Although China's insurance market started late, it expanded rapidly, benefiting from economic growth, demographic dividends, regulatory support and the internet. However, many underlying issues were masked by rapidly rising numbers.

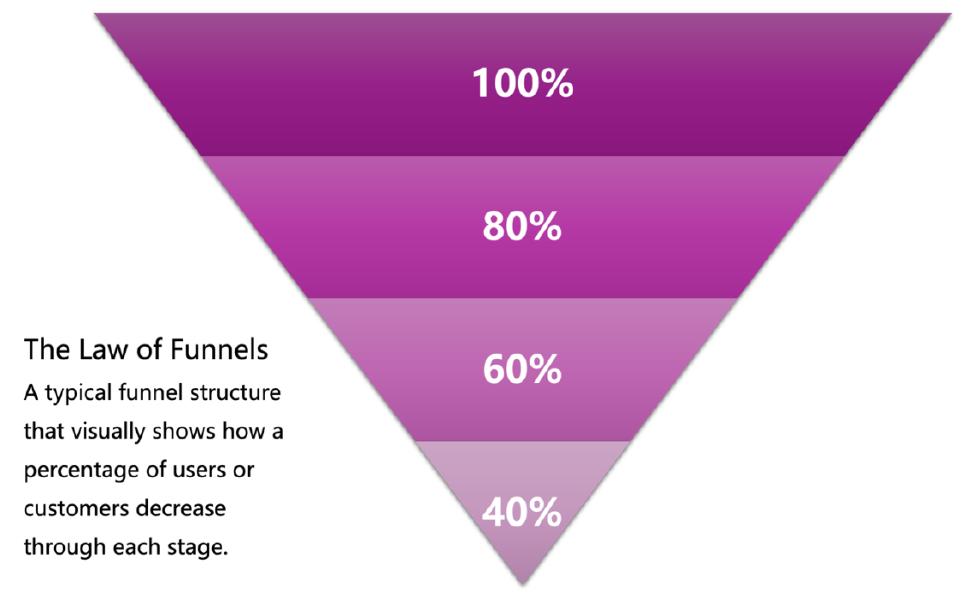

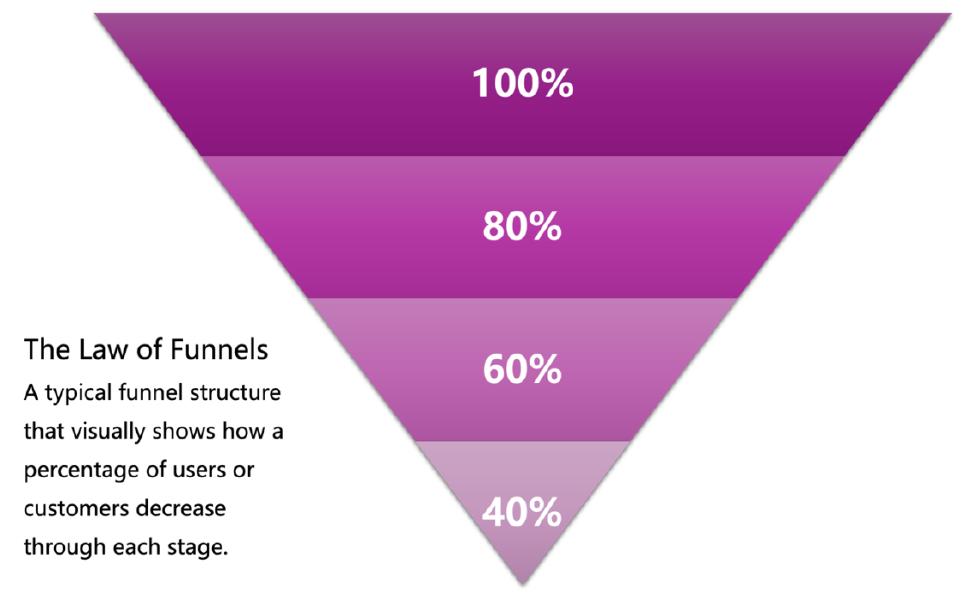

Traditional strategies in the insurance industry have struggled to keep pace with current challenges, particularly with the widespread use of the "funnel model" in marketing. Initially, I hoped that artificial intelligence could reduce costs and enhance conversion outcomes, but I quickly realized that technological advancement alone wasn't enough. Breaking through existing difficulties required a new marketing perspective, leading me to question the limitations of the funnel model.

When conversion rates drop, traditional remedies usually involve adding incentives or increasing channel commissions. However, with rising intermediary costs and competitive price pressures, insurance companies must sacrifice profits to stay competitive. Regardless of marketers' efforts, the traditional funnel model inevitably leads to increasing inefficiency, resulting in a predicament where "inputs exceed outputs."

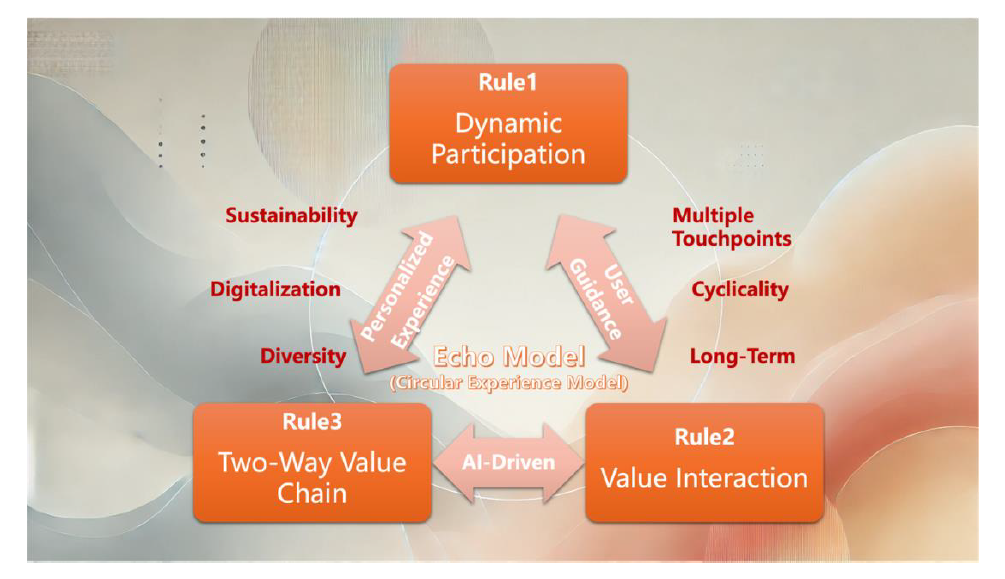

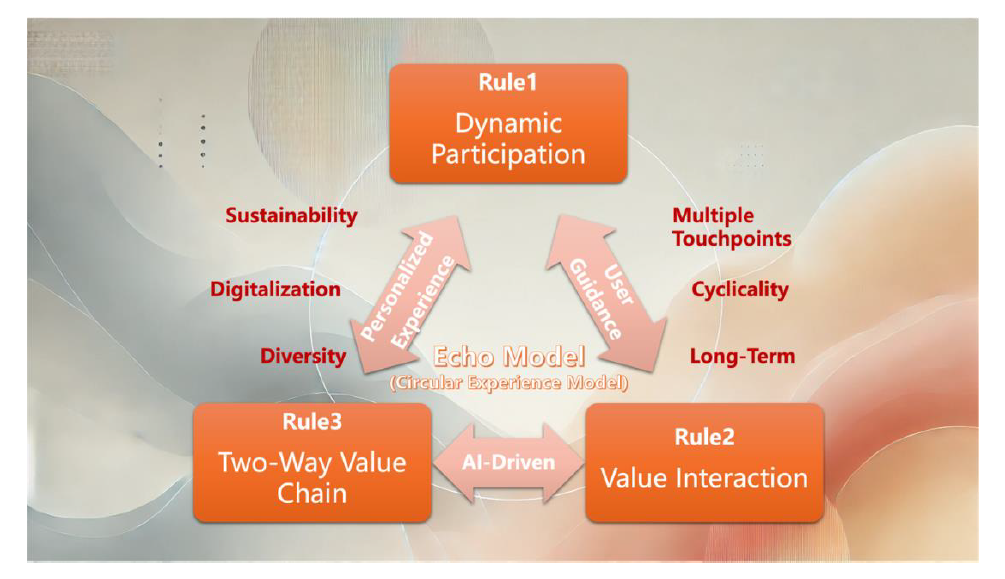

I question the effectiveness and sustainability of the funnel model and instead recommend an innovative solution — the "Echo Model," also known as the "Circular Experience Model" (CEM).

The new model focuses on a user-centered cycle, replacing the linear flow of the funnel with brand-user interactions that emphasize two-way feedback and long-term value creation. This process is iterative, involving dynamic participation (not just simplified steps), prioritizing valuable interactions (rather than low-friction steps), and establishing a two-way value chain (instead of solely focusing on high-value users).

See also: The Sales Funnel Is Obsolete

The Funnel Model and Its Three Rules

The funnel model is a widely recognized framework for user conversion, particularly in digital marketing and product design. It suggests that the more steps users must complete, the less likely they are to finish the desired task due to user fatigue and the "sunk cost" effect.

In Nir Zicherman's article, "The Law of Funnels," he expands on three key rules:

- Rule One: Minimize User Steps — The fewer steps users must complete, the fewer will drop off. Simplification must strike a balance between reducing steps and avoiding excessive clutter.

- Rule Two: Place Low-Friction Steps Before High-Friction Ones — Easier steps should be placed earlier in the flow, using the "sunk cost" effect to motivate users to complete subsequent steps.

- Rule Three: Optimize for High-Value Users, Not Just High-Conversion Users — Products should focus on converting high-potential users, not just existing high-conversion groups.

Confusions About the Funnel Model and Its Rules

The funnel model and its basic rules still hold sway among many marketing and user experience experts, who view them as vital for optimizing conversion processes. However, with the changing marketing environment, such as the emergence of short videos and WeChat for Business, consumer behavior and expectations have also significantly evolved, challenging the effectiveness of the traditional funnel model.

- Confusion One: Does WeChat for Business Defy Funnel Logic?

The funnel model suggests fewer steps lead to higher completion rates. However, WeChat for Business requires multiple interactions to convert potential customers, adding steps and potentially increasing dropout rates.

- Confusion Two: Are Low-Friction Strategies Suitable for All Scenarios?

While low friction can boost conversion rates, high-friction steps may better identify valuable users, especially in high-value products such as annuities.

- Confusion Three: Do Different Market Environments Require Different Conversion Strategies?

Different products and markets may need different approaches. For instance, a "90% * 80% * 50%" strategy may be more suitable for mass markets, while a "50% * 80% * 90%" strategy could work better for niche high-value markets.

- Confusion Four: Do Rules Two and Three Contradict Each Other?

Focusing on high-value users often requires higher initial friction, potentially conflicting with Rule Two, which advises minimizing early steps to improve conversion.

The Necessity of Reevaluating the Funnel Model

The funnel model and its derived rules are fundamentally oriented toward the company, rather than the user. This perspective is increasingly inadequate in today's market, where consumers demand deeper engagement and respect in the buying process, beyond simplified processes. A new model that embraces continuous interactions, feedback and dynamic adjustment — not just a linear funnel — is needed to meet modern consumer expectations.

- Step One: Break Away From the Funnel Model

The Echo Model replaces the linear funnel with a dynamic, multi-touchpoint cycle, viewing users as long-term experience partners. Companies continuously interact with users in diverse contexts, ensuring each interaction adds value and provides an opportunity for users to participate in the company's services.

- Step Two: Rewrite the Rules — Driven by User Needs and Dynamic Flywheels

- New Rule One: Dynamic Participation Instead of Fewer Steps — Instead of merely reducing steps, companies should make each step valuable, encouraging users to engage meaningfully.

- New Rule Two: Prioritize Valuable Interactions Over Low-Friction Steps — The goal isn't simply to minimize friction but to foster meaningful engagements that demonstrate product value.

- New Rule Three: Establish a Two-Way Value Chain — Focus on building mutually beneficial relationships, considering how each interaction can add value for the user, regardless of their profitability.

The Assistance and Resistance of the Echo Model

The Echo Model benefits significantly from advancements in AI technology, which plays a crucial role in enabling a more personalized, dynamic and adaptive marketing approach. AI empowers companies to continuously adjust and optimize interactions based on real-time data, ensuring each interaction is personalized and meaningful for the user. Below, we explore both the supporting factors and challenges in implementing the Echo Model.

See also: Transforming Insurance Operations With AI

Assistance From AI

1. Personalization and Dynamic Adaptation: AI allows brands to dynamically personalize interactions by analyzing user behavior and preferences in real time. This continuous adaptation not only enhances the user experience but also fosters deeper engagement. Instead of following a rigid, one-size-fits-all funnel, AI-driven insights can recommend products or services tailored to an individual user's needs and interests, making each touchpoint valuable.

2. Proactive User Engagement: AI-driven chatbots and recommendation engines can proactively engage users at different stages of their journey. By understanding when and how to reach out to users, brands can create a more seamless experience that guides users without overwhelming them. This helps reduce drop-off rates and keeps users engaged through intelligent prompts and valuable content.

3. Enhanced Feedback Loop: The Echo Model thrives on continuous feedback, which AI can facilitate effectively. By collecting data from user interactions, companies can rapidly iterate and improve their offerings. AI can identify patterns in user behavior, providing actionable insights that allow brands to adjust their strategies in real time. This iterative process strengthens brand-user relationships, emphasizing a user-centric approach.

4. Multi-Channel Integration: The Echo Model involves engaging users across multiple touchpoints. AI helps manage and unify these interactions across channels — such as social media, email and chat — creating a coherent and consistent experience. Users benefit from a holistic approach where each interaction feels connected, regardless of the platform or medium.

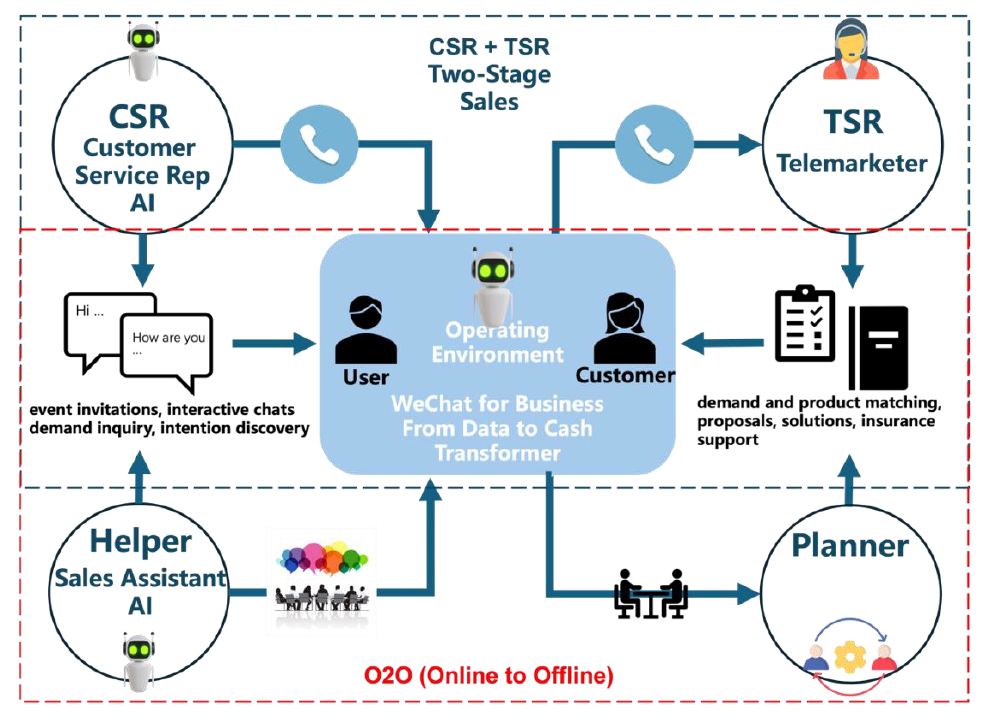

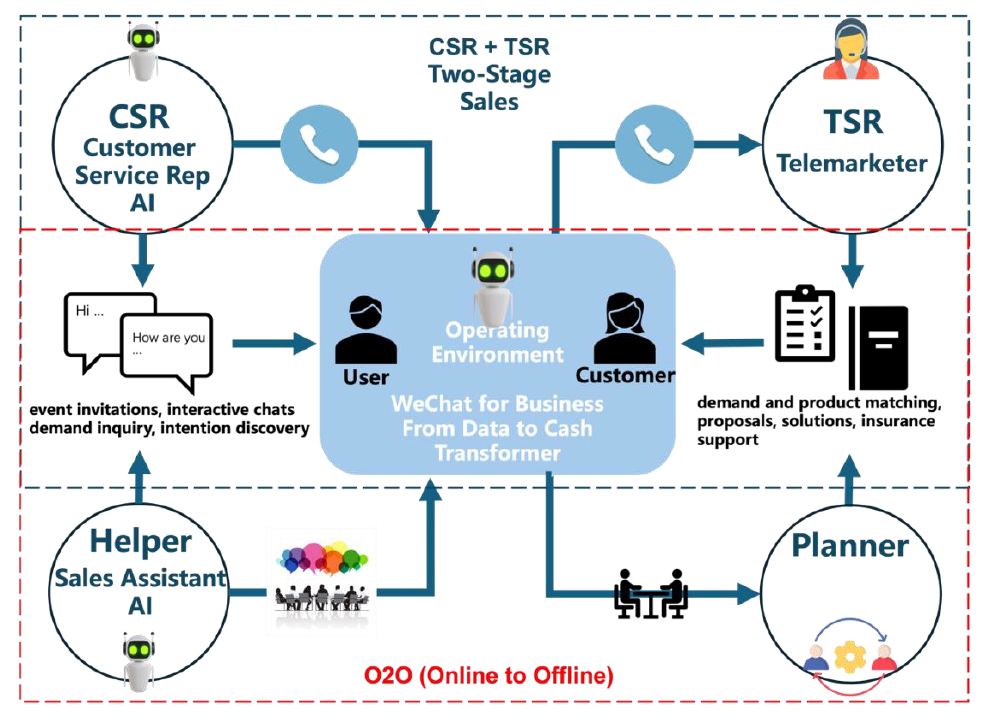

The above picture is a schematic diagram of an AI intelligent and automated WeChat for Business operation, which supports the realization of a marketing innovation business model of two-stage sales and online-to-offline integration.

Resistance and Challenges

1. Data Quality and Management: Implementing the Echo Model requires high-quality data for personalization and decision-making. Many companies face challenges related to data fragmentation, data silos and low data quality, which can hinder AI's ability to deliver meaningful insights. Effective data integration across departments and platforms is critical for overcoming these barriers.

2. Organizational Structure and Culture: The Echo Model necessitates a shift from traditional, linear workflows to more collaborative, cross-functional teams. Departments such as marketing, product, customer service and IT need to work in synergy to deliver a consistent user experience. This requires breaking down organizational silos and fostering a culture of collaboration, which can be challenging in large, traditional organizations resistant to change.

3. Balancing Personalization With Privacy: While personalization is at the core of the Echo Model, it raises concerns about user privacy and data security. Users today are more conscious of how their data is used, and brands must navigate the fine line between delivering personalized experiences and respecting user privacy. Transparent data practices and strong privacy safeguards are essential to gain and maintain user trust.

4. Technical and Implementation Complexity: Deploying AI-driven solutions requires significant technical expertise and investment. Companies may face hurdles related to integrating AI technologies with existing systems, developing accurate predictive models and maintaining them. Furthermore, AI algorithms must be trained to avoid biases and inaccuracies that could damage the user experience. These technical challenges demand resources, both in terms of financial investment and skilled personnel.

5. Managing User Expectations: Modern consumers have high expectations when it comes to personalized experiences. If an AI-driven interaction falls short — whether due to inaccurate recommendations, delayed responses or inconsistent experiences — it can lead to user dissatisfaction. Brands must carefully manage these expectations and ensure that the AI systems in place are well-calibrated to provide consistent value.

Despite these challenges, the Echo Model, supported by AI, represents a transformative shift toward a more adaptive, user-centric approach to marketing and customer engagement. By addressing the barriers effectively, companies can leverage the full potential of the Echo Model to foster deeper, more meaningful relationships with their users.

See also: Which Insurance Model Will Dominate?

Funnel Model No Longer Meets Needs of Digital Users

The evolution of digital marketing has fundamentally changed how consumers interact with brands. The linear, one-way funnel model is increasingly outdated in an environment where users seek deeper, continuing relationships with brands. The Echo Model's emphasis on continuous interaction and dynamic feedback provides a sustainable approach, breaking away from the rigid funnel structure. It fosters enduring relationships and genuine value exchanges, better suiting the expectations of today's empowered consumers.

The Echo Model, with its focus on dynamic engagement, continuous optimization and value creation, holds greater potential for helping companies maintain their competitive edge in a rapidly changing market.