Until the arrival of COVID-19, Americans had, for decades, been more concerned with outliving their savings than the prospect of premature death. With that in mind, it’s not surprising that life insurance policy sales dropped 45% during the 1980s and have remained flat ever since, according to LIMRA. Today, only half (52%) of Americans own life insurance, either bought individually or through employee benefit programs.

But COVID-19 may have reordered priorities. The pandemic has served as a reminder that life can be shortened unexpectedly. Eleven percent more life insurance policies were sold in the first quarter of 2021 as compared with early 2020, when employment was down and employee-based life policies lagged. This increase represents the biggest gain since 1983 and the first break after a long decline in life insurance sales. In addition, a greater percentage of policies were sold to households with more modest incomes.

This heightened awareness has given life insurers a chance to prove their value for the first time in decades. But they will only succeed if they are able to meet the needs of the largest group of adults in the workforce: millennials, the oldest of whom are now approaching 40. Representing 25% of the population and numbering approximately 73 million, according to Pew Research, millennials are the generation life insurers will need to reach most urgently if they are to revive their fortunes.

It won’t be easy.

This is a generation that has a lot going on. It is the most educated generation of Americans, with 39% holding a B.A., but millennials are also preoccupied with competing financial priorities, including paying off student loans, managing healthcare costs, finding jobs that pay well, establishing home ownership, starting families and dealing with the cost of supporting aging parents.

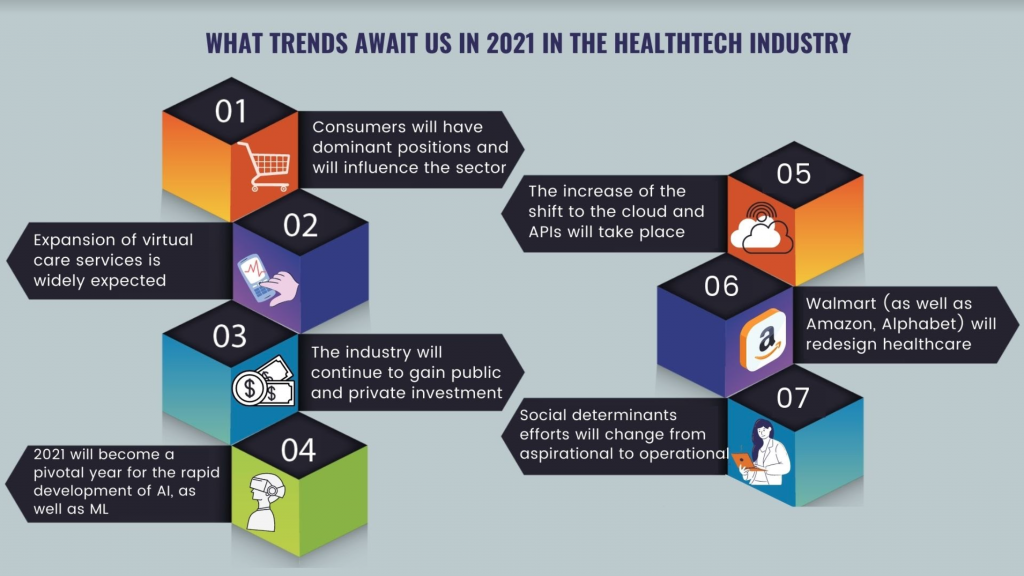

See also: Looking to Future of Insurance, Insurtech

JungleScout notes that millennials also constitute the majority (58%) of U.S. mobile shoppers. These are consumers who think nothing of ordering a latte or a pizza through a smartphone. Siegel & Gale found that 64% of all consumers are willing to pay for a simpler experience, but millennials are particularly used to quick and easy digital solutions. It’s no wonder a KPMG study notes that 46% of millennials cite confusion as the biggest barrier to purchasing life insurance. After all, life insurance has been a highly regulated industry loaded with jargon and legalese, and life insurers have lagged P&C counterparts such as Lemonade, which offer P&C insurance on a smartphone app powered by AI and machine learning that can onboard digital customers in less than a minute and pay claims in a matter of seconds.

How Life Insurers Can Reach Millennials

Millennials already understand the need for car and home insurance. Now that the pandemic has gotten their attention, life insurers must speak to them in a language they understand, or risk being ignored. Here are a few factors life carriers should keep in mind as they seek deeper connections with this key demographic:

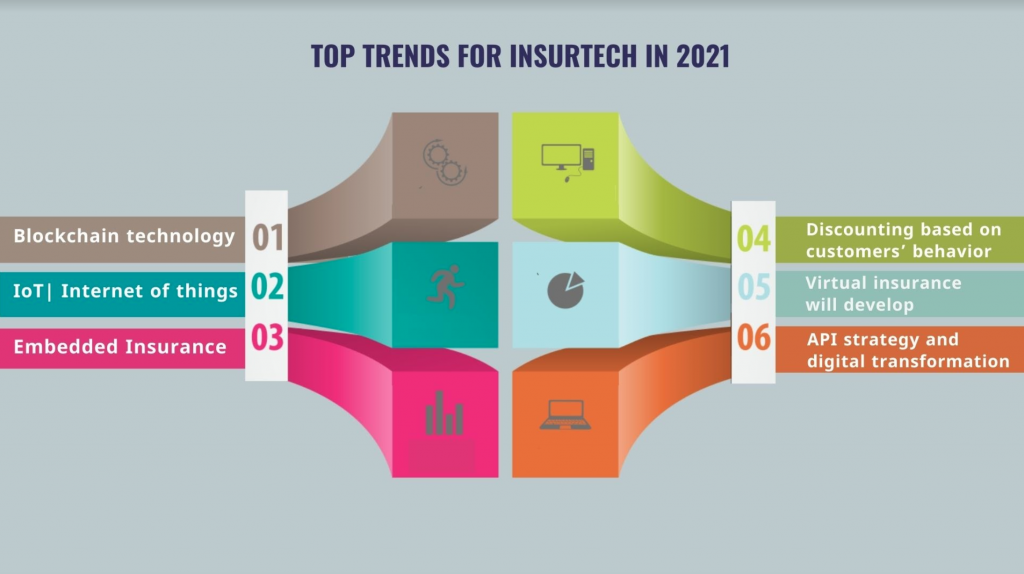

- Use Rewards to Drive Loyalty: According to a KPMG study, 81% of millennial consumers say being a member of a rewards program encourages them to spend more money with a brand. With this in mind, life insurers should consider rewarding policyholders with discounts and better rates as they commit to healthy lifestyle choices through partnerships with third-party wellness programs and insurtechs. From a technology perspective, this means life insurers will need to create platforms based on application programming interfaces (APIs) that can integrate data from a multitude of sources.

- Make it Easy: According to an IBM study, almost half of all millennials say that buying life insurance is too confusing. Whether an interaction takes place through an app, web browser or face-to-face with an agent, millennial customers expect simplified explanations and options, price tiers and bulleted lists of specifics. Policy applications should include only the most relevant questions and, where possible, avoid medical exams. Insurers that do the best job of shielding shoppers from unnecessary complexity will win.

- Prioritize Mobile Apps: Given millennials’ digital-first lifestyles, to stay relevant, incumbent life insurers must offer intuitive mobile apps that are both technologically sophisticated and intuitive, leveraging capabilities such as Face ID for quick login and providing smooth integrations with other financial products.

- Develop a Subscription Model: A massive 92% of millennials have active monthly subscription services, from razors to clothing to music to food. These services are automatized, tailored, simple and easy to manage. The subscription model could work well for life insurers, which, like other insurers, collect monthly premiums. What’s required is packing additional value into a more personalized monthly subscription.

See also: How Digital Health, Insurtech Are Adapting

It’s not too late for traditional life carriers to reach millennials. Although insurtechs and startups unencumbered by legacy infrastructure have gained some traction, their success has been modest. Larger life insurers still have the lion’s share of customers, highly recognizable brands and the resources to scale quickly. But they need to couple these advantages with a broader re-think of their core technologies if they are to regain a competitive advantage and create the kind of seamless user experiences that will engender millennial loyalty.