Phoenix just wrapped up a month in which the high temperature exceeded 110 degrees Fahrenheit every day — many who simply fell in a parking lot had to be treated for burns from the asphalt. Water temperatures off the Atlantic coast of Florida exceeded 101 degrees, near the maximum recommended for hot tubs. The average global temperature on July 6 was the hottest on record, and the U.N. says we've entered "an era of global boiling."

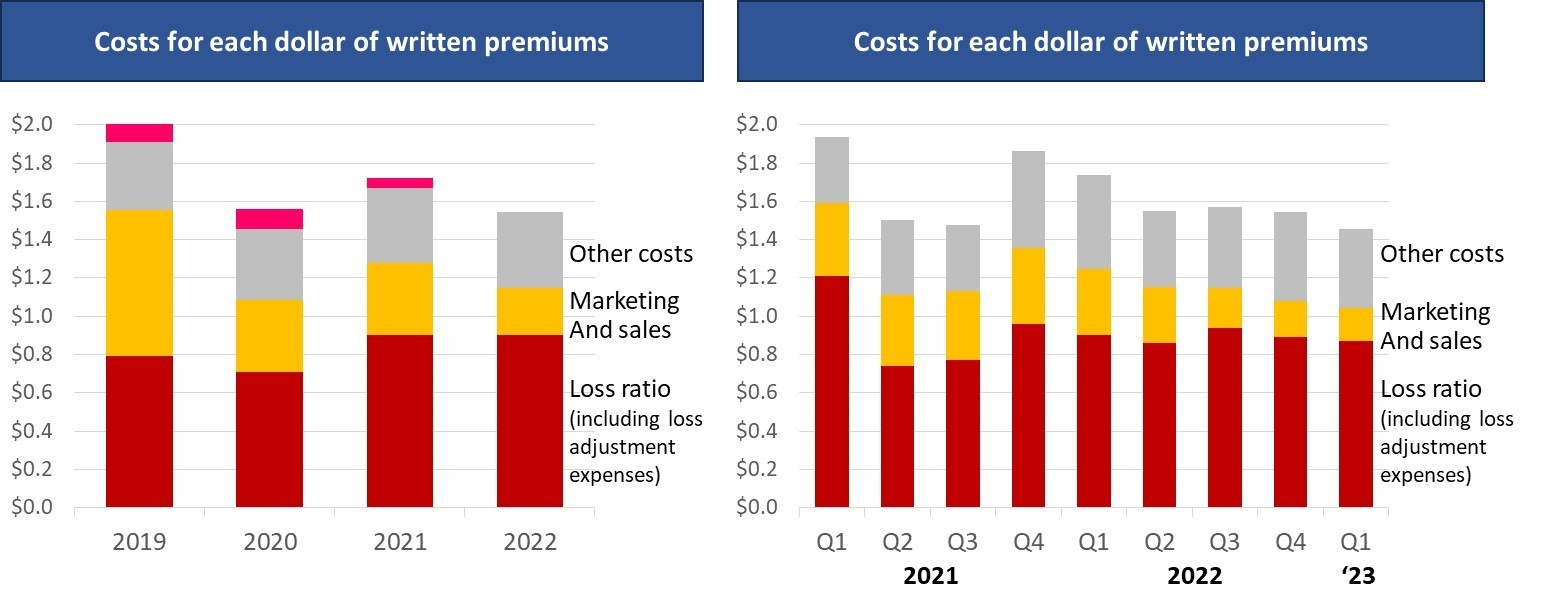

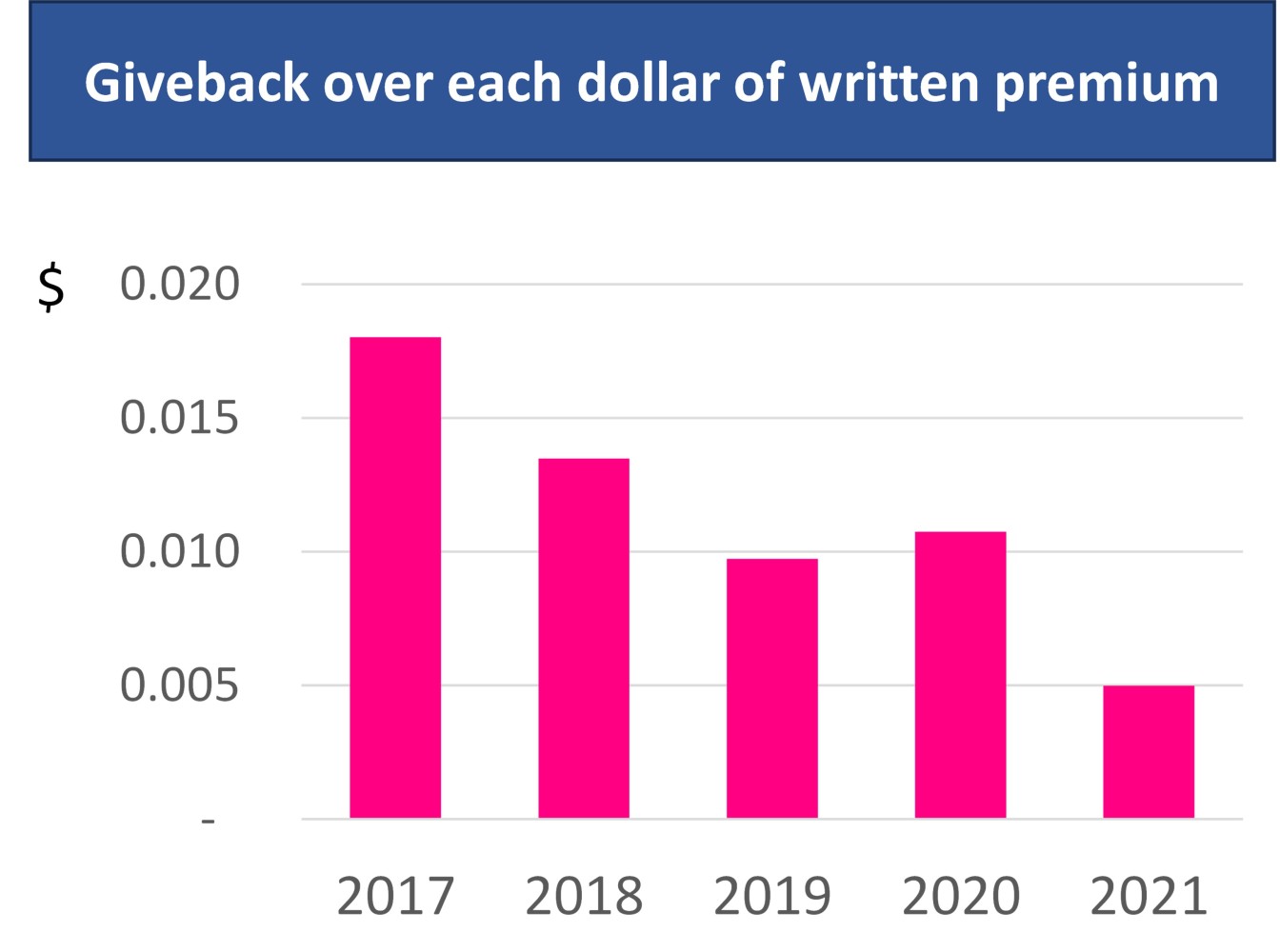

Challenged by climate change, home insurers in the U.S. have lost money in five of the past six years and continued to rack up losses in the first half of 2023, according to an article that appeared in "the Wall Street Journal over the weekend. Insurers are raising rates as fast as they can, while narrowing coverage or even exiting troubled markets, the article says, but it quotes a colleague of ours from the Insurance Information Institute as saying underwriting losses are expected to continue through 2025.

"Progressive, for example, said catastrophe losses last month ate up 92% of home-insurance premiums earned" because of severe weather, the article said.

By raising rates and reducing coverage, insurers aren't just tackling their business problems but are sending signals to homeowners that will encourage them to reduce their risks from severe weather. Increases of thousands of dollars in premiums tend to grab people's attention, and media coverage is amplifying the message.

Still, I think insurers need to greatly accelerate two incipient, data-related initiatives. Insurers need to be much more specific in their risk assessments and communicate them to clients — don't just tell me what my premium is; tell me that the vegetation around my house and my shake roof have increased my wildfire risk and thus my premium by X percent. Insurers also need to work with regulators to show that they have to be able to use predictive models to set rates, rather than base them entirely on historical data.

Setting rates for the 2020s based on historical data doesn't work when, according to the WSJ piece, insured damage in the U.S. from severe storms, wildfires, floods and other natural disasters averaged $40 billion for the 2000s and $54 billion for the 2010s (adjusted for inflation) while the figure has topped $90 billion in each of the past three years.

I'm especially sensitive to the recent heat wave because I had my own brush with wild weather over the weekend in Washington, DC, one that ended happily only because of an alert brother-in-law.

The weather has been exceptionally hot for DC, reminding me of visits to Florida — blistering, muggy days have repeatedly turned into thunderstorms in the late afternoon. On Saturday, my elder daughter and I stepped out of the National Gallery of Art into a moderate rain to walk a half-mile to a Metro stop to go see one of my sisters and her family for dinner in Arlington, Virginia. But as soon as we started to cross the National Mall — where there is no shelter to be found — thunder and lightning erupted, and we were in the middle of the most violent rain and windstorm that I may have ever experienced. Metal signs tore loose and starting flying at us from behind, and we began running.

We made it to the Metro — where we stood, so we left our puddles on the floor, not the seats — and the storm subsided by the time we got to Arlington. As my sister drove us to her house, though, we had to take several detours because any number of massive trees had been uprooted and fallen across residential streets, blocking them. Most of the traffic lights were out because Arlington had lost power in many areas—- as had some 200,000 people in the DC area. Fallen trees and severed branches had crumpled some roofs.

My sister's house was undamaged, partly through the luck of the draw but also because her husband had become concerned about a massive branch of an old tree that was drooping toward their roof. He had a tree service cut the branch off a week before the storm hit.

If everyone were as prudent as Erik, the world would be a safer place with much lower insurance premiums. In the absence of that possibility, though, insurers can push people in his direction.

A recent McKinsey article explores two ways, in particular, that AI can lead to better underwriting and, as a result, better understanding of and mitigation of risks.

The article quotes an executive from ZestyAI as saying its analytics tools can let carriers tell a customer, “'We are giving you a wildfire score of eight because you have 70% overhanging vegetation, you have a wood shake roof and you are on a 15-degree slope.'” The executive added: "The former two, you can change. The last one, you cannot. And then when renewal season comes, the insurance company can say, 'Dear homeowner, have you made those recommended changes to mitigate your risk?'”

Another ZestyAI executive said it's key to model the risk property by property. He said: "I think even the DOIs [departments of insurance] would agree here, [that] the traditional risk models spread risk across large regions versus having a laser-focus on the individual property. So in the case of the traditional model, for example, everything east of I-95 in Florida might be considered all the same risk, when, in reality, it’s not."

Specific information about risks, along with an opportunity to address them, could go a long way. I could even imagine doing something akin to what OPower (now a part of Oracle) does with energy bills: letting people know how they stack up against their neighbors in terms of energy-efficiency. One of the cofounders told me years ago after we were on a panel together that his earlier work on political campaigns had shown him that the best way to get people to vote was to send them a note showing how their voting record compared with their neighbors'. He took that idea from politics to energy, where he nudges me every month and surely nudges many of you to think about how you compare with others.

Imagine how that might work with, say, wildfire risk: "Your risk puts you in the XX percentile compared with similar families in your area...."

You could even extend the idea to communities, given that your wildfire risk rises or falls based on what your neighbors do: "Your community ranks in the XX percentile compared with similar communities in the Sierra Nevadas...."

Peer pressure can be very effective.

The other key piece is that, as one of the ZestyAI executives said, the models for risk have to be predictive, "trained on the right amount of loss history.... That’s where the future has to go: Risk assessment has to be rooted in property-specific insights, and it has to be forward-looking. It can’t be just stochastic simulation."

His colleague said that will be a challenge for regulators, who want to deal in facts, not projections: "You will see a collision between an exponentially improving product versus a pretty static or maybe linearly improving regulatory landscape and IT landscape. I think you can build 10 times better products, but if you can only bring them to the market at the pace at which regulators would approve them, it’s still going to be a challenge."

The executives did express some optimism because ZestyAI recently got an AI model accepted as part of a rate filing in California. Winning approval took three years, but ZestyAI hopes that approvals will become simpler as regulators get more comfortable with AI and predictive models.

Carriers have their work cut out for them as they try to reverse years of losses on homeowners insurance while dealing with increasingly severe weather. But AI that enables property-by-property risk assessments and that allows for better predictive modeling (subject to regulatory approval) will increasingly help carriers and customers reduce risks.

In the meantime, we can all just try to be more like Erik.

Cheers,

Paul

At OZ, Murray plays a pivotal role in understanding our clients’ businesses and then determining the best strategies and customer experiences to drive their business forward using real-world digital, marketing, and technology tools. Prior to OZ, Murray held senior positions at some of the world’s largest digital agencies, including Razorfish and Sapient, and co-founded and ran a successful digital engagement and technology agency for 7 years.

At OZ, Murray plays a pivotal role in understanding our clients’ businesses and then determining the best strategies and customer experiences to drive their business forward using real-world digital, marketing, and technology tools. Prior to OZ, Murray held senior positions at some of the world’s largest digital agencies, including Razorfish and Sapient, and co-founded and ran a successful digital engagement and technology agency for 7 years.