We cannot imagine a riskier undertaking than predicting the future given the totally unforeseeable events of recent years, as well as the current state of the insurance industry and the world in general. On the other hand, there are some basic principles that help guide us through our annual predictions. In addition, we have hedged by widening our timeframe to not just 2024 but also to the near future.

Change Becomes a Constant

The one thing we can count on is that very few of yesterday’s approaches will be successful in tomorrow’s world. The only constant now is change. It has become non-negotiable. Technology, especially AI, will be a major driver.

Insurers Breaks Out of Their Bubble

Insurers cannot continue to operate in a bubble. Other segments of financial services and other industries have already realized that diversification, partnerships and bold innovation are critical to success – and perhaps even survival. This is especially evident in bottom line under-performance of P&C insurers.

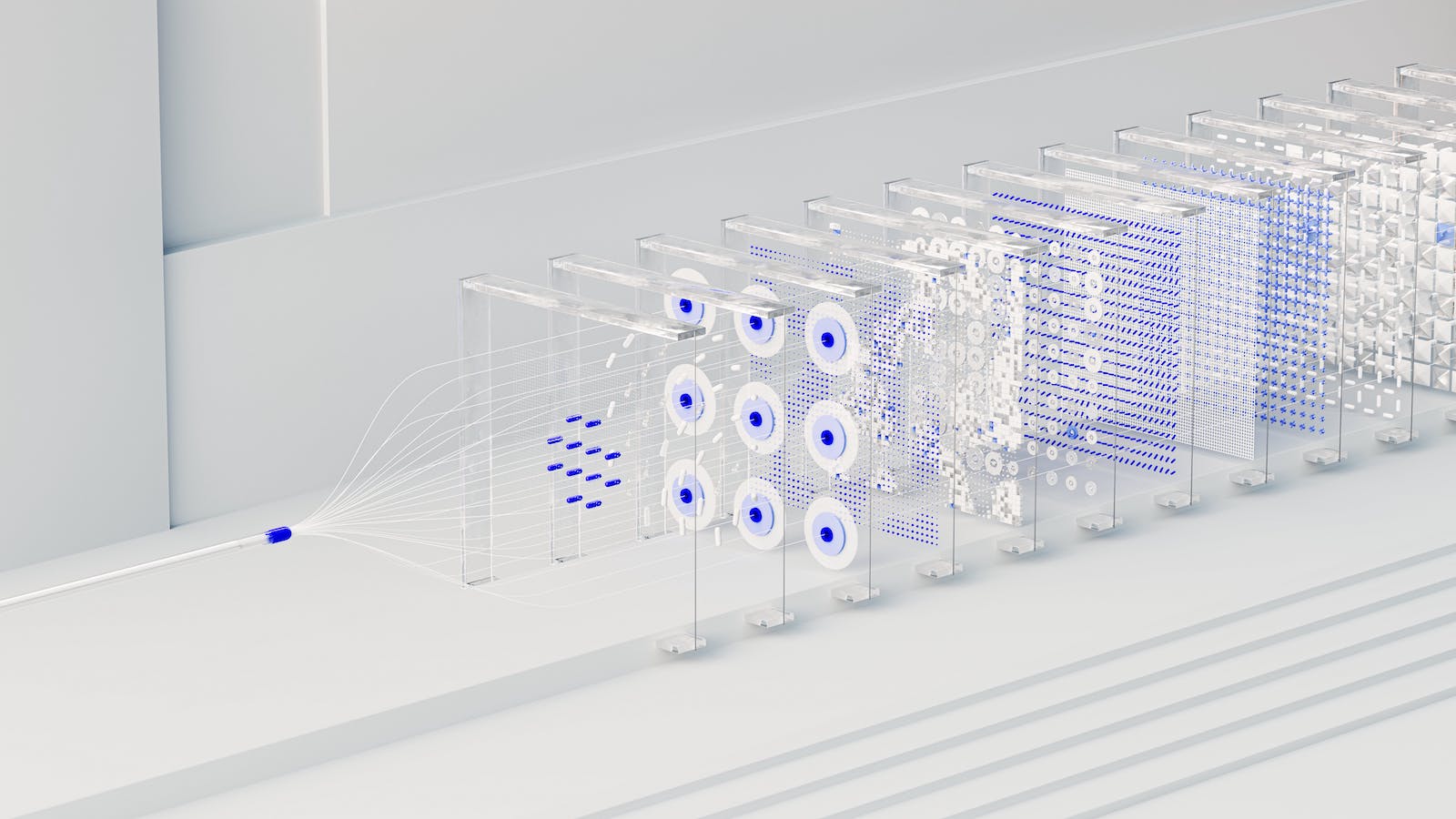

Technology Moves Beyond Enabler

Technology is much more than just an enabler. It is quickly becoming the lifeblood of all commercial undertakings. Those who see it as only an optional tool will be left behind. Use cases will expand beyond the basics to meaningful and measurable business outcomes.

Work and Workplace Shifts

Work, employment and the workplace as we have known them have been forever changed and will continue to change as the workforce ages and businesses continue to shed staff, enabled by technology and more efficient business models while attempting to lure, cajole or force return-to-office. There are significant opportunities for innovators who create business models that can leverage these realities.

See also: 10 Trends Shaping the Future of Insurance in 2024

Consolidation Marches On

Consolidation among competitors and strategic partners will continue apace, fueled by the growth of private equity and growing capital supply on top of already-record stockpiles of “dry powder” (investment capital). Recent slowdowns are a temporary reaction to overheated start-up business valuations and rising interest rates, neither of which will persist. Small independent businesses will find it increasingly difficult to earn a profit and compete with consolidated behemoths.

Transportation Evolves and Converges

The automotive, and transportation industries overall, have already begun their inevitable transformation as major industry segments converge on some future state that is yet to be clearly defined. Whether autonomous vehicles will become reality at some future date is almost irrelevant for now. What is clear is that the key participants in this converged landscape will be car makers, technology providers, aftermarket suppliers and service providers and – if they act quickly enough – insurers. The economic and safety benefits of advanced safety and driver assistance technologies will not fully offset the impact of increasing distracted and reckless driving behavior.

Connected Everything and Everybody

Connected devices and the IoT – including cars, smartphones, wearables and sensors – will continue to grow in both number and functionality. This will spawn services of many kinds, along with significant revenue opportunities, for those who own or control the connections. Forward-thinking auto makers and auto insurers will have no choice but to collaborate on telematics-enabled solutions and offer services related to safe driving, emergency response, accident management and crash detection. We could conceivably see some combination between auto makers and insurers. Consumers will increasingly resign themselves to sharing defined personal information in exchange for perceived savings and other personal safety benefits.

Climate Change Accelerates ‘Predict and Prevent’

Climate change will continue to attract more headlines and global conferences than meaningful solutions, but insurers cannot afford to ignore the extreme implications to their businesses. Simply withdrawing from riskier markets and continuously increasing premiums is not sustainable. And adaptation may well overtake mitigation as a pragmatic strategy to cope with the effects of climate change rather than the cause.

Emerging technologies that can accurately predict extreme weather events further into the future and down to rooftop level accuracy will enable insurers to better price and reduce risk while also providing valuable protection to their customers. Insurers will shift from a "repair and replace" to a "predict and prevent" mindset across the enterprise, including product, process, marketing, distribution, underwriting and claims.

See also: Opportunity Now and in 2024

Auto Insurers Transform Products and Processes

Auto insurers face an unprecedented number of daunting challenges. Growing vehicle complexity and inflation in the aftermarket supply chain have driven combined ratios to record levels while consumers are reacting to round after round of premium increases by seeking lower-cost coverage and, in some cases, dropping coverages. Direct writers are fiercely competing on price for each other’s customers, and agency writers are seeking more effective and efficient distribution methods and models. Customer satisfaction – and ultimately loyalty – continues to erode as technology-enabled solutions are imperfect and displace comforting human interaction. Carriers that can transform their products and processes to overcome these challenges have an enormous market opportunity.

Further consolidation involving the largest auto insurers is inevitable, in a market where each 1% U.S. market share is worth almost $3 billion in annual premium for private passenger auto. Progressive will take market share and come much closer to overtaking State Farm as the #1 auto writer, and the top 10 rankings will be further re-ordered through acquisition.

Wild Cards in 2024

Any one of these events could alter our future in material ways:

- Global wars; how widely will they spread?

- Presidential election; a referendum on American democracy?

- Will AI eat software?

- U.S.-China relations; will economic growth objectives supersede geopolitical ambition?

- Crime – both cyber and physical; how will it change public policy and consumer behavior?

In the new future, people will still make the difference between highly successful companies and others, but these people will have to be as conversant and comfortable with technology as they are with other people.