Financial planning for those with disability needs has often been viewed as an "advanced sales support" capability for carriers, useful for when an advisor runs into a client with more sophisticated needs than traditional sales training provides. This commonly occurs in situations where families have children with disabilities, whether that is physical, cognitive, or mental. As a whole, the insurance industry is immature, often referring to this as "special needs planning," terminology that is not in line with disability advocacy best practices. Many carriers have no formalized special considerations planning capabilities, while less immature models may have trusts specialists who may be able to assist as a part of a sales desk. Leaders will have formalized home office support in the form of a dedicated disability considerations team. This may include needs calculators, marketing materials, or even a dedicated sales representative that is a Chartered Special Needs Consultant (ChSNC) in the home office.

But most specific needs planning capabilities are based on the assumption that disability needs planning is a secondary consideration to broader estate planning through an advisor. These assumptions are simply no longer accurate. First, disability needs planning is no longer a niche market reserved only for ultra-high-net-worth individuals. Mental health and broader disability consideration services affect all markets, many of which may not traditionally have advisors. Second, specific needs services and mental health providers represent significant spend on their own. While the average child is estimated to cost $13,000 a year to raise, a child with disability needs is estimated to cost $30,000 a year to raise. And unlike other children, children with specific needs typically need support well beyond the age of 18. Mental health spend may be less (~$1,100 a year) but affects a significantly larger number of individuals. Third, needs are not quite as simple as effective estate planning. Consumers need products and advisors that can reasonably understand disability needs scenarios to ensure that coverage is accurate. For example, simply identifying an individual as bipolar is not sufficient – the long-term care for that individual must include medication, plans/treatment, and monitoring.

Growth In Specific Needs and Mental Health Markets

The number of individuals who qualify as specific needs has significantly grown over the last 20 years. From 2017 – 2023, the number of individuals three-21 years who qualified as disability needs under the Individuals With Disabilities Education Act (IDEA) grew 7%, with overall growth from 2013-2023 showing 14-15% growth.

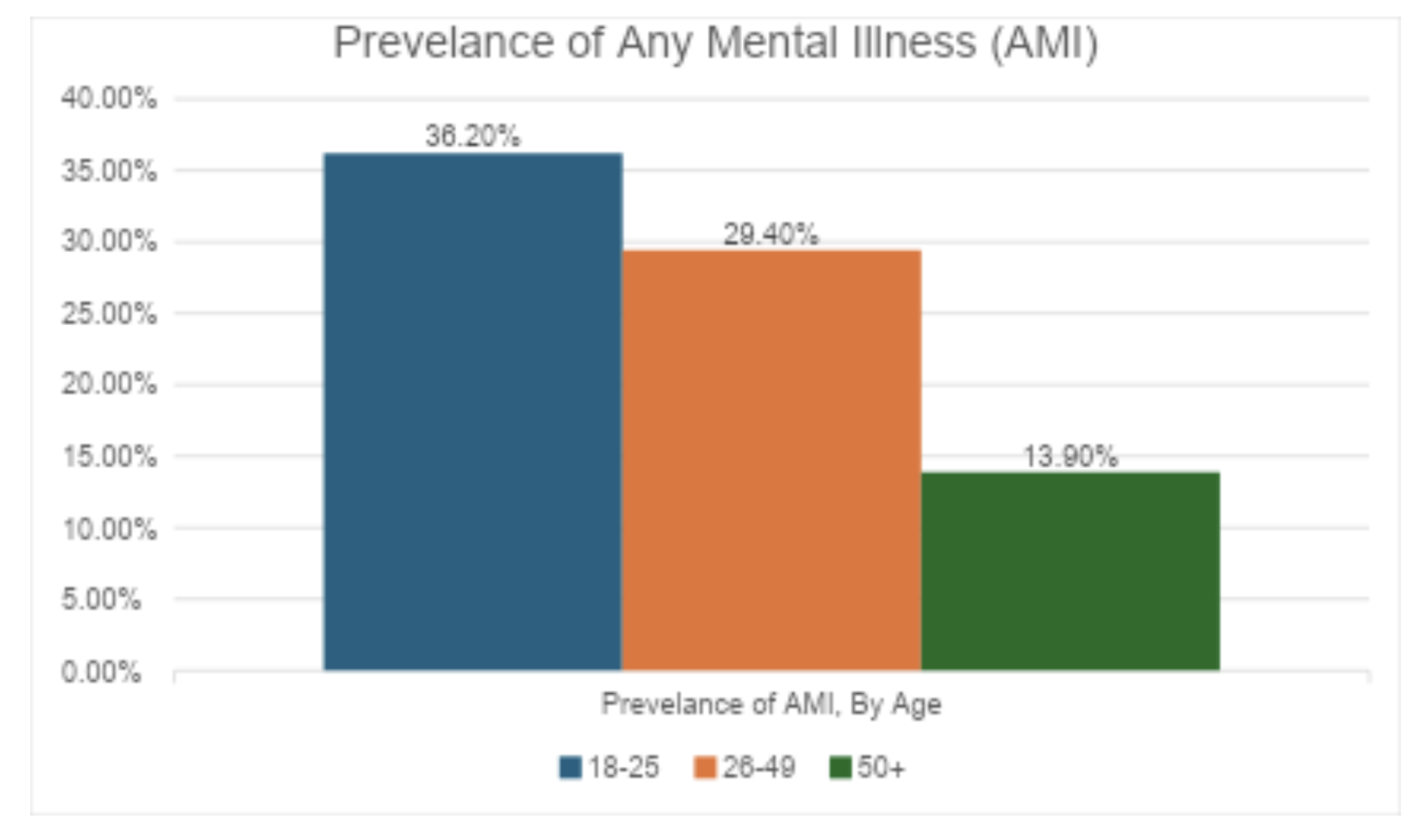

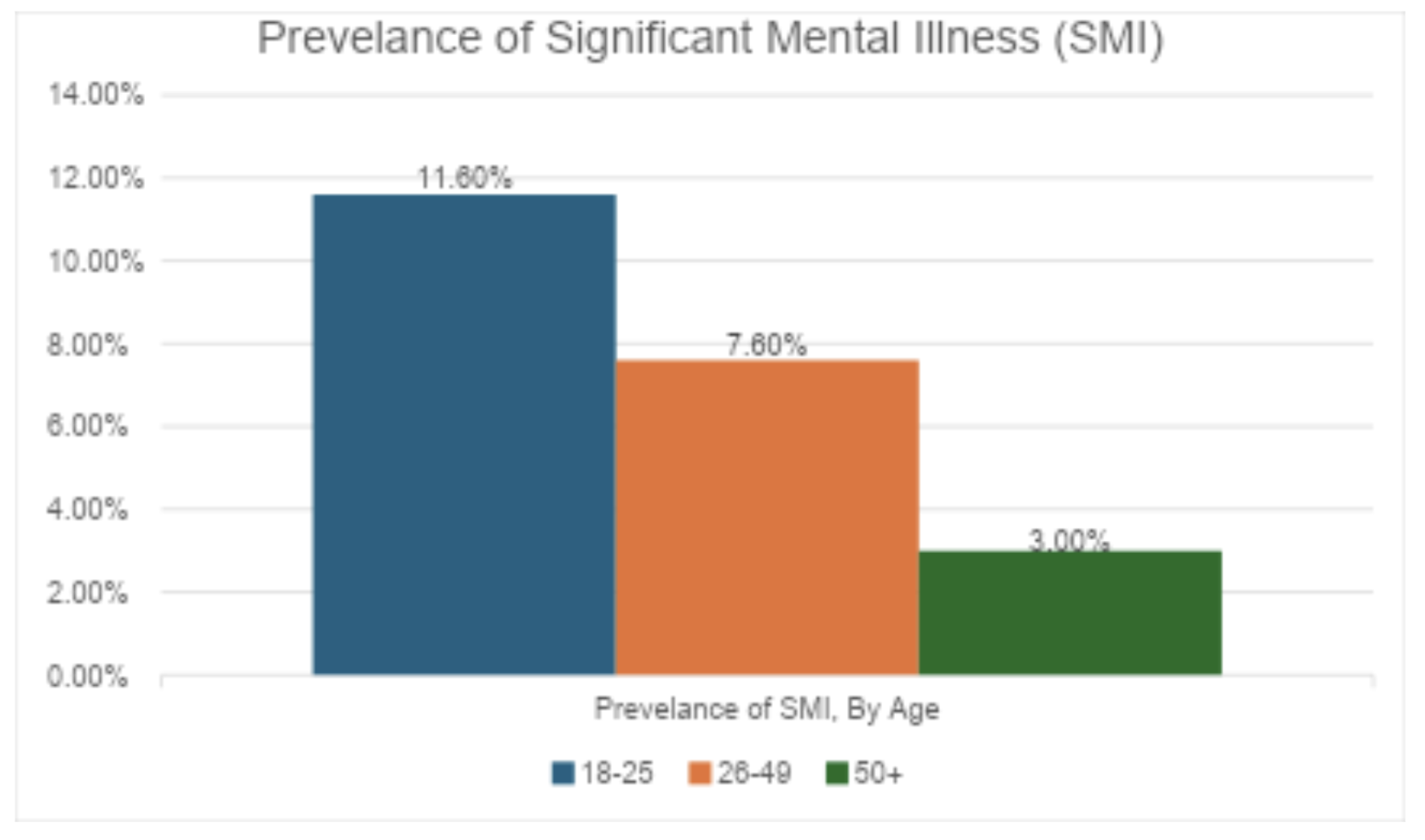

In addition to the growth in the disabilities market, there has been an increase in both frequency and severity of mental illness . Not only are coming generations experiencing mental illness at a significantly greater rate than older generations, they are experiencing more severe diagnoses, as well.

This population is not just receiving diagnoses – they are receiving mental health treatment, defined as having received inpatient treatment/counseling or outpatient treatment/counseling or having used prescription medication to help with mental health challenges. In 2022, among the 15.4 million adults with a significant mental illness (SMI), 10.2 million (67%) received mental health treatment in the past year .

Most projections show significant growth in the mental health space. A combination of destigmatization, proliferation of mental health and behavioral resources, and technology to assist in serving historically underserved communities is likely to drive growth in this space. Some estimates put behavioral and mental health service growth at 18% over the next decade.

Opportunity for Carriers

The significant growth in the number of individuals with disabilities and mental health presents a growth opportunity for insurance carriers. Existing products simply do not meet the needs of families attempting to ensure care of their dependents when they are no longer able to care for them themselves.

- Government Benefits Are Uncertain – Historically, the bedrock of benefits for individuals with disabilities were government programs, such as SNAP or housing benefits. But budget concerns affecting discretionary spending, both at the federal and state levels, put these programs in jeopardy. Parents who need long-term planning cannot reasonably rely on these programs to remain.

- Trusts Are Complex – Third-party trusts are often complex, costly, and not easily administered. Consider that the trustee must have strong understanding of legalities of specific needs programs, particularly government benefits, to avoid jeopardizing them in the long run. A trust is also expensive to set up and an incorrect legal structure can ruin the beneficiary's benefit eligibility. There is also the practical administration – smaller families and weakened familial ties often mean there is no obvious individual to serve as a trustee.

- Insurance Products Are Not Fit For Purpose – While it is possible to leverage life insurance and other financial products to fund a trust, this again requires significant planning and expense to properly set up the trust and administer it long-term. While long-term care can support dependents with disability needs, the policies are often expensive and may not actually cover what you need (e.g., supporting speech therapy versus mental health sessions).

- Group Benefits Only Work For Employees – While there has been an expansion of mental health benefits in the group and voluntary benefit space, many dependents will be unable to have traditional jobs to qualify for the benefits.

Customer-centric product design suggests a simple solution – creating products specifically for dependents with specific needs and developing distribution and operational support necessary to enable the products. A growing market, limited alternatives, and a consistent need for the services all support further research and expansion into this market.

For carriers to succeed, they will need to address five critical challenges:

- Underwriting Operational Support – Most critical of these challenges is the development of underwriting processes and risk management necessary to accurately price the product. This will require the mental health equivalent of a chief medical officer, comprehensive training, and trial and error to ensure proper pricing discipline.

- Sales and Distribution Enhancement – Product sales can be driven through direct channels or through advisor-led channels, each with significant advantages and disadvantages. Designing the right distribution channel strategy will be critical – one key consideration will be the carrier's ability to successfully market and educate consumers on the product. Strong marketing capabilities could favor a direct model that reduces commission costs and helps ensure profitable growth.

- Technology Enablement – This relatively new insurance space has one other upside – it is not bound by legacy systems or processes. The best carriers will leverage AI and automation to streamline product development, new business processing, and servicing. Because the dependent population may or may not be able to advocate for themselves, this presents an opportunity for carriers to heavily invest in technology so that the process does not require heavy intervention from the beneficiary, who may have limited decision-making capacity.

- Advisor and Consumer Awareness – Advisors are typically ill-equipped to advise families in these areas. The sales scenario is not usually practiced in formal training programs, and advisors typically have little knowledge of mental health or disabilities to truly understand risks and client needs. Consumers are often not much more aware. Carriers will have a significant awareness challenge, but can develop this capability in conjunction with mental health and disability institutions to drive broader education efforts.

- Regulatory and Compliance Frameworks – Insurance carriers can provide consumers the ability to administer trusts and handle the legal complexity associated with them. While this would likely involve third-party administrators, the challenge will be the legal standard applied to value-based care and the liability limits associated with them. For example, will there be a simple suitability standard applied to providing mental health care or will there be a heightened best interest standard? How is this standard monitored and enforced?

The good news for insurers is that they do not have to rush into this market. A macrotrend in insurance is the move toward hyper-personalization. The more tailored a product is to a need, the easier it is to underwrite the risk and meet the consumer's needs. This market is so broad that carriers can begin by offering adapted versions of existing products before eventually developing net new products. The important aspects are having the right individuals that understand both mental health/disability needs (e.g., therapists, caretakers) and those who understand insurance to marry the two to create a viable model that can serve a significantly growing population.