For decades, insurers used a broad-brush approach. They categorized people based on limited and generalized information. But this old model doesn't help today, as no two individuals are alike. From driving habits to home security, everything is unique. How can insurance businesses accurately price risk when the world is changing faster than a spreadsheet can track?

Thankfully, AI-based underwriting software systems have got insurers covered. These are changing underwriting from a slow, manual process into a dynamic conversation, one that includes actual risk and ensures the system is fairer, faster, and more accurate for everyone.

To truly appreciate the power of AI, let's first understand the challenges of old-school underwriting processes. It is through these issues that we recognize what AI-based underwriting software offers insurers and how they can capitalize on this opportunity.

Why Are Traditional Insurance Underwriting Methods No Longer Effective?

For decades, underwriters have been the backbone of the industry, making careful judgments based on their expertise and available data. Though this approach served the purpose well for years, it presents hurdles in terms of accuracy and profits. Here are some of the major hurdles insurance underwriters face:

1. Data Silos and Manual Entry

Important information often remains trapped in separate departments, either in physical files or online folders. What's more frustrating is manually entering and reconciling this data. Besides consuming time, this manual process makes room for human error, which can lead to incorrect risk assessment from the very start.

2. Static Risk Models

Insurers have always relied on historical data, which has undoubtedly proved valuable. But by looking backward, insurers may miss out on emerging risks entirely. A model built on past weather patterns, for example, may not be the right option for assessing a property's risk in the face of today's changing climatic scenario.

3. Assessing Everyone Using the Same Lens

One-size-fits-all approach worked really well when data was simpler and sources were limited. The problem arises when insurers have to differentiate between individuals who appear the same on paper but have totally different risks in reality. This often leads to homogenized premiums, causing insurers to miss opportunities to attract and reward low-risk customers.

4. Slow Turnaround Times

In times when customers can get a loan or book international travel in minutes, waiting for days and weeks for the underwriting process feels unrealistic. Such long waiting times frustrate potential customers, putting insurers at a competitive disadvantage.

Given all these factors, it's clear that insurance underwriting needs a new approach. It should add to human expertise. Insurance underwriting automation software aptly serves the purpose.

How Does AI Affect Underwriting in Insurance?

AI makes processes intelligent, and underwriting in insurance is no exception. At its core, AI allows insurance underwriters to make choices that are backed by data. Let's see how:

I. Machine learning

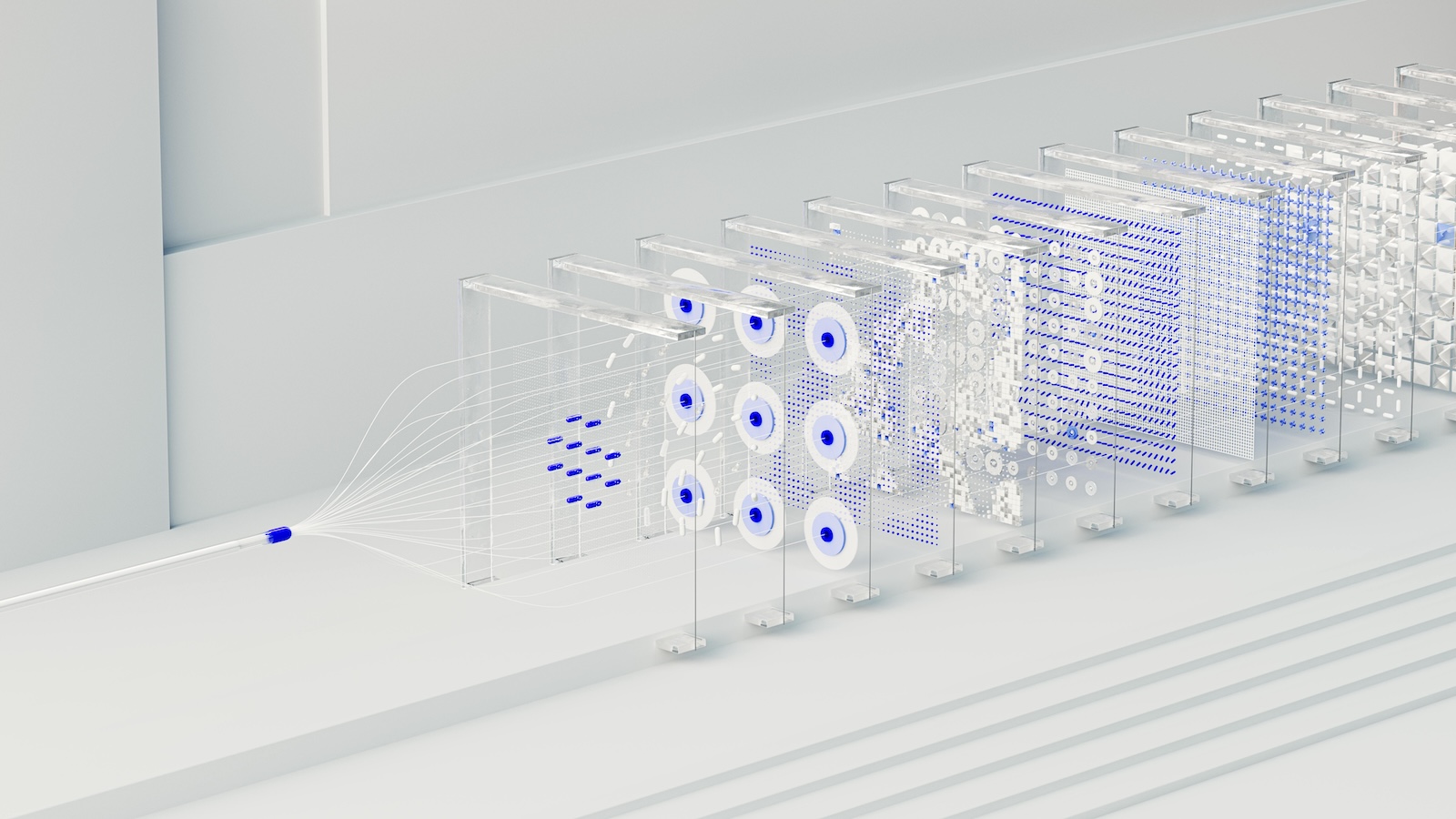

This is the engine of AI. ML algorithms are fed vast amounts of historical data, such as millions of past applications, claims records, and outcomes. Instead of being explicitly programmed, these algorithms learn to spot the complex patterns and correlations that lead to a claim. They continuously improve their predictive accuracy as they process more data.

II. Predictive analytics

This is the primary output of ML. By understanding the patterns of the past, the software can predict the future probability of a claim for a new applicant. It answers the basic underwriting question, "What is the probability of a loss?" with a much higher degree of detail.

III. Natural language processing

A huge portion of valuable risk information is buried in unstructured text. This includes doctors' notes in a medical record, detailed descriptions in a claims report, and even regulatory filings. NLP allows the software to "read" and "understand" this text, extracting relevant facts and sentiments that would be impractical to evaluate manually. The best part? All this is done while adhering to strict privacy protocols.

IV. Alternative data

This is where AI truly expands the horizon of risk assessment in insurance. Advanced models go beyond traditional sources, such as credit scores and motor vehicle records, to also consider non-traditional data points. For auto insurance, this could be telematics data showing actual driving behavior. For property insurance, it could be IoT sensor data indicating the quality of a building's maintenance. This creates a much richer, more dynamic picture of risk.

Insurance underwriting platforms with all these capabilities have the power to turn underwriting from a static, form-based exercise into a dynamic, multi-dimensional analysis. This is equally beneficial for both insurers and insureds. Explore what more insurers can do with such advanced solutions in the next section.

How Does AI-Powered Software Improve Risk Assessment in Insurance?

The theoretical advantages of the latest underwriting software are undoubtedly compelling. But what convinces the stakeholders to actually adopt is measurable results. By using AI-powered underwriting software, insurers can speed up old processes and enhance the quality and fairness of risk assessment. Here's what they can do:

i. Personalized Risk Profiling

AI lets insurers shift from grouping people into risk buckets to evaluating each applicant as a unique individual. By synthesizing thousands of data points, the software creates an individualized risk score.

The result? Two 40-year-old non-smokers living in the same ZIP code can receive vastly different life insurance premiums. Why? Because the model considers one's fitness routine and regular health check-ups versus the other's inactive lifestyle. This fairness benefits both the insurer, which can price risk more accurately, and the customer, who pays a premium truly reflective of their individual situation.

ii. More Accurate Fraud Detection

The human eye is excellent, but it can miss subtle, complex patterns that might point toward fraud. AI algorithms excel at spotting anomalies and correlations that are invisible in a manual review. By assessing an application against millions of previous ones, the software flags inconsistencies. For example, a discrepancy between stated income and spending patterns obtained from alternative data, or a claims history that follows a suspicious pattern.

Thus, insurers can spot potentially fraudulent applications at the point of underwriting, preventing losses before a policy is even issued and protecting honest policyholders from bearing the cost of fraud.

iii. Higher Efficiency and Speed

One of the most immediate benefits is efficiency. AI-powered underwriting software solutions handle the routine, repetitive tasks that eat up a human underwriter's time. It can instantly validate data, run checks against external databases, and even make straight-through processing decisions on low-risk, standard applications.

This slashes turnaround times from days to minutes, meeting the need for instant gratification. Crucially, it also elevates the role of the human underwriter. Freed from mundane tasks, they can focus their expertise on complex, high-value cases that require nuanced judgment and empathy.

iv. Risk Insights

The latest underwriting software enables insurers to prevent risks instead of crying over them later. By connecting real-time external data feeds, such as climate models, geospatial imagery, and economic indicators, these solutions can tell what the future holds.

For instance, they can spot properties at increasing risk of wildfire due to changing vegetation density and drought conditions. Alternatively, they can also identify commercial properties in a supply chain that are more susceptible to specific geopolitical disruptions. This allows insurers to work with clients on risk mitigation strategies before a loss occurs, turning the insurer from a simple payer of claims into a genuine risk management partner.

Wrapping Up

The way insurers assess risk today is way different from how it was done, say, three to four years ago. It is no longer a craft meant only for experienced underwriters but has become a fair practice, one that ensures accuracy and transparency. And AI-powered underwriting software for insurance helps businesses take the jump.