Becoming a digital insurer is an essential requirement for being competitive in insurance today – but even more so for the future. Your digital strategy becomes the framework from which to leverage all other transformational initiatives, not only for the customer experience but for the employee and operational experiences, as well. This process requires clarity on priorities, focus and mindset to determine the path, the sequence and the right investments to reach the ultimate goal – going beyond a digital experience to transformation.

See also: Seeing Through Digital GlassesOur research shows us that while no single insurer is doing everything, every insurer is doing something, and some are doing more than others. So, how do you ensure you are doing the right things at the right times and in the right sequence? The following is a list the 10 essential actions required for success as you develop and execute your digital strategy:

- Understand Digital as a New Lens: Digital strategy touches aspects of all strategies – business, technology and operational plans, as well – consider it a new lens for clarity about the possibilities and linkage to strategies and plans.

- Obtain Executive Sponsorship: Given the transformational potential, digital requires buy-in from the top – the CEO/board level – to set the tone, priority, urgency and funding to create a new value proposition.

- Assign a Champion: Create a position for one executive with the vision, the power and the resources to champion your company’s digital transformation strategy. This role cuts across the enterprise, not just business or IT.

- Be Clear on the Definition: Define a consistent and comprehensive definition of “digital” across the company and recognize that there is a difference between digital and the customer experience. It’s essential to establish clarity on “what it is” and “what it is not.”

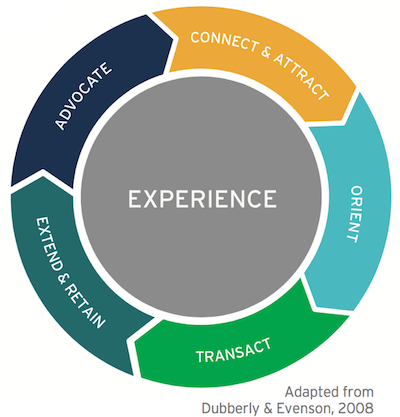

- Solicit Input: Ignite the synergy by gaining input and insights from the customers – policyholders, agents, brokers – and employees, as well. Set new experience standards and guidelines, leverage journey mapping, develop personas and create service blueprints.

- Understand Gaps and Opportunities: Conduct an assessment to identify the current gaps and future opportunities. Understand what the market leaders are investing in today, the lessons learned and implications for the future.

- Balance Customer and Operational: Remember to move up the SMA Digital Maturity Model diagonally – investing in both the external and internal experiences to create a seamless end-to-end experience.

- Leverage Emerging Technologies, Data and Advanced Analytics: Move beyond core modernization activities, and innovate with emerging technologies like artificial intelligence, Internet of Things (IoT), interactive voice response (IVR), microservices and open APIs that are available. Expand the application of external data, advanced analytics and big data. Explore the world of insurtech – partner, pilot and learn from their lessons-learned pivots.

- Create the Strategy and Road Map: Define the strategy, plan and begin to execute. Understand that this a journey. Plan five years out, but be prepared to adjust annually – because things are changing, maturing and pivoting around insurance.

- Rethink the Business of Insurance: Last but not least, take the opportunity to reimagine every aspect of your company. It’s not about implementing more and more projects, or just investing in technology. It’s about creating the new fabric of your company’s culture and business model.