Recently, third party administrators (TPAs) have experienced inorganic growth through acquisition. Acquiring new lines of business or further expanding existing lines of business has been at the core of business growth strategy for several TPAs. TPAs then attempt to reduce cost to improve business unit (BU) margin and overall profitability. While that is a viable growth strategy, TPAs often ignore an obvious growth lever – cross-selling and upselling existing clients.

The value of cross-selling and upselling has not been lost in the insurance space – indeed, carriers have used data- and analytics-driven models to cross-sell and upsell and improve productivity. Those carriers have seen revenue increases of up to 30% increase. But the cross-selling/upselling focus has historically been in the retail markets, driven by financial advisors and brokers. For TPAs, sales strategy is typically fragmented.

Putting the Pieces Together

A TPA sales and renewal strategy typically faces several key obstacles that inhibit cross-selling and upselling:

1. Lack of Financial Alignment Between Performance and Cross-Selling – Most TPAs report on margin at two levels – business unit (BU) margin and enterprise margin. As a result, BUs are given incentives to consider only their own profitability and growth, not the profitability of the enterprise. This results in missed opportunities – for example, a healthcare claims TPA missed opportunities to provide tort claims administration because the client was unaware the TPA provided the additional services.

2. Disjointed Relationship Management – Client relationships are often owned and managed at the BU level. This structure creates a challenge, as leaders of individual lines of business rarely identify or pursue opportunities to offer services from other units. While some TPAs use enterprise-level client relationship managers, these roles often lack the authority or visibility needed to serve as the primary point of contact for all client interactions.

3. Lack of Pricing Discipline – Pricing for both new business and renewals is usually a struggle for several reasons. First, TPAs tend to offer several different pricing models for services. Each of those comes with different cost assumptions, which may or may not accurately reflect the true cost of the service offered. Second, pricing may be done in a shared service model or it may be done at a BU level. At the BU level, cost assumptions may not be the same for each line of business. For example, are corporate functions (e.g., finance) included in costs underlying pricing assumptions?

Cost allocation mistakes can lead to unprofitable underwriting. In one instance, a TPA made faulty assumptions on labor costs, where claims adjuster productivity was 33% worse than the numbers used in pricing assumptions. Additional claims personnel were needed to meet overall production requirements. The same TPA also failed to allocate enterprise costs when calculating pricing. What appeared to be a 20% margin on paper actually was a single-digit or even negative margin in reality.

These challenges can be overcome, but TPAs must understand what cross-selling and upselling opportunities can mean to both topline revenue and overall profitability. Although TPAs typically have nascent cross-selling capabilities, there is significant upside to TPAs that invest appropriately.

So what should TPAs do if they want to expand their cross-selling and upselling capabilities?

Unlocking Value Through Cross-Selling

For TPAs to unlock value through cross-selling, TPAs need to ensure they have met all the activation requirements:

- The functional capability to cross-sell and upsell

- Strong pricing and cost discipline

- Organizational enablement

Functional Capability to Cross-Sell and Upsell

Cross-selling and upselling for TPAs begins with good-quality data. TPAs need to use their data to understand 1) the factors that drive a customer to purchase additional services and 2) the best timing for making the purchase. This will prove to be a significant pain point for TPAs to overcome, but this will be a critical market differentiator. TPAs often segment customers based on line of business and size of account. Understanding how these interactions and key cross-selling factors will differ based on the type of client is a major opportunity.

In addition to data components, TPAs also need to ensure that there is the necessary technology. Specifically, the use of common CRMs, customer segmentation tools, centralized reporting tools, and leveraging AI for automation purposes are all critical tools that help enable cross-selling and upselling.

Strong Pricing and Cost Discipline

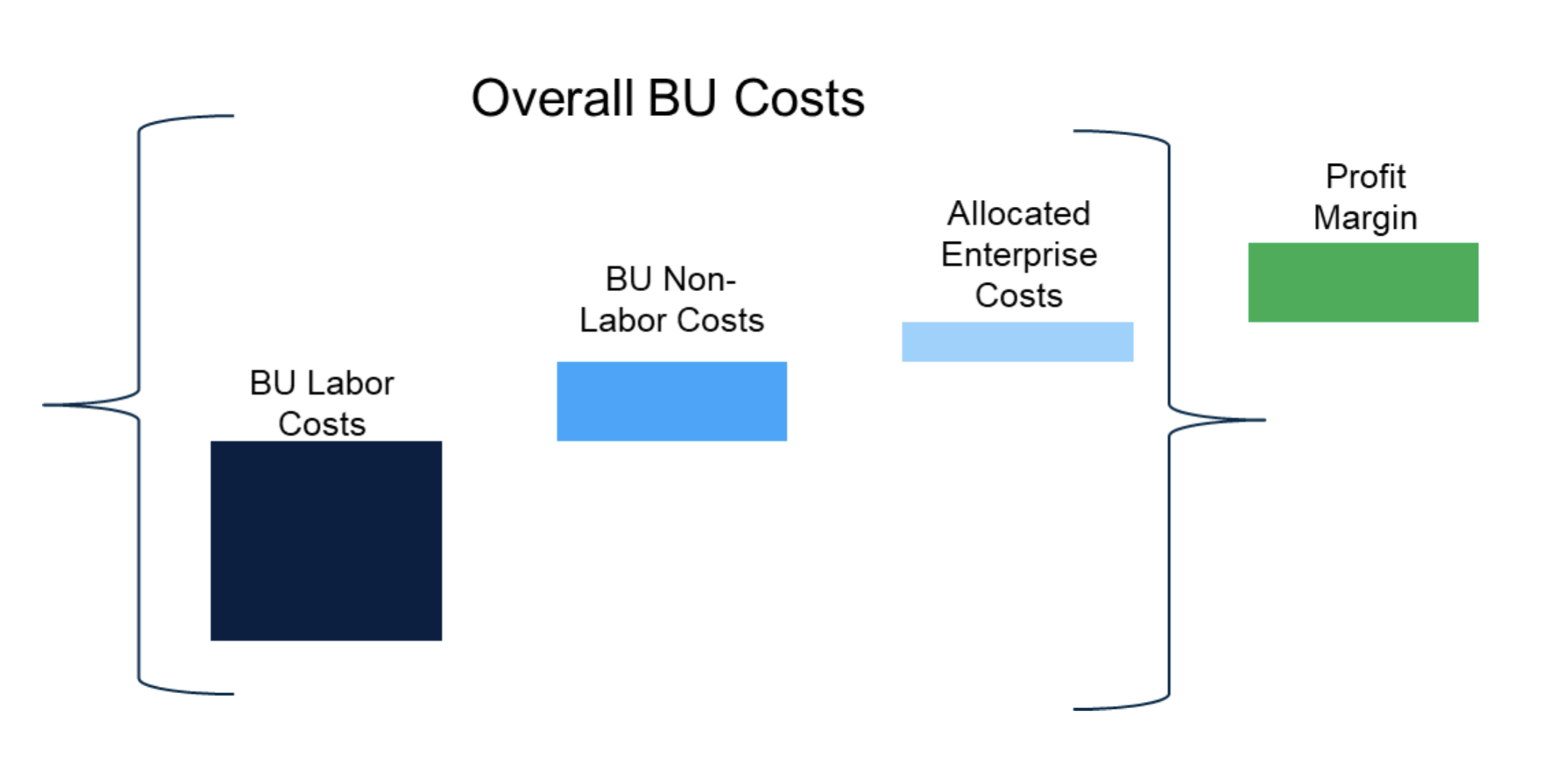

Cross-selling can drive revenue, but the true value is in unlocking additional profitability, both at the BU and enterprise level. To do so, TPAs need to understand a service's cost drivers and more importantly, how cross-selling and upselling can reduce traditional costs. TPA services typically have three cost types – BU labor, BU non-labor, and enterprise/corporate costs. The graphical representation below highlights how disciplined pricing teams will incorporate these three costs (shades of blue), and then adjust pricing to the target profitability (in green).

When TPAs attempt to cross-sell or upsell, they need to ensure their pricing team has accurately included all cost variables in their quote.

Here's an example:

If a TPA is currently providing P&C claims support to a client, and now can provide cyber claims support, the TPA has to have a strong understanding of cyber claims support pricing. If the TPA is leveraging a claims-driven pricing model (i.e., price to process X amount of claims over Y time leveraging Z individuals with certain processing assumptions), then profitability against the BU labor costs depend on how accurate the processing assumptions are for the TPA. Accuracy promotes stable margins, while inaccuracy invites cost creep. But cross-selling should inspire a reduction in BU non-labor costs. For example, marketing expenses that are typical for the cyber business should not exist in a cross-sale scenario, thus improving profitability both for the BU and the enterprise. But the opportunity does not stop there. Allocating corporate costs ensures profitability against shared resources, but it also helps to benchmark spend against revenue.

In the case of cross-selling and upselling, TPAs have the opportunity to improve the spending ratio between corporate support and the revenue generated, which should lead to improved enterprise margin, assuming scalability.

Organizational Enablement

Last, but certainly not least, TPAs need to integrate the cross-selling and upselling process into their sales dynamic. It is not uncommon to see lines of business, enterprise customer relations teams, and other teams involved in the sales and renewal processes, with significant friction as the usual result.

While the exact method by which a TPA manages these various teams to achieve cross-sale and upselling goals will vary, there are general concepts that can push the organization in the right direction.

1. Tie Financial Incentives to Cross-Sale/Upselling Metrics – TPAs should consider setting enterprise goals that highlight the importance of cross-selling/upselling. Rather than tying any particular individuals' compensation to a specific target, the enterprise could set a target that X amount of revenue is derived from selling new services to existing clients for the enterprise to be eligible for specific incentives (e.g., a minimum amount of cross-sales yields a 5% bonus toward every employee in the company).

2. Automate Where Possible – Too often, insurance carriers and distributors try to consciously engage in cross-selling, rather than trying to embed it into their sales process. For TPAs, the opportunity exists to automate the upselling and cross-selling processes, particularly for small or medium-sized employers or customers. In these situations, where renewals are likely already automated, TPAs should consider redesigning processes and responsibilities to suggest services leveraged by customers of similar size and industry.

3. Emphasize Customer-Centric Relationship Models – For larger clients, TPAs can leverage client-centric customer relationship teams to serve as single points of contact. This approach can reduce friction and encourage a "single TPA" interaction with the customer. The customer relationship management team then triages to the relevant internal teams. In these scenarios, the TPA can much more easily showcase its product shelf to customers and encourage cross-selling/upselling opportunities.

What's Next?

For TPAs, an investment into cross-selling and upselling provides an opportunity for organic growth. While the M&A market remains hot for TPAs, TPAs will eventually reach a point where inorganic growth is no longer a viable long-term strategy. Instead, TPAs will need to modify their growth goals to include customer penetration goals.

To do so, TPAs must act now to develop the organizational muscle necessary to grow this capability.

TPAs that are interested in pursuing cross-selling and upselling initiatives should:

- Assess their readiness against operational, technical, growth strategy, and organizational dimensions.

- Identify the factors that lead to opportunities

- Develop data models and pilots to test these factors

- Refine these models and roll out for broader application

Doing so will position TPAs to develop deeper relationships with their customers and with that, secure profitable clients for the future.