News channels and insurance distribution have something in common. Both have been undergoing two decades of disruptive change. Both have had to re-examine their role in the life of the customer. Both are facing the dilemma of how to reach customers in the face of information overload. And… it may be that both are finding their way back into the customer mind through new technologies, data and analytics and a personalized touch that is fostered through digital means.

In the last two decades, we have seen a dramatic decline in the tangible newspaper. Most of us no longer walk outside to pick it up. If we read a paper, it has lost its heft. We gather our news through online sources. Of course, much of the support of newspapers – ads — has been pushed into the online realm, where, instead of three lines for $20, someone selling their car can show images, location and as many lines of text as they want for free until they sell. Craigslist and Facebook Marketplace and a thousand other sites have hastened the push of news into digital models. Though many of us pine for the glory days of the newspaper, the average reader probably feels less guilt over the paper they consume… and they don’t miss all of those pages of ads.

This is where every insurer needs to begin. We need to examine the insurer relationship to distributors in light of the customer mindset. What is changing with the customer and how they take in information? How do insurers and distributors adapt?

As customers, we don’t want ads. We want access to information on products. We don’t want to be sold insurance. We want access to the insurance products we need with tailored expertise across a wider array of channels.

Insurers need to work to use distributors to their advantage through the lens of the customer. Done properly, this means a better experience for the distributor, the insurer and the customer. Insurers need to help customers with an experience that will be enhanced by synchronized and seamless distributor/digital channels. People and businesses that interact with their agents feel more comfortable with their insurance products when they understand their insurance products. This is why the broker/agent channel isn’t in danger of disruptive demise but instead is ripe for digital development.

In Touch With Agents/In Touch With Customers

Insurers that are interested in serving customers will keep tabs on what customers are needing and what agencies need to serve them. In August 2021, Majesco asked Celent to give us a status report. What’s going on in the distributor/insurer relationship? Celent surveyed 231 agents, analyzed their responses and published them in a report, Reshaping the Distributor Insurer Relationship: A Survey of Independent Insurance Agents. Today, we are looking at one portion of that report: digital service and the balance that needs to be created for effective customer experiences. We’ll look at what the brokers/agents have to tell us and how it is affecting insurers.

See also: ‘Digital’ Needs a Personal Touch

The Insurer/Distributor Conundrum — Policyholder Self-Service

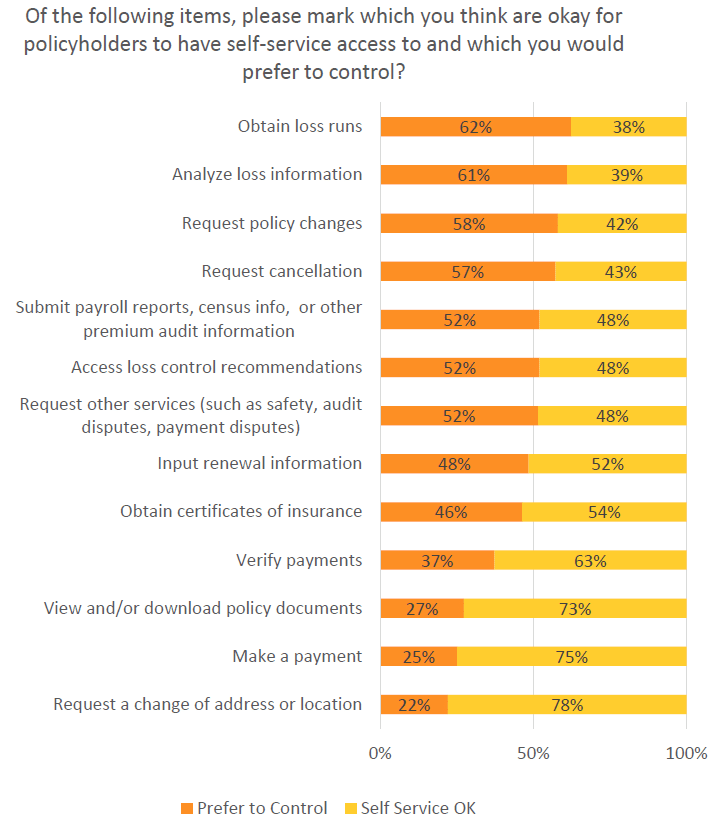

In most “retail” industries, customer digital enablement is just a matter of “give them what they want.” When it comes to insurance, however, total access can mean that the customer loses out on business wisdom when making big decisions, and the agent may lose out on customer business by not staying in touch. We were curious: Which transactions aren’t threatening to the agent/customer relationship? Which transactions release the agent from work he or she would rather not be doing? There’s a fine line. (See Fig. 1.)

Figure 1

The assessment of the data by Celent came from both statistical analysis and agents’ comments.

“While most agents are generally okay with allowing self-service for transactions associated with maintaining an existing contract," the report found, "they would prefer to maintain control over activities associated with changing the policy or signaling a potential change (e.g., requesting loss runs). Some of their concern is around the potential for disintermediation.”

The quotes from agents reflect that they also wrestle with a desire to give customers great self-service, yet keep them from some of the stressful situations that can arise when they are allowed to make certain moves without the agent knowing. Here are examples from two agents:

“I prefer that the customer not be able to log on and make changes to their coverages without us….It puts us in an E&O spot. You get this change—where did this come from? Who requested that?”

“It’s their information, so I don’t personally have any issues with it. I would have an issue with the loss runs. That’s a red flag that they're shopping, and we want to be ahead of that. A copy of their policy? CSR24 all the way. But notify us if there is any activity making changes.”

The Insurer Imperative — View Digital Service Through Two Lenses

As insurers decide what they need to do to facilitate business through independent agents, it might be good for them to visualize the customer and the agent at a virtual table, with the insurer present, acting on behalf of both. What does the customer want in the way of communication and self-access? What does the agent need to place the business, to maintain it and report on it, etc.? What is needed to facilitate communication between the two?

The answer to what is needed can be determined by the tools that the insurer brings to the table. There is a wide variance in capabilities. In general, agents are pleased with their primary insurers (see our blog on insurer/distributor bonding), but they are also expecting those insurers to “up their game” with relevant tech improvements across a wide range of capabilities. Celent’s data from a separate study indicated that 76% of agents agreed that they would send more business to the carriers that catered to them by improving the technologies that would make working with the insurer easier.

inThis means that insurers need to be thinking of technology improvement from both the agency and customer perspectives. How will improved processes fill agency communication and transaction gaps in ways that streamline and improve end-customer experience? Nearly all answers to this question end in the need for carrier system change.

Two Perspectives With One Shared Answer to Modernization

The only way to improve broad-level and detailed capabilities and to rewrite customer engagement processes is to design and implement a system where innovation and flexibility naturally occur in a “native” environment. Both the agent and the end-customer share the need for personalization, relationship development and data-driven policy management. This requires that carriers prepare for digitally infused automation and capabilities that move way beyond transactions. There are implications in terms of the vast differences you see currently between carriers.

The report found: “There is wide variation in insurers’ abilities to deliver on the needs of an agent. For many, only critical business processes have been automated…even many of the 'modern systems' commercially available today are not as open or flexible as needed. Even those that have updated their core systems often have legacy systems in place for distribution management. Many still use spreadsheets to manage bonuses, and many insurers only provide PDFs of production reports and commission statements.

“Contrast this with the insurers on the other end of the capability scale. These insurers are heavily automated, using predictive analytics and AI in their workflow automation. A robust integration layer allows the orchestration of third-party data and additional digital processes to become part of the delivery of customer-centric services. A high level of routine business is handled without touch… Some insurers use analytics to manage the distribution channel at a very granular level. Policy, claims and commission data has been well-organized in a logical and physical model, making it easier to utilize extremely complex segmentation and compensation programs and manage agents in a more sophisticated fashion.”

See also: The Digital Journey in Personal Lines

Investment Along Two Lines

Everyone recognizes that technology isn’t an end unto itself, but that it must be supported by the processes and methodologies that match. Real innovation and advancement happens when the organization can approach both from a high level and integrate tech design and new processes. The hurdle, of course, is usually the traditional processes used by insurers. Old implementation methodologies will also stand in the way of real innovation.

Celent adds, “Old methods to create products that provide transaction efficiency, maximize features and deliver scale will not deliver digital customer experiences. Step-by-step implementations take too long and are overly rigid. Sending books of requirements to a coding factory and receiving deliverables at some time in the distant future does not allow for responsive, iterative adjustments. To move down this path, insurers need to invest in two major workstreams simultaneously—designing their future information technology architecture and shifting their implementation methods.”

The suggestion?

“Select high-value business functions and rebuild these using an API and microservice architecture approach. If you’re not able to rebuild, consider wrapping your existing technology with a digital platform as the base to create the agent experience across core transactions. Include agency management functions such as access to commission statements, production reports, marketing information, training and other capabilities to support an agent’s full set of needs.”

Many agencies are adapting as quickly as they can to digital needs, and they are making the kinds of changes that they need to make to provide digital service with a personal touch. But for them to truly grow and adapt, they need carrier partners that are willing to advance their own technology agendas in a manner that supports the agents in their efforts to touch customers and manage their businesses.

The report says: “Agents select their carrier of choice based on their alignment to key capabilities that support them in promptly selling business…. To compete and grow, insurers must enable future-ready distribution models that support multi-channel engagement; embrace platform technologies including cloud and APIs to support increased real-time integration; use advanced digital and data analytics to rethink distribution optimization; embrace ecosystems for access to data, distribution channels and digital capabilities from a growing array of partners; and implement digital experience platforms to build next-gen customer and distributor experiences.”

Is your organization ready to adapt and improve the agent and customer experience? Are you preparing for the next generation of agent-led customers who are both digitally savvy and interested in a deeper understanding of their insurance coverage?

For greater insight, check out Majesco’s webinar, Seismographic and Technology Shifts Reshape the Distributor-Carrier Relationship, and download Reshaping the Distributor Insurer Relationship: A Survey of Independent Insurance Agents.