This article delves into the application of systems using multiple AI "agents" and into human-machine collaboration in industry, aiming to reveal to readers without a technical background how they can lead us to a tech-driven, AI-powered work world.

Think about the writing process, typically divided according to people's work habits into: gathering information, drafting, revising and finalizing. What would happen if artificial intelligence were introduced?

The seemingly linear and unidirectional writing task could be entirely generated by AI, although the content generated by AI might not meet our expectations or standards. Alternatively, we could have AI assist us in analyzing and handling complex topics, collecting, filtering and summarizing useful information from multiple sources, embodying human-machine collaboration. Further, if the content of an article is rich, covering profound discussions and extensive knowledge, assigning each step of the writing process to agents with different expertise and requiring them to cooperate with each other would undoubtedly produce superior outcomes. That is the approach of multi-agent systems.

Early AI capabilities were limited, and it was more of a "human-centered" auxiliary tool. As machine capabilities improve, the nature of human work changes, and the "machine-centered" human-machine collaboration model becomes possible, continually evolving the boundaries between humans and machines.

In this new work model, AI is not just a tool or service; it has become a collaborative partner for humans, facing challenges and solving problems together.

For example, in the healthcare field, AI is assisting doctors in analyzing cases and developing treatment plans, and playing a role in personalized medical services. In the creative and design industry, AI's involvement provides new sources of inspiration and creative tools for artists and designers, pushing innovation while challenging traditional creative processes.

Everyone is a participant and beneficiary of this transformation. Multi-agent systems and human-machine collaboration are changing our ways of working, reshaping our behaviors and habits. In the relationship between humans and AI, we can act as observers overseeing AI's work from a god's-eye view, or actively participate in the multi-agent system, cooperating with AI as part of the process. As consumers, understanding how AI affects the provision of products and services can help us make more informed choices. As AI technology spreads, many jobs will evolve, and understanding these technologies helps us adapt to future work environments and seize new career opportunities.

I. The Future of Human-Machine Collaboration and Multi-Agent Systems

As AI technology rapidly advances, we are entering a new era assisted by intelligent systems and robots. Multi-agent systems and human-machine collaboration not only showcase technological innovation but also directly affect our work and lifestyle, signaling that cooperation between humans and machines will become the norm.

1.1 What is an Agent?

Computer scientists and AI researchers Stuart Russell and Peter Norvig in their book "Artificial Intelligence: A Modern Approach" define an agent as "anything that can be considered to perceive its environment through sensors and acts upon that environment through effectors." This definition applies to humans, robots, software programs and artificial intelligence.

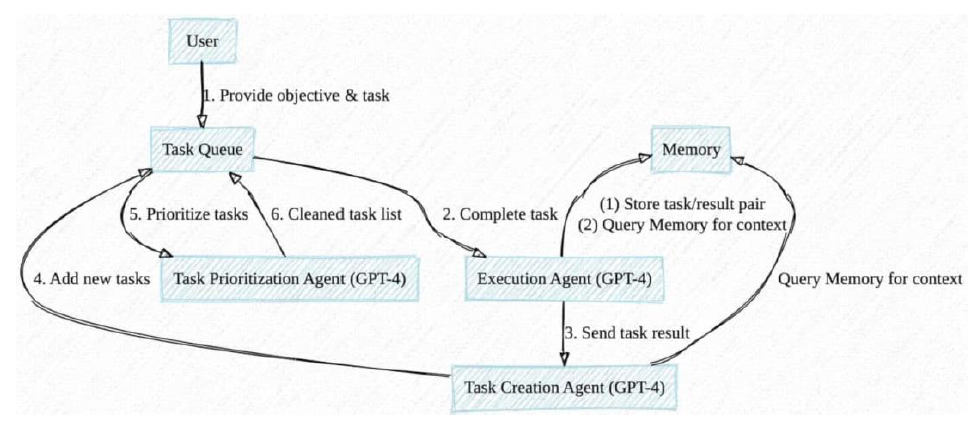

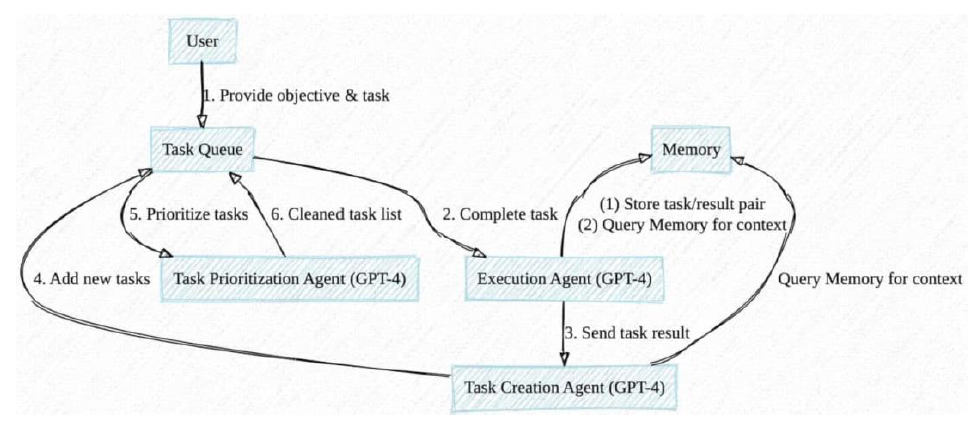

With the rollout of large language models like GPT-4, agent scenarios have seen explosive growth. Below is an illustration by Yohei Nakajima showing the interaction between agents and a large model (GPT-4):

Agents act like the "decision engines" for large models, communicating with GPT-4 to complete high-difficulty tasks such as data analysis, brainstorming, resource management, language translation and task organization, prioritizing tasks needed to achieve user-defined goals.

1.2 Defining a New Work Paradigm Through Human-Machine Collaboration

Under the human-machine collaboration model, AI is no longer just a tool for executing commands but a working partner for humans, together solving problems and completing tasks. This cooperation significantly enhances work efficiency and frees humans from repetitive or high-risk tasks, allowing more involvement in creativity and emotional intelligence tasks. Subsequent demands for new skills, including AI technology knowledge, data analysis capabilities and communication coordination skills for cooperating with AI, will be key to future workplace success.

In the past, most people only needed to understand the surface functions of the tools or technologies they used enough to apply them in daily life and work, without delving into how they work. For instance, when using the Windows operating system, users are more concerned with how it can help them complete tasks or enjoy entertainment, rather than understanding its internal mechanisms. However, this traditional approach to technology understanding, particularly in the field of artificial intelligence and in the context of multi-agent systems, may prove insufficient because in future human-machine collaborations, everyone's role might resemble those of agents in a multi-agent system, necessitating a deeper understanding of technology.

When the nature and organizational form of work shift toward models similar to multi-agent systems, where previously human-centered processes are deconstructed and reconstructed according to machine capabilities, each person plays a role similar to that in a multi-agent system, focusing on their expertise and tasks while collaborating with others or AI assistants to achieve larger tasks and goals.

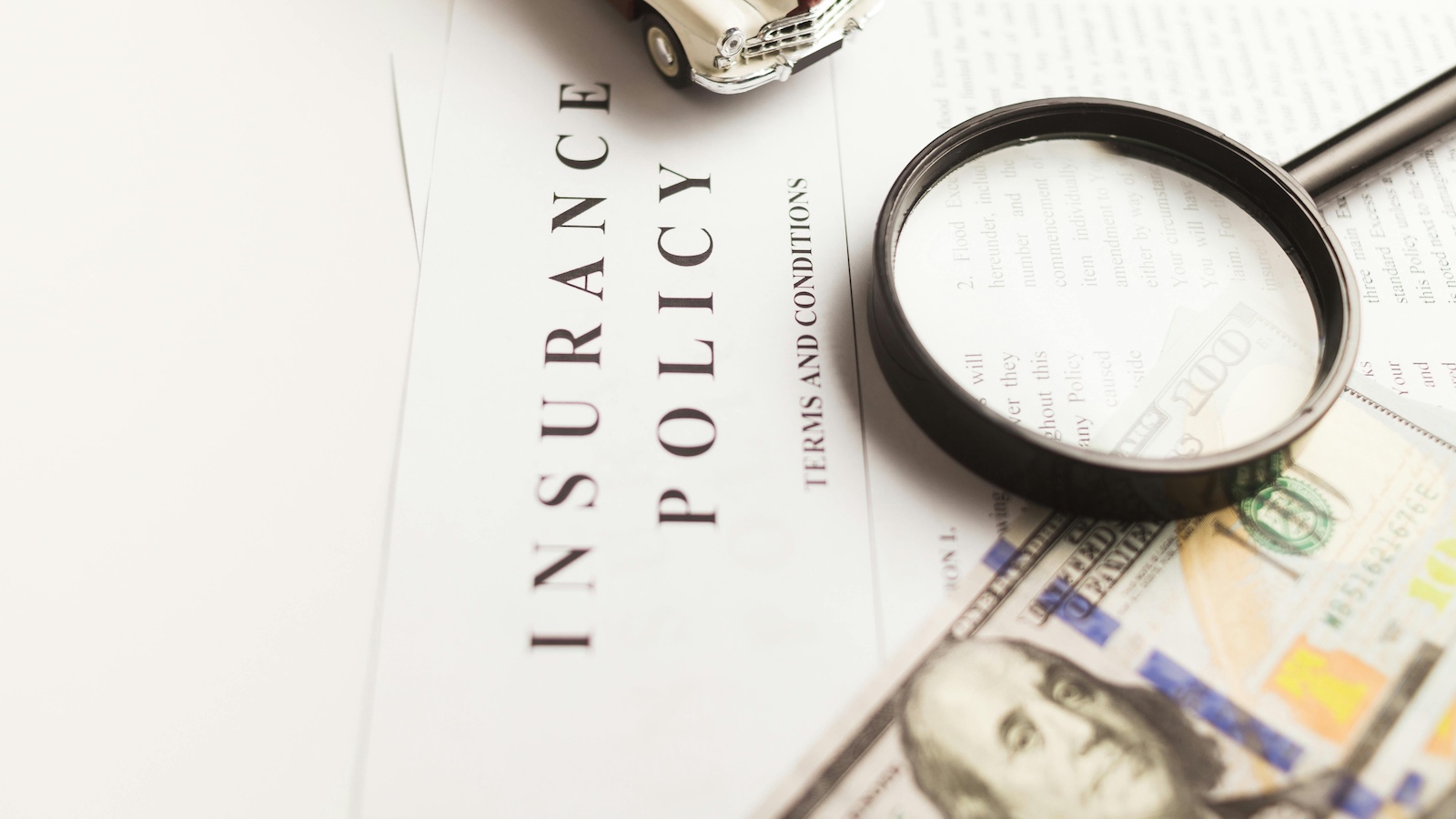

McKinsey's report "Insurance 2030: The Impact of AI on the Future of Insurance" predicts that by 2030, AI and related technologies will have a significant impact on distribution, underwriting, pricing and claims. However, these changes are not just imaginary stories, nor do they have to wait six years; they are realities happening today.

These transformations indicate that AI is reshaping every aspect of insurance sales at an unprecedented speed, making it smarter, more efficient and user-friendly. As technology continues to advance and its applications deepen, we expect AI to play an increasingly important role in the development of various sectors of the insurance industry, creating more value for businesses and customers.

1.3 AI-Driven Work Environments and Changes in Human Performance

People's attitudes towards artificial intelligence are at two extremes: One end is denial (believing AI cannot replace my job), and the other is panic (believing AI will definitely replace my job).

In AI-driven work environments, human performance will undergo multiple changes:

- Enhancing Specialization and Efficiency

In work models centered on human-machine collaboration and multi-agent systems, the repetitive, simple parts are replaced by AI, allowing individuals more opportunity to focus on their areas of expertise. The efficient collaboration between humans and machines not only accelerates the process of resolving user issues but also optimizes the efficiency and effectiveness of task completion. This cooperation symbolizes the future trend of work—achieving higher productivity through technological power.

- Stimulating the Desire to Learn and Develop

Whether with telesales or planning consultants, when individuals realize that they are playing a role similar to that in a multi-agent system in their work, their motivation to learn relevant technological knowledge also increases. This realization pushes individuals to understand their roles in the team, how to collaborate with AI more effectively and thus enhance personal skills and the overall work effect of the team.

- Developing Cross-Domain Skills

Future work requires not only deep professional knowledge but also cross-domain skills, including technological knowledge, human-machine communication and coordination abilities, and an acceptance of innovative thinking. The enhancement of personal cognition and awareness, in turn, helps the iterative progress of AI capabilities, which is key to successful collaboration in a multi-agent system and is also the foundation for individuals to adapt to future work changes.

- Promoting Personalized Career Paths

As standardization and digitalization progress, everyone's job becomes more personalized and modularized. Those who cannot adapt choose to leave, while those who accept the challenge have more opportunities to tailor their career paths based on their interests, expertise and goals. This change not only enhances individual job satisfaction but also provides a broad space for personal long-term development.

- Improving Understanding and Application of AI Technology

For most people with non-technical backgrounds, a basic understanding of AI technology becomes particularly important in the new AI-driven work environment. Inquiry into "why" gradually becomes a norm in the workplace. This is not only about individual career development but also about how to effectively position oneself and maximize value in the future work world.

II. Multi-Agent Systems (MAS)

Large language models (LLMs) provide AI agents that excel in different fields, and multi-agent systems bring them together to cooperatively accomplish set goals. Below, we introduce what multi-agents are and how they differ from single agents, role specialization and content generation.

2.1 What is Multi-Agent?

Imagine a scenario where a team composed of members with different expertise works together to complete a complex project. In a multi-agent system, the team members are replaced by AI agents, each playing a specific role and responsible for specific tasks. This type of collaborative mechanism allows multi-agent systems to effectively solve complex problems that are difficult for a single intelligent entity to handle.

Multi-agent systems excel at handling complex, dynamic tasks that require coordination of multiple participants' actions, relying on their expertise, flexibility and creativity to gain an advantage. For applications of multi-agent systems in smart home management, supply chain optimization and personalized services, see the last section.

However, the construction of multi-agent systems faces many challenges, such as effective coordination between agents, managing system complexity and the illusions of AI and inadequate understanding of vertical professional fields. Only when these issues are effectively addressed can multi-agent systems function properly.

2.2 Differences From Single-Agent Systems

The comparison between single-agent systems and multi-agent systems goes beyond their distinct technological architectures; they also differ in complexity, interaction modes and the strategies for completing tasks through cooperation or competition:

- Simplicity and Focus of Single-Agent Systems

Single-agent systems are characterized by their straightforward nature, making them ideal for executing clear, relatively fixed tasks within a controlled environment. In these systems, a single intelligent entity can make decisions and perform tasks independently. For example, a chatbot providing responses based on user inputs, or a personal assistant software managing schedules and reminders, are typical applications of single-agent systems.

- Complex Interactions and Cooperation in Multi-Agent Systems

In contrast, multi-agent systems consist of multiple intelligent entities that can be functionally similar homogenous bodies or functionally different heterogeneous bodies. They operate in parallel within the same environment, achieving common or individual goals through cooperation, competition or independent actions. The core is the coordinated actions between agents, involving complex communication, negotiation and learning other agents' behaviors.

- Collective Intelligence of Multi-Agent Systems

Multi-agent systems are not merely about stringing together single agents with different functions. Their complexity mainly arises from the dynamic interaction rules and cooperative strategies between agents, and how they adjust themselves and make decisions based on external environments and the statuses of other agents. Similar to human collective decision-making, multi-agents exhibit characteristics of swarm intelligence, where the system's overall performance exceeds the simple sum of individual agents' capabilities.

Designing and implementing multi-agent systems require consideration of complex factors such as communication protocols, decision mechanisms, and cooperation and competition strategies, all of which go far beyond what is involved in single-agent systems. The application of multi-agent systems has driven deep development in AI technology and provided new perspectives and methods for solving real-world complex problems.

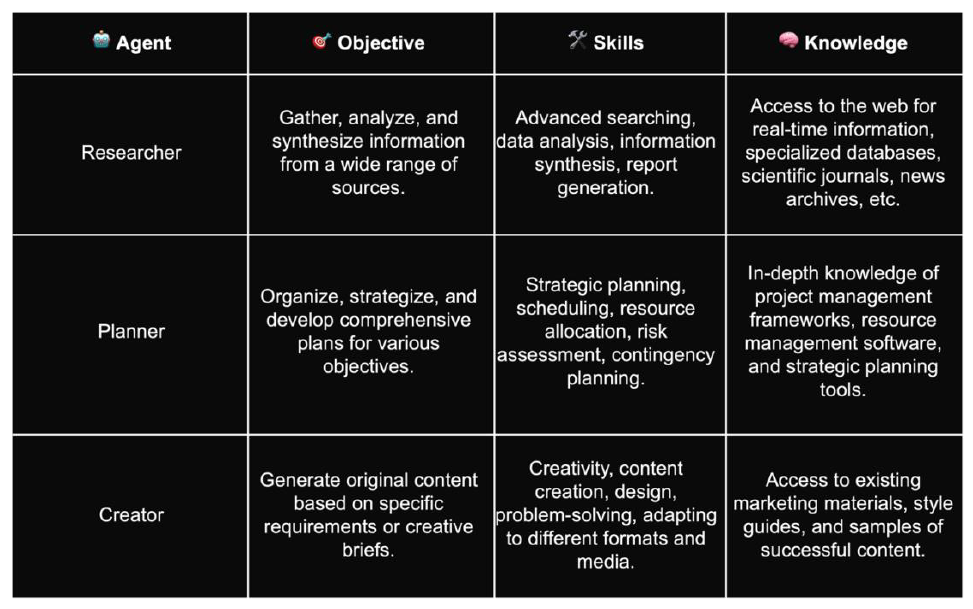

2.3 Differences with Role Specialization

Agents can possess unique skills and "personalities"; we can define their capabilities through online resources or uploaded document knowledge. Building an efficient, scalable and stable multi-agent system is not easy—it requires clearly defining each agent's role and responsibilities during the system design phase, which is crucial for ensuring the system works collaboratively to achieve the intended goals.

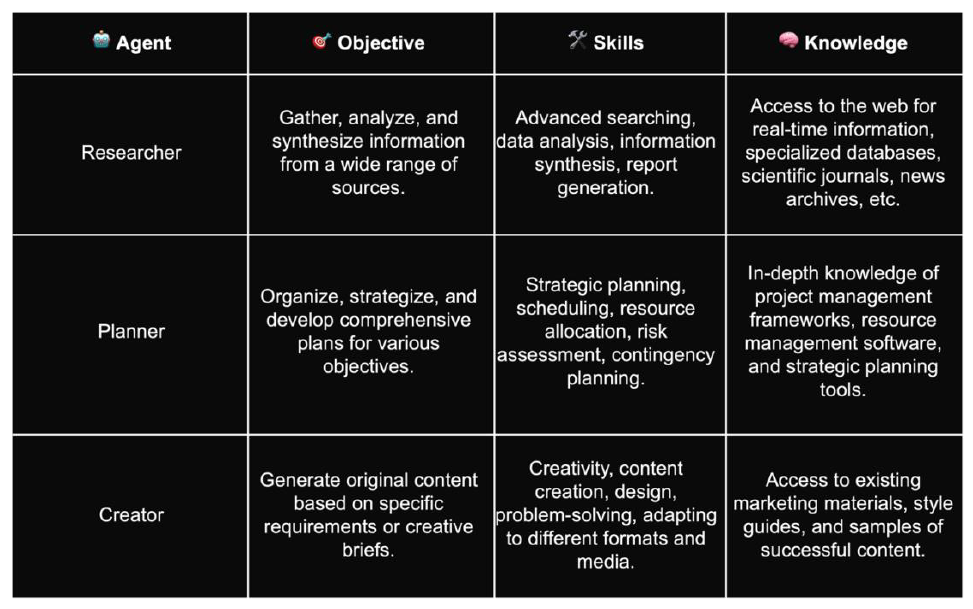

Suppose we are launching a product. At this point, a multi-agent system can be employed, assigning a role and function to each agent:

- The Importance of Role Specialization

In a multi-agent system, clearly defining role specialization helps delineate the scope of responsibilities within the system, allowing each agent to perform optimally in its area of expertise. This specialization not only prevents redundant work but also enhances overall work efficiency. The clear demarcation of roles and responsibilities among agents facilitates their smooth collaboration, efficient information exchange and decision-making negotiation, thereby optimizing the overall system performance.

- Collaborative Efficiency and System Scalability

Clear role definition not only enhances collaborative efficiency but also increases system scalability. When faced with new demands or functional adjustments, the system can adapt flexibly to changes without needing a complete system overhaul, by introducing new agent roles or modifying the responsibilities of existing agents. Although this flexibility is crucial for coping with the ever-changing environment and demands, without effective interaction and coordination among agents, simply having roles and responsibilities will not enable a multi-agent system to function effectively. In the next section, we will discuss how agents can interact effectively.

- Implementing a Multi-Agent System

Defining roles provides the basic framework for the system, but implementing a well-functioning multi-agent system requires additional steps:

- Specific Implementation of Agents: Each role must be realized through an AI agent, involving the programming, training and configuring of agents' behaviors and response strategies.

- Interaction and Coordination Mechanisms: Effective interaction and coordination mechanisms among agents are key to a multi-agent system's capabilities, ensuring agents can share information, make collective decisions and cooperate on tasks.

- Environment and Context: Multi-agent systems typically operate in a specific environment. Defining the environment and how agents perceive and affect it is an essential part of system design.

Integration and Testing: The success of the system depends on the effective integration and comprehensive testing of all parts, ensuring that agents can work together and operate as expected.

Building a multi-agent system capable of solving complex tasks involves in-depth planning and technical implementation, and a profound understanding of the system's goals and the modes of cooperation among agents is necessary.

2.4 Differences With Content Generation

ChatGPT interacts with users primarily based on a word-by-word generation mode. As a large language model (such as the GPT series), it generates responses based on the information provided by users, the context of the question and the training data of the large model. This means that in the process, there are not multiple independent agents responsible for different parts of the answer or different stages of processing, but a unified model is responsible for understanding the question and generating the entire answer.

Regardless of whether the user uses a conversational prompt or a structured prompt, the large model, due to its ability to coherently understand the input question and generate corresponding answers, performs well in handling single interactions. However, this method's limitation lies in its heavy reliance on the capabilities of a single model and the breadth of its training data, unlike the specialization and flexibility of multi-agent systems in specific tasks.

In the introduction of this article, we used the writing process to illustrate the concept of multi-agent systems. Below, we continue this analogy to further explain the differences between a single word-by-word generation model and a multi-agent system. Multi-agent systems assign different tasks to specialized agents, not only improving the professionalism and efficiency of writing but also enhancing flexibility, adaptability and creativity, ultimately achieving high-quality writing outcomes.

In a multi-agent system, each agent is responsible for a specific task within the writing process. For instance, some agents focus on gathering information from specific fields, while others are responsible for structuring the draft or refining the style and language. This clear division of labor ensures that each part of the writing process meets higher professional standards and depth.

One of the major advantages of multi-agent systems over single models is their capability for parallel processing. Multiple agents work simultaneously, much like having several assistants who help the author collect information from various sources or edit different parts of the article at the same time, significantly speeding up the overall writing process.

- Flexibility and Adaptability

Another highlight of multi-agent systems is their outstanding flexibility and adaptability. The real-time collaboration between agents can quickly respond to changes in the article's needs, whether adjusting strategies based on initial feedback or optimizing information collection and editing methods during the writing process.

Different agents bring a diversity of perspectives and backgrounds to the article, enriching the content and creativity. This input from various intelligent entities not only expands the boundaries of thought but also makes the content more innovative and appealing.

While generative AI sometimes produces hallucinations, we can establish specialized agents within a multi-agent system responsible for quality control of the article, including fact-checking, grammar and spelling checks, and ensuring the coherence of the content. This collaborative mechanism can effectively enhance the overall quality of the article.

Thus, compared with single word-by-word generation models, multi-agent systems offer comprehensive advantages—specialized processing, high efficiency, flexibility, enhanced creativity and quality control—providing robust support for complex writing tasks and offering a more refined and high-quality solution. This not only marks the progress in writing technology but also opens up possibilities for future content creation.

2.5 Effective Interaction and Coordination Between Agents

In a multi-agent system, ensuring effective interaction and coordination between agents is crucial. The latest paper, "AIOS: LLM Agent Operating System," proposes that in the AIOS framework, agent communication is achieved through a shared memory and storage system. Other methods such as tool invocation and context management are also explored, and interested readers may refer to the paper for more details.

Let's focus on several core technologies and concepts, such as communication protocols, negotiation mechanisms and learning algorithms.

Imagine if each agent were a country; communication protocols would be like the language and etiquette between diplomats. They specify the format, timing and manner in which agents exchange information, ensuring that messages are sent and received correctly. Just as people need translations to communicate in different languages, communication protocols help different agents understand each other's "languages."

Negotiation mechanisms are methods used in multi-agent systems to resolve conflicts and reach consensus. Like in a team project where members need to discuss and decide on the best course of action, agents also need some way to "discuss" and decide which action fits best with the current goals. This can be implemented through various algorithms such as voting, auctions or rule-based decision processes.

Learning algorithms allow agents to improve their behavior based on experience. This functionality is similar to how humans learn to ride a bicycle: we might fall initially, but through repeated attempts and adjustments, we eventually learn to balance. In a multi-agent system, agents can "learn" the best ways to interact by observing feedback from the environment and the behavior of other agents, thus improving the system's overall performance over time.

- Simple Application Scenarios

Imagine we are organizing a large party and need to coordinate multiple teams (agents): catering, music, venue setup, etc. Each team has its specific tasks, but they must communicate and coordinate with other teams to ensure the party goes smoothly. This requires a good "communication protocol" to ensure accurate information transmission; a "negotiation mechanism" to resolve any situations where, for example, the venue setup team needs more time, affecting the catering team's preparations; and a "learning algorithm" that allows each team to learn from each event how to cooperate more effectively.

III. Case Studies of Human-Machine Collaboration and Multi-Agent Systems

Below are some examples of applications of human-machine collaboration:

Medical Diagnostic Collaboration

IBM Watson Health, in partnership with several global hospitals such as the Memorial Sloan Kettering Cancer Center in New York, uses its cognitive computing capabilities to analyze clinical data and provide precise diagnostic suggestions and personalized cancer treatment plans. This showcases the tremendous potential of artificial intelligence in enhancing the quality of medical services and accelerating the diagnostic process.

Creative Design Assistance

Adobe Sensei, Adobe's AI and machine learning platform, is integrated into software such as Photoshop and Illustrator, providing intelligent editing features like automatic image cropping and facial recognition adjustments. This helps designers work more efficiently, demonstrating AI's role in advancing the creative industry.

Here are some examples of multi-agent systems applications:

Intelligent Traffic Management

Singapore's smart management of urban traffic through its Intelligent Transport System (ITS) allows the city to monitor and adjust traffic flow in real time, effectively reducing congestion and enhancing road usage efficiency. This demonstrates the capacity of multi-agent systems to improve public service efficiency.

Supply Chain Automation

Walmart, one of the world's largest retailers, uses AI and machine learning algorithms to optimize its supply chain management. Through the Retail Link system, Walmart automatically tracks inventory levels, predicts demand and ensures timely product restocking, showcasing the application value of multi-agent systems in commercial operations.

Smart Home Systems

Google's Nest smart home product line, including the Nest Learning Thermostat and Nest Protect smoke alarm, learns users' living habits to automatically adjust home temperatures and monitor safety, creating an efficient and comfortable home environment. This highlights the potential of multi-agent systems to enhance the quality of life.

Through these specific examples, whether in the fields of healthcare, creative design, city management, retail logistics or home living, we observe that both human-machine collaboration and multi-agent systems are playing an increasingly important role. These technologies not only enhance the efficiency of work and life but also provide higher quality and more personalized services. As technology continues to evolve, we anticipate even more innovative applications to emerge in the future.

IV. Conclusion

As we step into a new era shaped by AI technology, multi-agent systems and human-machine collaboration are not only hot topics in the field of technology but are also beginning to influence our ways of working, living habits and even our thinking. Steve Jobs once said, "Technology is nothing. What's important is that you have faith in people, that they're basically good and smart, and if you give them tools, they'll do wonderful things with them." Multi-agent systems and human-machine collaboration are precisely such tools, giving us unprecedented capabilities to solve complex problems, enhance efficiency and stimulate innovation.

Through this article, we have witnessed the application of these technologies across various sectors. They have made services more personalized, decisions more intelligent and creativity unleashed. However, facing the new challenges brought by artificial intelligence, we need new perspectives, new ways of thinking and interdisciplinary collaboration to fully harness the potential of multi-agent systems and human-machine collaboration.

As technology continues to evolve and its applications expand, we have good reason to believe that multi-agent systems and human-machine collaboration will open doors to innovation in more fields. In this process, every one of us is a participant, and our curiosity, creativity and desire for knowledge will be the driving forces that propel this intelligent revolution forward.

This article is not only a description of current technological trends but also an expression of hope for the boundless possibilities of the future. Let us join hands with AI, dance on the edge of intelligence, explore the yet-to-be-discovered wonders and together create a world that is smarter, more efficient and harmonious.