|

November 2025 ITL FOCUS: Underwriting

ITL FOCUS is a monthly initiative featuring topics related to innovation in risk management and insurance.

ITL FOCUS is a monthly initiative featuring topics related to innovation in risk management and insurance.

|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Insurance Thought Leadership (ITL) delivers engaging, informative articles from our global network of thought leaders and decision makers. Their insights are transforming the insurance and risk management marketplace through knowledge sharing, big ideas on a wide variety of topics, and lessons learned through real-life applications of innovative technology.

We also connect our network of authors and readers in ways that help them uncover opportunities and that lead to innovation and strategic advantage.

Here are 20 non-negotiables for winning in business in the age of AI, based on Saban and a former assistant doing remarkable things at Indiana.

My Indiana Hoosiers (or is it Bison?) are 10-0 and ranked second in the nation. What Coach Curt Cignetti has accomplished in his year-plus in Bloomington is nothing short of remarkable. Coach Cignetti worked under the GOAT, Nick Saban, at Alabama for four seasons, and he cites Coach Saban as his main influence.

I've written about Saban in this column here. Studying both coaches, today I propose a framework we can all use for building teams and winning championships. It's a paradox, but in the age of AI, leadership style and people matter more than ever—so listen up. Here we go.

Don't think about winning championships. Think about what you need to do in this drill, on this play, in this moment. Stop obsessing about quarterly results and execute today's tasks with precision. Think about the eight hours in this day and the 65 business days in this quarter, not the quarter.

Saban shifted from transactional to transformational leadership at Michigan State in 1998 against Ohio State when he realized he couldn't win the "transaction" against a superior team. Transformational leadership means you care about other people to help them for their benefit, not your benefit - if it's for your benefit, it's manipulation. Stop managing tasks. Start developing people.

The No. 1 thing is culture, and the culture comes from the individuals who make the team what it is. Mediocre people don't like high achievers; high achievers don't like mediocre people - you can't let those two things coexist. Fire the mediocre. Now.

Cignetti's "production over potential" principle means an underperforming five-star has to compete for playing time with a less-talented player who does his job on the field. Stop hiring based on résumés and pedigree. Hire based on what people have actually accomplished.

Becoming head coach after Indiana posted a dismal 3-9 record in 2023, Cignetti was asked about his biggest challenge and said simply: "Changing the way people think." Your first job isn't strategy - it's breaking the loser mentality.

Saban eats two Oatmeal Creme Pies for breakfast every morning and the same salad every day for lunch so he doesn't have to spend a single second debating what he wants. Automate the trivial. Save mental energy for what matters.

Saban hired outspoken Lane Kiffin as offensive coordinator—he in many ways is everything Saban is not—because he respected Kiffin's offensive mind. Stop surrounding yourself with yes-men. Hire people who make you uncomfortable because they're better than you at something critical.

Saban allows himself, his team and his coaching staff 24 hours to either enjoy a victory or contemplate a defeat, then they move on to the next goal. Stop celebrating or wallowing. Next play.

Saban was a master in handling the media, going on a rant or two every season to divert attention away from one story line and redirect it back to what he believes is important. Cignetti has followed suit. If you're not influencing the story your people believe, you're failing to lead them.

When asked what fans should expect, Cignetti said simply: "I win. Google me." National coverage has characterized his public tone and on-field identity as unapologetically aggressive, noting his "attack" ethos and unwillingness to "play nice." Stop hedging. Own your track record.

Cignetti took the majority of his staff from James Madison and immediately got to work, bringing in 22 transfers. Don't inherit broken culture. Import winning culture.

Cignetti cites a culture of accountability as critical - the best players don't need coaches barking at them to show up to conditioning on time or study the playbook. If you're micromanaging, you hired wrong.

Cignetti's emphasis: "We try to play every play like it's nothing-nothing, game on the line, regardless of the competitive circumstances." His philosophy of fighting human nature keeps his team focused — ignoring outside noise, staying level-headed, and locking in on the next play. Stop thinking about the quarter. Execute this hour, this day.

One of Indiana's defining characteristics is the way it limits mistakes — Cignetti's emphasis on fundamentals and playing relentlessly but also disciplined has molded a team that doesn't give much away. Discipline isn't punishment. It's freedom through mastery of basics.

Recently, Cignetti mentioned UCLA's fake punts in multiple media availabilities during the week, and Special Teams Coordinator Grant Cain made sure players were ready — they stopped a fake on fourth-and-7. Preparation isn't paranoia. It's professional obligation.

Cignetti: "I put in the hours because I expect my team to do the same. You can't out-talent hard work. Teams win because they outwork the competition." If you're not the hardest worker, you have no credibility if you demand it from others.

Over time, "kind lies" lead to dysfunctional (read: losing) systems; "unkind truths" lead to functional (read: winning) systems. Give true feedback. Deal in truth over feelings. Tell your players it's not criticism, it's coaching — which is what they said they signed up for.

Cignetti: "You can't win today's game with yesterday's plan. Adjustments are the name of the game. Leadership is about seeing the big picture but knowing when to pivot in the moment." Saban benched starting QB Jalen Hurts at halftime of the national championship game and replaced him with Tua Tagovailoa when the game plan needed it — Hurts' response: "Tua was purpose-built for tonight." Process doesn't mean rigidity. It means disciplined flexibility.

Cignetti didn't just sift through the transfer portal — he interviewed players with a purpose, bringing in transfers who were the best players on their previous teams and had played a lot of football. Stop hiring for credentials. Hire for proven performance in your system.

A key element of Saban's process is clearly defined expectations for players not only on the field but also academically and personally, including a dress code, and monitors players year-round. Ambiguity is the enemy of execution.

The "process" is easier to define than execute: Execution requires obsessive attention to process, zero tolerance for mediocrity, relentless preparation, and absolute accountability. Winning isn't complicated, but it requires high daily energy, absolute discipline, and zero tolerance for BS.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tom Bobrowski is a management consultant and writer focused on operational and marketing excellence.

He has served as senior partner, insurance, at Skan.AI; automation advisory leader at Coforge; and head of North America for the Digital Insurer.

As real-time policy issuance becomes possible, the traditional insurance binder may quietly fade into obsolescence.

As automation, APIs, and smart contracts redefine how policies are issued, one of the industry's most enduring artifacts — the binder — may quietly fade into history.

As an underwriter, I've long moved through the familiar insurance life cycle: submission, rating, booking, quote, binder, issuance, renewal, and endorsement.

It's a rhythm every underwriter knows well. But a simple question recently crossed my mind:

What if automation doesn't just reimagine this cycle — but erases one of its oldest steps, the binder?

For more than a century, the binder has played a vital role in confirming temporary coverage while the final policy is prepared. It served as a bridge between intent and issuance — a necessary pause in a largely manual, paper-driven process.

But as the industry embraces artificial intelligence, automation, blockchain, and smart contracts, that bridge may no longer be needed.

Today, the binder stage often adds delays, introduces manual errors, and requires repetitive back-and-forth between carriers, brokers, and clients. In a future where risks are assessed, priced, and bound in real time, does this interim step still make sense?

Imagine a world where:

In this model, the policy itself becomes immediate, removing the need for a traditional binder.

Some insurtechs, such as Lemonade and Cover Whale, are already experimenting with real-time issuance and policy management models that compress binding and issuance into one seamless transaction.

One innovation that could make this reality possible is a unified client identity system — a blockchain-secured digital ID for every insured individual or entity.

Every coverage, transaction, and claim could be linked to that identity, simplifying servicing, audits, and compliance while dramatically improving fraud detection.

However, for such a framework to work, the industry would need common data standards and regulatory alignment — significant hurdles that will take time and collaboration to overcome.

Still, the payoff could be transformative: a frictionless, verifiable insurance experience from application to claim.

This evolution doesn't replace brokers and agents — it redefines their value.

Instead of operating with issuing authority tied to individual carriers, brokers could gain what I call "API authority."

Through standardized application programming interfaces (APIs), they could quote, bind, issue, and manage policies across multiple insurers in a single environment.

Imagine a brokerage platform connected to 10 carriers simultaneously, comparing quotes, binding coverage, and issuing policies in minutes — all through secure APIs.

This shift would make distribution faster, more transparent, and far more client-centric, turning brokers into technology-enabled advisors rather than transactional intermediaries.

Looking ahead, we may even see AI-powered personal insurance assistants managing coverage on behalf of clients:

In such a world, these AI agents wouldn't just handle renewals — they could also bind coverage instantly based on verified data streams, removing human latency from the process altogether.

Maybe. Or maybe it will evolve into a new digital verification layer embedded within automated issuance systems.

Either way, the binder's traditional purpose — to bridge time and uncertainty — is being challenged by technology that eliminates both.

Whether the binder disappears or evolves into a digital handshake, its transformation will signal something bigger — an industry finally unburdening itself from paper-era pauses to embrace true, data-driven immediacy.

As automation deepens its roots, we should all be asking: What other legacy steps might quietly evolve or fade next?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Manjunath Krishna is a property and casualty underwriting consultant at Accenture.

He has nearly a decade of experience supporting global underwriters and carriers. He holds CPCU, AU, AINS, and AIS designations.

America's flood insurance crisis deepens as climate-fueled disasters expose low penetration rates in vulnerable communities.

Between April 1 and April 6, 2025, a storm crossed the south and eastern Midwest of the United States, bringing strong winds, tornadoes and heavy rainfall to a large area ranging from North Dakota to Texas. The most significant damage occurred in Iowa, Missouri, Arkansas, Kentucky, Oklahoma, Tennessee, Indiana and Mississippi. The National Weather Service warned a week beforehand that the storm had the highest possible risk, allowing emergency managers to prepare.

The storm produced over 156 tornadoes, including at least six rated EF3 (i.e. with estimated wind speeds between 136 and 165 mph). It received a score of 96 (classified as "devastating") on the Outbreak Intensity Score, with recorded hail seven centimeters in diameter and straight-line wind speeds of up to 110 mph. Fed by an atmospheric river drawing moisture up from the Gulf of Mexico, over 200mm of rain fell over a wide area, with western Kentucky experiencing nearly 400mm in four days. Widespread surface water flooding and numerous rivers reaching moderate or severe flood stages, with several setting records, caused devastation and power cuts. Kentucky faced the most severe impact, with scores of bridges destroyed and hundreds of roads closed. Mountaintop removal mining in Kentucky is known to have changed the hydrological response of the area during previous floods and likely exacerbated the flooding in this latest event.

Leading up to this storm, Gulf of Mexico sea surface temperatures were 1.2C above average, which helped the atmosphere to hold more moisture and fuel the atmospheric river. Post-event analysis suggests that climate change made the event 40% more likely and 9% more intense.

In Arkansas, the Burlington Northern and Santa Fe Railway restored service just two days after a derailment and bridge washout, demonstrating the benefits of early warnings and good emergency planning. Overall, the storm affected nine million people, resulted in 24 fatalities and inundated more than 15,000 homes and businesses. Insured losses are estimated at $2 billion or more, with economic losses already exceeding $3.5 billion.

The Federal Emergency Management Agency (FEMA) established the National Flood Insurance Program (NFIP) in 1968 to provide flood insurance and sponsor flood risk reduction projects. However, since then, climate change, exposure growth and inflation have significantly increased the costs of rebuilding after natural catastrophes. An additional challenge for the NFIP is the low take-up rates outside high-risk coastal counties. In recent years, claims from tropical-cyclone flooding have resulted in NFIP accumulating $20 billion in debt to the U.S. Treasury.

These debts have required several congressional bailouts. While NFIP participation is mandatory for federally backed mortgage holders, it is capped at levels often considered inadequate for flood restoration. As illustrated by 2024's Hurricane Debby, much of the flooding occurs outside FEMA mapped flood areas, where flood insurance uptake remains stubbornly low. In 2021, Risk Rating 2.0 was introduced by FEMA to move the NFIP toward actuarially-sound pricing, with staged increases that will double prices for many policyholders, especially those at high risk.

It is possible to source private insurance, but flood cover is an add-on in most cases. Between 2021 and 2024, private insurance costs rose by 24% on average, with some states experiencing 40%-60% increases.

NFIP penetration rates in the area affected by these floods are among the lowest in the country. Impoverished communities in the U.S. have a disproportionately high flood risk exposure, and insurance affordability is contributing to a widening insurance protection gap.

Globally, disaster financing responses are under many of the same pressures. Approaches vary from country to country, with each insurance market using a range of levers to reduce flood exposure. One approach is restricting access to credit or rebuilding aid for those without insurance, thereby providing incentives for or even mandating coverage uptake. Another strategy is balancing public and private involvement, with models ranging from fully government-backed systems to entirely private markets. Some countries require disaster insurance, while others leave it voluntary or have the state cover disaster recovery costs. Additionally, the choice between offering comprehensive (all-risks) versus hazard-specific policies depends on the structure and capacity of national insurance systems. Finally, applying risk-based versus subsidized pricing is a critical consideration, where premiums may reflect actual risk or be offset by cross-subsidies or government support.

For example, in France, carriers are supported by the Compagnie Centrale de Reassurance, a public-sector reinsurer that provides a low-cost reinsurance plan for natural catastrophes and uninsurable risks. Though this service does undermine the private reinsurance market, it has allowed France to achieve penetration rates for natural catastrophe coverage close to 100%.

Under an unusual model in Switzerland, cantonal (provincial) insurers offer all-perils cover; however, they also participate in land use planning and donate significant amounts to measures that reduce risk. Insurers should expect that nation states will commit to effective flood management and land use planning in new and existing developments, while property owners must make their homes more resilient. How this is achieved will vary by country and market. But as losses continue to rise, long-term policies should be reviewed to ensure the most vulnerable are not left behind as climate change increases risk.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Supply chain cyberattacks have surged 431% as insurance firms face mounting threats from third-party vendor vulnerabilities.

It's a common misconception that the "supply chain" only applies to the movement of physical goods. However, the insurance supply chain (which connects reinsurers, carriers, agencies, and customers) is a key example of a non-tangible connection. Through this chain, brokerages, agencies, and carriers all provide customers with competitive products, dependent on each other's expertise and financial capacities.

With this connectivity comes a wealth of opportunities and risks. Insurance firms within the chain that rely on third-party vendors, and those that are increasingly digitizing their operations, put themselves at an increasing threat of cyberattacks.

Risks may vary from firm to firm. However, supply chain attacks in general increased by 431% across two years, indicating now is not the time to assume your firm isn't affected.

Global insurance businesses that digitize their services, including documents and other operations for efficiency and accessibility, are doing so while increasing their cyberattack surfaces. The more third-party software and network devices are rolled out, the more opportunities there are for hackers to target.

Third parties pose an increasing level of risk to operations within global insurance supply chain. Regrettably, as secure as your own networks and processes might be, any lapses in your software or hardware vendors' securities may still put you and your customers at risk. In fact, operational risk from third parties is now a leading concern for companies on most chains.

With modern insurance firms reliant on content management systems, cloud storage and servers, and customer relationship management software solutions, they cannot simply avoid working with third parties.

What's more, cyber risks emerge in the global insurance supply chain when there is variation in security policies and standards between linked firms, and when parties simply neglect to update software versions, hardware, and security processes.

This is all compounded by the fact that hackers see insurance companies as prime targets for ransomware and data theft. The data you possess on customers is not only sensitive but also financially lucrative in the wrong hands. It also provides cybercriminals with a target list of organizations, as well as an understanding of the limits their insurance will cover, any exclusions that may apply, and the terms and timelines of payments. This enables them to focus and customize their efforts on both attack vectors of the victim organization and the amount of funds they can look to extort from the victim organization, maximizing their ability to achieve an ROI on their time and resources.

Although cyberattacks are evolving in scope and sophistication (for example, through the proliferation of artificial intelligence), there are still many common vulnerabilities that supply chain insurers can easily monitor and patch, and implementing strategies to address these gaps can further strengthen your defenses.

What's more, in cases where weaknesses may not be so obvious, firms use penetration testing techniques to map out security flaws beneath the surface.

Here are some common vulnerabilities in the supply chain that insurers must keep vigilant for:

Of course, the risks facing any specific insurer or agency will vary. However, companies can best prepare themselves (alongside working with a cybersecurity expert) by consulting OWASP's software supply chain security cheat sheet, which breaks down the threat landscape affecting software artifacts and explores potential risk mitigations.

Cyberattacks are no longer "just problems for IT to worry about." They pose a genuine risk to business operations and customer livelihoods, particularly given the scope and depth they can reach in the current landscape.

Cyber risks in the insurance supply chain could result in innocent firms losing customer data, revenue, and reputation. Even with a robust internal security process, companies may also risk falling foul of compliance violations, leading to heavy fines and further reputational damage.

Any data leaked through European Union vendors, for example, may fall under the scope of the GDPR, where businesses can face fines stretching into the millions.

The "domino effect" of a cyberattack on the insurance supply chain could see multiple vendors (and therefore thousands of customers) at risk of data loss and operational slowdown.

For example, a reinsurer attacked by ransomware, which holds systems to ransom until payment is made to hackers, may freeze operations for other firms dependent on their expertise further down the chain.

Effectively, the right (or indeed wrong) attack could halt the movement of the supply chain for indeterminate amounts of time, causing loss of revenue, loss of business, and customer trust.

Although there is no way to entirely remove cyberattack risk from the insurance supply chain, there are stringent measures individual business owners can take to protect their interests (and others). For example, they might:

Of course, it is still prudent to consult cybersecurity professionals for a customized analysis and action plan (as these steps offer a high-level overview of potential actions).

Ultimately, every level of an insurance supply chain firm must take cybersecurity seriously. That means there needs to be oversight and buy-in from the top downwards, with a company culture built around data compliance and on the principles of zero trust.

The best step an insurance firm can take immediately is to start embedding a culture of risk preparation and proactive remediation. This is easily started by taking greater care in vetting new partners, training internal staff, and adopting more stringent access controls.

What's more, there needs to be open communication and collaboration. Regardless of where attacks may stem from in the supply chain, pointing the blame only wastes time and resources even further. Take care of your own cybersecurity, but at the same time, plan to support your partners and others in the chain with accountability, awareness, and proactive measures.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Aminzade is vice president of managed compliance services at VikingCloud.

He has over 26 years of experience within cyber, information security and compliance industries.

Insurance enterprises abandon comprehensive data governance and focus on critical data elements that drive measurable business outcomes.

In today's insurance enterprises, data underwrites every decision - from pricing precision and reserving adequacy to regulatory compliance and capital efficiency. Yet even the most data-rich insurers stumble on a deceptively simple question – "which data truly matters most"?

The answer isn't found in a massive catalog or a one-size-fits-all governance policy. It lies in identifying the Critical Data Elements (or CDEs, as we call them) that have a direct measurable impact on the business and managing them with the right level of accountability.

Traditional governance programs treat criticality as an inherent property of the data. Teams document everything, classify exhaustively, and build controls across the board, assuming completeness equals control.

In insurance, however, data criticality is not a technical attribute. It's a business condition. A policy effective date that drives billing cycles or a loss development factor in a statutory filing is far more "critical" than a seldom-used rating variable, even if both sit in the same table. What matters is the business consequence of error, not the data's complexity.

Consider these business impacts when evaluating whether a data element qualifies as critical:

Remember, the goal is not to govern everything. It is to govern what drives the business.

Once identified, CDEs need governance proportional to their business scope and risk. A two-tier approach balances enterprise oversight with domain execution:

This tiered structure prevents both under-governance and over-governance. Enterprise CDEs get the control they require, while domain CDEs stay agile and business aligned.

This four-phase framework aligns with how leading insurers already deliver data products and analytics.

A well-implemented CDE framework turns governance from a compliance exercise into a business enabler. When governance aligns with value creation, it no longer slows innovation… it amplifies it. For insurers ready to move beyond traditional data governance, focusing on what truly matters - the critical few rather than the comprehensive many -offers a path to both better control and greater agility.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Anil Venugopal is chief technology officer at PremiumIQ.

He has over two decades of experience in digital strategy, data management, and analytics.

Technology-enabled prevention transforms agents into risk advisors as winter water damage threatens coverage sustainability

Each winter, the same hazard returns: a sudden freeze that could lead to burst pipes and costly water damage inside homes. And when families are away for winter break or holidays, the damage can be even more disastrous. For insurance professionals, the pattern is predictable, yet preventable. This is the season when agents and brokers can play one of their most valuable roles: guiding homeowners toward practical steps that reduce risk, protect coverage and reinforce the value of good advice.

Every year, insurers see a surge in water-related claims as temperatures drop. Water damage accounts for over 40% of all winter insurance claims, with frozen pipes being the leading culprit. When water freezes, it expands, creating enough pressure to rupture pipes and release hundreds of gallons in minutes.

The damage extends far beyond what's visible. Burst pipes can ruin drywall, flooring and electrical systems, while residual moisture fosters mold growth that adds weeks to restoration timelines. According to the Insurance Information Institute, water damage — including freezing events — is the second most common cause of home insurance claims annually, representing roughly 22–29% of all reported losses. The average cost per claim exceeds $15,000. Across high-net-worth carriers, that number jumps to $55,000. And those figures spike even more when leaks go undetected.

Despite widespread awareness, these losses remain stubbornly common. Frozen pipes often occur in overlooked areas — basements, crawl spaces, attics or exterior walls where insulation or heating is limited. Homeowners often underestimate the risk, assuming that newer homes or mild climates offer protection. However, extreme cold events in traditionally temperate regions, such as the Texas freeze of 2021 ("Snowmageddon"), have proven that every property can be vulnerable.

Climate variability is also expanding the risk map. States that rarely faced hard freezes are now experiencing them more often, catching both homeowners and insurers off guard. As the boundaries of winter risk expand, preparedness and the agents who promote it have become essential to preserving insurability.

In today's ever-changing property market, the agent's role is no longer limited to securing coverage; it's about helping clients prevent losses that threaten their eligibility altogether. Homeowners now expect their insurance partners to act as risk advisors, not just intermediaries.

Independent agents and brokers must step up to fill this role. They can help clients understand how simple preventive measures — such as insulating exposed pipes, maintaining indoor heat and shutting off outdoor spigots — reduce the likelihood of catastrophic loss. But beyond basic maintenance, agents can guide homeowners toward the next generation of home protection: automated risk mitigation technologies that stop losses before they start.

Automatic water shutoff valves and smart leak detection systems have become critical tools for modern risk management. These devices continuously monitor water flow and pressure, shutting off the main supply when irregularities suggest a leak or burst pipe.

According to data from LexisNexis, homes equipped with smart shutoff valves experience up to 90% fewer water loss claims. Many insurers now recognize this impact, offering premium credits or underwriting incentives for verified installations. In some regions, particularly California, these devices are even becoming part of recommended mitigation programs or programs that provide incentives, alongside wildfire prevention measures.

However, while technology can dramatically reduce losses, proper installation and verification are key.

A growing concern for both homeowners and insurers is improper installation. A smart valve installed incorrectly — too far from the main line without full system integration or missing essential sensors — can fail when it matters most. Worse, it may void any insurance discount or invalidate mitigation credits.

That's where guidance from a knowledgeable agent becomes invaluable. Agents can help clients ensure these systems are installed by licensed, reputable professionals who understand manufacturer specifications and insurer expectations. A properly installed device reduces loss potential and ensures that mitigation efforts are recognized and validated in underwriting.

Agents can further support their clients by recommending that they:

When these steps are part of conversations, agents demonstrate their value as proactive partners who connect and ensure their clients are protected against losses year-round, not just at renewal time.

The difficulty many homeowners now face in securing coverage, particularly in high-risk states like California, underscores why prevention must become a priority. The 2025 PRMA Private Client Insurance Insights Survey found that one in five high-net-worth homeowners nationwide have struggled to obtain insurance, rising to nearly one in three in higher-risk states.

Sustainability in the personal lines market will depend on pricing, capacity and prevention. Agents and brokers can help homeowners take that step by:

Each of these actions strengthens client trust while aligning with the industry's growing emphasis on resilience.

Winter may bring claim volume, but it also brings opportunity for agents and brokers to demonstrate their role as trusted advisors. By helping homeowners take practical steps to prevent frozen pipe failures and leveraging modern technology for continuous protection, they can significantly reduce water losses and improve client outcomes.

This is what the next era of property protection looks like: data-informed prevention, technology-enabled risk management and human expertise guiding both.

The agents who embrace this shift will help shape a more sustainable, resilient insurance market for years to come, ultimately benefiting their clients.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Vacquier is chief executive officer of Beagle Services, which helps homeowners prevent costly water damage through technology deployment, smart valve installation and monitoring.

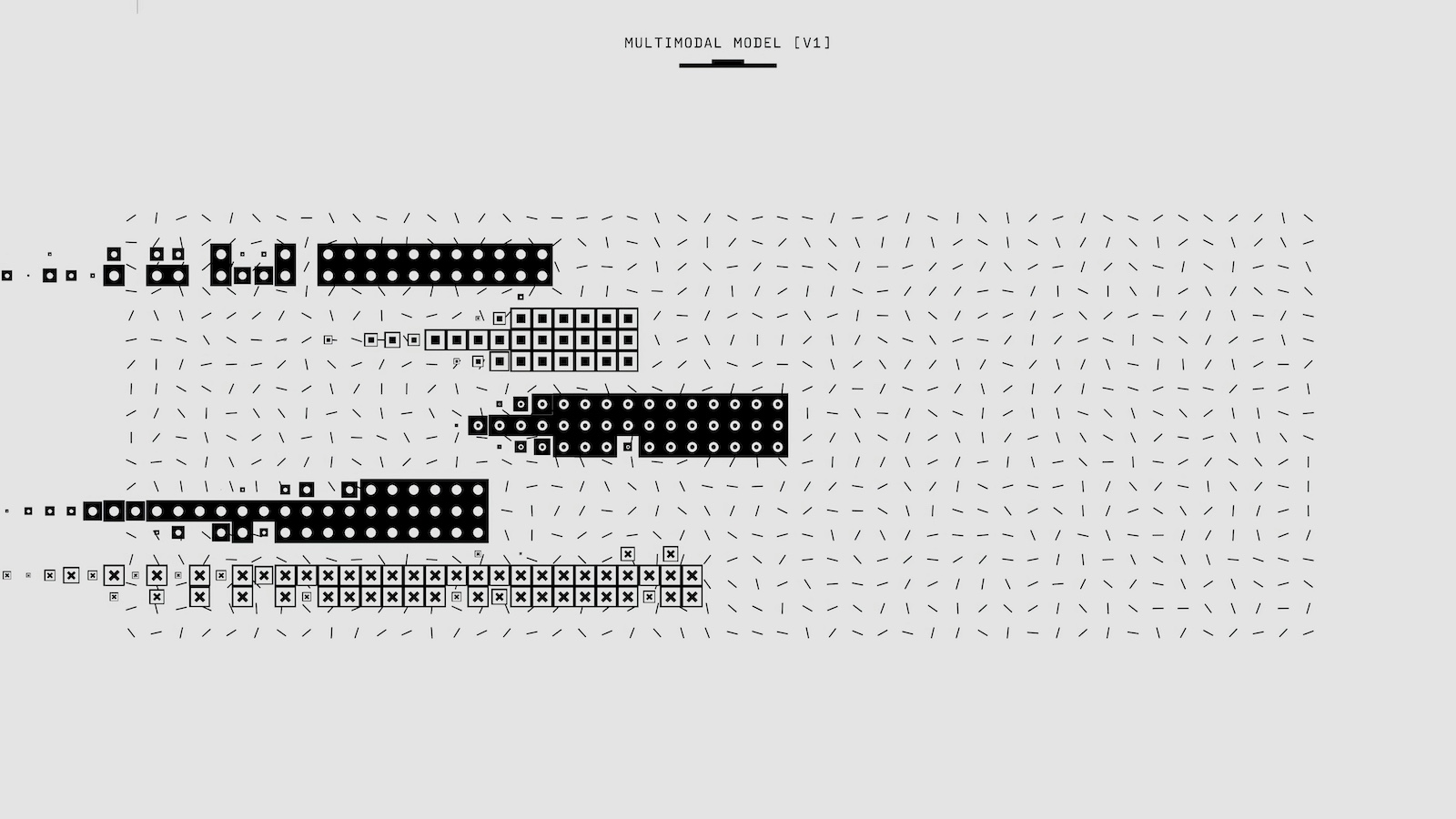

MIT research reveals 95% of AI pilots fail to deliver value as enterprises skip crucial tool-building for flashier autonomous agents.

Over the past year, the potential of AI agents has captured the imagination of many enterprises. Projects like AutoGPT and frameworks such as LangChain and CrewAI have enabled AI systems to take autonomous actions: reading and analyzing documents, calling application programming interfaces (APIs), and making decisions on their own. The promise of these models is enticing AI that doesn't just chat but acts.

Insurance and financial services leaders are envisioning the automation of complex tasks, such as handling claims or investigating possible fraud cases using these intelligent agents.

Yet, amid the hype, a new MIT Media Lab report found that, despite $30–40 billion in enterprise AI spending, 95% of organizations have not seen a measurable return on these investments. Only a handful (about 5%) of AI pilots are delivering tangible value, while the rest stall out with no effect on the bottom line. This creates a noticeable gap that separates the few companies gaining value from these agents from those stagnating in experimentation.

Therefore, we must inquire as to the cause of this divide. It's not model quality or lack of enthusiasm, as evidenced by the executives who are eager to adopt AI, resulting in 90% of these executives having seriously explored solutions with these models. The core of the issue is in the approach.

Early enterprise AI efforts struggled with their integration of AI into real value creation workflows, as these efforts were lacking in mechanisms for the AI machine to learn and adapt. According to a recent report published by MIT called the "State of AI in Business 2025," in large organizations, only 5% of custom AI tools ever make it from their early pilot version to production-ready models. The rest never move beyond proofs of concept, often because they remain unable to handle the complexities of real-world cases.

To make real progress in AI, organizations need to rethink their approach: Rather than jumping straight to autonomous agents, they should first master the fundamentals by developing robust AI-powered tools. Simply put, walk before you run.

Cases exist of individual employees already figuring this out. In their "State of AI in Business 2025" survey, MIT researchers found that while only 40% of companies officially bought an LLM subscription, employees at over 90% of firms were using personal AI tools (like ChatGPT or Claude) to speed up their work. These "shadow AI" users succeeded by leveraging focused tools (e.g. drafting emails, summarizing texts) that deliver quick wins.

Enterprises can learn from this pattern. By deploying a portfolio of narrow and reliable AI tools that augment specific tasks, organizations set the foundation for bigger agent-driven transformations. It's a phased approach to AI maturity, one that is proving far more effective than leaping straight into "autonomous everything" without significant groundwork.

To understand why developing specialized tools comes first, it helps to demystify and better understand how AI agent frameworks work. An agent works as a decision-making engine (often a large language model) that can perform a series of reasoning steps toward a goal. Crucially, these agents aren't all-powerful on their own, they rely on tools to take actions in the world outside the AI's own mind. A tool, on the other hand, is an external function or API that the agent can invoke. For example, an insurance-focused agent might have tools for retrieving a customer's policy data, running a fraud check, or sending an email. The agent's job is to figure out which tools to use, in what sequence, to accomplish a complex task.

In practical terms, agent frameworks implement a loop often described as "think, act, observe". The AI agent "thinks" (meaning that it generates a reasoning step in natural language), decides to invoke a tool with some inputs, then "observes" the tool's output and incorporates it into the next reasoning cycle. This continues until the agent arrives at a final answer or action.

An agent is like a sophisticated orchestrator or problem-solver, and tools are the discrete capabilities it can leverage (query a database, call an API, run a calculation, etc.). The agent chooses and sequences tools to achieve an objective. This means that the agent is only as powerful as the tools given allow it to be. If the tools are weak, unreliable, or non-existent for a needed function, the agent will inevitably stumble. This is why building a robust toolset is a necessary and important step in the foundation of an agent.

For instance, imagine asking an AI agent to "Process this new claim and flag any anomalies." The agent might first use a document parsing tool to extract key fields, then call a knowledge base search tool to compare details with past claims, then use a calculation tool to compute risk scores, and so on – reasoning at each step about what to do next. The framework (LangChain, CrewAI, etc.) provides the orchestration that ties these steps together and manages intermediate states (so that, say, the result of step 1 can be fed into step 2). It also manages the agent's memory, which in this context means the information the agent retains as it moves through the sequence. Memory could include the conversation history or results from prior tool calls, allowing the agent to maintain context over multiple turns.

Not every task calls for an agent. Some are better handled by sharp, single-purpose tools. An AI tool might be something as simple as a document summarizer, a language translation function, or an email classification model – narrow in scope but high in accuracy.

Tools can be deployed directly into workflows (for example, auto summarizing each incoming claim report). In contrast, an AI agent tackles open-ended tasks that involve multiple decisions or tool uses (for example, handling an entire claims adjustment process). Trying to skip straight to agents without a base of proven tools is a recipe for frustration.

For enterprise leaders, the takeaway should be clear: Tools are the building blocks of any agentic system. If you want an AI agent to reliably execute a multi-step process, you must first invest in those individual steps as standalone competencies. Think of it like training an employee – you wouldn't expect a new hire to handle an entire claims process on day one without first ensuring they know how to do each component task (review documents, check databases, draft responses). Equipping an AI agent is similar; you need to furnish it with dependable mini-skills and data access (the tools) and then give it the autonomy to string them together.

Just as you wouldn't deploy a piece of software to production without testing each module, you shouldn't deploy an autonomous AI agent without first proving out the individual tool actions, data connections, and guardrails. Tools are an important foundation in the building of AI agents, and any individual or company that wishes to use AI agents in their workflow or systems should prioritize developing strong tools.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Alejandro Zarate Santovena is a managing director at Marsh-USA.

He has more than 25 years of global experience in technology, consulting, and marketing in Europe, Latin America, and the U.S. He focuses on using machine learning and data science to drive business intelligence and innovative product development globally, leading teams in New York, London, and Dublin.

Santovena received an M.S. in management of technology - machine learning, AI, and predictive modeling from the Massachusetts Institute of Technology, an M.B.A. from Carnegie Mellon University, and a B.S. in chemical engineering from the Universidad Iberoamericana in Mexico City.

Shravankumar Chandrasekaran is global product manager at Marsh McLennan.

He has over 13 years of experience across product management, software development, and insurance. He focuses on leveraging advanced analytics and AI to drive benchmarking solutions globally.

He received an M.S. in operations research from Columbia University and a B.Tech in electronics and communications engineering from Amrita Vishwa Vidyapeetham in Bangalore, India.

Poor documentation triggers domino-effect delays in claims processing, but property capture technology offers insurers an innovative solution.

Insurance claims are complex enough without the added frustration of delays. Yet in high-volume environments, whether at a small independent agency or a large commercial firm, delays tend to stack up like dominoes, one problem leading to another. And delays are becoming more common.

According to a J.D. Power study released this year, homeowner satisfaction with insurance claims is decreasing. Mark Garrett, director of insurance intelligence at J.D. Power, summarized the findings, saying, "Customers are, in essence, paying higher prices for slower service. The average claimant does not receive final payment on a claim until 44 days after the first notice of loss, and unless insurers are communicating frequently and clearly along the way, customer satisfaction suffers."

The good news is many of these delays can be prevented, starting with how claims are documented.

The tactical reasons insurance claims are delayed will be very familiar. But what may be less apparent is that many delays in claims processing can be traced to one of three main causes—complexity, inefficient internal processes, and incomplete or inaccurate documentation—or a combination of these factors.

While insurance adjusters can't make complex claims simpler, nor can they single-handedly solve inefficiencies, they can address the problem of incomplete or inaccurate documentation. Poor documentation at the start of a claim almost always guarantees setbacks later. In fact, it can trigger a domino effect of delays, including the need for repeat visits to a site, additional inspections, poor communication among the parties, and even potential coverage disputes.

The importance of claim documentation isn't a new concept. Any number of insurance guides encourage policyholders to document claims to ensure accuracy and minimize disputes later. But for both insurers and the insured, accurate documentation can be harder than taking a few pictures.

Even a high number of digital images doesn't always capture the right shot, and images may miss small details that restoration contractors need to know to restore a structure to its "before" state.

Accuracy of measurements is another challenge in damaged spaces. Hand measurements are time-consuming and prone to errors, which makes them open to dispute. Claims are delayed when multiple trips are needed to a site to confirm measurements or to obtain a missed measurement.

Once the documentation is gathered, there is also the challenge of combining it in a single place where all parties can easily access it, including adjusters, contractors, insurance firms, and policy holders.

While one solution can't solve every problem, property capture technology is proving to be an effective tool to improve the accuracy and efficiency of property damage assessment, thereby ending the domino effect of other delays.

In simplest terms, property capture technology combines LiDAR (Light Detection and Ranging) scanning with 360º photography to capture spatial and visual records of a property in a single site visit.

Using time-of-flight LiDAR scanning, property capture technology provides highly accurate spatial data using laser-based distance measurements that are quick and non-invasive. For example, a residential home can often be scanned in less than 15 minutes. The technology, such as that offered by iGUIDE, can capture thousands of precise measurements in minutes with measurement uncertainty as low as 0.5% or better for distance measurement on a floor plan and 1% or better for square footage.

The 360º photography provides a complete visual record with high-resolution still shots, as well as a 3D virtual tour so all parties have a complete visual documentation record in a single visit, eliminating the need to make multiple site visits.

With property capture technology, adjusters never have to worry about not having the right shot or errors in manual measurements.

Certain property capture technology platforms feature additional user-friendly features that aid the claims documentation process. Some automatically generate floor plans from the collected data and provide an automatic integration with Xactimate®, the leading property estimation software. This tool is enormously helpful for contractors, enabling them to prioritize and plan how best to restore the property.

Select platforms also feature a real-time tagging feature that lets adjusters add photos, videos, descriptions, and other documentation on-site, streamlining the process and reducing post-processing time while giving a more complete picture of the loss. For example, rather than make a written record of a moisture meter reading, users can create a tag with an image of the reading when documenting the property, so it appears automatically in the generated output.

The combination of these features on a centralized platform with 3D virtual tours and detailed floor plans facilitates smoother communication and collaboration among all parties.

Insurance companies will always have to contend with claim delays for various reasons, but poor documentation need not be one of them. Property capture technology can help avoid the domino effect of claim delays to ensure accurate and thorough documentation from the very beginning of every claim. It is a proven documentation method that leads to faster claims settlement for improved customer satisfaction and happy, returning clients.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Vervena is vice president of sales and business development at iGUIDE, a platform for 3D virtual tours, floor plans, and property data.

He has over 20 years of experience in tech and marketing.

Life insurers are shifting from hyper automation to hyper personalization, creating flexible journeys that adapt to individual customer needs.

Discussing life insurance is a conversation most people would rather not have. It's about mortality. That makes it uncomfortable and deeply personal, yet historically, the process of buying life insurance has been anything but personal. Daunting paper forms, long phone calls, multi-week wait times and workflows that treat every applicant the same. That friction doesn't just frustrate people; it slows access to something designed to protect families during life's hardest moments.

The emotional stakes of life insurance are high, and the application experience needs to meet people with the same care, speed and clarity they've come to expect in today's digital world, whether that's ordering breakfast ahead of time, booking a ride in seconds, or streaming a movie with one click.

For years, the industry has focused on hyper automation: data, machine learning, and advanced workflows to remove manual steps and streamline decisions. That remains critical. But the next frontier is hyper personalization. One-size-fits-all digital journeys won't work.

The process of filling out the application should fit each customer, accounting for their health profile, life events, distribution channel, and product selection. The process should happen however the customer wants: fully digital, fully supported by an advisor, or somewhere in between. That means building ecosystems that can adapt to each customer.

Transformation isn't just an engineering challenge. It requires both technologists and business experts, with deep experience, so business expertise is embedded directly inside technology.

This approach bridges the traditional divide. Product and transformation leaders ensure that the team is not just building systems that work but building systems that solve the right problems for customers, advisors and distribution partners.

Emerging AI technologies have the potential to meaningfully improve the customer experience and enhance the overall buying process. We see opportunities for AI to surface new insights, drive faster operational workflows, and improve back-office efficiency. AI can efficiently complement the human expertise we will continue to rely on to make underwriting decisions, process claims, and provide personal support when you need it.

There is no longer a single "insurance journey." Applicants may want to apply from their phone in 15 minutes or sit down with an advisor they've trusted for years. Many want a blend, starting digitally, then shifting to human guidance when the decisions feel weightier. The role of the life insurance industry is to support all paths with flexible, intelligent systems.

For advisors, transformation means less time chasing paperwork and more time guiding clients. With better tools and fewer administrative burdens, advisors can focus on what matters most: helping families choose the right protection.

The life insurance industry is shifting from a process that was once slow, rigid and static to one that is fast, flexible and deeply personal. It's not about choosing between speed and personalization any more. We at Legal & General America have to deliver both. Because when the worst day comes for a family, they deserve protection that was easy to secure, affordable to maintain, and designed with their unique needs in mind.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Brooke Vemuri is vice president, IT and innovation, at Banner Life and William Penn.