Health: 3 Ways to Win Over Millennials

Health insurers need to win millennial small business owners through an emphasis on cost, transparency and digital experiences.

Health insurers need to win millennial small business owners through an emphasis on cost, transparency and digital experiences.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sally Poblete has been a leader and innovator in the health care industry for over 20 years. She founded Wellthie in 2013 out of a deep passion for making health insurance more simple and approachable for consumers. She had a successful career leading product development at Anthem, one of the nation’s largest health insurance companies.

Insurers used to define microinsurance policies as social responsibility projects. With insurtech, the picture is changing rapidly!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Zeynep Stefan is a post-graduate student in Munich studying financial deepening and mentoring startup companies in insurtech, while writing for insurance publications in Turkey.

Mary Meeker laid out her annual report on the state of the internet and e-commerce last week, and I waded through the full 294 slides so you don't have to. (The full report is here—http://www.kpcb.com/internet-trends—for those who want all the detail.) The report by Meeker, a partner at venture capital firm Kleiner Perkins, has become the bible for internet followers and, as usual, contained some surprises.

To me, the most startling number was that sessions on mobile shopping apps surged 54% last year (use of mobile apps overall rose just 6%). The 54% covers all types of products, many of which are easier to buy on a mobile phone than insurance is, but, still: The time for a robust mobile strategy was yesterday (minus about a year and a half).

It was also striking to see that 6% of all online product purchases began with something that someone saw in a social media feed. The figure represents all product sales online, so the applicability to insurance needs to be sorted out, but the 6% is triple the percentage from just two years earlier, suggesting that there is upside for those promoted product placements.

As always, the report showed a continued surge in online commerce—up 16% in 2017, even faster growth than the 14% increase in 2016. The online share of the value of total consumer purchases in the U.S. reached 28%, up from 20% in 2013. When people were asked how they conducted their 10 most recent transactions, 60% occurred digitally.

The social and mobile trends, on top of the general growth of online commerce, suggest to Meeker that companies will increasingly sell directly to consumers—but that companies must target their efforts well. She reports that many of the best mobile apps, for instance, used video and "gamification" and that successful offers were increasingly personalized.

Amazon may, though, soak up much of the increase in e-commerce: Already, 49% of product searches in the U.S. begin at Amazon, and most of the searchers never leave the site.

Although Meeker didn't specifically address insurance, some observations in the report suggest both opportunities and challenges for the industry.

On the plus side, she said the world is moving more toward subscription models, rather than sales of individual products—and subscriptions sound a lot like automatically renewable insurance policies. The number of gig workers available to help inexpensively with, say, parts of the claims process—a la those employed by our friends at WeGoLook—reached 5.4 million in the U.S. last year, up from 3.9 million in 2016. The cost of cloud computing fell 11% last year, on top of the 10% drop the year earlier.

On the challenges side, profits are increasingly being competed away. The price for an offline good fell 1% since the start of 2016, and the cost of an identical good online declined 3% over the same period. In addition, some insurance costs were negative outliers in her general economic analysis. While prices have been falling for almost every category of household expenditure in the U.S. for decades, the percentage of household income devoted to pensions and insurance climbed from 7% in 1972 to 8% in 1990 and now to 10% in 2017. The percentage devoted to health insurance went from 5% in 1972 to 5% in 1990 and now to 7%.

Either we take advantage of the opportunities presented by digitization and meet the challenges, or ... perhaps Amazon or some other tech giant will.

Have a great week.

Paul Carroll

Editor-in-Chief

P.S. As advertised last week, we finalized the agreement between our Innovator's Edge information platform and SAP. Here is the announcement: http://insurancethoughtleadership.com/press_release/ie-sap-partner/

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

All honest and competent vendors of wellness programs need to incorporate this pledge into their operations and contractual obligations.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Al Lewis, widely credited with having invented disease management, is co-founder and CEO of Quizzify, the leading employee health literacy vendor. He was founding president of the Care Continuum Alliance and is president of the Disease Management Purchasing Consortium.

We were promised protection from litigation and ended up with a system that facilitates it instead. Three changes are needed.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Gregory Moore is the former chief commercial officer of CLARA Analytics, a division of LeanTaaS and a leading predictive analytics company for workers’ compensation.

Prior to joining CLARA Analytics, Moore founded Harbor Health Systems, which he led for 16 years.

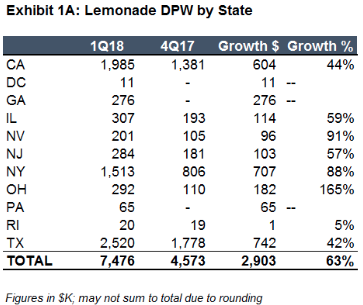

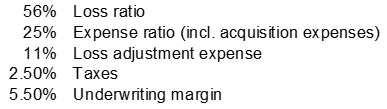

A detailed look at Lemonade, Root and Metromile shows both the promise and the short-term challenges for insurtech startups.

Reinsurers continue to subsidize the company’s losses: Reinsurers incurred $3.53 for every $1 in premium they received in the most recent quarter. The aggregate XOL reinsurance contract normally runs another two years (through 6/30/2020), illustrating why reinsurers that back startups also consider having equity participation.

See also: Touching Customers in the Insurtech Era

A homeowner’s company would typically aim for numbers something like the following (which are from a leading homeowner’s insurer), plus or minus a few points:

Reinsurers continue to subsidize the company’s losses: Reinsurers incurred $3.53 for every $1 in premium they received in the most recent quarter. The aggregate XOL reinsurance contract normally runs another two years (through 6/30/2020), illustrating why reinsurers that back startups also consider having equity participation.

See also: Touching Customers in the Insurtech Era

A homeowner’s company would typically aim for numbers something like the following (which are from a leading homeowner’s insurer), plus or minus a few points:

Compare with Lemonade’s numbers:

Compare with Lemonade’s numbers:

The Giveback

Lemonade’s giveback is one of the company’s most intriguing features. Customers join cohorts, and, if any premium remains after paying the cohort’s claims, fees and reinsurance, that money goes to a designated charity. Lemonade says that this “giveback” was 10% of “revenues Lemonade recognized” from its launch in 2016 until mid-2017. Another is coming in mid-2018.

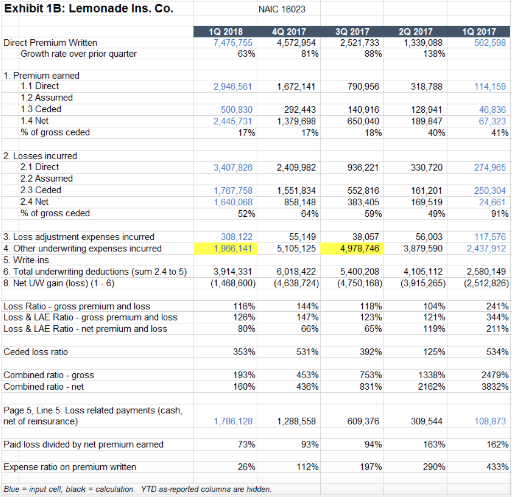

Lemonade has hinted at “an exponentially larger giveback in years to come.” We’re not so sure. There are two big headwinds. First, Lemonade raised the fee paid from its cohorts to the parent company from 20% to 25%, effective 1/1/2018. Such arrangements are common in the insurance industry and are approved by regulators, but not always gladly. Sometimes profit is moved to an affiliated agency that doesn’t have to pay claims, while losses remain in the regulated insurer.

The second headwind against the giveback is that Lemonade’s cohorts have to pay for reinsurance, the cost of which is almost certain to rise in 2020 if the company continues ceding several times more losses than premiums. The giveback will probably remain – someone’s cohort will have very low losses – but the combined effects of a bigger fee to the parent and more expensive reinsurance could greatly reduce the giveback “in years to come.”

This matters because the giveback is the crux of Lemonade’s business model for both its investors and customers. As CEO Daniel Schreiber has explained:

The Giveback

Lemonade’s giveback is one of the company’s most intriguing features. Customers join cohorts, and, if any premium remains after paying the cohort’s claims, fees and reinsurance, that money goes to a designated charity. Lemonade says that this “giveback” was 10% of “revenues Lemonade recognized” from its launch in 2016 until mid-2017. Another is coming in mid-2018.

Lemonade has hinted at “an exponentially larger giveback in years to come.” We’re not so sure. There are two big headwinds. First, Lemonade raised the fee paid from its cohorts to the parent company from 20% to 25%, effective 1/1/2018. Such arrangements are common in the insurance industry and are approved by regulators, but not always gladly. Sometimes profit is moved to an affiliated agency that doesn’t have to pay claims, while losses remain in the regulated insurer.

The second headwind against the giveback is that Lemonade’s cohorts have to pay for reinsurance, the cost of which is almost certain to rise in 2020 if the company continues ceding several times more losses than premiums. The giveback will probably remain – someone’s cohort will have very low losses – but the combined effects of a bigger fee to the parent and more expensive reinsurance could greatly reduce the giveback “in years to come.”

This matters because the giveback is the crux of Lemonade’s business model for both its investors and customers. As CEO Daniel Schreiber has explained:

“If there is underwriting profit it is donated to non-profit - if it isn't and there are insufficient funds the reinsurers have a bad day, not Lemonade. "The 20% is insulated - we take 20% in good years and in bad and that is not really impacted by loss ratios - so we are indifferent to the level of claims.”Set aside the line about being “indifferent to the level of claims.” The 20% is not insulated – it has already gone up – and reinsurers usually seek “payback” if they have a bad day. Payback means higher reinsurance fees such that, over time, reinsurers make at least a modest profit margin. That means a bad day may be coming for Lemonade, though perhaps not until late 2020. What would happen to the company’s vaunted social mission and behavioral incentives if the economics stop adding up? Lemonade has the cash to weather a lot of bad days and maybe even a pivot or two. The company confirmed its shareholding structure in the first quarter, and the figures support (but do not precisely confirm) the rumored $600 million valuation when Softbank and other investors put in $120 million.

In the past weeks, Lemonade’s Policy 2.0 initiative has generated a relevant debate and raised challenges to regulators, who will have to examine the policy and deal with claims disputes. Ambiguity in an insurance contract typically is interpreted against the insurer, which could make it that much harder to get the loss ratio down. Lemonade remains a challenging company for regulators, and traditional agents are lining up to kill any regulatory flexibility given to insurtechs.

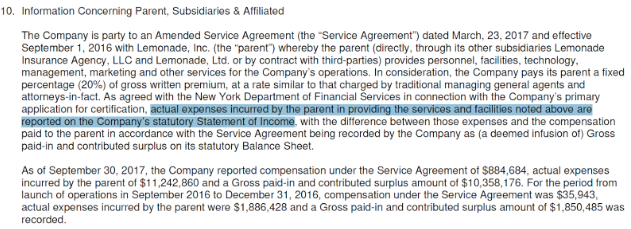

Lastly, we comment on a quiet but meaningful accounting change. The 20% fee paid by Lemonade Insurance Co. (now 25%) was far less than the actual cost of the services received. Lemonade Insurance Co. used to report consolidated figures that gave a true representation of the cost of running its operation. No longer. Effective in 2018, the consolidation is gone, and perhaps $3 million of expenses seem to be missing in 1Q18 – highlighted in yellow above. In terms of disclosure, throughout 2017, Lemonade used the language shown below. The highlighted language is the key bit that is missing in 2018.

In the past weeks, Lemonade’s Policy 2.0 initiative has generated a relevant debate and raised challenges to regulators, who will have to examine the policy and deal with claims disputes. Ambiguity in an insurance contract typically is interpreted against the insurer, which could make it that much harder to get the loss ratio down. Lemonade remains a challenging company for regulators, and traditional agents are lining up to kill any regulatory flexibility given to insurtechs.

Lastly, we comment on a quiet but meaningful accounting change. The 20% fee paid by Lemonade Insurance Co. (now 25%) was far less than the actual cost of the services received. Lemonade Insurance Co. used to report consolidated figures that gave a true representation of the cost of running its operation. No longer. Effective in 2018, the consolidation is gone, and perhaps $3 million of expenses seem to be missing in 1Q18 – highlighted in yellow above. In terms of disclosure, throughout 2017, Lemonade used the language shown below. The highlighted language is the key bit that is missing in 2018.

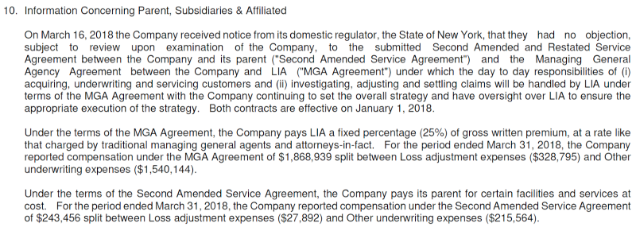

Now in 2018:

Now in 2018:

Transparency….

Root Insurance Co.

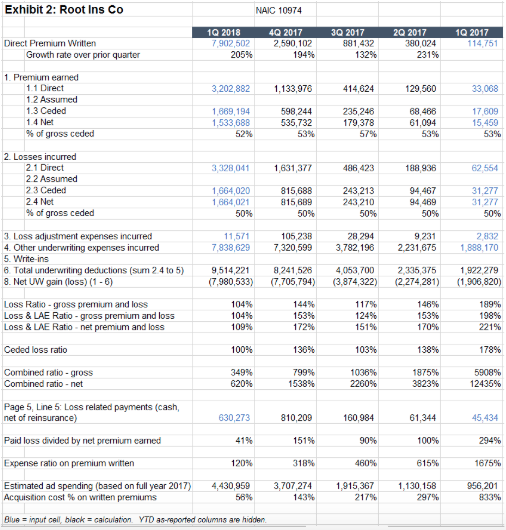

Root has grown explosively, with gross premiums written having trebled since 4Q17, for a run rate exceeding $30 million. $2.9 million of $7.9 million of gross premiums written were in Texas, with Ohio and Arizona also chipping in more than $1 million each. Potentially most impressive is that Root apparently has achieved its growth without massive advertising spending. If ad spending as a percent of total expenses remained constant this quarter compared with last year (a big “if,” because overall expense are rising rapidly), then Root has greatly cut its ad spending as a percent of the premium. See the bottom line of Exhibit 2.

As with Metromile and Lemonade, Root’s loss ratio remains unsustainably high, but the company’s $51 million fundraising round in June gives it a few years of runway to make improvements. Following our previous article, the CEO of Root commented that his company’s loss ratio was high in part due to prudent reserving. Indeed, Root was the only of the three startup insurers to report favorable development in the quarter, to the tune of $239,000 of gross positive development, which would cut almost 10 points off the 2017 gross loss ratio. (In reality, Root cut about seven points from the 1Q18 loss ratio, because prior year results aren’t restated when reserves develop.) There could continue to be favorable development, but so far the 2017 loss ratio would be cut from 138% to 128% -- still well above a sustainable level. Further, the company in 2017 paid $1.36 of losses for every $1 of premium earned (on a net basis).

Root’s reinsurance comes up for renewal at the end of June 2018 and currently consists of a 50% quota share and $1M XS $100K tower, which limits volatility in results.

Transparency….

Root Insurance Co.

Root has grown explosively, with gross premiums written having trebled since 4Q17, for a run rate exceeding $30 million. $2.9 million of $7.9 million of gross premiums written were in Texas, with Ohio and Arizona also chipping in more than $1 million each. Potentially most impressive is that Root apparently has achieved its growth without massive advertising spending. If ad spending as a percent of total expenses remained constant this quarter compared with last year (a big “if,” because overall expense are rising rapidly), then Root has greatly cut its ad spending as a percent of the premium. See the bottom line of Exhibit 2.

As with Metromile and Lemonade, Root’s loss ratio remains unsustainably high, but the company’s $51 million fundraising round in June gives it a few years of runway to make improvements. Following our previous article, the CEO of Root commented that his company’s loss ratio was high in part due to prudent reserving. Indeed, Root was the only of the three startup insurers to report favorable development in the quarter, to the tune of $239,000 of gross positive development, which would cut almost 10 points off the 2017 gross loss ratio. (In reality, Root cut about seven points from the 1Q18 loss ratio, because prior year results aren’t restated when reserves develop.) There could continue to be favorable development, but so far the 2017 loss ratio would be cut from 138% to 128% -- still well above a sustainable level. Further, the company in 2017 paid $1.36 of losses for every $1 of premium earned (on a net basis).

Root’s reinsurance comes up for renewal at the end of June 2018 and currently consists of a 50% quota share and $1M XS $100K tower, which limits volatility in results.

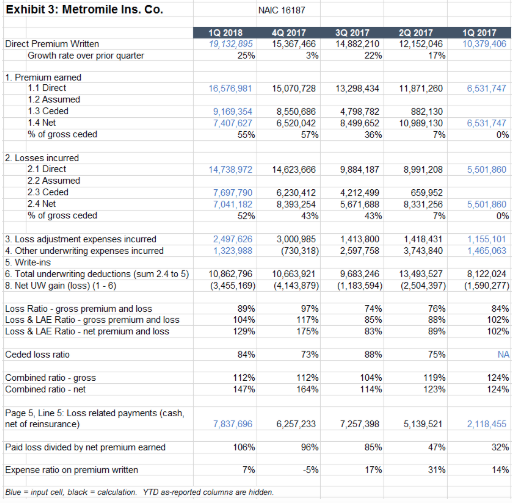

Metromile Insurance Co.

Metromile, the oldest and the biggest of the three, continues to grow premium – achieving an impressive plus-25% quarter-to-quarter, nearing an $80 million run rate. California continues to be the largest state for Metromile, accounting for $11 million of $19 million of direct premium written this quarter, as compared with $5 million of $10 million in the first quarter of 2017, which suggests that the company relies on one state but has room to expand. The company appears to be losing money in each state.

As with other insurtechs, distribution has been easier than profitability. The gross loss ratio including LAE at 104% remains close to the results posted in 2017 but above a sustainable long-term rate. For comparison, Progressive’s personal lines loss & LAE ratio was 74% in 2017 (30 points lower), with a combined ratio of 93%. The gross loss ratio is affected by $1.5 million of adverse development at Metromile, which added about eight points to the loss ratio this quarter.

Metromile Insurance Co.

Metromile, the oldest and the biggest of the three, continues to grow premium – achieving an impressive plus-25% quarter-to-quarter, nearing an $80 million run rate. California continues to be the largest state for Metromile, accounting for $11 million of $19 million of direct premium written this quarter, as compared with $5 million of $10 million in the first quarter of 2017, which suggests that the company relies on one state but has room to expand. The company appears to be losing money in each state.

As with other insurtechs, distribution has been easier than profitability. The gross loss ratio including LAE at 104% remains close to the results posted in 2017 but above a sustainable long-term rate. For comparison, Progressive’s personal lines loss & LAE ratio was 74% in 2017 (30 points lower), with a combined ratio of 93%. The gross loss ratio is affected by $1.5 million of adverse development at Metromile, which added about eight points to the loss ratio this quarter.

Does loss ratio scale?

We have been surprised to hear some investors comment that they expect loss ratios to decline with scale and to consider them as any other costs on the insurance income statement. There are some elements of loss ratio that scale, but only in a limited way, i.e. a few points, not cutting the loss ratio in half.

Does loss ratio scale?

We have been surprised to hear some investors comment that they expect loss ratios to decline with scale and to consider them as any other costs on the insurance income statement. There are some elements of loss ratio that scale, but only in a limited way, i.e. a few points, not cutting the loss ratio in half.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Matteo Carbone is founder and director of the Connected Insurance Observatory and a global insurtech thought leader. He is an author and public speaker who is internationally recognized as an insurance industry strategist with a specialization in innovation.

Are insurtechs all marketing talk, without substance, or can they solve the industry's value, complexity and trust problems?

Insurance Company: "An affiliation of pirate-gamblers who accept bets called premiums. The dollar amounts of the premiums are non-negotiable, but the amounts of the claim settlements, should the company lose the bet, are rarely delivered without argument."While the quoted source may be a parody, I believe the underlying inclination signifies the typical level of distrust that consumers have of insurance. See also: Where Will Unicorn of Insurtech Appear? Don't get me wrong. I believe insurance plays a critical role in our lives, and insurance companies can provide a great service as well as a very rewarding career path. But, when it comes to the general consumer view of insurance, there seems to be an issue.

Ask 10 random people on the street to describe "insurance" in three words, and you can be nearly sure at least one person will allude to issues of distrust

Insurtech to the rescue?

So what is the industry doing to solve these problems?

It appears that the nimble insurance technology startups (insurtechs) are playing a large part in leading the way in attempting to overcome these issues.

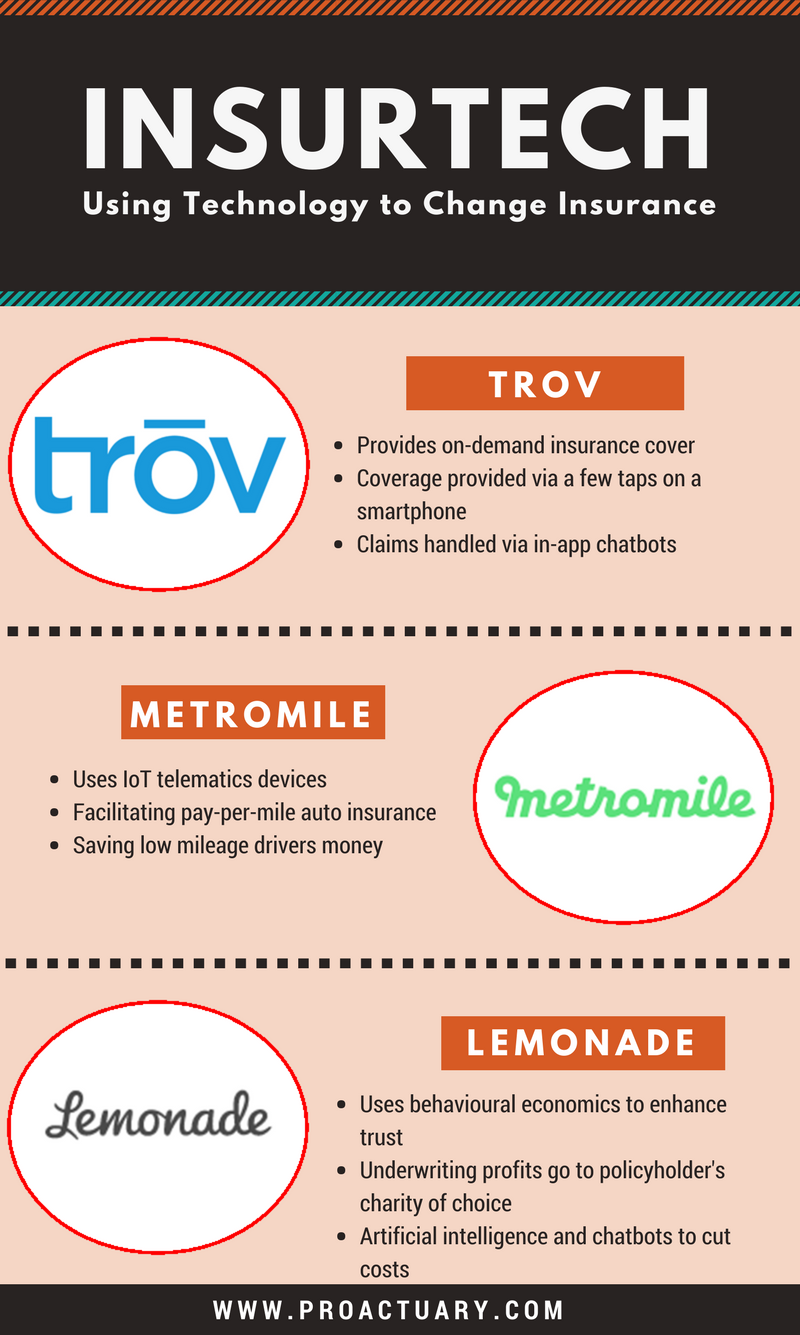

Below are three insurtech companies focused on addressing these issues and arguably changing the insurance world for the better:

Solution # 1: Improved Value - Metromile

Telematics has been around for a few years now, particularly in Italy, the U.K. and the U.S.

Onboard car technology is used to monitor and potentially assess the driving behavior of each individual driver, thus moving insurance from a pooled pricing model to a more individual specific model, one where the underlying policyholder risk is more closely monitored.

These telematics technology devices (also known as a “black box”) are able to pick up a number of diverse driving metrics such as:

Ask 10 random people on the street to describe "insurance" in three words, and you can be nearly sure at least one person will allude to issues of distrust

Insurtech to the rescue?

So what is the industry doing to solve these problems?

It appears that the nimble insurance technology startups (insurtechs) are playing a large part in leading the way in attempting to overcome these issues.

Below are three insurtech companies focused on addressing these issues and arguably changing the insurance world for the better:

Solution # 1: Improved Value - Metromile

Telematics has been around for a few years now, particularly in Italy, the U.K. and the U.S.

Onboard car technology is used to monitor and potentially assess the driving behavior of each individual driver, thus moving insurance from a pooled pricing model to a more individual specific model, one where the underlying policyholder risk is more closely monitored.

These telematics technology devices (also known as a “black box”) are able to pick up a number of diverse driving metrics such as:

"As simple as Tinder and as beautiful as Airbnb" — Scott Walchek: CEO of TrovTrov provides on-demand insurance for personal items that can be toggled on and off via a few simple taps from your phone. The company aims to give the mobile generation easy protection that they can enjoy "without worrying about rigid policies and confusing fine print." In addition, Trov seems to be jumping on the personalized cover bandwagon - treating policyholders as individuals instead of an average risk within a cohort. The flexible app gives customers the option to tweak their cover toward their own personal circumstances. As one customer put it: "Why pay for an expensive insurance plan designed to cover your worldly belongings when all you really care about is your mountain bike and your laptop?"

"Protect just the things you want - exactly when you want - entirely from your phone" — Trov websiteThis simplicity and flexibility seems certain to appeal. I personally like the idea of being able to quickly and easily protect my mountain bike by getting temporary insurance for the times when I do actually take it out and use it. And if a claim is required, it's all handled via an in-app chatbot. Insurance for the smartphone generation indeed! While I do wonder how Trov counters fraud (given the ability to so easily turn the cover on and off), as we are living in the age of convenience, it would seem that this model is sure to appeal beyond just tech-savvy millennials. Solution #3: Enhanced Trust - Lemonade Lemonade is the poster child of insurtech, or at least the king of savvy insurtech marketing. When the company shouts about paying a claim in three seconds, using AI not actuaries and bots not brokers, it certainly makes one stand up and take notice. Lemonade began selling insurance nearly two years ago and has now amassed a sizable level of funding and following. The companyy promised to bring trust back into the insurance world - the way it should be and how it was in the beginning. The tools of their trade: behavioral economics and artificial intelligence. The promise to the customer: simplicity, convenience and affordability. But back to the trust issue. How is Lemonade approaching it? The business model attempts to disrupt the cycle of distrust between the insurer and the insured. This is done by separating the pool of risk capital from the company's own 20% flat fee. Essentially this model aims to remove the incentive for the insurer to minimize claim payouts on the basis that doing so will not affect its bottom line (the remaining 80% claim pot gets paid out to small peer groups under a giveback scheme, after some unavoidable expenses such as reinsurance cover). Basically, the deal is: Trust us to pay out your claim quickly, with minimal fuss and without any sneaky "catching you out in the fine print" shenanigans, and we will trust you to only claim if it's genuine.

"Knowing that every dollar denied to you in claims is a dollar more to your insurer brings out the worst in us all… Since we don’t pocket unclaimed money, we can be trusted to pay claims fast and hassle-free. As for our customers, knowing fraud harms a cause they believe in, rather than an insurance company they don’t, brings out their better nature too. Everyone wins." — Dan Ariely, chief behavioral officer at LemonadeThe behavioral implication, with the removal of potential conflict, is that the enhanced two-way trust will drastically reduce fraudulent claims. This, combined with the operational cost efficiency savings from AI and technology will allow the company to have happy customers and still make a sustainable profit. At least that's the theory. See also: Convergence in Action in Insurtech Now, while I love what they are doing, I'm not entirely convinced their model is altogether different from some of the smaller mutuals, especially those that still maintain some level of social bonds. Maybe I'm biased because Lemonade doesn't seem to like actuaries, but I also wonder whether the company's pricing, underwriting and risk management will allow its loss ratios to stay low enough to not affect their 20% flat fee over the long term. It takes some time for reality to test the theory, in insurance. So I, for one, will be watching the Lemonade space with interest. Conclusion

So is insurance really broken and in need of fixing?

Let's not forget what insurance is all about. In essence, insurance is about the pooling and sharing of risk. Swapping an uncertain, and potentially large, outgo for a small(er) more certain outgo (the premium). This is unlikely to change, and insurance companies obviously already do this.

But, I do believe, there is a need to modernize, especially in relation to the customer experience. I don't see insurtech companies causing a complete revolution. But they are likely to play a big part in the evolution of insurance.

What do you think? Does insurance need to evolve? Is insurtech the answer to the customer experience issues? Are these insurtechs all marketing talk and lacking substance? Will the asset-rich insurance incumbents ultimately lead the way in the unfolding tech world evolution?

This post first appeared on the ProActuary blog here.

So is insurance really broken and in need of fixing?

Let's not forget what insurance is all about. In essence, insurance is about the pooling and sharing of risk. Swapping an uncertain, and potentially large, outgo for a small(er) more certain outgo (the premium). This is unlikely to change, and insurance companies obviously already do this.

But, I do believe, there is a need to modernize, especially in relation to the customer experience. I don't see insurtech companies causing a complete revolution. But they are likely to play a big part in the evolution of insurance.

What do you think? Does insurance need to evolve? Is insurtech the answer to the customer experience issues? Are these insurtechs all marketing talk and lacking substance? Will the asset-rich insurance incumbents ultimately lead the way in the unfolding tech world evolution?

This post first appeared on the ProActuary blog here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Dr. Mark Farrell is a fellow of the Institute and Faculty of Actuaries (FIA) and senior lecturer at Queen’s University Belfast. He is program director of actuarial science and risk management at Queen’s Management School.

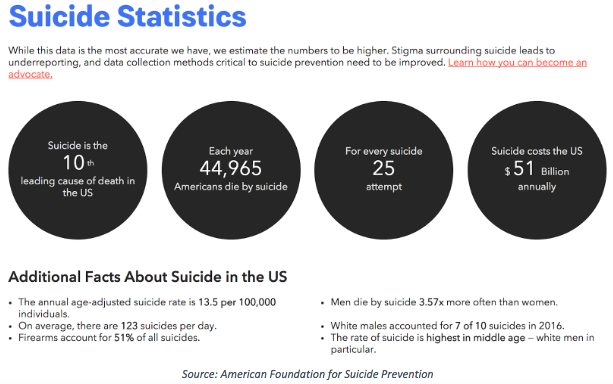

New research suggests that we might be able to begin using social media to predict suicidal behavior. We need to try.

Children as young as 11 are dying by suicide as a result of experiences on social media, and we know of at least three examples of children broadcasting their own death to live audiences using social media tools such as Facebook live, Twitter and YouTube.

How are leaders responding?

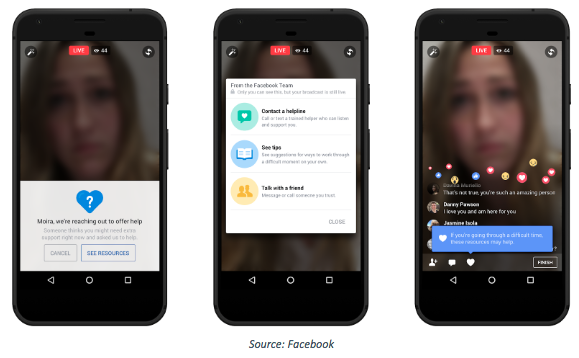

In response to these disturbing trends, Facebook has partnered with organizations like the National Suicide Prevention Lifeline to develop a set of tools intended to help individuals find resources and support who are considered "at risk" for self-harm.

The first of these tools is a new suicide-prevention feature on Facebook that uses artificial intelligence (AI) to identify posts indicating suicidal or harmful thoughts. The AI scans the posts and their associated comments, compares them with others that merited intervention and, in some cases, passes them along to its community team for review. The company plans to reach out to users it believes are at risk, showing them a screen with suicide-prevention resources including options to contact a helpline or contact a friend.

Children as young as 11 are dying by suicide as a result of experiences on social media, and we know of at least three examples of children broadcasting their own death to live audiences using social media tools such as Facebook live, Twitter and YouTube.

How are leaders responding?

In response to these disturbing trends, Facebook has partnered with organizations like the National Suicide Prevention Lifeline to develop a set of tools intended to help individuals find resources and support who are considered "at risk" for self-harm.

The first of these tools is a new suicide-prevention feature on Facebook that uses artificial intelligence (AI) to identify posts indicating suicidal or harmful thoughts. The AI scans the posts and their associated comments, compares them with others that merited intervention and, in some cases, passes them along to its community team for review. The company plans to reach out to users it believes are at risk, showing them a screen with suicide-prevention resources including options to contact a helpline or contact a friend.

While in some cases the artificial intelligence software will notify the Facebook community if it flags a situation as “very likely urgent,” in most cases it will simply work in the background to offer messaging and advice to the friends and family of a person in need.

See also: Blueprint for Suicide Prevention

Dr. John Draper, of the National Suicide Prevention Lifeline, said that he feels that the software sounds promising. “If a person is in the process of hurting themselves and this is a way to get to them faster, all the better,” he told BuzzFeed News. “In suicide prevention, sometimes timing is everything.”

Facebook is also making certain suicide prevention organizations available via Facebook Messenger, its instant messaging app. Facebook users will be able to flag posts that they feel indicate "at risk behavior,” which Facebook will respond to with an on-screen option to receive suicide-prevention resources.

Can we use social media to predict suicide?

New research out of Korea suggests that we might be able to begin using social media to predict suicidal behavior.

The three-year study looks at the social and environmental factors that contribute to suicidal behavior and describes correlations between public mood and suicide and how data from social media sources and weblogs (blogs) might be used to predict that behavior; their primary hypothesis being that social media variables are meaningfully associated with nationwide suicide numbers.

At the end of the study, the research team concluded that, “We found a significant association of social media data with national suicide rate, resulting in a robust, proof-of-principle predictive model,” and the team suggests social media data be used in future predictive modeling.

How suicide prevention advocates are using social media.

Sites like the Suicide Prevention Coalition of Colorado, the Mighty and To Write Love on Her Arms are also using social media to engage audiences with messages of help and hope.

The Suicide Prevention Coalition of Colorado, an organization of which the author of this article is a member, uses Facebook, Twitter and email newsletters as educational and communications tools to promote events, raise awareness of mental health legislation and bridge the gap between service providers across the state of Colorado that might not have the resources they need as solo practitioners.

To Write Love On Her Arms (TWLOHA) is a site that offers hope and help to those struggling with depression, addiction, self-injury and suicide.

With a Facebook following of more than 1.5 million and a Twitter following of nearly 300,000, they share individual stories of hope and recovery and work to destigmatize suicide and self-harm.

The Mighty is a blog with more than 5,000 contributors and 150 million readers that also gives people suffering from mental health disabilities a place to find resources, encouragement and support.

This site, like TWLOHA, focuses on shared experiences. Individuals struggling with disability, disease and mental illness write in and share their stories of hope and recovery.

While in some cases the artificial intelligence software will notify the Facebook community if it flags a situation as “very likely urgent,” in most cases it will simply work in the background to offer messaging and advice to the friends and family of a person in need.

See also: Blueprint for Suicide Prevention

Dr. John Draper, of the National Suicide Prevention Lifeline, said that he feels that the software sounds promising. “If a person is in the process of hurting themselves and this is a way to get to them faster, all the better,” he told BuzzFeed News. “In suicide prevention, sometimes timing is everything.”

Facebook is also making certain suicide prevention organizations available via Facebook Messenger, its instant messaging app. Facebook users will be able to flag posts that they feel indicate "at risk behavior,” which Facebook will respond to with an on-screen option to receive suicide-prevention resources.

Can we use social media to predict suicide?

New research out of Korea suggests that we might be able to begin using social media to predict suicidal behavior.

The three-year study looks at the social and environmental factors that contribute to suicidal behavior and describes correlations between public mood and suicide and how data from social media sources and weblogs (blogs) might be used to predict that behavior; their primary hypothesis being that social media variables are meaningfully associated with nationwide suicide numbers.

At the end of the study, the research team concluded that, “We found a significant association of social media data with national suicide rate, resulting in a robust, proof-of-principle predictive model,” and the team suggests social media data be used in future predictive modeling.

How suicide prevention advocates are using social media.

Sites like the Suicide Prevention Coalition of Colorado, the Mighty and To Write Love on Her Arms are also using social media to engage audiences with messages of help and hope.

The Suicide Prevention Coalition of Colorado, an organization of which the author of this article is a member, uses Facebook, Twitter and email newsletters as educational and communications tools to promote events, raise awareness of mental health legislation and bridge the gap between service providers across the state of Colorado that might not have the resources they need as solo practitioners.

To Write Love On Her Arms (TWLOHA) is a site that offers hope and help to those struggling with depression, addiction, self-injury and suicide.

With a Facebook following of more than 1.5 million and a Twitter following of nearly 300,000, they share individual stories of hope and recovery and work to destigmatize suicide and self-harm.

The Mighty is a blog with more than 5,000 contributors and 150 million readers that also gives people suffering from mental health disabilities a place to find resources, encouragement and support.

This site, like TWLOHA, focuses on shared experiences. Individuals struggling with disability, disease and mental illness write in and share their stories of hope and recovery.

Bell Canada, a telephone company in Canada, is running a "Let's Talk" campaign dedicated to raising $100 million for mental health programs by 2020 and encouraging people to find the strength to come out and talk to someone if they find themselves struggling with thoughts of self-harm.

See also: 6 Things to Do to Prevent Suicides

What you can do to get involved today.

Twitter is a wonderful conversation tool where you can do a search for keywords like #SuicidePrevention and become a part of the conversation with leaders, educators, individuals struggling and those with experience. A continued effort to destigmatize mental health issues helps those struggling realize that there is help.

You can use social media to interact with your legislature. Most politicians today are active on social media, and some even have live events on social media, giving us the opportunity to ask them where they stand on issues such as mental healthcare as well as share our opinions on the issues.

You can share resources on social media, especially around the death of a celebrity, to help further the conversation online and help someone find resources who might not have the strength to ask for help.

Finally, if you or anyone you know is struggling with thoughts of suicide and need to talk to someone right away, reach out to the National Suicide Prevention Lifeline at 1-800-273-8255 or visit online at http://suicidepreventionlifeline.org/talk-to-someone-now/.

If you need support for suicide grief or suicidal thoughts but are not in crisis, the National Suicide Prevention Lifeline offers resources on how to help either yourself or a loved one.

Bell Canada, a telephone company in Canada, is running a "Let's Talk" campaign dedicated to raising $100 million for mental health programs by 2020 and encouraging people to find the strength to come out and talk to someone if they find themselves struggling with thoughts of self-harm.

See also: 6 Things to Do to Prevent Suicides

What you can do to get involved today.

Twitter is a wonderful conversation tool where you can do a search for keywords like #SuicidePrevention and become a part of the conversation with leaders, educators, individuals struggling and those with experience. A continued effort to destigmatize mental health issues helps those struggling realize that there is help.

You can use social media to interact with your legislature. Most politicians today are active on social media, and some even have live events on social media, giving us the opportunity to ask them where they stand on issues such as mental healthcare as well as share our opinions on the issues.

You can share resources on social media, especially around the death of a celebrity, to help further the conversation online and help someone find resources who might not have the strength to ask for help.

Finally, if you or anyone you know is struggling with thoughts of suicide and need to talk to someone right away, reach out to the National Suicide Prevention Lifeline at 1-800-273-8255 or visit online at http://suicidepreventionlifeline.org/talk-to-someone-now/.

If you need support for suicide grief or suicidal thoughts but are not in crisis, the National Suicide Prevention Lifeline offers resources on how to help either yourself or a loved one.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sally Spencer-Thomas is a clinical psychologist, inspirational international speaker and impact entrepreneur. Dr. Spencer-Thomas was moved to work in suicide prevention after her younger brother, a Denver entrepreneur, died of suicide after a battle with bipolar condition.

The Walmart acquisition of Flipkart may convince Indians that the best opportunities are not in Silicon Valley but at home. Then look out.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Vivek Wadhwa is a fellow at Arthur and Toni Rembe Rock Center for Corporate Governance, Stanford University; director of research at the Center for Entrepreneurship and Research Commercialization at the Pratt School of Engineering, Duke University; and distinguished fellow at Singularity University.

Just 15% of customers are satisfied with their insurer’s digital experience -- which, done right, can cut claims process costs by 30%.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Blake Morgan is a customer experience futurist. Her first book is "More is More: How the Best Companies Work Harder and Go Farther to Create Knock Your Socks Off Customer Experiences." Morgan is adjunct faculty at the Rutgers MBA program.