2025 did not start well for weather-related disasters. Early estimates from JPMorgan show that overall economic losses and insured losses from the Los Angeles wildfires could make it the costliest disaster in California's history.

This is particularly jarring as we come out of 2024, which held the unfortunate distinction of having an above-average number, when compared with the prior four years, of weather or climate disaster events with costs that exceed $1 billion in the U.S. This spotlights a critical crisis: the increasing vulnerability of American households to the financial implications of natural disasters.

The financial aftershocks of a natural disaster can include lower credit scores and more debt in collections, and over half of people who experienced a weather event in the past year (57%) faced increased household expenses.

Despite these risks, many households have inadequate insurance coverage due to factors including cost and complexity that can lead to confusion around insurance policies. Behavioral science can help insurers support consumers in overcoming these challenges through a greater understanding of consumer decision-making. A recently released Insurance Behavioral Design Guide highlights innovative practices that insurers can consider to support financial stability for individuals and communities as they navigate the financial fallout from natural disasters.

Behavioral Barriers to Coverage

Only 59% of households in the U.S. reported feeling confident that their insurance policies would cover them in an emergency in 2024. This lack of confidence can be due to a number of factors, including being underinsured -- but why do people not choose greater coverage? Behavioral science offers several clues as to what may be holding households back.

First, consumers may experience friction in accessing coverage, especially if they find their options for policies to be too numerous or complex. The mental load of having to sort through confusing options or too much information can throw people off track. This friction can be compounded by status quo bias, making change more difficult.

People's perceptions of their need for insurance are also influenced by the availability heuristic, which describes how the recency of an event (like a natural disaster) influences how likely a person thinks it is to happen again. In some cases, though, people may not take action toward coverage because they want to avoid uncomfortable information altogether -- a phenomenon known as the ostrich effect.

Perceptions of insurance costs can also be an obstacle, and high premiums are a commonly cited factor for policyholders who drop their coverage. This decision can also be influenced by loss aversion—people's preference for avoiding losses over seeking gains makes paying for a policy for which they may never make a claim unappealing. Insurers can drive higher uptake by strategically addressing these behavioral barriers.

See also: 'Predict & Prevent' Can Rescue Insurance

Market Innovations to Drive Engagement

Newer entrants to the insurance market (insurtechs) and the larger incumbent insurers alike have developed innovative strategies that could overcome some of these behavioral barriers, making coverage more accessible and promoting financial resilience.

- Alternative Premium Models

Adding flexibility to premiums shows promise for reaching more consumers. For example, auto insurtech Hugo developed a pay-as-you-go premium model that allows customers to purchase increments of coverage, including policies as small as three days. This can appeal to consumers with variable incomes, giving them greater control over their expenses. Or consider how Ladder, a life insurance provider, offers adjustable coverage: Policyholders have the option to increase or decrease their protection based on life changes, like purchasing a home. These flexible options help consumers to know that their insurance policies can easily evolve with their changing lives and needs.

- Building Customer Trust

Nearly 30% do not believe they are valued customers, feeling that insurance companies are not interested in serving them. Lemonade's innovative "giveback" program aims to counter this mistrust by aligning its interests with those of its customers. Under this program, it donates unclaimed premiums to causes that its customers choose, promoting loyalty and trust, which are key drivers to ensuring consumers feel confident in their insurance policies.

- Simplifying Uptake

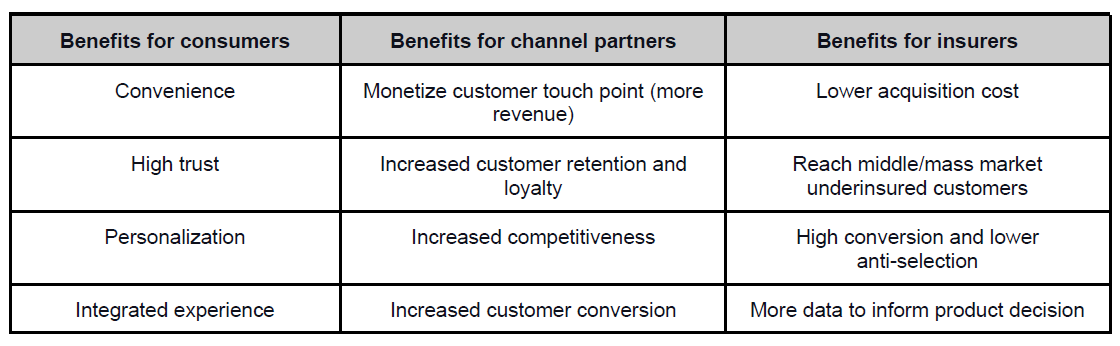

Finding an insurance policy can be daunting for consumers as they encounter a large volume of choices and friction. Root Insurance has a partnership with Carvana that enables customers to apply for auto insurance while purchasing a used car -- eliminating much of the friction to finding coverage. Similarly, AXA's pilot with Western Union offers life and disability insurance alongside remittances. By embedding insurance with existing services, these partnerships remove some of the complexity of finding coverage.

- Using Motivating Messaging

Marketing can play a pivotal role in helping people to overcome the ostrich effect and engage with insurance. It may be unsurprising that many individuals without life insurance (nearly one in five) report that they have avoided life insurance because they don't want to think about death. MassMutual developed their "Uncomfortable Truths" campaign to address this discomfort head-on, acknowledging difficult topics with an approachable tone. This type of approach can encourage people to take action to protect themselves and pursue financial resilience.

- Helping Customers Choose Their Policies

When consumers are uncertain about what coverage they should get, they may avoid the decision altogether and end up uninsured. Insurers can take inspiration from tools that guide consumers by providing key information as they search for plans. For instance, Washington D.C.'s health insurance marketplace, DC Health Link, offers a personalized comparison tool and calculator for users that estimates costs and benefits of different plans. Even simple tools like this can help consumers to identify and enroll in the right coverage for their needs.

See also: Insurers Must Lead Disaster Risk Awareness

Promoting Financial Resilience

Accessible insurance solutions are more critical than ever to supporting consumers' financial resilience. As extreme weather events continue to rise, more consumers will face the financial fallout of natural disasters. Insurers can deliver critical protection by applying behavioral insights to overcome some of the barriers consumers face to accessing adequate coverage. Leveraging behavioral science in the design and delivery of insurance products can not only foster financial stability but also build customer satisfaction and loyalty. Research has shown that customer satisfaction triples when customers see their financial institutions taking action to support their financial health.

Leveraging behavioral insights isn't just beneficial for insurers; it is essential for relevance and growth. From innovating premium models to simplifying the process of finding or enrolling in insurance, companies can narrow the insurance gap and contribute to more resilient communities prepared for the storms ahead.