| Amy Radin is a transformation strategist, a scholar-practitioner at Columbia University and an executive adviser. As a member of the Fast Company Executive Board and author of the award-winning book, "The Change Maker's Playbook: How to Seek, Seed and Scale Innovation in Any Company," Radin regularly shares insights that help leaders reimagine their approach to organizational change. Her thought leadership draws from both her scholarly work and hands-on experience implementing transformative initiatives in complex business environments. Previously, she held senior roles at American Express, served as chief digital officer and one of the corporate world’s first chief innovation officers at Citi and was chief marketing officer at AXA (now Equitable) in the U.S. Radin holds degrees from Wesleyan University and the Wharton School. |

Insurance Thought Leadership

You’ve said that companies need to change the way they change. How do you approach that problem, both generally and in the context of the course you teach at Columbia?

Amy Radin

The whole premise of the course, much of which is drawn from my own lessons learned, is about moving a complex bureaucracy forward and having people accept the idea of change. For a long time, I was an operating executive on the bleeding edge of change, often in conflict or intense discussion with colleagues. In a zero-sum, fixed-resource environment, which is how most big companies operate, doing something new often is perceived as coming at the expense of something else.

Starting in the early eighties, consulting firms built businesses around what's called change management. The eighties' idea of change management, which is still prevalent, is that change happens from the top down—incremental changes at a predictable pace, often within organizational silos, and in a command-and-control mode. Leaders plan and direct, leveraging their hierarchical authority to get things done.

However, in today's world, with AI, robotics, advanced data analytics, and the integration of technology to enhance human creativity and problem-solving, that traditional mode of change management is no longer effective. Change will happen in organizations that can rapidly adapt and iterate, promoting engagement and collaboration across silos, and where employees are empowered rather than told what to do. Leaders need to build a culture of empowerment and participation, where the customer comes first, experimentation is promoted, and failure is treated as learning.

The shift is from hierarchical authority, where leaders plan and direct, to a world where change is driven by the power of networks, and leaders inspire and empower belief in a vision of the future. This is something I've learned from the executives I work with in my course at Columbia and from my own experiences as an operator. Instead of just telling people what to do, which frankly doesn't work, it's about building change leadership skills, mindset, and capabilities to help employees and stakeholders navigate the integration of human-centric technologies, anticipate and pivot quickly as new challenges and opportunities arise, and provide transparent communications and a clear vision. Leveraging networks rather than hierarchical authority is key to winning support and accomplishing change.

This approach resonates with those leading change because the work is really tough, especially with everything that's happened in the last couple of years with AI and advanced data analytics layered on top of the usual challenges of change. Old methods just don't work anymore.

Insurance Thought Leadership

I was always rather skeptical of the change management stuff, even as a partner at one of those consulting firms, because it seemed a little too packaged.

Amy Radin

You make an interesting point. One of the things I talk about in my class is that one of the worst things you can do when you want to drive transformation is get everybody together and say, "Okay, we're all going to change now." What you're doing is essentially telling the resistors in the room what they need to resist, enabling more resistance while confusing most of the other people.

One of the books we read in my course is a best-seller called "Cascades." The author, Greg Satell, spent about 15 years in Ukraine. He was there during the Orange Revolution and became really interested in the history of social movements and how they take hold and build steam. He tells the story of how the Orange Revolution started with just a handful of guys in a coffee shop, and how they went from this small group to a couple hundred, to a few thousand, to tens of thousands in the course of a year or so.

Greg's idea was that the lessons learned from how social movements build momentum could be replicated in the corporate world. Not that we want to promote overthrow, but rather to build momentum and scale change. It's really about starting with a small team, then finding other small teams, helping them, and building networks across all those small teams of believers, uniting them against a common purpose and vision.

I find it fascinating. When I think back to some of my corporate experiences, it makes so much sense. We did some of that, but more because we stumbled into it by accident, not because we could label it as an effective strategy.

If you're interested in learning more, you can search for Gene Sharp and “How to Start a Revolution” on YouTube. He worked with resistance movements all over the world to help them apply best practices of resistance. If you cross out the word "resistance" and repackage it as "transformative change" in the corporate world, it becomes very relevant.

Based on my student evaluations, it seems this approach resonates with people in organizational settings. I've always been a fan of learning from completely different sectors.

This is about the power of networks and starting really small, uniting people around a common purpose or vision. It's about abandoning the idea that just because you have a big title and a big budget, you're going to get people to pay attention.

Insurance Thought Leadership

I’m betting that the wave of innovation involving AI creates an environment where people are thinking more about change.

Amy Radin

That's hugely important. Too many people are approaching AI as just a way to automate and eliminate jobs. The early data is already showing that the economic value of AI and these technologies, including robotics, is much greater when viewed as tools to augment and expand human creativity. In fact, the economic value of creativity enhancement is triple the value of productivity gains from efficiency and staff reduction. Most people are missing the point by seeing AI purely as an expense reduction tool versus a means of expanding human potential with many other benefits, not just cutting costs.

I'm experiencing this firsthand while taking an online course in generative AI. Yes, it's making me more productive, but more importantly, it's expanding my thinking and capacity to imagine things, driving me toward higher order of thinking and expanded impact for my clients.

If you're approaching this as a CEO or CFO simply asking how to save money using AI and pushing that on the organization, versus thinking about how it's a tool to increase human capacity to perform and engaging employees to begin to experiment, you're missing the boat. If you want to focus on the bigger opportunity -- enhancing human performance -- by definition, you must start engaging your organization and experimenting with small pods of people who are up for doing something different.

Insurance Thought Leadership

Do you have an example from your experience in financial services about how a CEO should approach organizational change?

Amy Radin

First, you truly have to start with deeply listening to your customers and other stakeholders. Everybody says they're customer-centric, but most people aren't. You have to start with understanding who you really want to do business with and deeply listening to understand where they are and what they're looking for right now.

Then you need to identify sparks of interest, activity, or commitment within your organization to pursue solving those customer needs using new technologies. Rather than starting change with a big announcement and program, thinking it's all about communications, seed activity that helps prove what your change path should look like and empower your people to expand from that small group to other parts of the organization. It's much more about driving real collaboration versus telling people what to do.

I just started writing an article this morning on the power of asking the right questions. Rather than going into a room and presenting a new idea only to have it get shot down because everybody thinks they're the expert, what if you promoted a culture where the expert was willing to say, "Wow, that's really interesting. How did you come to that insight?"

I don't know if you can make people be more curious - much of that may be innate or cultivated through childhood. But, you can hire for this attribute. We've become so transactional that just having the conversation matters. Promoting a culture where there's actual curiosity, conversation, questioning, learning through experimentation, and accepting failure as learning - these cultural attributes are vital to transformation. People think that, through rigid control, they'll get change done faster, but you won't.

Insurance Thought Leadership

My innovation mantra for decades has been, Think Big, Start Small, Learn Fast. Tell me a bit about how you approach experimentation.

Amy Radin

You pull a few people from different departments like claims, underwriting, distribution, and put them together. Explain your vision of the future. Give them a well-defined problem to solve aligned with your vision, some time and budget, and see what they come up with, what kind of tools they need. Assess the experience, then improve upon your approach with a view toward scaling across many small teams.

When someone comes into your office and says, "I have this crazy idea," and they've got some customer insight, whether it's from a policyholder or distributor, don’t discount it. Ask, “Why don't you develop that further? Can you come back with what the next step would be to help validate your hypothesis?"

It's not about throwing a million dollars at an idea right away. Instead, it's about creating some open time, allocating a little budget for follow-up client interviews, giving permission, creating space in the organization, and encouraging people to come forward with ideas aligned to the vision.

Insurance Thought Leadership

I assume this approach should be a sort of fractal, happening not just at the top levels of an organization but at every level.

Amy Radin

It's more important to encourage the middle and lower parts of the organization to open up.

This is not about having a suggestion box or any of that nonsense. What leaders can do that's powerful is help the organization understand the vision for what we want to become. Create a framework and structure around that vision, and then you can say we want to promote experimentation to help us move and change toward it. You have to tell people where you want to go. It's about uniting people around a common sense of purpose and vision.

Insurance companies like to talk about their purpose, but it's often at such a theoretical level. You have to bring it down to the ground and help people understand what that means in claims, what that means in servicing, what that means in underwriting. Too many insurance companies treat purpose and vision as just a marketing slogan. But it's not - it's about what goes on at every level of the organization, across all functions and business units.

You've got to frame that out to people and help make it concrete, maybe even by example, and then create some process and structure that's not heavy-handed and not hierarchical that helps people understand we think it's valuable for them to help us cultivate concepts that can move us toward our vision.

Insurance Thought Leadership

I've become a big believer in teams. When you talk about middle and lower management, one thing they can do that those in the trenches can't is to connect people. For example, if someone has an idea here and another person has an idea there, the managers can bring them together. They can mix and match, so you're not just dealing with people in finance or claims or whatever.

Amy Radin

Totally. That's why I said one of the most important roles for leaders, rather than just telling people what to do or focusing solely on reporting relationships, is to inspire and empower belief. It's about cultivating the expansion of these networks across the organization.

Insurance Thought Leadership

How do you encourage a culture that embraces failure as part of the innovation process?

Amy Radin

It's not just about saying failure is okay - you have to build that idea into your processes and how you work. When we do an experiment and don't get the ideal result, we need to talk about what happened, what we can learn from it, and how we apply those learnings to the next iteration.

Too many organizations struggle with this. I remember in one of my insurance experiences, we were trying to move more marketing activities online. We went into the market, did a test, and got a result. When we took that into a management meeting, one of the senior executives immediately said, "That's terrible!" This not only brought down the whole room's energy, but they were wrong - the result for that particular type of digital campaign was pretty good. They just weren't accustomed to seeing results for digital campaigns. And even if it was terrible, the question should have been: "Help us understand how that test was constructed, what can we learn from it, and what would the next test look like?"

There's this tendency toward a "one and done" attitude that won't work. It took Steve Jobs nine years to perfect the iPad. When a great innovation comes out, when something has its miracle moment, nobody asks how long it really took to get there, and what their struggles were.

That's the reality of how transformative change happens: iteratively, through learning from how things go in each stage of experimentation.

Insurance Thought Leadership

I love the iPad example and have written about it in some detail. The idea actually originated some 25 years before the iPad’s introduction and was embodied in a video, driven by a longtime colleague of mine, about a Knowledge Navigator in 1987. That idea kept percolating along in the labs until Jobs grabbed hold of it and, as you say, perfected it. He did another super smart thing, too. During the experimentation process, he saw that he could introduce a phone, with a smaller screen, three years before the iPad was ready. That iPhone sparked the real revolution in communication even though it wasn’t the original intent.

Amy Radin

I think there are a lot of lessons in that. Your vision is crucial, and this is where executives trained in traditional management styles often struggle. People want things to be structured in black and white, but this is not just a world of gray; it's a world of many colors, and things happen serendipitously. It's important to set a vision and understand that you're embarking on a journey where you'll explore many paths.

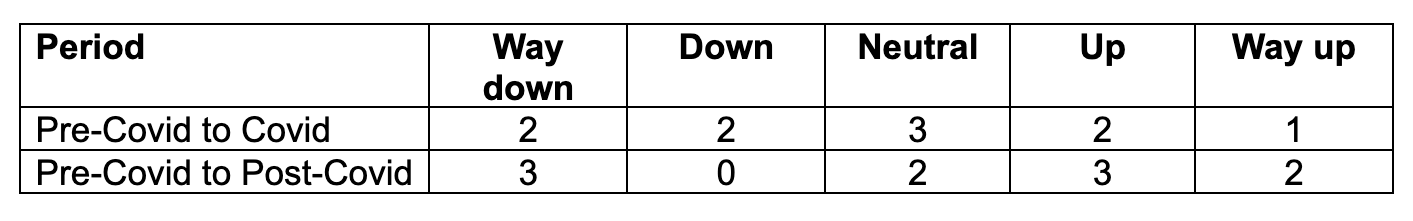

Setting that vision gives people permission to start down the path and avoid being incremental or sticking to current methods. Another point about why we need to change the way we change is the shift in workforce attitudes and the work environment since the pandemic. You can't just gather everyone in a meeting room, even if you wanted to.

I don't know about you, but I don't know many Gen Zers or millennials who want to be told what to do. If you want to engage today's workforce and have them do their best work, these ideas about empowerment and fostering an environment where people can pursue new ideas are crucial. If you don't offer that to your best people, they'll go elsewhere.

We have to really reframe what it means to accomplish transformational change.

Insurance Thought Leadership

Thanks so much, Amy. It’s always a pleasure.