Paul Carroll

You’ve written for us about the need for hyper-personalization in life insurance. Would you start us off by describing what that looks like in practice, as well as how it differs from how life insurance has historically been handled?

Brooke Vemuri

I've been in the life insurance business for 23 years, working in both technology and operations, so I've seen firsthand the evolution from moving physical forms around the building—we had folders, and we put them in carts, and we drove them around to our underwriters—to where we are today. We've crossed a lot of hurdles over the last 20 years.

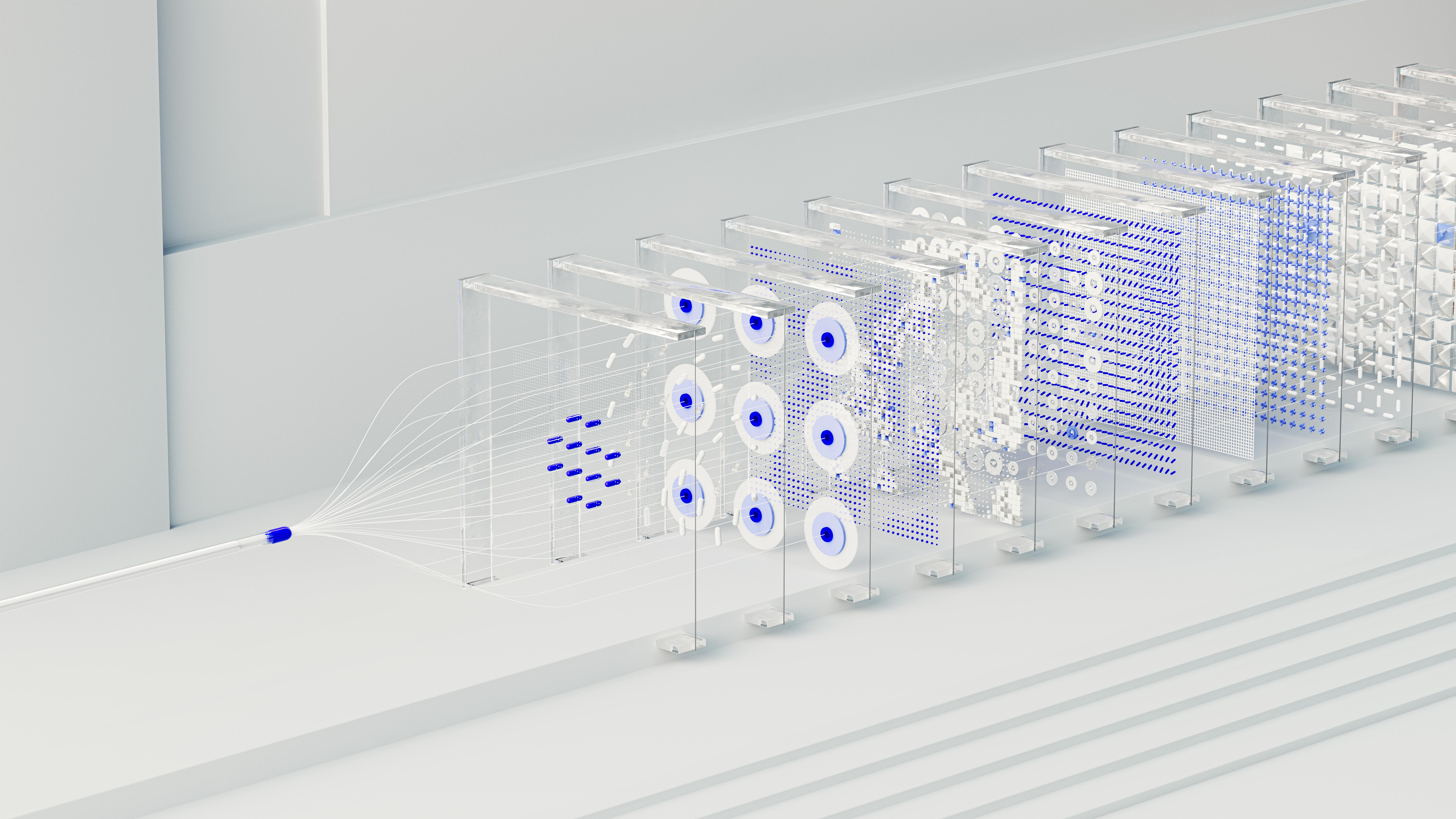

Now we're in a place where we have intelligent automation and a digital application process. Over the past few years, this has meant having an event-driven, rules-based system that allows us to capture the right application questions, then run rule sets underneath, call third-party data, and do all the things we need to amalgamate and come together on a decision. That change was hard to get across the line, but we've arrived and are doing very well as a result.

The next evolution is moving away from considering the application as one static process or one way to get to an outcome. Instead, we're moving toward tailoring the experience by distribution, by agent, by customer. Personalization means accommodating the way our agents and agencies like to do business.

Just to give you a small example: We have some agents who say, "Don't waste my time collecting beneficiary information. I'm going to get you everything I need to get a decision on the case. Then once I have a decision and the customer accepts, I'll gather that beneficiary information—it's more of an administrative piece of work because it's not influencing the decision." I have another distribution partner that says, "We start with beneficiaries. We connect the sale to the reason why you're making the purchase."

That's a high-level example on the easier side of personalization—how do we tailor or reorder the journey?

Next comes determining how many questions we ask based on the product, and how we tailor that experience based on the product, the partner, and the customer. You start to get all these different variations of how you would flow a digital application process to collect the right information at the right time, make the right decision, and end up with a case you can place in force—in a way that works with every agent and partner you have.

You can start to see that there are going to be lots of permutations and combinations of how all of that evolves and comes together. From a technology perspective, that's all about creating the right, flexible architecture to make that happen, to allow that configuration, and to support our agents in the way they want to sell the business.

Paul Carroll

Is this personalization extending beyond the sales process to policy offerings and features, as well?

Brooke Vemuri

Yes, that's a good question. Over the last 20 years or so, you typically entered the journey when you already knew what product you wanted. For example, "I know I want a term 20 policy. It's for a 50-year-old male with two children.” Now we're heading toward a different approach—someone starts the journey as that same person, but they really don't know what product or combination of features they want until they move through the journey.

Whether that means recommendations based on how many beneficiaries you have, what stage of life you're in, what your income levels are, or what job you have—as the system starts to understand who the customer is in the journey, we can start to make the right recommendations for a product.

I think you're going to see both tailoring of products and features. One of the things we're working on is how to come out with an offer for every applicant. Because in a lot of cases, there are still declines in our environment, even on term business. So how do you enter the process saying, "I have a desire to have life insurance" and be sure to end up with something—whether that's an accidental death product or a final expense product?

So yes, you're going to start to see tailoring of offers, cross-sell, counter-offers—that's what we're calling it. How do we come up with another product that might be viable for both the customer and the life insurance company so that, at the end of the journey, you still get some product that is available to you.

Paul Carroll

How is AI being incorporated into this process, particularly in terms of gathering customer information and providing real-time recommendations to agents during customer interactions?

Brooke Vemuri

Intelligence is coming into play primarily in our agent-facing capabilities. Our journey encompasses both customer-agent interactions and internal, employee-facing systems. As people interface with the system, it makes certain recommendations to the agent based on how the journey is progressing.

You might not do that directly with a customer, though. If a customer is going through the process unassisted, it's a little bit more complex for them to navigate some of those things. So our thought process is a lot like TurboTax—in the upper right-hand corner as you progress, it shows what you're accruing, what we know now, and where we might go in this journey, and starts to forecast and give options for next best steps.

For now, we’ll just focus on agent-facing capabilities, because that feels more like advisory-type activities. That's at least our early thinking.

Paul Carroll

What innovation can we expect to see over the next few years?

Brooke Vemuri

I think we'll be very much focused on what we're talking about now, which is tailoring our apply processes—for both customer and agent. We're looking at getting some cues or indicators into the journey about how a case is tracking and how agents might handle what's going to happen in terms of that sale, whether it's going to be a decline or whether we can pivot to another product.

I think you're going to see all of that in the next two to three years—tailoring the counter offers or the alternate offers, tailoring the journey to align with how that agent wants to sell their business.

Beyond that, we're imagining a lot more variation on the product. We're going to see more things in terms of what we call table ratings today: How do we get more price variability in the product so we can accommodate more and more applicants? I think that's probably on the three- to five-year horizon.

Paul Carroll

What trends are you seeing around younger generations being more interested in living benefits rather than death benefits?

Brooke Vemuri

That's a good point. Things are being added on and tailored into the product that allow more utility out of the product. It's not a policy that you print and put on the shelf and wait till you die, and then someone gets the benefits of it. It's about how the policy can give you benefits while you're living—tapping into that face amount for critical illness or accidents and things like that.

I agree that living benefits are giving more value to the term product. I mean, there's still a need for your basic term product out there that has no bells and whistles. But to reach some of the younger generations, we're finding that living benefits have been valuable for them.

Paul Carroll

Life insurance policies represent long-term commitments—20 years for term policies, often longer for permanent ones—making it challenging to validate underwriting assumptions quickly. How is the recent industry shift toward fluidless evaluation and fewer application questions working in practice?

Brooke Vemuri

It does take years to know if your assumptions are right. I think the biggest value of the data right now is being able to look at historical data and model it in a way that makes us more comfortable with innovations—whether that's leveraging other third-party evidence sources or forgoing exams altogether, like with fluidless underwriting.

We're using a combination of historical data—looking at how it would perform based on our back book of hundreds of thousands of cases at this point—and other third-party evidence that we can leverage, like medical claims data and labs data. We're leaning heavily into claims data specifically.

It's really about putting those pieces of the puzzle together alongside the self-declarations from the application so that you have a complete picture to underwrite from and make a decision. We're going after alternative evidence sources to eliminate some exams while also looking retrospectively at the data to see what it's telling us. Through our modeling, we can apply new assumptions to that data, see what it might look like, and price accordingly.

Paul Carroll

What other trends should our readers be aware of in life insurance?

Brooke Vemuri

I think you've probably captured a lot of them. There's going to be a lot of tailoring—tailoring on the journey and tailoring on the products, tailoring on the prices, tailoring on the variation of features and capabilities that exist in the term product space.

How do we alternate out of term if we need to? How do we counter out of that if we need to? I think that's the real progress on the horizon.

Paul Carroll

Thanks, Brooke.

About Brooke Vemuri

| Brooke Vemuri is vice president, IT and innovation at Banner Life and William Penn. She leads people and cross-functional teams to reimagine the future of life insurance from lead generation, through apply and underwriting, to offer, pay, and in-force. Her team drives transformation and change to the business and distribution through the development and execution of business propositions focused on growth and cost reduction through a digital business strategy. |