The digital revolution in insurance, which began in distribution and then spread to claims, has now reached underwriting in a big way.

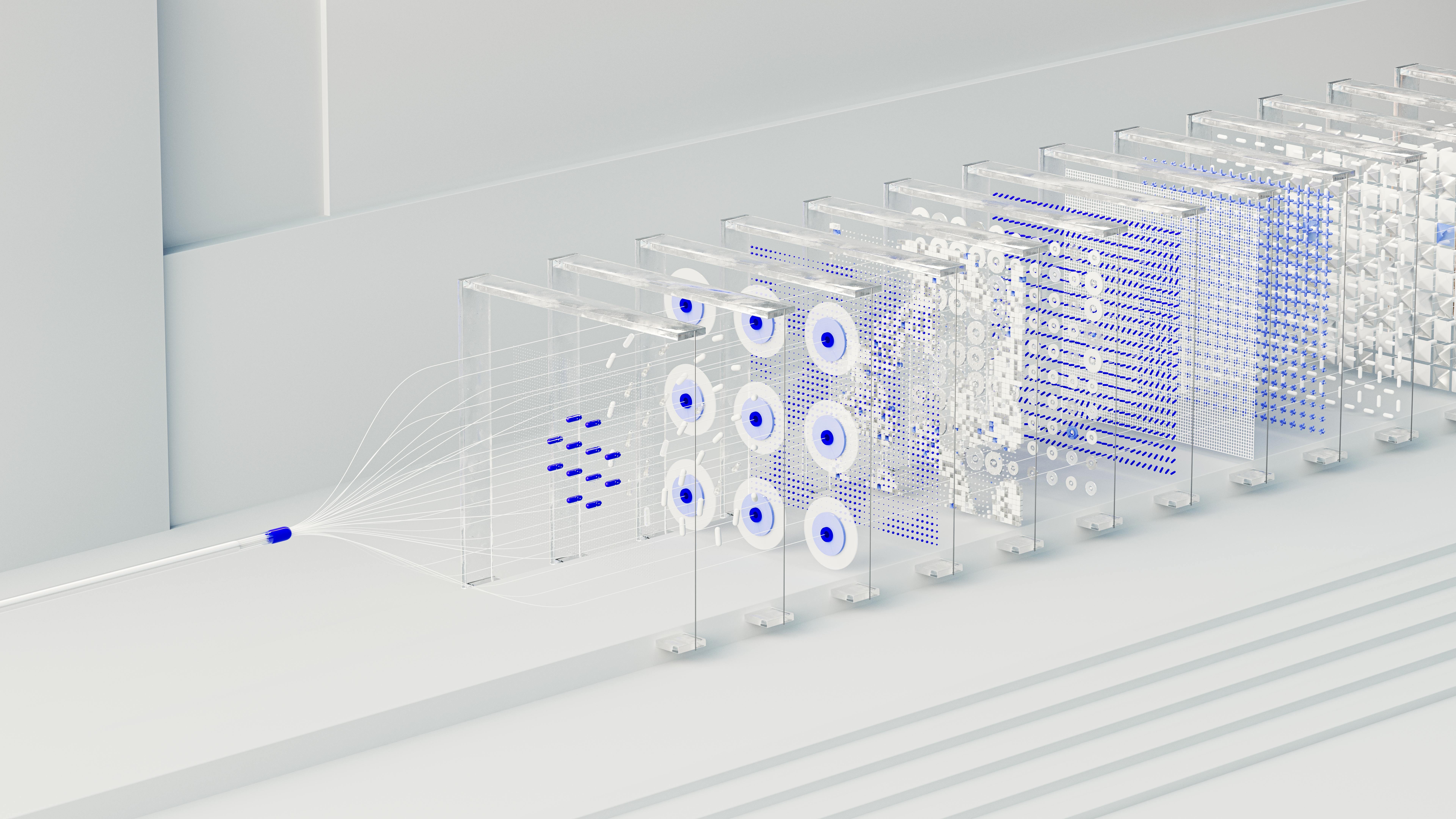

There are two consistent themes: 1) Advanced AI and ML technologies, paired with big data and sophisticated risk models, are fundamentally shifting the way underwriting is done. 2) Insurers are leveraging low-cost, cloud platforms that are built for scale and agility with new business models.

In this article, we will explore those two themes and show how digitization streamlines the underwriting process for a more efficient and sophisticated outcome. In our next article, we will explore how carriers are making the shift to next-generation underwriting, changes to user journeys and experience, and measuring ROI in these AI journeys.