--Infrastructure is not just a technical issue—it's a moral one. It determines who gets access to opportunity and who is left behind. --Esther Duflo, Nobel laureate, MIT economist

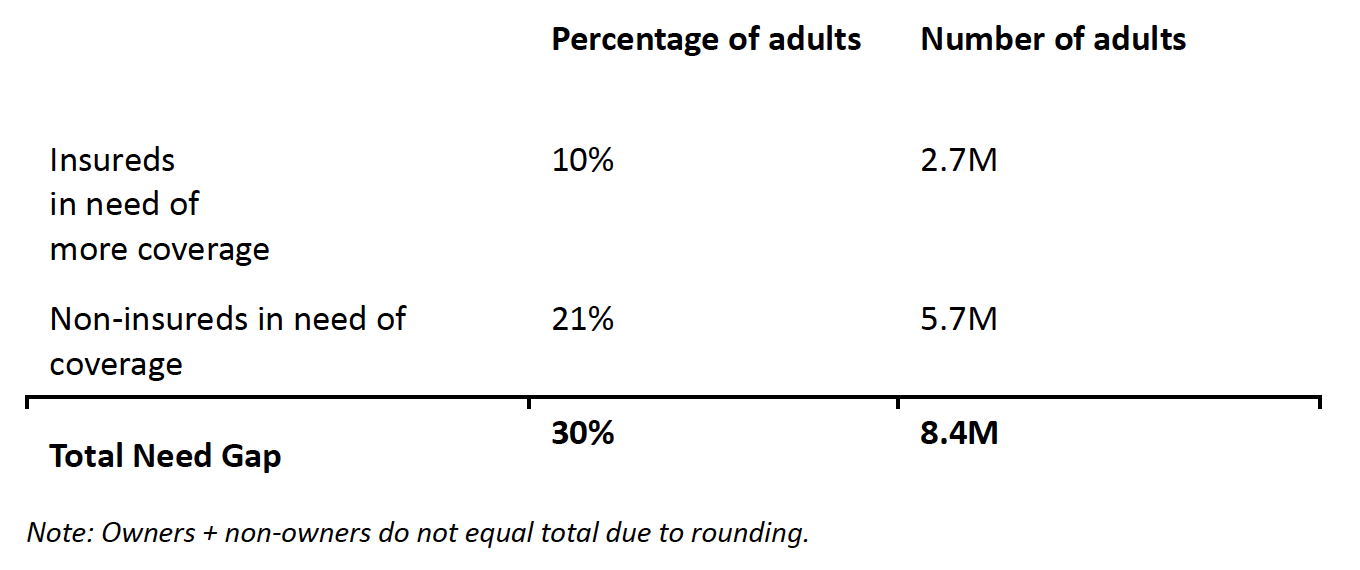

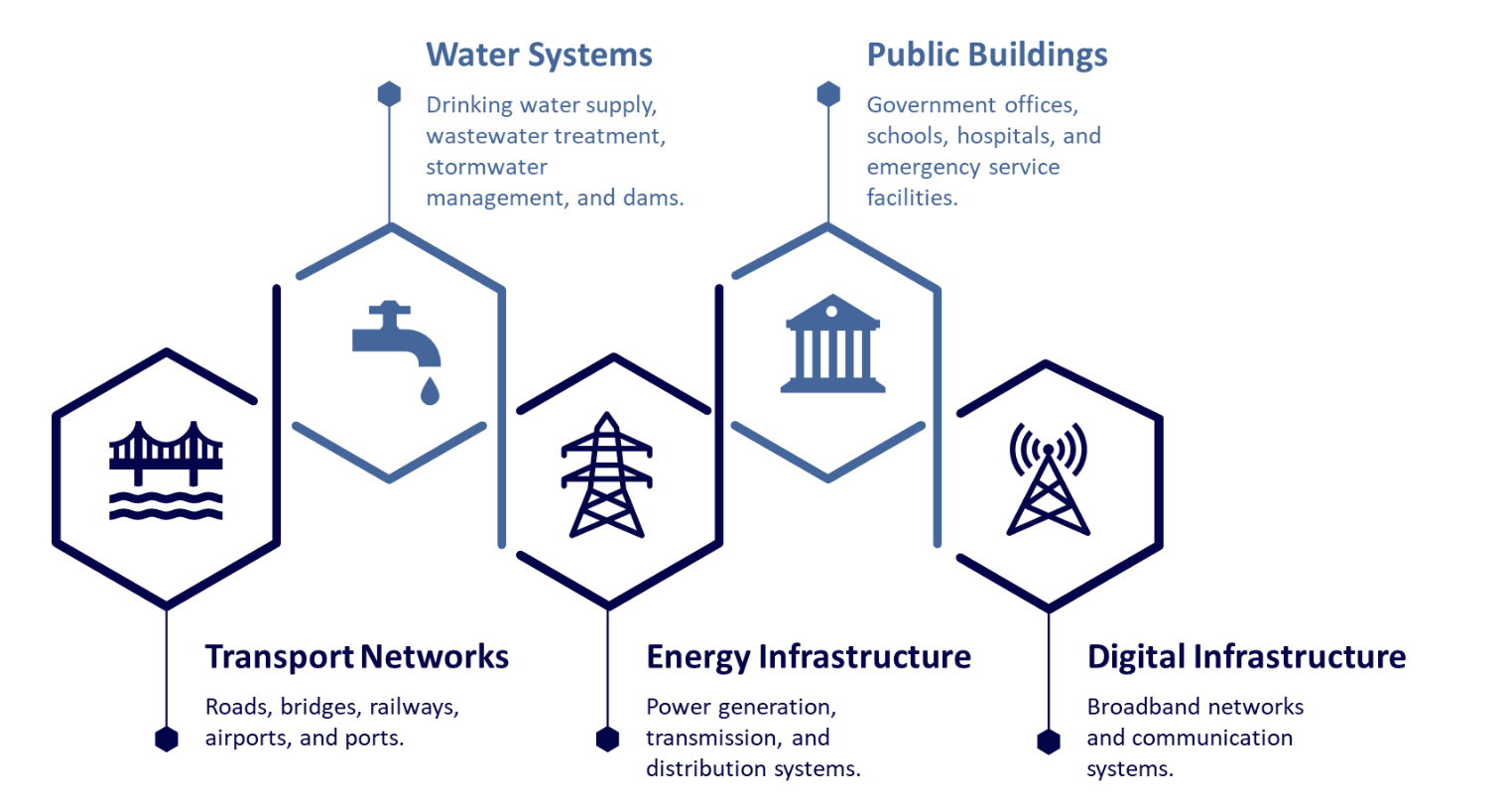

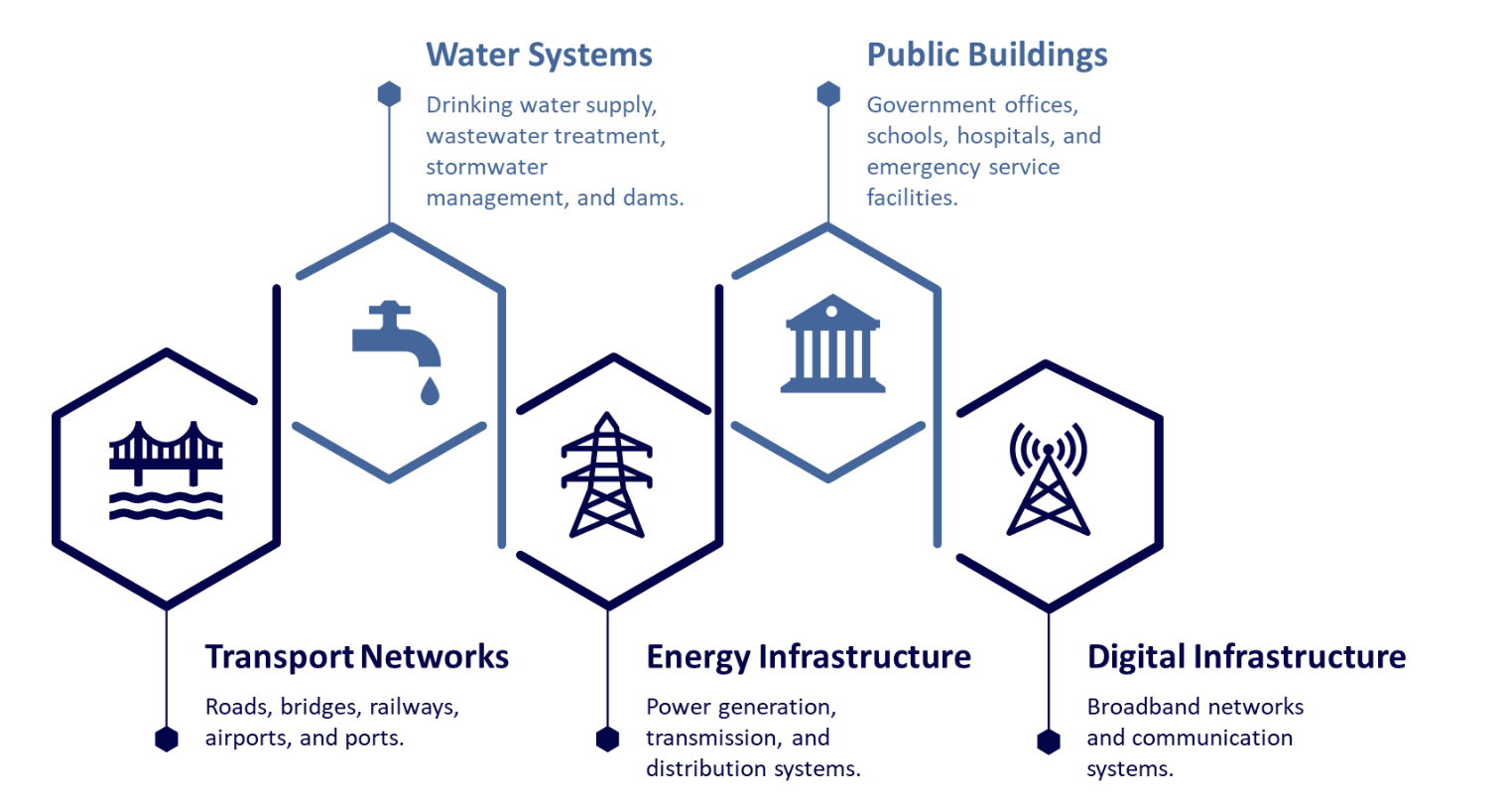

Public infrastructure encompasses a wide range of essential assets (see Figure 1)—including transport networks, water systems, energy infrastructure, public buildings, and digital infrastructure—that underpin the societal and economic functioning of any country.

Figure 1 Public Infrastructure Assets

In the developed world, every nation has experienced a phase of infrastructure boom—driven by post-war reconstruction, industrial expansion, and rapid urbanization—that transformed them from agrarian-based societies into industrialized economies. In many of these countries, a significant portion of the existing infrastructure was built or rebuilt during the post–World War II era, particularly between 1950 and 1970. As a result, these assets are now 50–70 years old. Designed with a finite lifespan of 40 to 100 years, much of this infrastructure is either approaching the end of its intended service life or has already exceeded it.

These assets were designed and constructed using the technological standards, materials, and construction methods available at the time, based on the then-current and projected trends in population growth, demand, usage patterns, capacity requirements, and weather conditions. However, evolving usage patterns, rising demand, rapid urbanization, and increasing exposure to adverse climate and weather conditions are placing significant stress on these assets, leading to deterioration in quality and increased fragility. Although deterioration is typically gradual, aging infrastructure becomes vulnerable to sudden failure when a critical tolerance threshold is breached or when exposed to high-intensity stressors such as extreme weather events. While digital infrastructure is relatively newer compared with other asset classes, it is still susceptible to cascading impacts resulting from failures in interconnected systems.

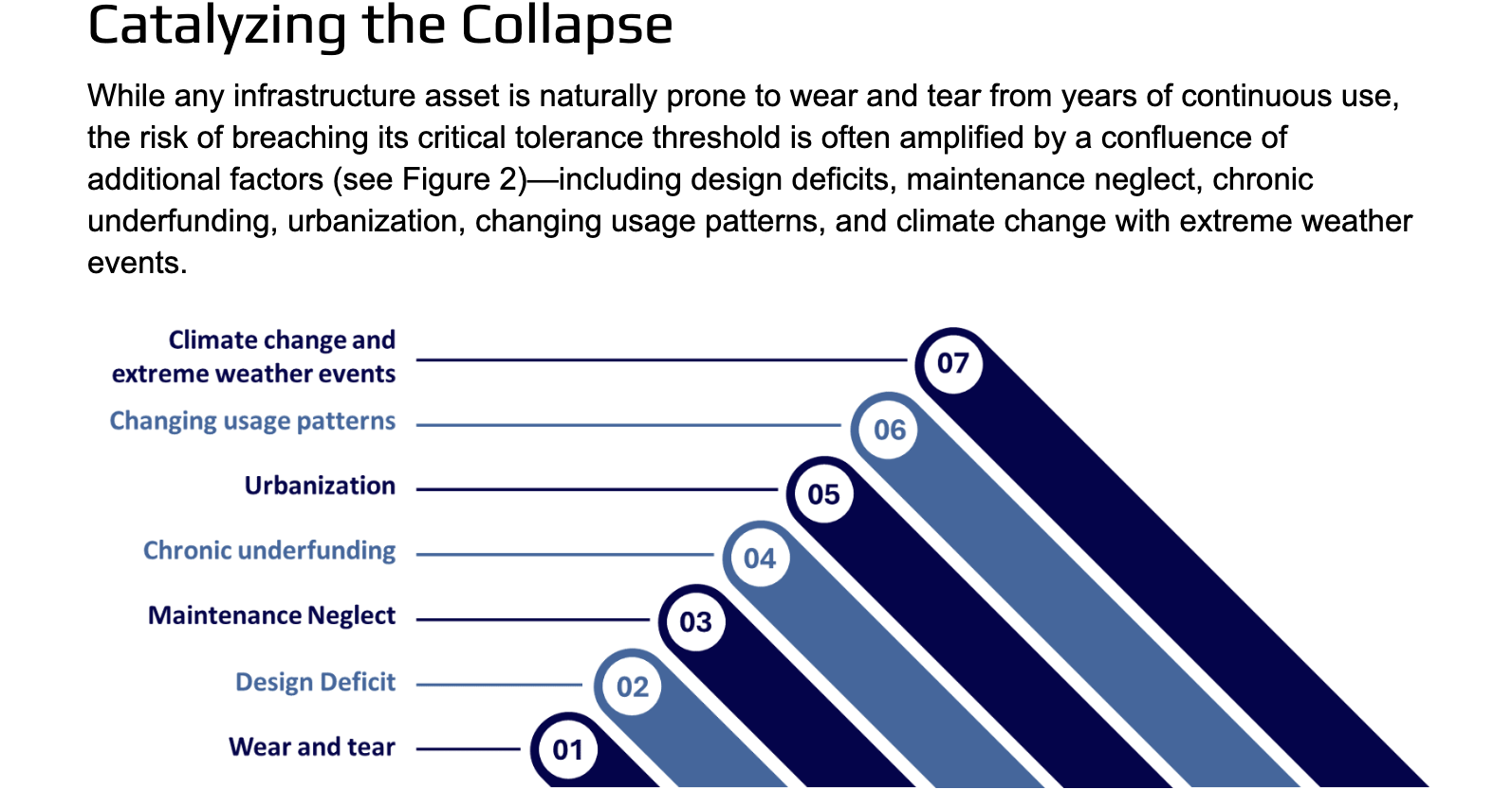

Catalyzing the Collapse

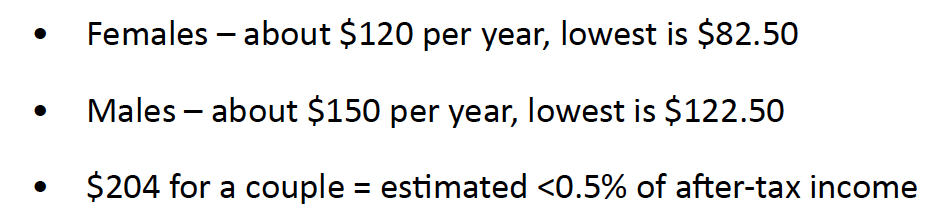

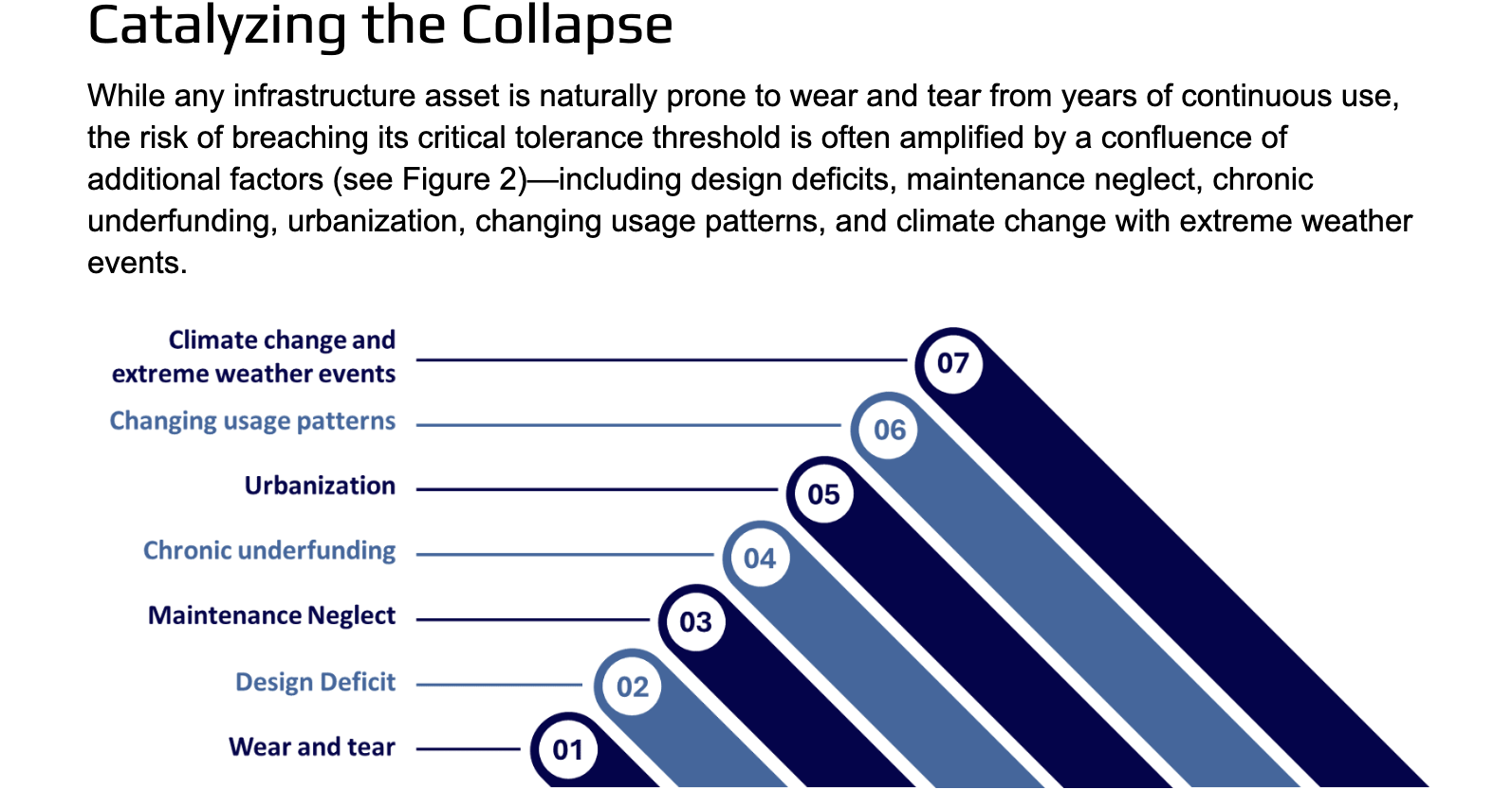

While any infrastructure asset is naturally prone to wear and tear from years of continuous use, the risk of breaching its critical tolerance threshold is often amplified by a confluence of additional factors (see Figure 2)—including design deficits, maintenance neglect, chronic underfunding, urbanization, changing usage patterns, and climate change with extreme weather events.

Figure 2 Factors Impacting Infrastructure Aging

Design Deficit

Infrastructure systems were originally designed to meet the conditions and demands of their respective eras. At the time of their conception and construction, many of today's developments—such as rapid urbanization, shifting usage patterns, and increasing climate volatility—could not have been reasonably anticipated. Consequently, these assets are now under strain from factors that far exceed their original design capacity. This has resulted in a "design life deficit," where even well-maintained legacy infrastructure is inherently vulnerable to contemporary challenges. Addressing this deficit requires more than routine maintenance; it necessitates fundamental redesigns, capacity upgrades, and substantial improvements in resilience.

Maintenance Neglect

Effective infrastructure maintenance—including protective, preventive, corrective, and rehabilitative measures—minimize service disruptions, improve operational efficiency, extend asset lifespan, reduce long-term costs, and enhance safety and reliability. Conversely, the absence of regular maintenance, particularly deferred maintenance, accelerates asset deterioration. Deferred maintenance refers to the postponement of necessary upkeep until an asset fails or a major issue disrupts normal operations. While routine maintenance may not fully resolve challenges arising from evolving demands and usage patterns, well-maintained infrastructure is significantly less prone to major failures and more resilient to otherwise manageable events. Without consistent maintenance, overlooked or neglected issues can escalate into major problems, making the cost of repair or modernization far exceed that of timely intervention.

Chronic Underfunding

The simultaneously deteriorating infrastructure assets impose compounding maintenance costs, yet budgetary allocations often fail to keep pace with the growing need for upkeep and structural rehabilitation. A key reason for this funding gap is a strategic shift from a "maintain and repair" approach to one focused on "redesign and rebuild." This shift is frequently influenced by political considerations, as governments tend to prioritize greenfield projects that offer greater visibility and political mileage. In contrast, maintenance of existing infrastructure—though critical—typically yields lower political returns. Infrastructure budget allocations are also closely tied to a country's prevailing economic and geopolitical conditions. Nations facing prolonged economic crises or heightened geopolitical tensions often reduce capital expenditure, affecting both the maintenance of existing infrastructure and investment in new projects. These reductions contribute to substantial backlogs, rendering existing funding mechanisms inadequate and unsustainable.

Urbanization

In the developed world, industrialization triggered mechanization, infrastructure expansion, the rise of factory-based employment, and a shift in economic focus from agriculture to manufacturing and services. These transformations led to significant improvements in living standards and accelerated urbanization—defined as the migration of populations from rural areas to urban centers in pursuit of industrial employment. The resulting increase in population density places immense, and often unforeseen, stress on infrastructure systems that were never designed to accommodate today's high-volume demands. Many legacy assets are already under severe strain. However, upgrading or retrofitting these assets presents a complex challenge, particularly in densely populated urban areas. Consequently, infrastructure management is frequently deferred until a disruption forces reactive intervention.

Changing usage patterns and demands

While rising population and urbanization have increased usage loads on infrastructure, the advent of new technologies has introduced both enhanced capabilities and new demands. These developments place considerable stress on legacy systems that were never designed to accommodate such requirements. On a positive note, emerging technologies, advanced materials, and modern construction techniques offer significant potential to improve resilience, durability, structural integrity, and the service life of infrastructure assets. To illustrate the broader context, some indicative changes that have affected infrastructure systems are outlined below.

• Roads and Bridges: Many bridges and roads were designed decades ago for traffic volumes, vehicle weights, and travel speeds that no longer reflect current usage. Over the past five decades, the number of personal motor vehicles and commercial trucks—as well as the speeds at which they travel and the loads they carry—has increased dramatically. With millions of trips made daily on aging and structurally deficient transport networks, these systems are under excessive and sustained stress.

• Dams: Many dams were constructed using engineering standards that were appropriate at the time but are now outdated and no longer compliant with modern safety and design codes. Critically, most of these dams were not designed to withstand the frequency and intensity of extreme weather events observed in recent years. Additionally, rising demand for hydropower imposes fluctuating operational loads on aging structures, further compromising their structural integrity.

• Water Infrastructure: Urban water systems were originally designed to support residential use, but many now serve mixed-use zones that include both residential and commercial areas with vastly different consumption patterns. Legacy pipelines—often made of iron or steel—are prone to corrosion. While modern systems incorporate corrosion-resistant materials, digital leak detection, and smart metering technologies, retrofitting older infrastructure is highly complex. Much of it is buried deep underground, making replacement both difficult and costly. Similarly, legacy stormwater systems were designed for predictable rainfall and lower levels of impermeable surfaces. However, changing weather patterns and increased urban impermeability now frequently overwhelm drainage systems, leading to flooding and system failures.

• Power Generation, Transmission, and Distribution: Many power plants, substations, and transmission lines were constructed decades ago and are not equipped to handle today's elevated demand levels or the increasing frequency of extreme weather events. These systems were not originally designed with the foresight of modern electrical loads, such as widespread electric vehicle (EV) charging infrastructure, energy-intensive data center operations, and cryptocurrency mining.

• Railway Assets: Many railway corridors operate beyond their designed capacity and at full usage, leading to severe congestion on tracks and at stations. Overloaded infrastructure also reduces the time available for routine safety inspections and maintenance, increasing the risk of accidents such as derailments and collisions. Rising freight and passenger volumes accelerate track wear, shorten asset lifespans, and drive-up maintenance costs.

• Ports: The surge in global trade and the advent of mega-ships have pushed many aging ports beyond their original design capacity. Modern container vessels are more than 15 times larger than those available 50 years ago. Accommodating these vessels requires deeper channels, larger cranes, reinforced berths, and expanded yard space—features that many older ports lack. Additionally, limited rail and road connectivity to ports further compounds bottlenecks, affecting supply chain reliability.

Climate change and extreme weather events

Climate change is not just another risk factor but a powerful force multiplier that amplifies the impact of all other risks and can directly trigger the collapse of infrastructure assets. Most aging infrastructure was designed based on historical climate data and weather patterns. The benchmark parameters considered in infrastructure designs such as temperature, storm frequency, and precipitation levels—are now outdated and no longer reflect current climate realities.

Climate change introduces new stressors—such as rising sea levels, increased temperatures, and more frequent and intense storms—all of which accelerate infrastructure failure. The frequent occurrence of previously rare extreme weather events—such as flash floods from atmospheric rivers, cloudbursts, rapid cyclone intensification, heat domes, and megafires/firestorms—places immense stress on aging infrastructure. While retrofitting infrastructure for climate resilience is essential, it requires substantial funding. Moreover, implementing upgrades without disrupting daily operations poses significant engineering and logistical challenges. An indicative list of climate change and extreme weather impacts on infrastructure is provided below.

• Extreme Heat and Rising Temperatures: Rising temperatures and heatwaves can significantly affect infrastructure performance and integrity. Asphalt on roads may soften, leading to buckling and rutting. Steel components in bridges expand under heat, potentially causing structural stress and misalignment. Thermal expansion can crack concrete and damage expansion joints, which are critical for structural integrity. Extreme temperature variability causes repeated expansion and contraction of metal structures, accelerating material fatigue and joint failure in railway tracks. Heatwaves also strain power infrastructure, causing transmission lines to swell and sag, which reduces efficiency and increases the risk of outages.

• Increased Precipitation and Flooding: Extreme weather events—such as 100-year floods, once considered rare, are now occurring with increasing frequency due to climate change. Heavy rainfall and flooding can damage road surfaces, wash out foundations, accelerate erosion, and lead to complete road closures. Sewage and stormwater systems are frequently overwhelmed, resulting in untreated sewage discharge and damage to water treatment facilities. Dams face heightened risks as increased reservoir inflows and shifting hydrological patterns raise the likelihood of overtopping and structural failure, potentially causing catastrophic downstream flooding.

• Increased Storm Intensity: Frequent and intense storms pose serious risks to infrastructure. High-wind events can cause structural damage, scatter debris, and lead to road closures. Storm surges and wind-driven debris threaten the integrity of dams, particularly older ones not designed to withstand such pressures. Drinking water and wastewater systems are vulnerable to physical damage and service disruptions caused by flooding and debris impact. Power transmission lines are susceptible to wind damage, while substations may be inundated, resulting in prolonged outages and grid instability.

• Sea Level Rise and Coastal Flooding: Rising sea levels significantly affect port infrastructure and coastal assets. Many ports will require elevation of existing structures or the construction of higher seawalls to remain operational. Container yards, warehouses, and terminal buildings face increased flooding risks, while even modest rises in base water levels can cause groundwater intrusion—resulting in foundation instability, basement flooding, and damage to underground utilities and electrical systems.

Managing the Risk

The growing crisis of aging infrastructure is a complex interplay of functional obsolescence, governance deficits, fiscal short-sightedness, evolving usage demands, and the intensifying stressors of climate change. The most straightforward solution to manage the risk is to proactively repair, replace, or retrofit aging assets. However, the scale of funding required, and the operational challenges involved make this a formidable task.

As a primary risk bearer, the re/insurance industry has both a vested interest and a unique capability in recognizing, assessing, and mitigating these complex and evolving risks. Insuring infrastructure assets is not new for insurers, and aging infrastructure represents a low-predictability, high-magnitude risk. While low-impact scenarios may lead to service interruptions, high-impact failures can cause personal injury, loss of life, significant property damage, and substantial disruptions. Catastrophic events—such as dam or bridge collapses or power grid failures—can affect the risk experience across multiple lines of business, including life, health, motor, property, casualty, business interruption, and liability, triggering multi-billion-dollar claims that may even threaten the solvency of insurers.

However, the challenge for insurers now is to assess the worsening nature of risk due to the interplay of several stress factors. Traditional risk models are increasingly challenged and upended by the unprecedented, dynamic, and unpredictable nature of climate change and its compounding impacts across the risk landscape. Moreover, infrastructure deterioration does not follow a linear or uniform timeline across different asset types. Each class of infrastructure experiences non-linear degradation, with deterioration rates varying based on asset type, usage intensity, maintenance history, and environmental exposure. The concurrent aging of these assets elevates overall risk.

Furthermore, infrastructure systems are highly connected and interdependent. Failures rarely remain isolated; a disruption in one system can trigger cascading effects across others. Given this predicament, all responsible stakeholders must adopt a system-of-systems perspective instead of focusing on isolated sectoral issues. Effective use of current-age technologies could tremendously transform how infrastructure is managed by shifting maintenance from reactive fixes to data-driven prevention.

Deploying a network of IoT sensors can continuously monitor stress, vibration, temperature, and corrosion, enabling early detection of structural issues. artificial intelligence and predictive maintenance models can analyze historical and real-time data to forecast potential failures, allowing for timely interventions before breakdowns occur. digital twins can create virtual replicas of infrastructure assets to simulate wear and tear, test scenarios, and optimize maintenance schedules. Drones and robots can inspect hard-to-reach areas, capturing high-resolution images and thermal data to identify cracks, rust, or material fatigue. Geospatial and satellite imaging can detect land shifts, water seepage, or vegetation changes around infrastructure, indicating potential foundational issues. Using cloud-based asset management platforms and big data to aggregate information from multiple sources helps stakeholders collaborate, access real-time data, and make informed decisions on prioritizing which assets need urgent attention based on risk and usage.

As more assets approach the critical point of breaching their failure thresholds, the threats posed by aging infrastructure become increasingly probable and imminent. Insurers must adapt by leveraging technology and real-time data to revise their risk models, underwriting procedures, pricing strategies, and capital reserves to ensure continued resilience. Nevertheless, this recalibration will be a challenging task, as it requires insurers to anticipate the effects of extreme climate and weather events on all types of assets, consider how a single failure may create a domino effect or reverberate across interconnected systems, and measure the complex web of risks that may emerge.

Conclusion

Aging infrastructure is central not only to public safety and economic prosperity but also to the resilience and insurability of modern society. Many of these assets have supported communities for decades and are so deeply woven into daily life that their presence often goes unnoticed—until a failure occurs. Upgrading or retrofitting them is particularly challenging in crowded urban environments, where such projects demand significant funding, may require displacing residents, and present complex engineering obstacles.

Addressing these challenges demands cross-sector partnerships that bring together governments, private-sector asset owners, re/insurance companies, and the public to mobilize resources, align incentives, share risk, and commit to robust investment and transparent maintenance. Only through this collective approach can we hope to modernize the vital infrastructure for a safer, more reliable, and insurable future.

Reference

American Society of Civil Engineers. (2025). A Comprehensive Assessment of America's Infrastructure. https://infrastructurereportcard.org/wp-content/uploads/2025/03/Full-Report-2025-Natl-IRC-WEB.pdf

Homeland Security. (2010). Aging Infrastructure: Issues, Research, and Technology. https://www.dhs.gov/xlibrary/assets/st-aging-infrastructure-issues-research-technology.pdf

Little, R., & Fellow, S. (2012). Managing the Risk of Aging Infrastructure. https://irgc.org/wp-content/uploads/2018/09/R.-Little_Risk-of-Aging-Infrastructure_revision-Nov2012.pdf

Willis Towers Watson. (2020). Ageing Infrastructure - More than a bump in the road. https://www.wtwco.com/-/media/wtw/insights/2020/02/ageing-infrastructure-jan-2020.pdf