The quarterly financial results of the listed insurtech carriers were published in August's first days. Their depressed valuations (which I have commented on in the last newsletter edition, Will insurtechs ever walk the talk?) improved somewhat before the announcements based on expectations. I posted about Lemonade's financial results, but otherwise let the dust settle until now.

We are still waiting for a clear sign that one of them can survive in the middle term. We are still waiting for Godot.

Let's look at some of the trends shown by the trio of the survival island saga.

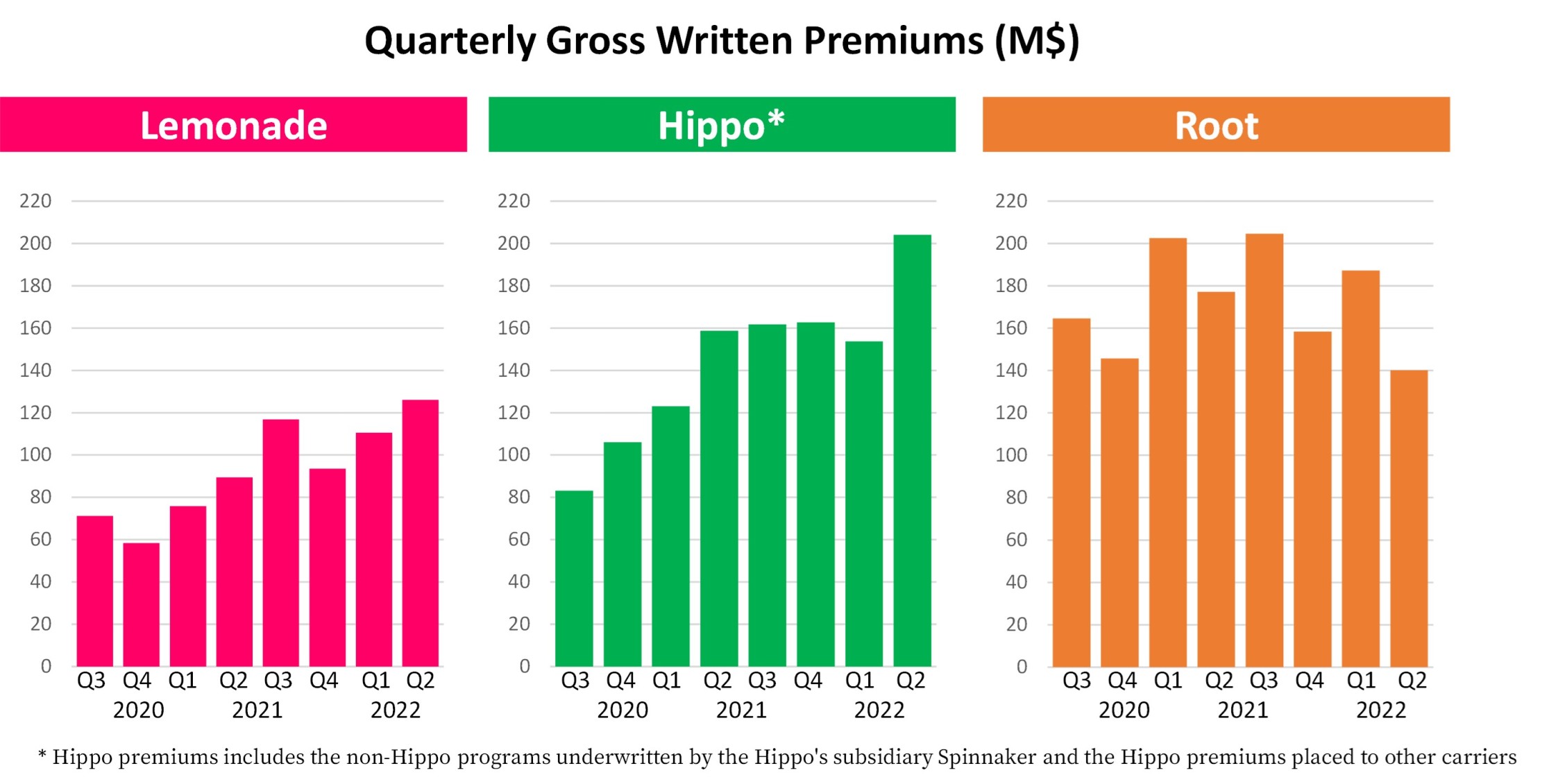

Top Line

We have a positive sign from Hippo, which has underwritten more business than in the previous quarters. Root is shrinking its portfolio. (The number of their auto policies had been reduced by more than one-fifth in the last three quarters)

See also: Will Insurtech Disrupt Homeowner Market?

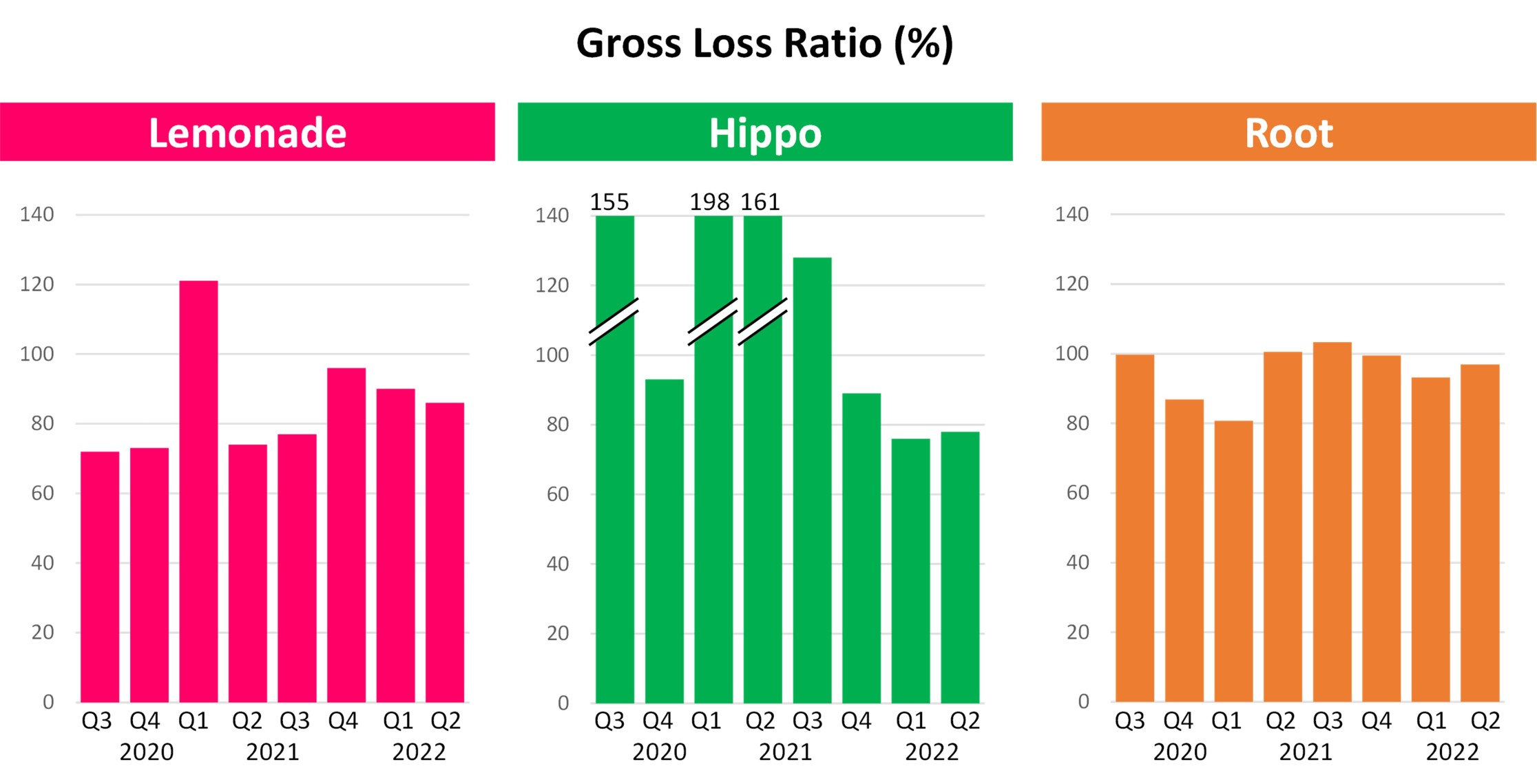

Loss Ratio

Hippo again stood out: It has provided some good news to its investors, while there has been nothing significantly positive about Lemonade or Root. However, Hippo's good news is a new version of the "seasoned policies" narrative. And, unfortunately for them, we are talking about an insurance portfolio, not a bottle of champagne. You can read in the comments of this post a deep discussion around this concept.

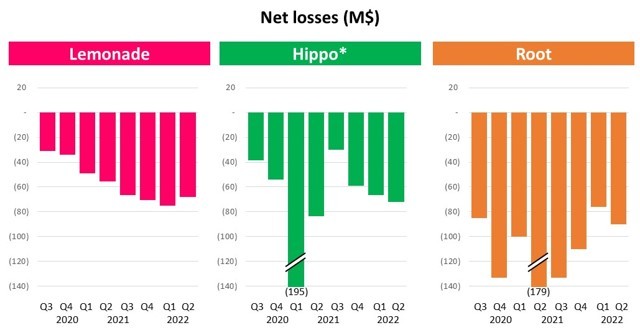

Net Losses

Each of them is still losing tens of million each quarter. This is still the major problem, even if they still have a pile of cash to burn.

Overall, it seems that Root is the player characterized by the worst trends. I highlighted in one of the previous editions of this newsletter that "Root is not using telematics data well for pricing and risk selection. Moreover, they have even denied the usage of telematics data for claim management and for changing driver behaviors."

A player such as Root -- which has focused all its equity story on telematics -- cannot miss nowadays having continuous monitoring and using the telematics data to improve the driving behaviors of its policyholders. It is well demonstrated how:

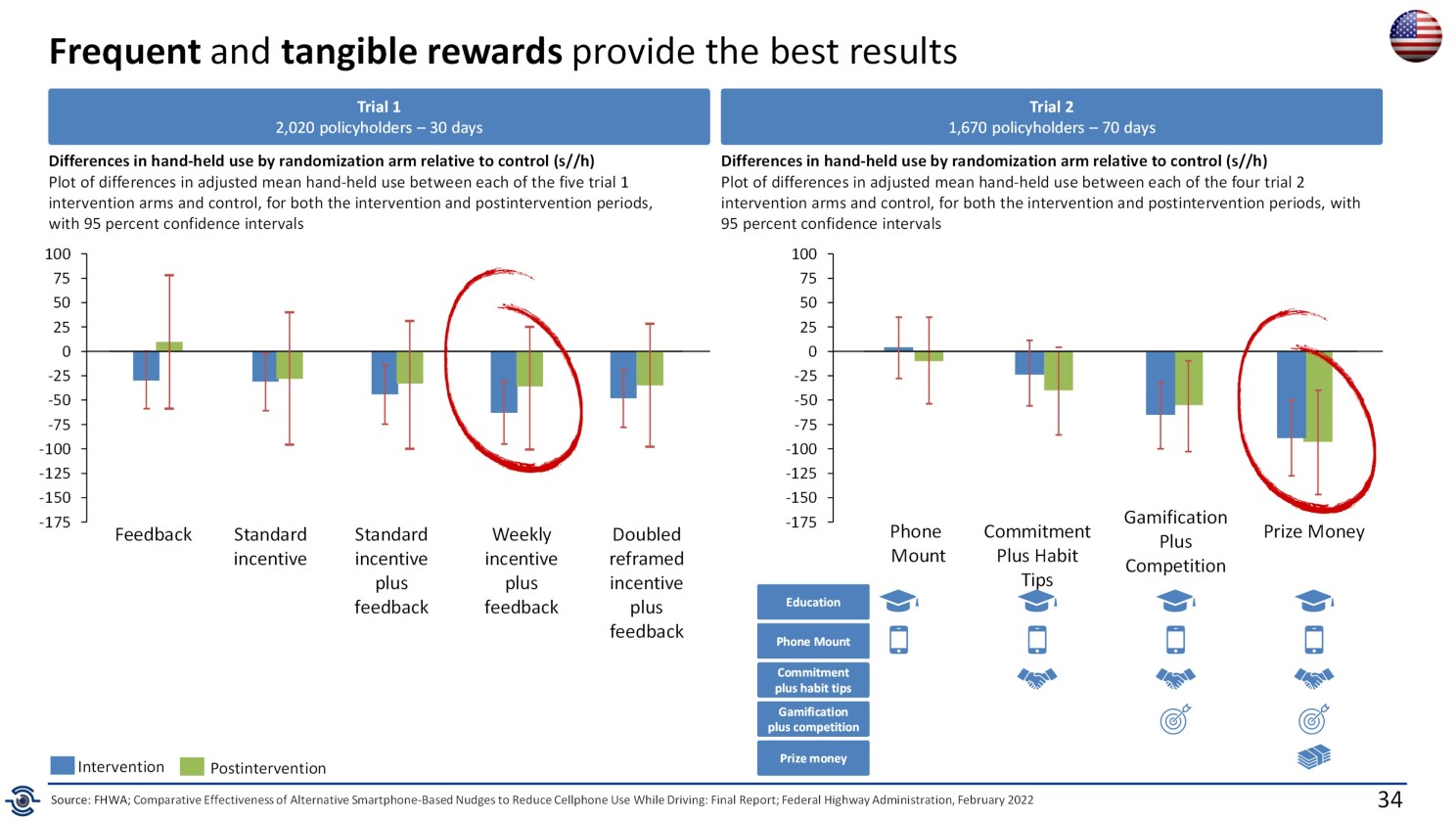

- insurers can modify driving behaviors.

- a structured behavioral modification program (including rewards) is necessary to obtain concrete results.

Here you can see a study on the field from the FHWA that I have discussed with the members of my IoT Insurance Observatory in the past few months: