There is a stretch of road yet to travel—but at long last the post-pandemic world is coming into view. As vaccine distribution accelerates and case counts drop, independent agents are contemplating what the future will look like. While it surely won’t be identical to the pre-pandemic business environment, there is room for optimism.

Technology will be a key to a fast recovery. In 2020, many independent agents were able to leverage technology to maintain relationships and even grow their businesses. But there is an opportunity to improve on objectives like paperless processes, remote relationship building and digital communications.

Technology can help independent agencies exit the pandemic era strong and ready for the future. Here are four smart ways agents can use technology in this new landscape and thrive in the years ahead:

Self-Service Tools

Some agents fear that clients will feel ignored or make decisions that diminish revenue if they can manage their own policies digitally.

In reality, clients appreciate and even demand the ability to do some policy maintenance on their own, when they wish. No one wants to wait until 9am to call or visit their bank, and insurance is no different. The ability to get a quote on a new auto policy or request an endorsement through a mobile app is not only considered highly efficient, but also respectful of the client’s time. Moreover, providing the capability creates a strong audit trail for the agency, saving staff from the tedium of compiling emails into a record.

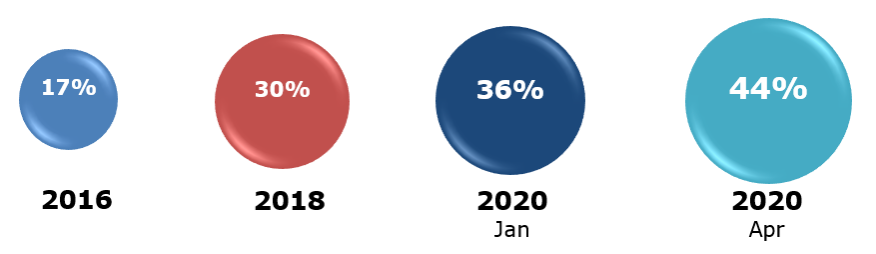

Many clients (and especially millennials and Gen Z) expect to be able to transact routine business on their devices, without assistance. While they want the ability to email or text their agent for advice (and most also appreciate timely outreach from their agent), self-service is fast becoming essential for agency success.

United Western Insurance Brokers (UWIB), a Seattle-based agency, discovered firsthand the value of self-service in 2020. After the pandemic hit, UWIB braced for a severe drop in business, thinking that clients would either ignore or actively cut back on their policies. Instead, the agency wrote more new premiums in the spring of 2020 than it did over the same period in 2019. Why?

UWIB’s online customer portal, which offered self-service and other convenient digital options, enabled remote, contactless business transactions. Even when clients were in lockdown, they could manage their policies—and the agency was able to write new business.

Automated Client Engagement

We’ve all received “personalized” communications where the personalization ends after the “Dear (NAME)” opening. And in an industry where relationships are key, that tactic has been a big turnoff for independent agents who have considered automated client communications solutions in the past.

The good news is that technology-backed client engagement has evolved lightyears from this kind of fill-in-the-blank approach. When integrated with an agency management system, marketing automation platforms—the lingo for mass digital communications—intelligently and intuitively identify important reasons for outreach. Automated communications share actionable, relevant information with clients to help them make better insurance decisions. In short, advances in artificial intelligence (AI) and machine learning (ML) mean that technology can deliver the right message to the right client at the right time to create a truly personalized client experience.

These advances are a boon for agencies looking for a way to set themselves apart from their competition. Intelligently prepared communications produce open rates and click rates far above insurance industry averages (which, according to MailChimp, are 21% and 2.1%, respectively.)

In addition, automation can remove the labor and expense required when sending renewal reminders, soliciting reviews and feedback, and seizing on life events or other triggers for new accounts and policies. Automated client engagement can even keep track of how often clients want to receive emails and create segmented lists that ensure clients receive content based on their particular lines of business or locale. These tools are helping agencies do more while still keeping the personal touch in their business.

See also: 4 Predictions for Independent Agents

E-Signatures and Electronic Payments

From mortgages to contracts to transferring money at the click of a button, consumers have gotten used to being able to transact business remotely. When it comes to covering their risks, clients expect their insurance to move at the same speed as everything else in their lives—which is why e-signatures and electronic payments are a necessity for independent agents.

The benefits to clients are clear, but there are strong business advantages for agents, as well. Clients are more responsive and timelier in returning signed digital documents, and they are more likely to pay premiums on time when they can use a credit card or ACH from their bank account. It’s true that some credit cards, mobile wallets (e.g., PayPal and Apple Pay) and pay-by-text services impose higher fees than checks or ACH, but the improvement in customer experience is more than worth it.

CB Insights, a technology analyst firm, reports that in 2019 paper checks accounted for 52% of disbursements in the insurance industry, compared with just 22% on average in other industries. The firm further states that ACH (Automated Clearing House) payments, which made up less than a quarter of insurance disbursements that same year, are a tenth as expensive as cutting a check.

Automated Policy Checking

The next big thing this year for independent insurance agents may be automated policy checking. Currently, most policy checks are outsourced and performed manually in batches. Using the traditional outsourcing approach of conducting the policy check and returning it to the agent, the process can take up to two weeks.

This can all change through automation. Some insurtech providers are offering solutions that use machine learning to check policies in a matter of minutes, with upwards of 90% accuracy and lower costs. Agents who pioneer automated policy checking in 2021 may gain a cost advantage and an edge in closing time-sensitive deals. The technology is worth testing.

Rather than separating agents from their clients, technology—when properly used—can actually build closer relationships and enhance customer loyalty.

In the past year, we’ve seen agencies adopt technology at a rate never seen before. This is no time to stop—in fact, agencies should double down on their investments. Technology has been proven to increase books of business and retention rates. As agencies look to their post-pandemic future, it’s time to see technology for what it is: a tool to not only accelerate business but to better adapt to the road ahead.