Will Chatbots Take Over Contact Centers?

Chatbots provide obvious benefits to any company with a call center. But how do consumers feel about this rapid change in customer service?

Chatbots provide obvious benefits to any company with a call center. But how do consumers feel about this rapid change in customer service?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Nicholas Piël is the founder and CEO of Surfly, a leading visual engagement tool for sharing web sessions online. With Surfly co-browsing, support agents and advisers can remotely assist website visitors without the need to download additional software.

Insurers must recognize these challenges and address them head on to start taking advantage of the new technologies.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Thiru Sivasubramanian is the VP of architecture and technology strategy at SE2. Prior to SE2, he held technology leadership roles at Salesforce.com, Tata Consultancy Services and Torry Harris Business Solutions.

Technologies such as connected health, homes and autonomous vehicles force insurers to re-invent offerings at an unprecedented pace.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Kannan Amaresh has spent nearly 18 years at Infosys, initially as the head of consulting for Infosys’ BFSI division, followed by his current role as the global industry head for insurance, where he manages global client relationships across Europe and North America.

The concept of a minimally viable product (MVP) has helped many companies, but some caution is in order.

Out here in Northern California, the hot debate over the past few days has been a luxury: whether the NBA Finals MVP should have been the spectacular Kevin Durant or the spectacular Steph Curry. (I'm Team Steph but have no problem with Team KD—or even with those who say Golden State Warriors fans are hopelessly spoiled after three titles in four years and should just stop talking.) But there's a conversation to be had about a more consequential MVP, and Dan Bricklin is just the guy to introduce it.

In this case, MVP stands for Minimum Viable Product. The concept has been the rage in innovation circles for a few years now, helping companies see the need to push a product into the market quickly, even though not fully baked, to gauge how real customers react in real situations and to adapt quickly. Historically, many companies have finetuned products so much that they have been late to market, only to find that what they're offering doesn't really match what customers want.

Now that MVPs have been in vogue for a while, Dan pointed me to some thoughts from a colleague on how to improve on them. Dan is always right on such issues. He invented the electronic spreadsheet back in the '70s as a Harvard Business School student bored of having to constantly recalculate so many cells in a paper spreadsheet every time a variable changed, and I've seen him be smart on a whole range of subject over the 30-plus years I've known him.

The finetuning, suggested by Dan's colleague Jensen Harris, consists of four points:

If you want to see the full set of Jensen's thoughts, click here: https://twitter.com/jensenharris/status/1001662472305106944.

Have a great week.

Paul B. Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

The combination of professional administration with an annuity is often the best way to protect an injured party’s settlement dollars.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Porter Leslie is the president of Ametros. He directs the growth of Ametros and works with its many partners and clients.

Expectations for a more business-friendly environment have yet to materialize, but there are signs that change may be coming.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Amanda Czepiel, J.D., is the senior managing editor of BLR’s EHS division. She oversees the workplace safety and environmental compliance content for BLR’s products, news, training and live events and works with clients to develop custom compliance solutions.

Few financial advisers address clients’ P&C needs—leaving clients exposed to significant gaps in coverage and out-of-pocket costs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Ori Ben-Yishai is executive vice president and chief marketing officer, North America personal risk services, at Chubb. He oversees marketing and client experience for the personal lines property and casualty business that serves affluent and successful clients in the U.S. and Canada.

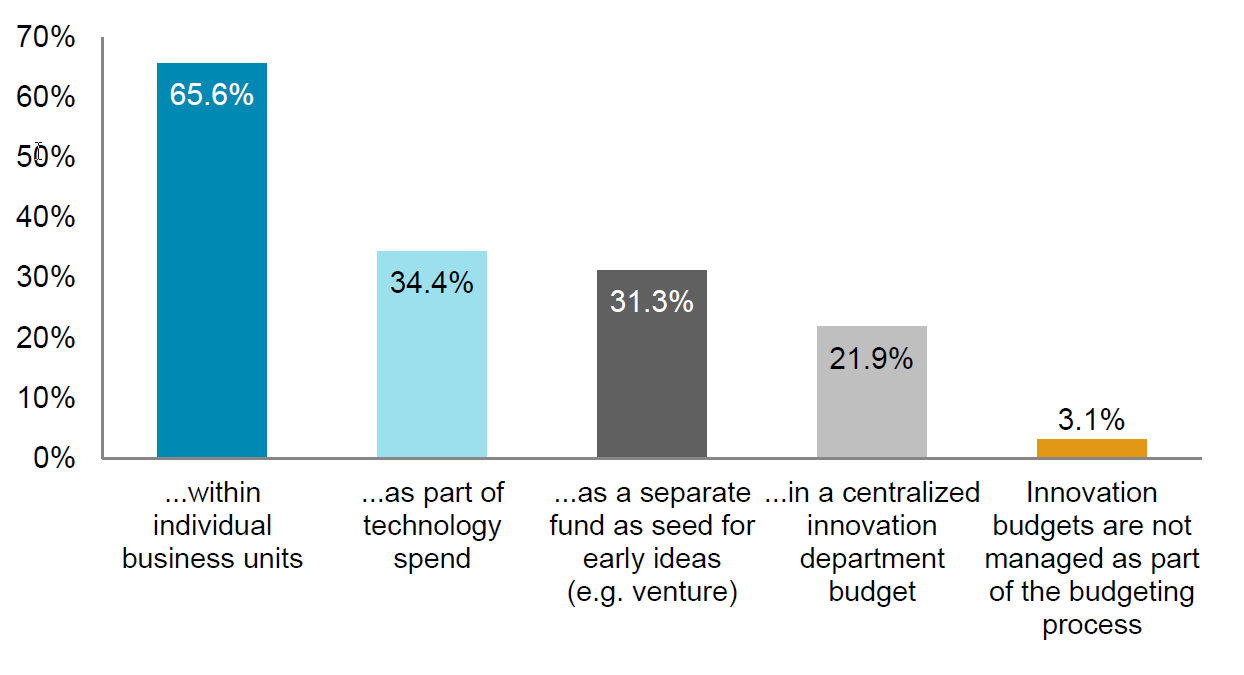

Are we ready to talk real traction in volume and customer value from innovation that goes beyond just a great concept?

Graph: Please indicate if you are utilizing any of the following innovation tools/techniques at your company (choose all that apply).

Source: Celent – Insurance Innovation Outlook 2018: Practitioners Predictions, n=29 chief innovation officers, innovation leads, digital leads).

Of course, central teams still play an important role. Often, they are the only places where more radical forms of innovation can be experimented with (helping to insulate them from the day-to-day pressures of running an existing business).

However, when considered altogether, the gradual shifts away from what can sometimes feel like an opportunistic mode of engagement (characterized by serial “proof of concept” projects, often sponsored by central teams), toward something more locally aligned, deliberate and focused on real customer value feels like a step forward.

See also: 3 Ways to Leverage Digital Innovation

Are we now at the point where innovation is truly back with the business and we’re ready to talk real traction in volume and customer value that goes beyond just a great concept? I can’t wait to see!

This article was originally published here.

Graph: Please indicate if you are utilizing any of the following innovation tools/techniques at your company (choose all that apply).

Source: Celent – Insurance Innovation Outlook 2018: Practitioners Predictions, n=29 chief innovation officers, innovation leads, digital leads).

Of course, central teams still play an important role. Often, they are the only places where more radical forms of innovation can be experimented with (helping to insulate them from the day-to-day pressures of running an existing business).

However, when considered altogether, the gradual shifts away from what can sometimes feel like an opportunistic mode of engagement (characterized by serial “proof of concept” projects, often sponsored by central teams), toward something more locally aligned, deliberate and focused on real customer value feels like a step forward.

See also: 3 Ways to Leverage Digital Innovation

Are we now at the point where innovation is truly back with the business and we’re ready to talk real traction in volume and customer value that goes beyond just a great concept? I can’t wait to see!

This article was originally published here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Cloud is set to be used in a whole new way by streamlining processes, connecting to advanced technology and consuming more data.

To learn more about the latest computing trends and how they will affect insurers’ core systems, please see our recent report, The New World of Core Systems: How New Computing Trends Will Transform the Core Systems Paradigm.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karen Furtado, a partner at SMA, is a recognized industry expert in the core systems space. Given her exceptional knowledge of policy administration, rating, billing and claims, insurers seek her unparalleled knowledge in mapping solutions to business requirements and IT needs.

Insurers are limited by legacy systems that track only certain types of customer data — and can’t crunch available data efficiently.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tom Hammond is the chief strategy officer at Confie. He was previously the president of U.S. operations at Bolt Solutions.