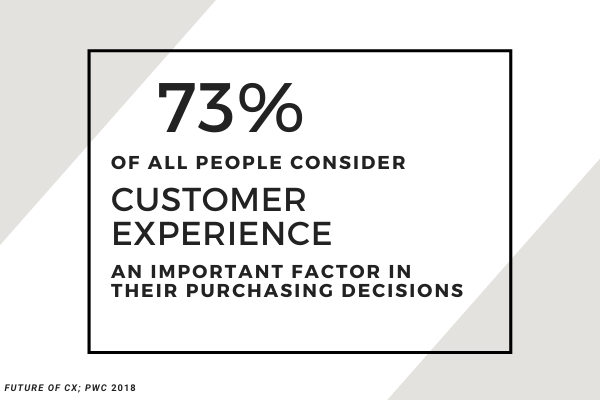

With more business being conducted online than ever, carriers, brokers and agents are discovering new strategies and tactics to better reach their customers. Traditional distribution methods are becoming less viable as insurance buyers have greater visibility into alternatives, expect personalized digital experiences, and can compare policies online with a few clicks.

It’s an opportunity for insurers to connect with their audiences and produce positive digital experiences in uncertain times.

Segment Audiences with Big Data

It is estimated that people worldwide generate 1.7 MB of data every second. This provides near-infinite ways for sales and marketing teams to segment audiences based on online behavior, demographic traits, shared interests, and purchasing habits.

Companies often struggle with interpreting this data. One survey shows 95% of organizations say managing unstructured data is a problem for their business. Our brains were never meant to process this amount of detail! Fortunately, there are online tools that can support you:

- APIs and web services: Big data is useless if it can’t be leveraged across systems, fully synchronized. When your sales and marketing systems fail to talk to each other, the results can appear cumbersome, or downright embarrassing. If your CRM has a contact listed as a client but your email system thinks they’re new business, their experience will be anything but personalized. Look for solutions that offer a robust API with a strong library of native integrations.

- Artificial intelligence: When segmenting audiences and personalizing messaging at scale, there is a level of granularity that can only be reached via artificial intelligence. Many solutions providers are launching AI layers to their tech stacks to enhance personalization for email outreach, email list segmentation, personalized digital advertising, and more.

- Your CRM: A flexible customer relationship management tool with configurable fields is essential to your segmentation strategy. Automate as much as possible, pulling all key information from your marketing stack into a single source of truth--your CRM--via APIs. One word of caution: over-engineering your CRM with custom fields can produce confusion and a poor user experience for your insurance sales team, leading to misuse and neglect. Keep it as simple as possible and make sure every member of your team understands what they are responsible for. Once established, APIs can be configured to push customer data into your quoting engine, eliminating redundant data entry and reducing quote turnaround time.

Personalization can pay off big: according to Netflix, 75% of their users’ viewing activity comes from recommended content. Insurance providers should take inspiration.

See also: Designing a Digital Insurance Ecosystem

Deploy Chatbots and Conversational AI

With customer-experience-focused insurtechs gaining market share, insureds now demand friendlier, more personalized, and simplified digital experiences.

The traditional role of a broker or an adviser is to educate clients and prospects on their coverage options. However, accomplishing this at scale while delivering an excellent customer experience in a digital-first landscape is a challenge. Moreover, insurance is already tough to grasp for insureds who don’t live in our world. A recent survey revealed that more than half of Americans are confused by their health insurance coverage. This is a serious problem.

Chatbots provide an opportunity for brokers and carriers to transform the digital insurance experience. Savvy insurers can use chatbots to save brokers an enormous amount of routine work. Chatbots can

- Provide quick answers to common questions, such as “What’s the difference between an HSA and an FSA?”

- Provide “how-to” advice: “How do I submit a claim online?”

- Outline coverage options and provide quick quotes

Chatbot scripts can be designed based on most-visited web pages, common search engine queries (Google Search Console can be helpful here), or notes from real-life conversations your salespeople are already having with customers.

You can even layer artificial intelligence on chatbots, which uses natural language processing to better guess what a user is requesting and automatically return the most useful information.

Deploy Predictive Analytics in Quoting

Customers expect to buy insurance to be fast. To remain competitive, brokers and agents must be able to rapidly generate quotes, amendments and renewals that continuously meet a prospect’s needs. Seamless integrations with various data sources are essential for feeding up-to-date claims experience, demographic information, and wearables/telematics data into a powerful quoting and rating engine.

Predictive analytics can take quoting and rating capabilities even further by identifying the most successful plan designs for a customer based on historical success data for a particular carrier. Furthermore, predictive analytics can be deployed to help brokers and carriers upsell and cross-sell additional coverage based on the data collected during initial quoting. Artificial intelligence is crucial here because it can calculate these recommendations based on disparate connections that would be impossible for our brains to process.

Don’t miss opportunities to maximize profitability during quoting with AI!

Get Social

One approach that is differentiating emerging insurtechs from large incumbents is a modern, friendly, and sometimes humorous presence on social media. These new entrants are answering one of the world’s most difficult questions: How can we get people excited about buying insurance?

While it can be fun and set your brand apart, it isn’t necessary to produce viral, humorous content to be successful on social media. Smaller brokerages and insurance companies targeted to younger generations may want to experiment with humor or even memes, while larger, more established brokerages might want to consider the kind of thought leadership their audience will find authoritative and engaging.

Whatever brand direction you choose, your sales team must be completely aligned on the brand “voice” and visual identity to ensure consistency across channels and online interactions. Social selling is about engagement.

See also: Benefits of Deploying a Hybrid Cloud

Let’s Get Personal

Customers today expect providers to reach them at the right time, on the right device, with the right solution. While it is important to remain cautious of over-personalization and perceived creepiness (or regulatory trouble, if you’re using data improperly), under-personalization is vastly more common.

Insurance customers who are shopping online to purchase coverage just want to get it over with. As great as a cordial onsite visit from an agent or broker is, the model is not quick, nor is it scalable. In a world where customers are shopping around for options and prices all the time, retention itself becomes a valuable commodity. To differentiate themselves, brokers, agents, and carrier sales teams must be willing to adapt their tech stack to offer digital experiences focused on the individual - not just the price tag.

Big data, AI, CRM, chatbots, predictive analytics, social-media messaging, and personalization can combine to produce the customized experience today’s insurance customers expect.