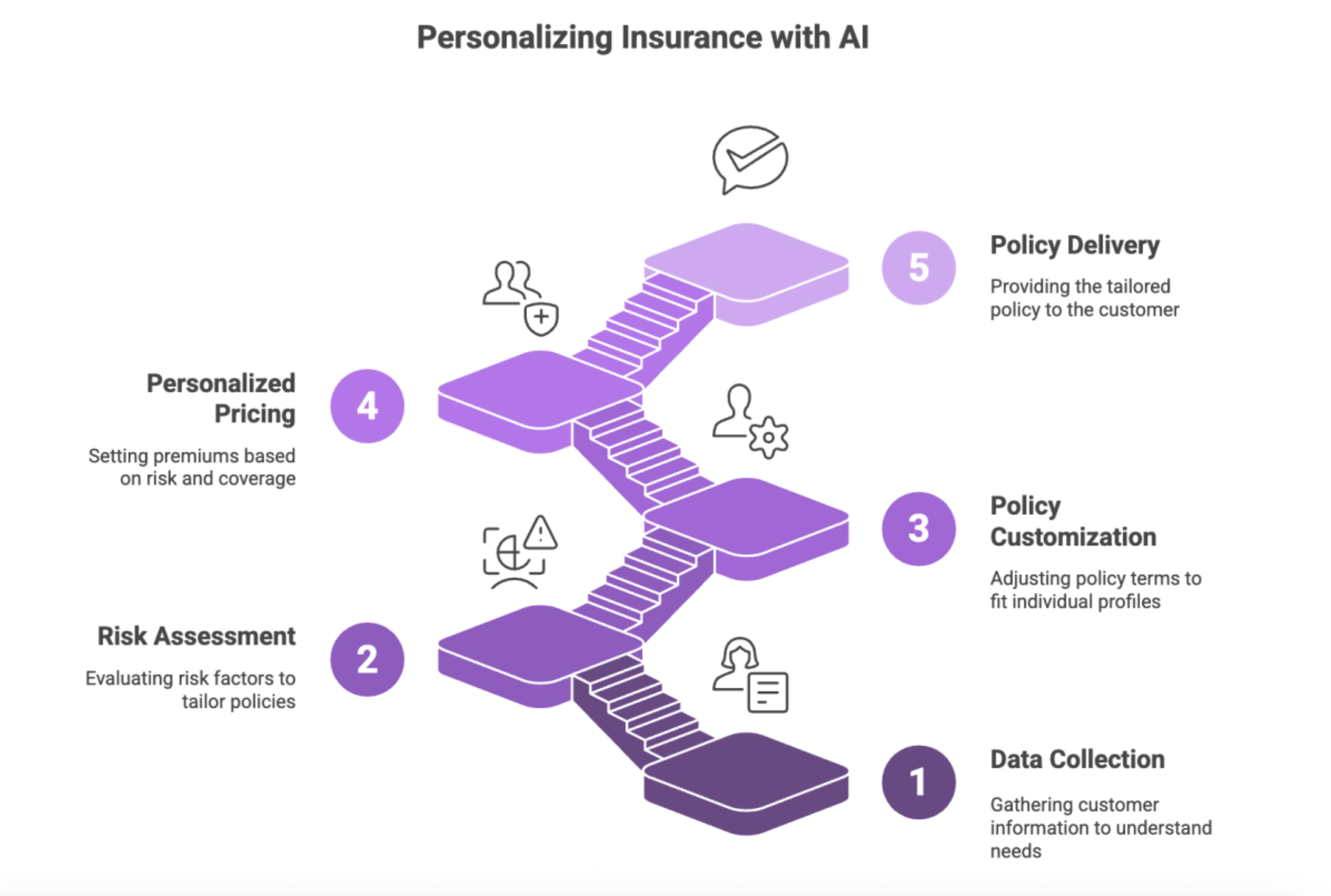

Personalization in policy means tailoring every aspect of a policy. It starts from coverages and premiums and runs to improving services and communication. Instead of giving the same plan to everyone, you give them something that they need. Completely flexible and relevant policies.

Imagine two people, Alex and Jordan. Alex is a 30-year-old city dweller who cycles to work and has a clean history. Jordan is a 45-year-old suburban resident who drives daily and has a family history of hypertension and prefers telehealth options.

If we personalize a policy for both of them, Alex might get a low premium, while Jordan would get a policy that includes regular health check-ups, diet consultations and more.

Role of AI In Improving Personalization

Let's understand how AI will help the insurance sector.

1. Machine Learning

Imagine getting a compilation of a policy's data within seconds that lets you study history, buying behavior, and wearable device data. For example, in car insurance, machine learning can access the driving data of someone using telematics and determine whether he is a cautious driver. In health insurance, machine learning can track a user's behavior, including how frequently he is going to the gym, through healthy biometric data. The knowledge can reduce premiums.

2. Predictive Analysis

With predictive analytics and AI, you can assess future risks by reading historical data. This will help mitigate risk overall. If data shows a customer entering a high-risk age group, for instance, he might face certain health problems. So the policy could be amended and preventive health services prescribed. In property insurance, geographic and weather data can be used to predict risk levels and offer personalized coverage.

Four Benefits of AI-Powered Personalization

1. Increasing Customer Satisfaction and Loyalty

When policies and services are completely personalized according to users' needs, they feel valued.

Think about it: A health insurance plan that adjusts to someone's lifestyle goals or a car insurance policy that rewards safe driving builds trust. The more you personalize, the better you can build strong relationships and improve customer satisfaction scores.

2. Reducing Churn Rate Through Relevant Offerings

You can sell generic policies to people, but customers will be disengaged. AI solves the issue. Continuously analyzing customers' data to make better decisions improves offerings. Giving timely recommendations, reminders, or added suggestions feels helpful.

3. Better Risk Management and Profitability

With AI, insurers can assess risk in a very detailed way. Instead of reading the broad-level data, you can now check based on behavior and lifestyle. AI can identify high-risk behavior that informs appropriate pricing and preventive measures.

4. Increased Operational Efficiency and Reduced Errors

With the involvement of AI, insurers can automate tasks like data analysis, policy customization, and enhanced customer interactions. You can start using chatbots and virtual assistants to handle common queries that reduce human intervention. This saves time and money. It also reduces human errors, ensuring faster response to queries.

Challenges and Ethical Considerations

1. Data Privacy and Consent

Providing personalized insurance services requires huge amounts of customer data – starting from wearable device metrics to online behavior. The challenge lies in collecting data and managing it properly. Proper consent must be obtained from customers so their data can be used for product and service improvement. Otherwise, the insurer might face compliance issues with HIPAA or GDPR.

2. Avoiding Bias In Algorithms

The data processed by AI is based on historical information. If there's some societal bias in the past data, this might be reflected in the solutions, as well. AI might unintentionally amplify biased data related to race, gender, or economic disparities.

Conclusion

AI is changing the insurance landscape fast. Insurance planning is becoming more dynamic, with data-driven personalization. Now, insurers can use real-time behavior to predict risks with precision.