Insurance firms are drowning in data. The average insurer processes over 10 million transactions annually—a figure expected to rise by 29% in the next two years. And the challenge isn't just volume, it's variety, too. That's according to a recent industry report that found that two-thirds of insurance firms handle data from an average of 17 different sources in their premium payment process alone.

Data sources are multiplying, too, and outdated systems are struggling to keep up. This increase in data is driven by the rise of digital transactions, third-party data sources, and regulatory changes. Meanwhile, customer expectations for faster payouts and greater transparency are higher than ever. And new tech-driven players (insurtechs) are setting the standard for faster, more accurate and efficient processes.

New Market Pressures

Legacy systems and manual processes weren't built for this level of complexity, and the consequences are evident. Manual processes are time-consuming and error-prone, leading to delayed settlements and making it difficult to consolidate data across platforms, resulting in data silos and fragmentation. Without centralized, automated data flows, insurance firms lack real-time visibility. However, 90% of firms are considering a new reconciliation solution to address these issues and avoid being left behind during a time of competitive change.

Insurance firms that centralize data management and automate reconciliation will save time, reduce human errors, accelerate reporting, and gain deeper strategic insights—turning data complexity into a competitive advantage.

The Need for Speed

Today's customers expect claims to be settled quickly and with minimal friction. In the U.S. alone, 80% of auto insurance customers are planning to or have already left their current insurer due to the lack of speed and accuracy.

With the insurtech market expected to grow more than 50% from 2024 to 2030 in the U.S., a new benchmark has been set for speed and efficiency to keep customers happy. Digital-first platforms are processing claims in minutes, while traditional insurance firms struggle to keep up with the amount of data being processed.

Insurance firms that automate payment processing and improve back-office efficiency will reduce settlement times, strengthen cash flow, and improve customer trust. So, faster payments don't just enhance customer experience, they create financial stability and free up capital for strategic growth.

Battling Regulatory Pressure

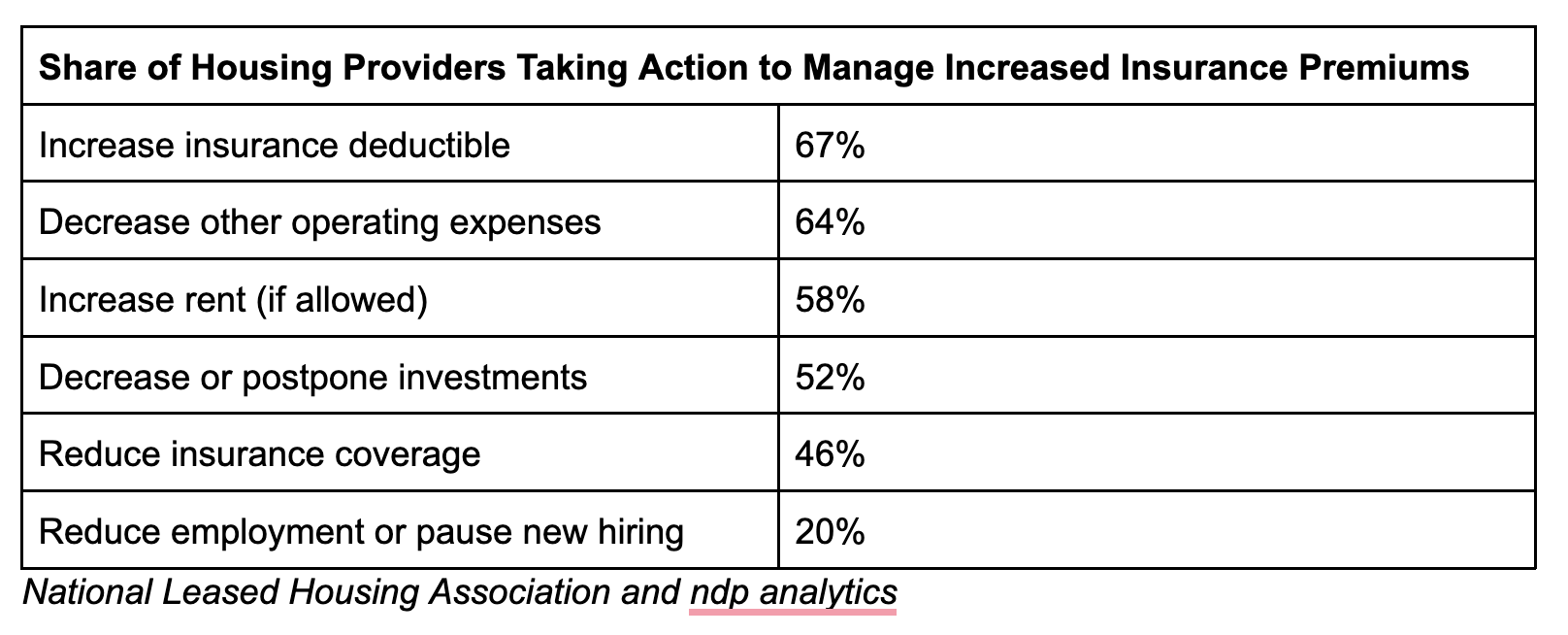

Regulatory standards are becoming more stringent across key markets like the U.S. and the U.K. With varying requirements across states, insurance firms are facing growing pressure to demonstrate accuracy, transparency, and financial control under regulations such as the International Finance Reporting Standard (IFRS 17) and the California Consumer Privacy Act (CCPA). Yet many insurance firms still rely on manual processes for regulatory reporting, raising the risk of inaccuracies, missed deadlines, and penalties.

Implementing automation in regulatory reporting and data reconciliation allows U.S. insurance firms to maintain compliance with greater accuracy and reduce manual efforts. Real-time data validation and automated reporting tools reduce the administrative burden, enabling insurance firms to adapt quickly to changing requirements.

The Power of Centralized Control

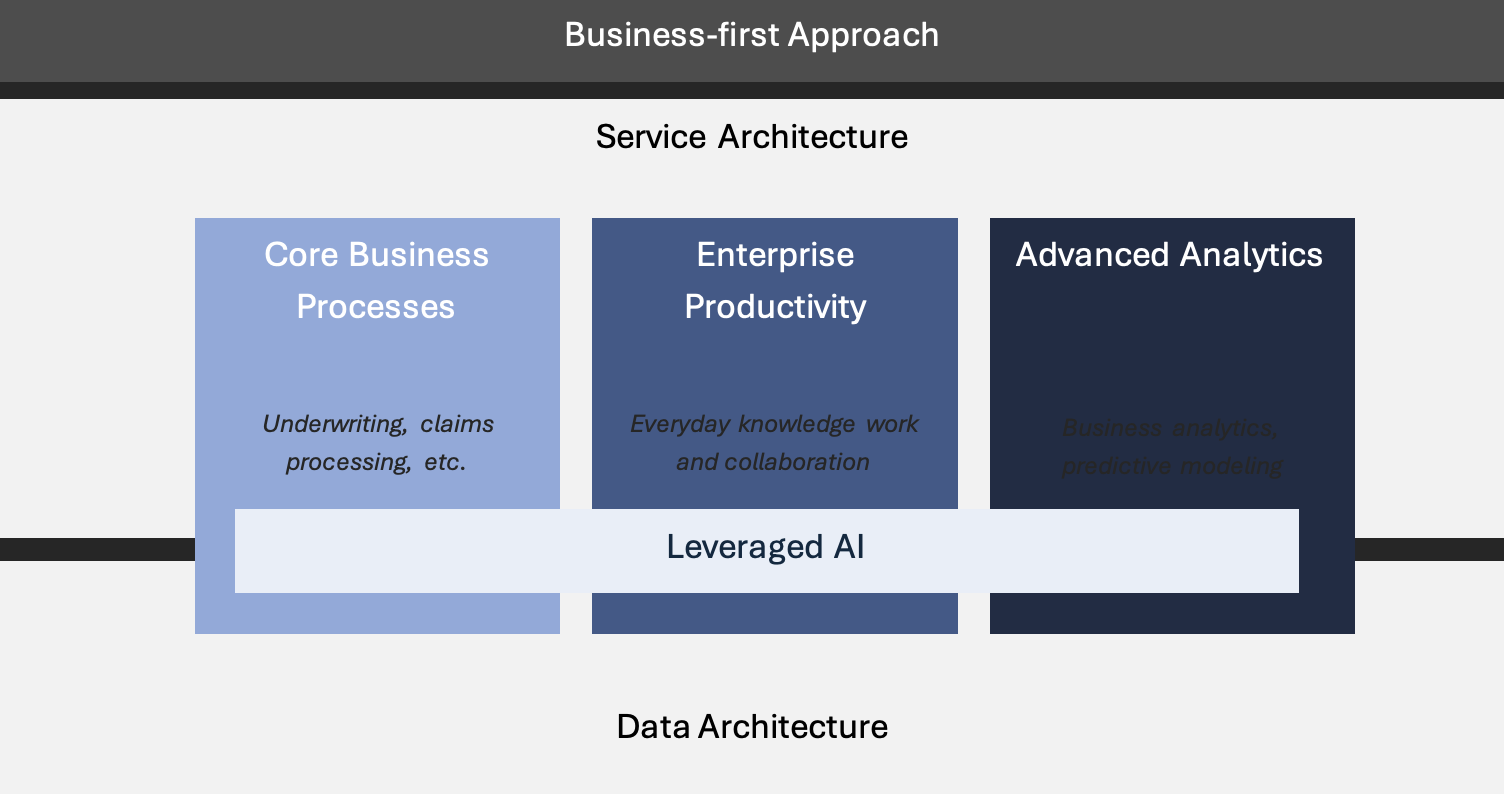

To stay competitive, insurance firms need more than small fixes—they need smarter, faster operations. Streamlining processes, improving accuracy, and speeding up service are key to meeting rising customer and market demands. Managing data across multiple platforms and sources is messy and slows operations when time is of the essence. Centralizing data into one system and automating key processes like reconciliations can reduce errors and speed reporting. With cleaner, more connected data, insurance firms can make faster, more informed decisions and respond to market changes with confidence.

Slow payouts frustrate customers and strain cash flow. Automating reconciliations and settlement processes reduces delays, lowers costs, and improves accuracy – boosting customer trust and financial strength. At scale, automating manual processes can lead to an average cost savings of up to 30% within five years for payers.

Regulations are complex and costly to get wrong. Automating reporting and data validation simplifies compliance – reducing risk without adding to operational workloads.

Adapt or Risk Being Outpaced by Competitors

The insurance industry is at a crossroads. Spreadsheets are still integral to financial operations in 90% of organizations. Firms that cling to outdated systems will face higher costs, slower growth, and frustrated customers.

Those who embrace automation and smarter data management will operate more efficiently, improve customer satisfaction, and strengthen their market position.