In his quarterly conversation with Insurance Thought Leadership, Dr. Michel Leonard is optimistic about the prospects for growth in the P&C industry and for an abatement of the punishing inflation in replacement costs. “After a very difficult two years, given the pandemic economy and so forth, we're heading into a better place for the P&C industry,” he says. But he also warns that the Fed has left the door open to continuing its interest-rate increases into 2025, which would shock financial markets, create new headwinds for the economy and delay the P&C industry’s recovery.

Listen Now:

Paul Carroll

Hi, I'm Paul Carroll. I'm the editor-in-chief at Insurance Thought Leadership. I am joined today by Dr. Michel Leonard, who among the other hats he wears is the chief economist for Triple-I, the Insurance Information Institute. We have these conversations every quarter to get his thinking on the latest outlook for the economy in general, and insurance in particular, I always look forward to these very much. So Michel, thank you as always for joining me today.

I looked at your outlook. And as usual, it's Michel giveth and Michel taketh away. I thought maybe we'd start with the giveth part very quickly to hit the headline numbers. Those headline numbers are about the outlook for the P&C industry versus GDP and the outlook for replacement costs as opposed to inflation. And then after that, we'll get into the Michel taketh away part, where you're going to talk about how interest rates are likely to keep rising even through 2025.

Having teed you up a little bit, how about you start us off with those headline numbers on P&C?

Dr. Michel Leonard

Absolutely, Paul. Again, always a pleasure to be here and to have this conversation. I can't wait to get to the second part of this conversation. But we're going to have underlying growth, which as your listeners recall is the economic driver for the P&C industry. That's going to be 1.3% [underlying growth for P&C in 2023] versus 2.1% [for U.S. GDP]. We are still a little below the overall GDP in 2023, but… there's a positive trend there. If this trend continues next year, underlying growth for the industry will be larger than for overall GDP. For 2024, we're estimating that will be around 2.6% for the industry versus 1.7% for the overall economy. Going into 2025, we’re estimating 4.5% for the industry versus 2.0% for the overall economy.

We're being optimistic there. What your listeners should take away here, Paul, is the trend. After a very difficult two years, given the pandemic economy and so forth, we're heading into a better place for the P&C industry.

Paul Carroll

Tell me about rate increases. My impression certainly has been that we're kind of topping out, and that the Fed was optimistic enough about inflation that they were going to stop raising rates. So I was surprised most of all by what you were saying [about interest rates in your outlook]. I gather that you found some information lurking within a federal report that makes you think otherwise. Could you walk us through that?

Dr. Michel Leonard

Absolutely. And I share your surprise there. We've talked before about how we were looking forward to the Fed no longer tightening. And in the last few months, we were headed that way. The financial press has been saying, "Okay, we're going to probably have one more increase going into Q1 of 2024, probably around March 1. March was likely to be the latest date for that increase, which we anticipate would most likely be 50 basis points [hundredths of a percentage point] or perhaps split into two increases at 25 basis points each between now and then.

That's the consensus. And we're of course welcoming that, as we've been saying that it's taken too long to [get to the end of the rate increases].

The Fed has been really good in the years since the 2007 Lehman crisis insofar as sharing many of their documents. And I urge your listeners to track down a Fed document called the "Economic projections of Federal Reserve Board members under their assumptions of projected appropriate monetary policy." It's a bit of a technical document, but what surprised me is that when it comes to monetary rates, they now have 25 bps [basis points] or 50 bps going into 2025. That doesn't mean that the Fed will keep raising rates [into 2025]. But it does mean that the Fed is opening a door there.

The Fed doesn't like to change overnight. They always telegraph. So now we're seeing this early telegraphing that [rate increases] potentially could go into 2025. If we tried to speculate a bit more, on the basis of the numbers [in the economic projections document], we could see a 25-basis-point increase early next year, which is less than the market consensus of financial economists. But in addition to that 25-bp increase, there may be a second 25-bp increase, for a total of a 50-bp increase into 2025.

It's a bit different [than the current consensus]. It's a bit unusual. And I thought that would be useful to share with your listeners.

Paul Carroll

I assume the implications of that are negative for the economy and for the P&C industry, right? I mean, the more you're raising interest rates, the more pressure you're putting on different parts of the economy.

Dr. Michel Leonard

Yes. And for this one, one doesn't need to be an economist. When the Fed increases rates, they right away impact housing mortgages and auto loans. Those are the two biggest components [for consumer loans]. And of course, this is largely what we insure in the insurance industry: For personal lines, we repair and rebuild cars and homes; for commercial lines, we repair and rebuild vehicles, commercial buildings and equipment.

And this is why the industry and the overall economy contracted [in 2023]. We were expecting to have a much better 2023, because we thought the Fed would really end the rate increases this year.

Going into 2024, and likely throughout the year, we're still going to have a decline in housing starts. We had a correction, and it got better, but housing starts and auto consumption will likely still lag. And that's bad for everything, not just the insurance industry. That specifically could derail our otherwise optimistic forecasts for the spread between P&C underlying growth and overall GDP.

Paul Carroll

I assume a lot of the reason for the possibility of continued interest rate increases is that the economy has stayed stronger than a lot of people thought. I saw something the other day where somebody was twitting Bloomberg a bit because they’d dug up a headline saying that the consensus on the possibility of a recession in the U.S. had reached 100% for the next year—and that headline was from 366 days previously. That 100% consensus didn't quite work out.

Anyway, I would be interested in hearing your thoughts on where the economy stands in terms of strength and how this balance between economic growth and inflation is working out.

Dr. Michel Leonard

Absolutely. The first thing is, we have this thing that economists call nowcasts. Instead of forecasting for tomorrow and next week, we're estimating current numbers. And we think growth accelerated to around 5% in Q3 and even the beginning of Q4. [The official U.S. numbers, released after this conversation, showed 4.9% growth in GDP in the third quarter.] Keep in mind, we think we're going to end the year at 2.1% GDP growth. Now we're at 5%. What does that mean for Q4? That means Q4 could be minus -1%. We could actually have a contraction.

Now remember, it takes two or three quarters [of contraction] and a few other conditions to have a recession. We're far from that. No one's talking about that. What I'm concerned about is that if this message from the Fed [tightening until 2025] starts permeating the financial press, it may bring sentiment down and people may overreact to the minus -1%, or to a much weaker Q4. That could trigger a recession in Q1 and Q2 of next year.

That actually happened in Q1 of last year. We would have had a much better recovery last year, going into Q1 of 2022, but expectations can play a big role. That's where I'm concerned about with these possible Q4 numbers.

Paul Carroll

As long as I've teed up the risks that are out there, how about if you walk us through the other ones that you've identified? The geopolitical risk hits us over the head every day with Ukraine and Israel and Gaza now. But what other risks are you seeing out there that might derail things?

Dr. Michel Leonard

Absolutely. The first one is monetary miscalculation. Paul, right now, the yield curve is fairly flat and slightly inverted. That's why CDs are attractive. While the Fed has been successful raising the full length of the curve, it’s raised the front slightly more.

What we're seeing is that the Fed is continuing to bring down its balance sheet. That's creating some liquidity. But we also know that, with rising interest rates, government debt and private sector debt is going to increase. There is talk in the financial press that we're going to have a steepening of the curve. We've been in this low-rate environment for years, and now we're heading into a world where the curve will begin higher and increase in the longer run. So it's a steeper curve.

What does that mean? In practice, not only are we going to be at these 2%, 3%, 4% or even 5% interest rates for a longer time, but we also can have a steeper curve, which could mean 6% or 7% 10 years out, which will be a very different economic environment.

This isn't just a risk of policy miscalculation, it’s the Fed tightening too long.

We are heading into this new normal. I hate that term. More accurately, we should start saying we are heading into the next normal. The next normal will have a steeper curve, but the whole curve will move up, and money will be more expensive. That further depresses growth over the long run. That average of 2% or 3% GDP growth that we had pre-pandemic is going to be a bit more challenging to achieve.

There are many implications for investments in terms of asset allocation and so forth.

Now, moving on to geopolitics. We've been saying for a long time that this inflation was supply-driven. Goods just stopped showing up. A few months ago, Paul, I presented at a group of business leaders, and we had a poll. We asked what they felt was the biggest risk: geopolitics, monetary policy, recession and so forth. Geopolitics came last across all the polls. It was cited by only 5% of those in the room. I laughed. I said, I agree with the 5% of you because geopolitics could really bring the economy to a halt.

And since then, we've had, of course, the terrible events in Israel. There’s been tremendous repercussions, but not economic to this point. But if [the conflict] continues and spreads to the rest of the Middle East, now we're going to have economic repercussions with oil and so forth. And we still have the issue of this new axis among Iran, China and Russia. That has direct implications for oil prices globally but also has direct implication on the potential for contagion in the Middle East.

Traditionally, besides oil, the Middle East hasn't been one of those triggers that leads to GDP contraction. But we're in a new environment here in this regard. In conversations with folks in the intelligence and defense community in DC, there is still not, as of the time of our discussion, a concern for contagion to Hezbollah and in southern Lebanon. However, that could worsen over the next few weeks. And obviously, that could send oil prices into a much different direction and really bring to a halt our underlying growth recovery.

We still have, of course, Ukraine. As we're speaking today, the president recently sent a proposal to Congress for a $75 billion to $100 billion aid package, which includes humanitarian and military aid. What we're seeing is the threat of Ukraine and Russia affecting the U.S. and Europe, but even more so emerging markets. In the U.S., it's raised the price of food significantly. In Europe, it's raised the price of food and energy significantly. And around the developing world, it's been all of that, but to the point of food not being available. Suddenly, you have these hot spots emerging in India and Pakistan, and we know that at the end of the day, food scarcity can lead to instability. And China could step in during that instability. These are very severe threats to the recovery.

Traditionally, financial markets underestimate the risks they get familiar with, they get comfortable with, and that have been around. That's exactly what's happening right now. Like with that poll, people need to realize that these geopolitical scenarios could change the investment environment and the economic landscape significantly overnight.

Paul Carroll

I have a feeling that what you were saying about interest rates will also increase the dysfunction in Washington, because borrowing costs are going up and will probably continue to do so. If you go back a few years, interest rates were so low that there were some people who were basically saying money is free, just borrow as much as you want. Now, it's pretty clear that there's a real cost to the federal debt. So as much craziness as we have going on in DC, people aren't going to be able to just ignore the deficit. There are going to be a lot of harsh conversations that are going to happen.

Dr. Michel Leonard

Absolutely, Paul, and that is specifically the issue related to the longer part of the yield curve. Infrastructure building, government funding and all of that is going to be much more difficult two, three, even 10 years out. And that will bring back this conversation about spending cuts and empower those who think that cutting is a good talking point.

I do want to speak about those other consequences, but just taking a step back, and not to bore people with economic theory, but [those focused on cutting] are all saying that you should run a government the way you run a household, and you should balance your budget. Well, that's just ludicrous. It's not the way it works.

Think about a household. Yes, we hopefully balance our current account, our checkbook, if we can, but for many Americans, our main asset is our home, and no one would think that you should pay off your home in one year. So even based on that parallel, if you actually look at short-term debt and long-term debt, households don’t balance their budget every year. We think of a house as an investment. For government, if we’re spending on defense, that's immediate protection. And if it's on education and healthcare, that's about preparing for tomorrow, like a family’s home. This misplaced runaway spending narrative comes back time and time again to undermine confidence in government, fueling the populism we have in D.C. Heading into an election year, that is extremely disturbing.

We'll have a few more of these calls before the election, and we can talk more, but there are really big risks that we haven't thought about. In the election of the Speaker of the House, there were threats made to members who didn't support a candidate. And those threats were credible and led to police in different parts of the country coming in and protecting families. This is Third World, banana republic-type stuff. That's very disturbing. And the presidential cycle isn’t even in full swing yet. Let's really think about that political risk for our next quarterly conversation.

Paul Carroll

I would love to talk about that. But to maybe swing things around and leave people on more of an upbeat note, would you talk a bit more about those two points we raised at the beginning, starting with describing how or why the P&C industry is going to outperform GDP? I'll ask you that first, and then we'll come back to replacement parts.

Dr. Michel Leonard

I love these conversations where we get to the context. It may seem optimistic that we're positioning the underlying drivers of the P&C industry to outpace overall growth. However, we need to remember that for many years we had P&C underlying growth that was significantly below growth in overall GDP. It's going to take a few years just to catch up. Even if we look at those optimistic numbers for 2025, where our underlying growth is at 4% and overall GDP is around 2%, we actually estimate we're going to need five years of that to just make up for what we lost during the pandemic. Remember, housing suffered greatly. During the pandemic, cars weren't available.

Now that those areas are returning to normal, we're able to catch up. But you know, it brings us back to the Fed, which keeps raising rates. And let's remember, it's not just whether the Fed keeps raising. It's also the expectation of what the Fed is going to do. That’s a very important point. And right now, there's an expectation in the market that rising rates are going to end in March. People have started to allocate their capital based on that expectation. If suddenly the Fed says, the end is going to be in March of the following year, you're going to have a lot of money moving around, and that can put downward pressure on an already volatile equity market.

Paul Carroll

How about replacement costs? As we've discussed at length, they've been just wildly outpacing inflation, which has already been high. Do you see some relief there, as well?

Dr. Michel Leonard

Yes. And I always have to caveat that it has been a tough few years. If we go back, at the height of the spread between our replacement cost increases and overall inflation, it was 8% for the U.S. economy as a whole and 16% for P&C replacement costs. Used car prices went up 40% because new cars weren't available. Construction materials for homeowners insurance spiked. Lumber went up on average 50% over three years. Remember where we came from.

And with a few exceptions, when inflation goes down, it doesn't mean that prices are contracting. They did contract for lumber and for used cars, but we're seeing an environment where prices will rise maybe 1% or 2% a year. Here again, we estimated that it will take 10 years for P&C replacement costs to get over what we had in the past three years.

The numbers look good, but it’ll take five years to get over the significantly weaker industry growth, and then 10 years on replacement costs. Those are big numbers.

That really affects us in the industry. It's difficult to increase rates fast enough to recover. Everyone is already mentioning about how much we're increasing and our profits are being compressed. We've been reducing employment in the insurance industry slightly in the last year, and we've been cutting costs in marketing and elsewhere. So, we've been able to make up a bit through efficiencies, but overall, there is significant pressure on combined ratio performance.

Paul Carroll

Well, it sounds like we're going to have a lot to talk about during our next quarterly conversation. Thanks as always, Michel.

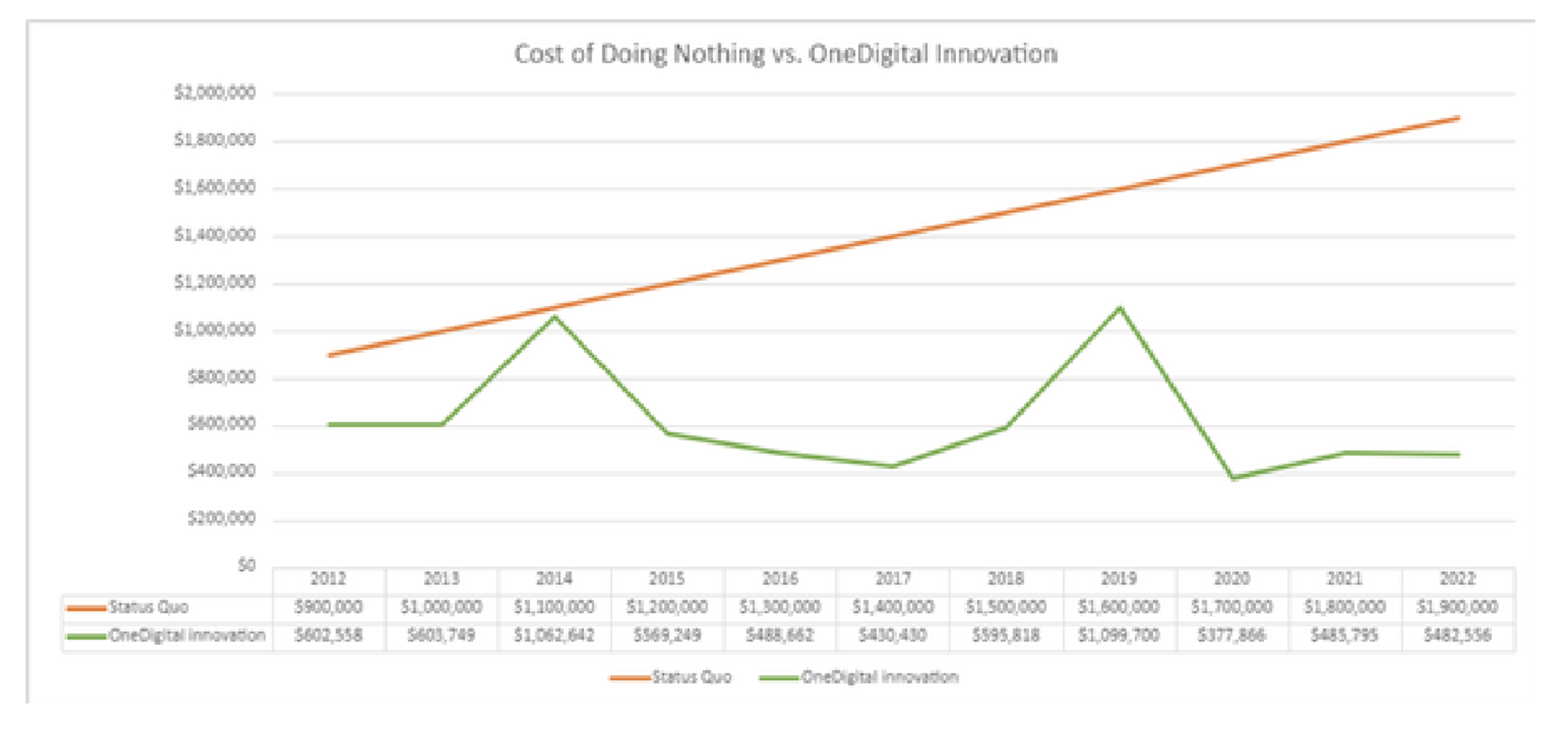

Employers with a substantial payroll, a strong commitment to workplace safety and a desire to reduce workers' compensation expenses should consider this option.

Employers with a substantial payroll, a strong commitment to workplace safety and a desire to reduce workers' compensation expenses should consider this option.