The critical measures in underwriting are operational exposures, hazards affecting those exposures and controls that manage the risk. Those measures, combined with an historical view of prior losses, provide the insight that underwriters need. Unfortunately, a long-standing inefficiency in the underwriting process slows engagement with customers and increases the time it takes to make decisions about adding business to fragile underwriting portfolios.

Underwriting needs a vision to advance in an ever-changing business environment, especially in commercial lines. That vision can be partitioned into five basic considerations and exercises to create a tactical road map for moving forward.

1. What is your desired trading model? How do you wish to engage your policyholders?

While there are numerous web- or app-based solutions in the market, the degrees of data collection and integration vary. So, a key initial step in evaluating a platform is to make sure it satisfies data extraction requirements from multiple file types. That flexibility allows the design of a fluid, low-friction process for customer engagement.

The more effort for customers on the first touch, the lower the probability of conversion from marketing to quote to bind.

2. What underwriting data can be foreseen and what proxies exist to capture that data without requiring customers to provide it?

Enhancing customer engagement and limiting unnecessary, onerous data-gathering tasks are critical elements of this strategic assessment phase. New technologies exist today for integrating bundles of third-party data sources — to ease data integration into legacy systems without the need for building new foundations.

Technology is pervasive in the personal lines space, but commercial lines adoption has been slow, even though far more effort is often needed to gather and assess risk data in this segment.

See also: The Future of Underwriting

3. How can you abbreviate the supply chain to build a more responsive initial indication/pre-quote?

This question illustrates an acute pain point for brokers and agents.

The foundation of the portfolio and pricing is predicated on a pre-formulated target set of classes that can be both underwritten and adjusted (post-claim) with the appropriate subject-matter expertise, to bind new business at a profitable rate and an expected loss ratio. A qualified decision must be made as quickly as possible — to determine if the risk profile is worth pursuing, before incurring substantial time and expense in the underwriting process.

At this stage, there is a heavy dependence on data analytics and presentation in support of decision-making.

4. Have you implemented a process to match available coverage products with the operational exposures and hazards of commercial accounts?

A matching process of all available products is a critical differentiator for creating a competitive advantage and achieving profitable growth. Through a matching algorithm to assess enhancements for existing coverages, as well as complementary additional coverages or endorsements, underwriters can provide more comprehensive, custom coverage to brokers and their clients.

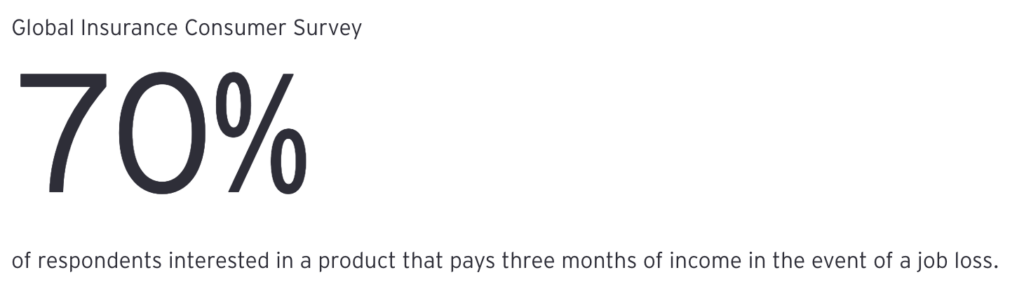

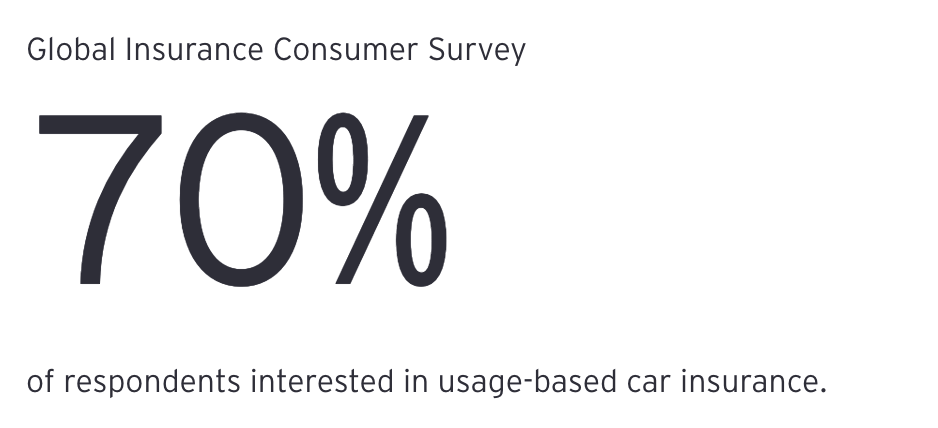

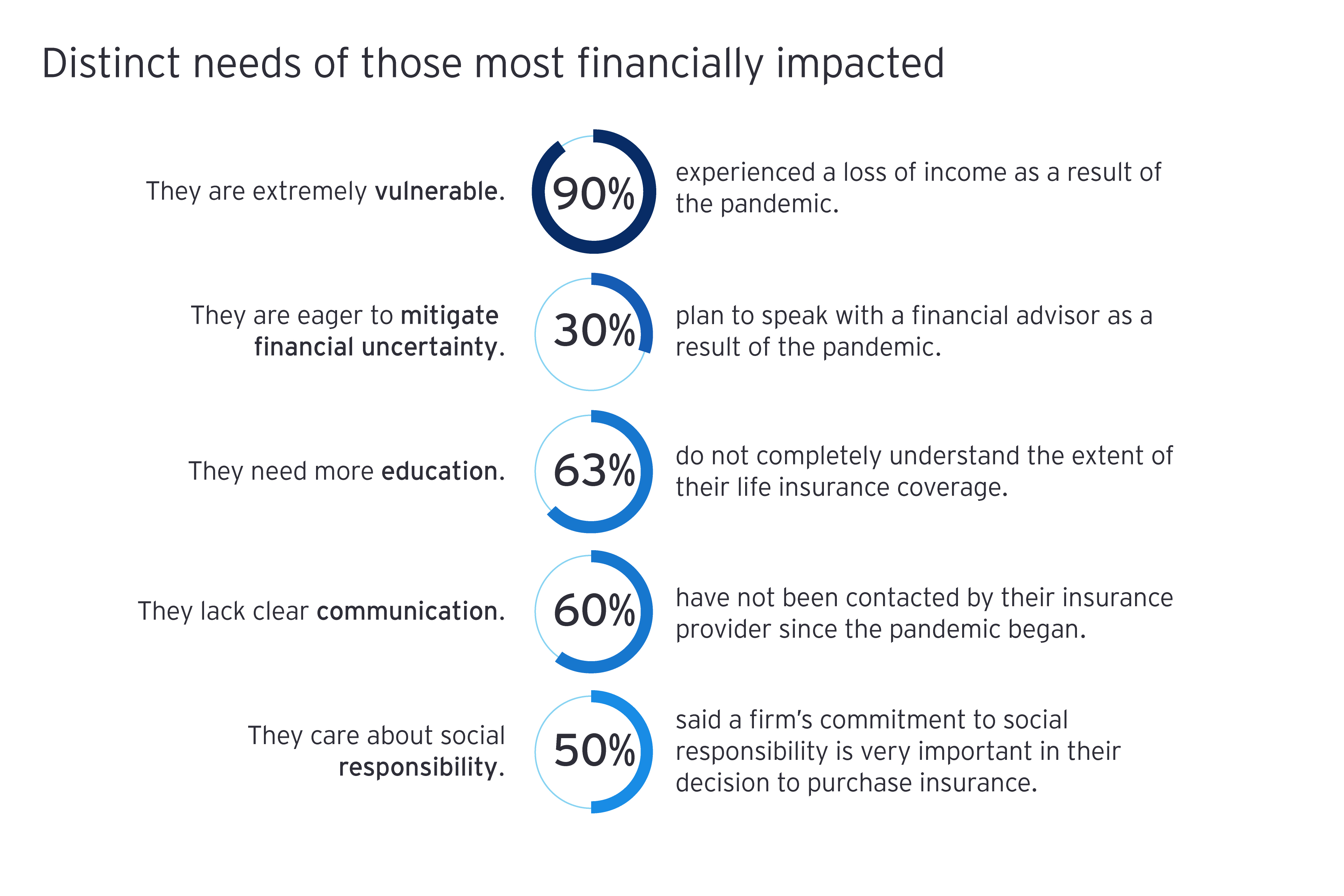

Insurance continues to transform into a customer-centric rather than product-centric industry, all but eliminating unnecessary coverages, terms and conditions. By definition, the industry is moving toward “pay for what you need” models. While simple and pragmatic, this concept has eluded the insurance industry for a lifetime in the commercial segment. However, the concept has been adopted in personal lines.

5. Have you built a feedback mechanism to monitor performance of the policy to take immediate and decisive action to mitigate upside and downside risks?

While there are significant decisions to be made prior to binding the policy, there are equally critical decisions post-bind, as the business moves from the “new” book to the “renewal” book. Underwriters should be enabled to monitor immediate changes to operational exposures, hazards and risks; and they should be able to exert suitable control on the potential erosion of profits.

As an example, the Internet of Things (IoT) continues to provide great advances in the real-time monitoring of exposures, be they man-made or inanimate. Creative manuscript endorsements and stronger terms and conditions can use the IoT to manage the risk of losses.

Transformation in underwriting is key for any insurance organization. And transformation is more possible than ever before due to the increasing impacts of modern technology — which makes it possible to get strategic insights from data for better real-time decision-making and results.