|

Nick Lamparelli has been working in the insurance industry for nearly 20 years as an agent, broker and underwriter for firms including AIR Worldwide, Aon, Marsh and QBE. Simulation and modeling of natural catastrophes occupy most of his day-to-day thinking. Billions of dollars of properties exposed to catastrophe that were once uninsurable are now insured because of his novel approaches. |

Insurance Thought Leadership:

What technology now in the market do you believe will have the biggest transformative impact on insurance and risk management in the next five years?

Nick Lamparelli:

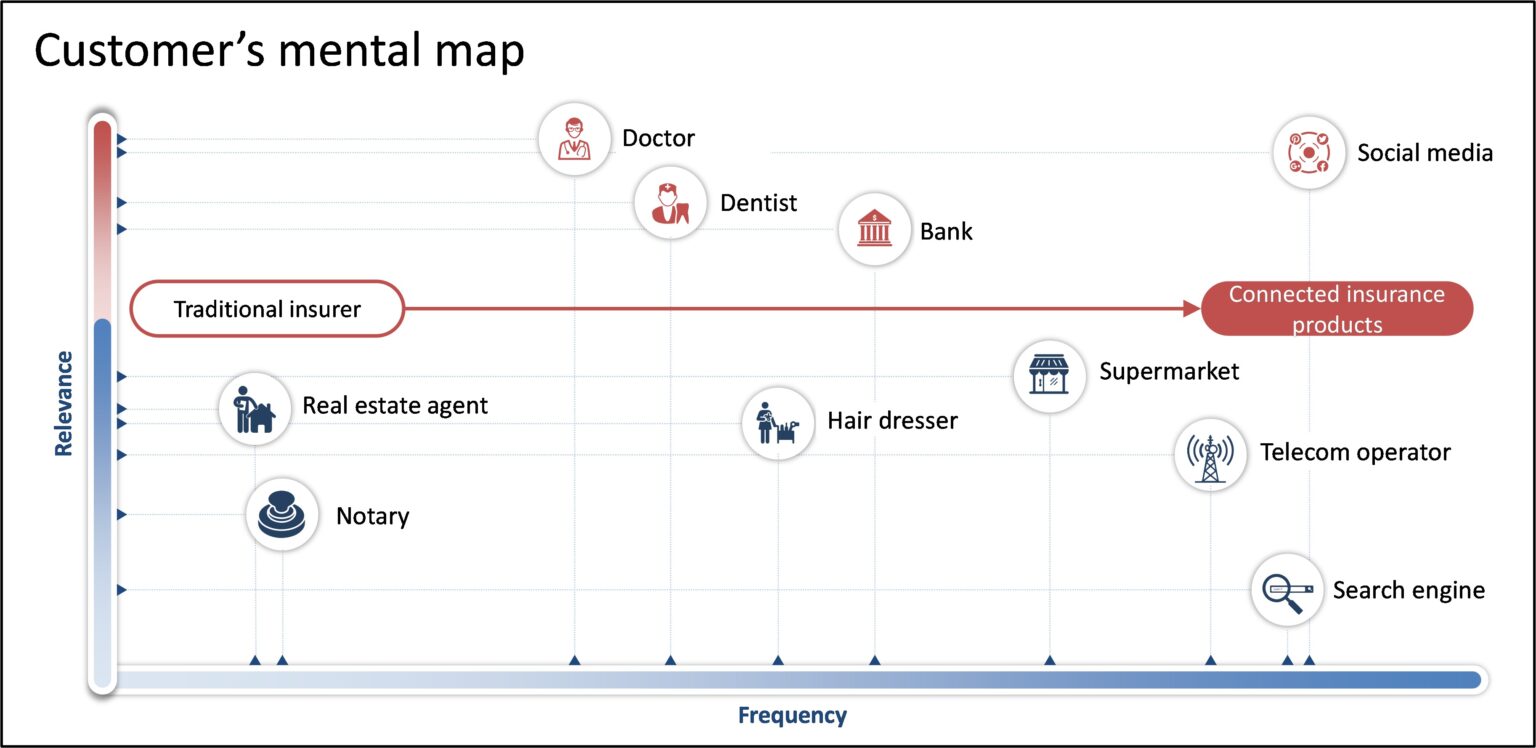

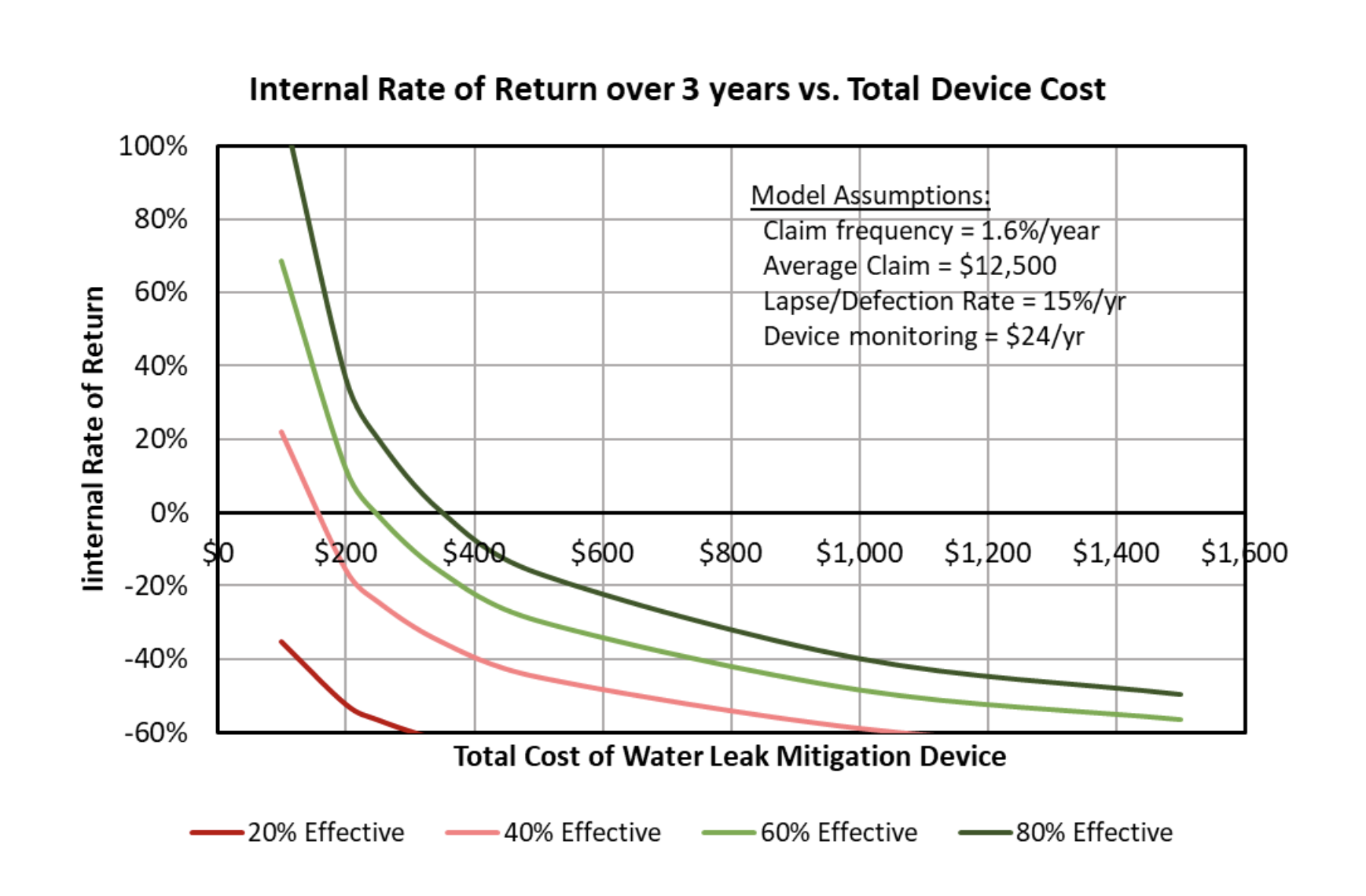

I believe IoT and sensor technology is getting traction, and insurance has finally noticed. Sensors can do much around notifying when events are occurring or about to occur. These technologies will have the capability to reduce both frequency and severity of claims (significantly). These technologies make the insurer highly relevant day to day to the policyholder. Because of this, insurers can get more innovative around coverage design and user experience. Insurers that invest in embedding IoT stand to be seen through a different lens every time a notification on someone's smart phone tells them that "no water was detected" so they can truly feel at ease and get the sense that their insurance premium is actually doing something for them.

Insurance Thought Leadership:

What do you see as the biggest obstacles to insurance innovation, and how would you recommend overcoming them?

Nick Lamparelli:

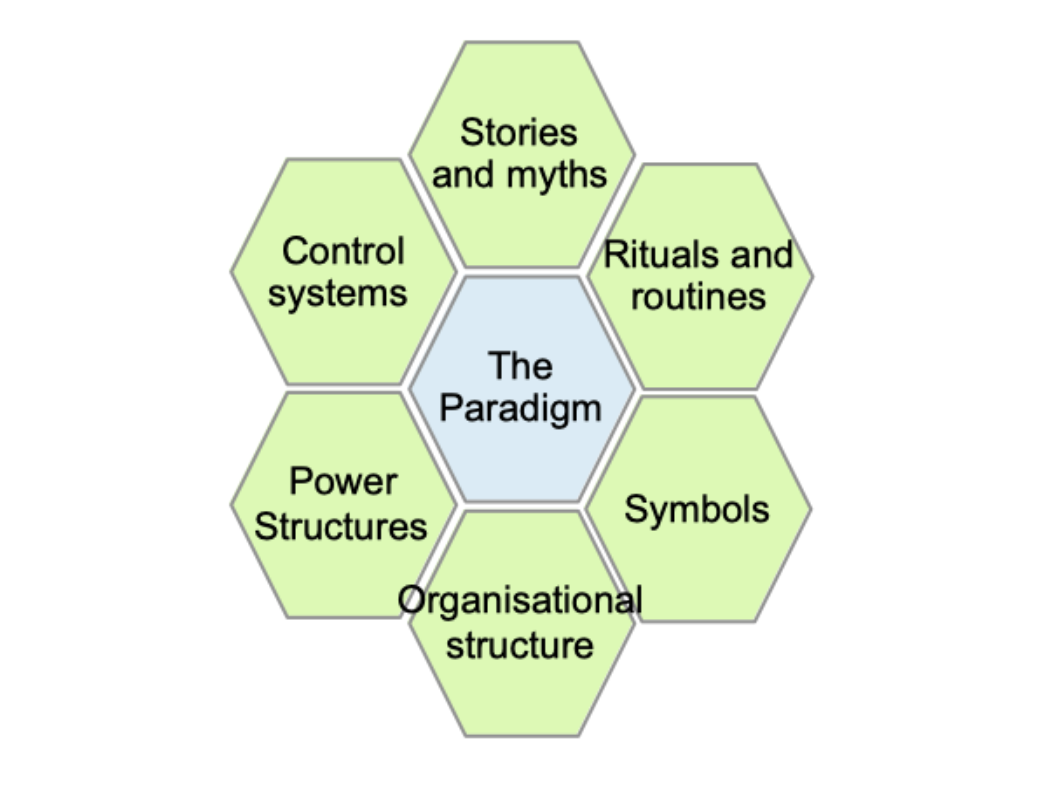

The biggest obstacle is inertia. And inertia is a byproduct of culture. Many insurance organizations do not have the corporate governance that forces them to enact change (see the mutuals and farm bureaus). For many of these firms, only the cold hard reality of financial existentialism will force someone, anyone to make the changes that need to be implemented.

Insurance Thought Leadership:

What is an area that you believe remains untapped/unfulfilled/overlooked for the promise of innovation in insurance?

Nick Lamparelli:

Knowledge management. We spend way too much time looking for things: searching for files, attachments, emails, etc. Insurers have done a decent job digitizing, but it hasn't helped them because now they have a mountain of data and no ability to mine it. Knowledge management, including using AI technologies to make sense of that data, will be crucial and unveil a ton of insights into a company's own data sets.

Insurance Thought Leadership:

How do you believe AI will transform insurance and risk management?

Nick Lamparelli:

Aside from where it is used now (to detect fraud, mostly), I think AI in knowledge management will be the first big value-producing outcome of generative AI. (See my prior answer.)

Insurance Thought Leadership:

Climate risk is leading to more frequent and severe loss events and contributing to high premiums and insurers withdrawing from some markets. How do you see technology being applied to mitigate risks and improve resilience?

Nick Lamparelli:

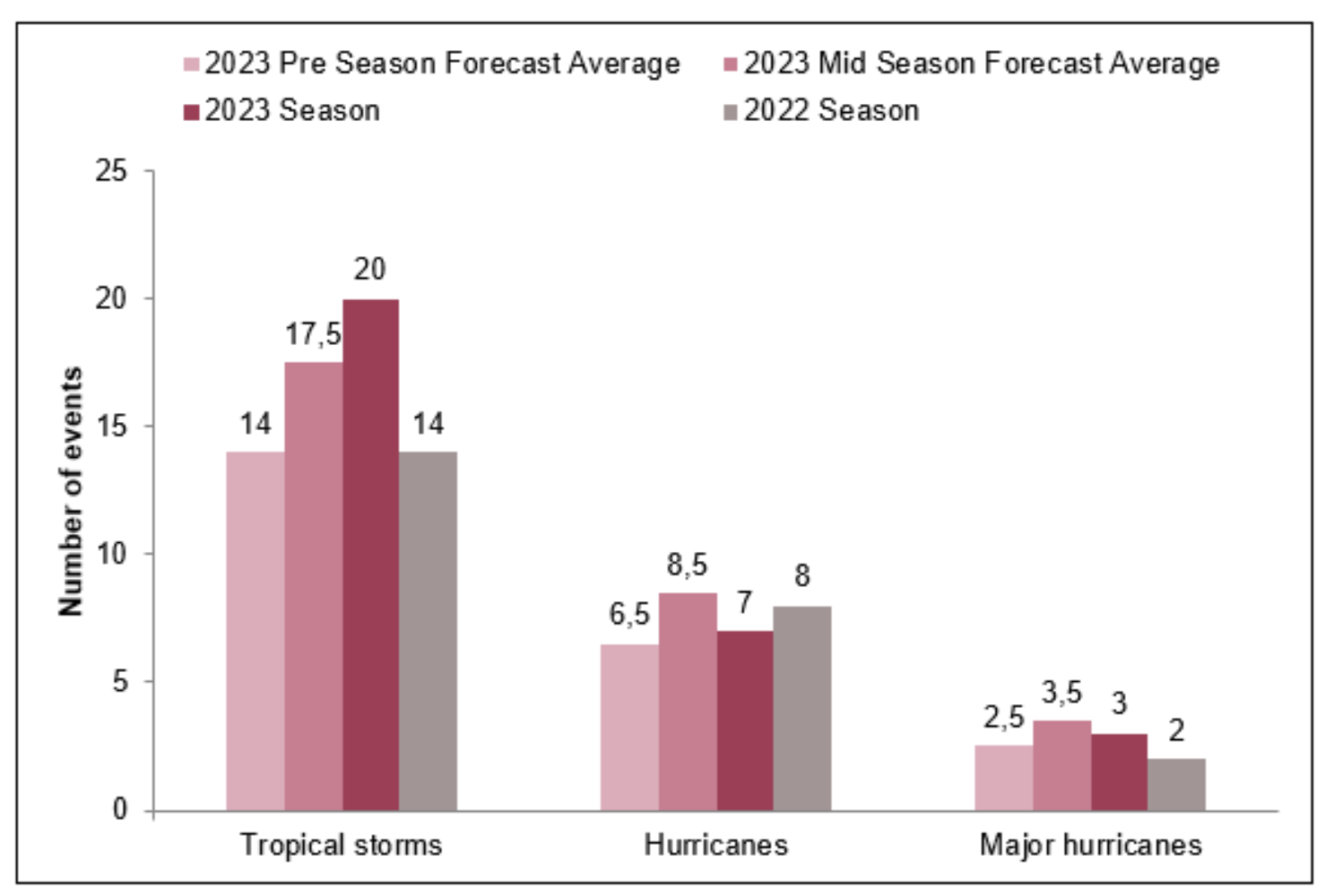

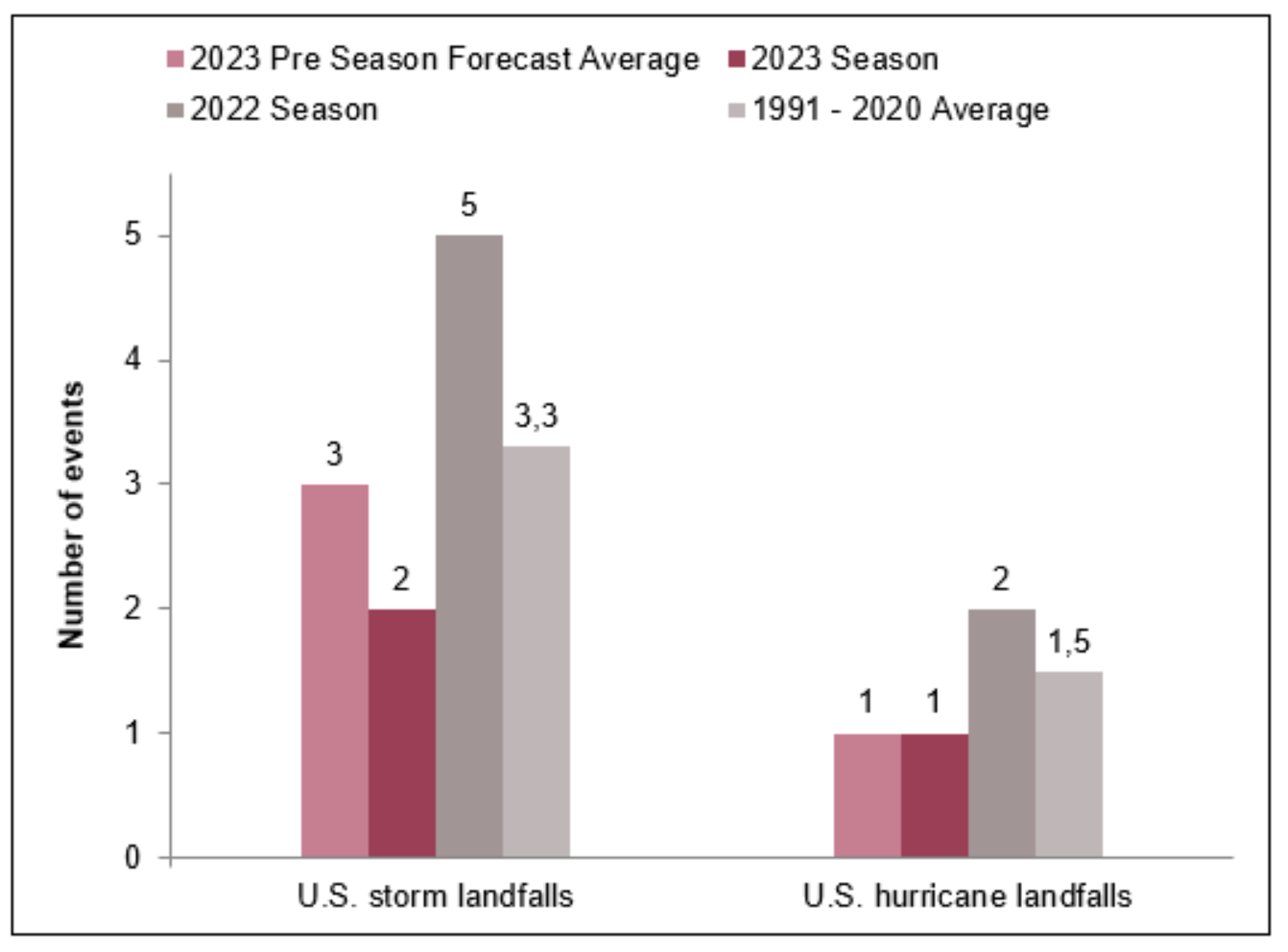

First, the jury is still out on more frequent and severe events. I am not sure we know that as of yet. Second, it doesn't matter if the climate is or isn't changing. Mega weather events have always played a critical role in insurance and still do. Technology innovation in the engineering of extreme wind, flood and fire events are crucial to our resilience. We know how to build resilient properties, we need a supply chain and investment that can lower the costs so these technologies can get to more properties. Wind-resistant glass, roof protections, external mist sprinklers and flood gates are all expensive solutions, but they work, and I am confident that technology and innovation in the engineering spaces will drive down the costs of these things. I think insurance can play a critical role in encouraging that push by providing financial incentives so property owners want to invest in them.

Insurance Thought Leadership:

You’ve contributed a lot over the years to Insurance Nerds, which focuses on “Insurance, Careers and Technology.” Do you believe that insurance is becoming more attractive as an industry because of how it is leveraging technology to solve big problems?

Nick Lamparelli:

I do not think it's become more attractive. Young people don't know anything about insurance until they need to (usually when they buy a car or become an adult). By then, they see insurance through the various stereotypes associated with it, instead of the vibrant, fun and engaging career choice it could be.