Imagine that you wake up one day in the future and you read this headline:

“Auto insurance is no longer being sold.”

The article says accidents are rare or no longer possible due to autonomous technologies, hundreds of new safety features, an entirely new methodology for handling vehicular risk and a dramatic reduction in the personal ownership of vehicles. When claims events do happen, they are covered by the manufacturer or simply paid for out of a reserve created by a globally pervasive mobility corporation.

If this seems far-fetched, you will want to read Majesco’s latest report, “Rethinking Auto Insurance: From a Transactional Relationship to a Mobility Customer Experience.” Though auto insurance is unlikely to go away any time soon, premiums are beginning to decline and will likely continue to decline in the coming two decades at a rate much faster than many would like to admit is possible. This decline will force auto insurers to reinvent themselves in ways that are both challenging and exciting. It will be the end of auto insurance as we currently know it, but it will be the beginning of mobility experience and ecosystems that could improve insurers’ profits with new revenue sources.

Four years ago, we published our first Future Trends report (with an update to the report in December 2019) that examined a major shift unfolding due to the converging “tectonic plates” of people, technology and market boundary changes disrupting and redefining the world, industries and businesses — including insurance. In particular, these trends are changing traditional auto insurance. Majesco’s new report goes one step further to answer two highly pertinent questions:

- What trends are pushing auto insurers to adapt their business models?

- Why should auto insurers begin creating mobility experiences and ecosystems that will transform their purpose and their profits?

In today’s blog, we examine the high-level trends that are affecting auto insurers and take a peek into how insurers are likely to adapt and respond. We’ll cover:

- Customer, Technology and Market Boundary Changes

- The Generational Shift in How Transportation Is Perceived and Used

- The Auto Insurance Transaction vs. a Mobility Customer Experience

Customer, Technology and Market Boundary Changes

In February, Uber said that 10% of U.S. millennials who ride with Uber have changed their car ownership behavior. Due to increased costs of vehicle ownership, environmental consciousness, technological innovation and the availability of mobility through Uber, millennials are choosing to get rid of a personal vehicle or choosing not to buy a car.

Because of the customer, technology and market boundary changes, traditional auto insurance is under growing pressure and threat from many fronts, including:

- The growing use of non-owned vehicles and mobility options like rideshare, rentals (traditional and shared economy) and other local rental options like scooters and bicycles, reducing the market size for individual auto insurance purchases.

- Non-insurance providers that offer/embed insurance for vehicles and other mobility options, potentially cutting off traditional carriers from these opportunities.

- Increased effectiveness of safety technology, putting more emphasis on prevention and less on traditional indemnification, potentially depressing auto insurance premiums. It is estimated that advanced driving assistance systems (ADAS) features and enabling technologies increasingly included in new vehicles can reduce losses 20% to 30%.

- Connected devices that enable improved data, beyond telematics, such as mileage, location, weather-related and driving behavior. This is allowing for real-time, data-based underwriting and pricing, which could lower premium volume or make it less predictable.

- Auto manufacturers that are leveraging their customer relationships and data to offer insurance, repairs and services (Porsche, Volvo, Tesla, Ford, GM, etc.). They are recasting themselves as “mobility companies.”

- The rise of on-demand insurance, expected to increase 30% by 2026.

- The rise in testing and use of self-driving vehicles and robots due to the COVID-19 pandemic for contactless deliveries, which could accelerate a shift to a future of autonomous/semi-autonomous mobility marked by fewer accidents.

See also: Evolving Trends in a Post-Covid-19 World

The Generational Shift in How Transportation Is Perceived and Used

Adding to the pressure on auto insurers is the shift in generational views on transportation, mobility and product expectations for auto insurance. Within the report, we discuss the shift between millennials and Gen Z versus Gen X and Boomers, including:

- 28% of the younger generation currently use a device or app to record mileage and driving behavior — compared with 15% for the older generation – nearly a 100% difference.

- 11% rented someone else’s car through a sharing service, and 9% rented out their car, versus 2% and 1% for the older generation.

- 30% of the younger generation are using or would use an all-inclusive vehicle subscription service – nearly four times higher than the older generation, indicating interest in different mobility options as opposed to owning a vehicle.

- 40% of the younger generational segment would pay $10 per month for a mobility solution with access to a wide array of services. Only 20% of the older generation is interested in this — a 100% difference.

- The younger generation is two times more likely to:

- buy auto insurance from a car shopping website or a vehicle manufacturer website,

- have insurance included in the purchase or lease of a vehicle,

- buy insurance from Amazon or Google.

Auto insurers must reimagine the scope of what they will offer to customers – an experience with a risk product, value-added services that are part of a broader mobility ecosystem and a compelling customer experience. This is where exciting new business opportunities await. And where new competitors are emerging, including automotive companies, ride share companies and others.

The industry status quo for auto insurance is rapidly eroding. Insurance is being re-defined with a growing number of influences, upending decades of business assumptions. In this new decade, a fresh auto insurance opportunity exists for those who will participate in a broader mobility ecosystem and the growing number of insurable situations.

The Auto Insurance Transaction vs. a Mobility Customer Experience

As a result of all of these changes, the greater threat may be auto insurers’ continued 100-plus-year-old view of auto insurance as a policy transaction.

With so much change around transportation options and automotive, companies outside insurance are coalescing around a shift to “mobility.” From the decline in car ownership for the first time since 1960, with 9.1% of households in 2015 having no cars, to the rise of ride-hailing and car-sharing services, a plethora of transportation options continue to expand.

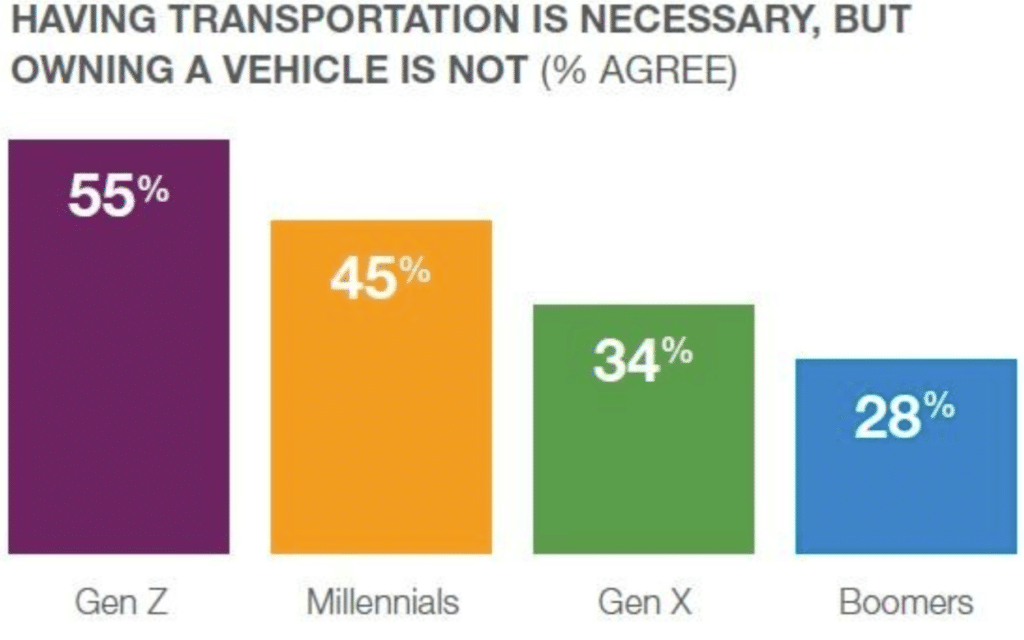

According to a survey from Cox Automotive, nearly 40% agree that having transportation is necessary, but owning a vehicle is not. Most interestingly, among millennials, the rate jumps to 45%, and for Gen Z it jumps to 55%, as reflected in Figure 1. This implies that mobility options are important but can be fulfilled by many means beyond traditional vehicle ownership … a significant shift affecting business models from automotive companies to insurance companies alike.

Figure 1: Importance of vehicle ownership as a mode of transportation

These shifting customer, market boundary and technology trends are creating a new market segment called “mobility” that brings together different elements of other markets or industries, including insurance. Unfortunately, for customers the current experience is fragmented, inconsistent and difficult at best, as they interact with disparate entities to complete necessary tasks across the mobility journey. These would include everything from financing a vehicle, to using and maintaining that vehicle, to selling that vehicle. You could also include transactions such as renting a car, parking a car, purchasing tickets for public transit, using public scooters and bicycles and, of course, maintaining insurance for any of those tasks.

Customers currently have to work with the different parties individually, requiring time and inducing frustration, meaning that customers may reduce, reallocate or eliminate a substantial portion of today’s auto insurance premiums. Insurers must rethink their scope away from an auto insurance transaction to a broader mobility experience that redefines and includes:

- Insurance Product: Product (risk, services, experience) redefined but requiring insurance to participate and play within ecosystems, rather than simply existing as an ecosystem unto itself.

- Mobility Policy: One unified policy to cover whatever mode of transportation a customer chooses, instead of separate policies for each.

- Value Added Services: Risk protection services as a component of an ecosystem that provides a single place for all of the “jobs” a customer needs to get done across the mobility customer journey – providing a powerful, single engagement and eliminating points of friction between the different participants of the ecosystem.

- Continuous Underwriting: Constantly updating the risk profile of an individual or thing that changes the terms and pricing, influenced by the continuous flow of data from autos, telematics and IoT devices.

Highly networked, data-driven, value-added mobility business models are rapidly emerging, primarily outside of insurance. Automotive companies like Tesla, Ford and GM are leading this shift along with platform companies like Uber. They are redefining the customer journey, and the entire customer relationship, across a broader set of transportation options.

See also: COVID-19’s Once-in-a-Lifetime Opportunity

These shifts will push auto insurers into new realms of business, expanding their definitions of product and service and making them much more relevant to the daily life and experience of each customer.

In our next blog, we’ll look at real evidence from a recent Majesco survey that confirms the trends we have highlighted above. We’ll look at the specifics of two major demographic groups and what they are looking for in their mobility experiences. We will also look at what they are currently doing regarding mobility and technology versus what changes they are considering for the future.

You can access this information even faster by downloading our latest report, “Rethinking Auto Insurance: From a Transactional Relationship to a Mobility Customer Experience,” or view the replay of our webinar on the research.