The insurance industry prides itself on the data it has. Carriers, historically, have had access to a wealth of data — and data sources — everything from disaster models to historic perils, real-time weather feeds, and current policy information to publicly available government data such as criminal records, bankruptcies, and foreclosures. But having access to data does not mean you have access to valuable insights. For data to be useful, you must first ensure the data you have is the data you want — clean, accurate, and reliable. Then, turn this data into information and that information into action. Good data leads to better decisions. And bad data? According to a recent MIT Sloan study, it costs carriers 20% of their revenue.

The Hidden Costs of Bad Data

The costs of bad data add up quickly. In fact, poor data quality can cost as much as 15-25% of total revenue, according to a study conducted by MIT Sloan. Poor data quality increases costs associated with the re-execution of a process due to data errors, correction efforts, and accruing out of lost or missed revenues. Conversely, according to the Sirius Group, quality data can lead to a 70% increase in revenue. With the right tools, carriers can turn the mountain of data they possess into a goldmine of opportunity.

But first, what do we mean by data quality?

According to IBM, data quality is the measure of how well a dataset meets the criteria for accuracy, completeness, validity, and consistency — crucial to data governance within an organization.

Good data helps organizations make better decisions. If data issues such as duplicate data, missing values, and outliers aren’t properly addressed, carriers increase their risk leading to less-than-optimal outcomes.

Is the Data You Have the Data You Want?

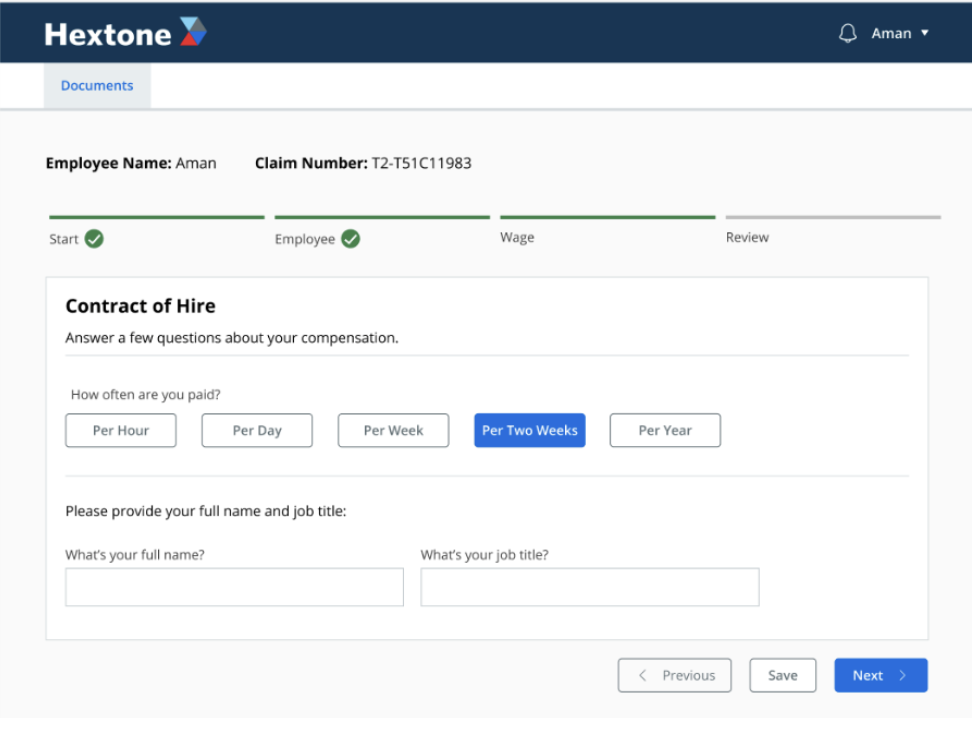

In the insurance industry, data accuracy is everything. The efficiency of the claims process is contingent upon the adjuster’s ability to verify a claim, which is based on having accurate data. The foundation of claims automation is also accurate data, both structured data from the system and unstructured data from the filing, to determine the appropriate course of action for each claim. The automation system continually reassesses its previous decisions as new information is added. Attempting this process with inconsistent or “dirty” data can lead to erroneous decisions and a poor customer experience.

Carriers wrestle with poor data quality because of the vast amounts of unstructured data that are stored in disparate systems. Many of these are legacy systems, while others are desktop-based actuarial applications. The problem is compounded by newer applications that have been added to the legacy systems, creating multi-layered, redundant IT architectures.

The Pitfalls of Bad Data

- Insurance underwriters depend on accurate data for risk assessment, which can influence premiums, policy terms, and profitability.

- Poor data quality increases costs associated with the re-execution of a process due to data errors, correction efforts, and lost or missed revenues. In a recent conversation on the “Slaying Your Data Dragons” webinar, OZ Senior Vice President Data Analytics & AI, Sal Cardozo, discussed the issues around data management.

- Inaccurate, inconsistent data leads to less-than-optimal decisions. For instance, when underwriting and pricing property insurance, carriers often rely on the insured or their agent to provide the Construction, Occupancy, Protection, and Exposure (COPE) details about the property. These details enable the carrier to evaluate the potential loss associated with the property and price it accordingly. However, the insured may not always provide accurate information, leading to policy underpricing and increased losses.

- Lack of trust in data prevents insurance leaders from making the right decisions — sometimes leading to regulatory non-compliance.

- Carriers must comply with strict regulations around data accuracy, completeness, and appropriateness; failure to do so may result in huge fines and penalties.

- Many carriers grapple with inaccurate underwriting data, necessitating requests for additional information from agents and customers, leading to longer underwriting turnaround times and lost business.

How to Avoid the Big Bad Data Trap

1. Automate Repetitive Tasks

Data collection and processing is a repetitive, tedious task prone to human error. These errors could range from incorrectly understood instructions, typos, mismatched names and emails, duplicate records, or simply overlooking certain entries. These errors and an overwhelming amount of incorrect and incomplete data can accumulate and become significant inconsistencies over time. Through intelligent automation, carriers can reduce errors, cut costs, and provide a better customer experience while freeing up employee time for higher-value work.

Watch this joint NAMIC webinar to learn more about creating the right automation strategy and roadmap for your business.

2. Standardize Processes

In lieu of standardized protocols for data collection, different teams might adopt different methodologies for the same data. This inconsistency can cause discrepancies when data is combined or compared.

3. Integrate Your Data and Systems

Insurance carriers operate in different regions around the world. With a large global footprint, local and overseas business units tend to have various systems to manage policy and claims data, financial information, and marketing and sales data. However, if this data is not integrated into a common platform and view, it could hamper decision making over time.

Here’s how a global P&C carrier consolidated its data sources with intelligent automation and reaped the benefits of a standardized platform. Read the full story.

4. Modernize Legacy Systems

Legacy systems are not equipped to handle newer data types and large volumes or share data across departments, leading to delays and lost opportunities. Compare the standard insurance approval process to a digital model, which allows customers to lodge a claim from anywhere, upload photographs or details of the damage from their smartphone, and where automated underwriting processes can approve the claim almost immediately. The latter is faster, more efficient, and provides a seamless experience for the policyholder. Besides, older systems might lack the safeguards or validation checks in more modern solutions.

5. Perform Data Quality Checks:

Carriers must perform periodic reviews and cleaning of databases to maintain data quality. If these checks are not carried out regularly, inaccuracies can persist and compound, leading to a deterioration in data quality.

Bad data in all its forms costs the insurance industry more than you realize, from the more obvious financial and productivity effects to impacts on customer experience. While investing in comprehensive data integration may seem costly, what carriers truly cannot afford is bad data.

To learn more about how you can achieve business success by leveraging the right data, get in touch with us. Read our e-book — Under the Hood: Unlocking the Hidden Value in Insurance Data, for all the ways you can reach your digital transformation goals with stronger data.

Murray Izenwasser, Senior Vice President, Digital Strategy

At OZ, Murray plays a pivotal role in understanding our clients’ businesses and then determining the best strategies and customer experiences to drive their business forward using real-world digital, marketing, and technology tools. Prior to OZ, Murray held senior positions at some of the world’s largest digital agencies, including Razorfish and Sapient, and co-founded and ran a successful digital engagement and technology agency for 7 years.

At OZ, Murray plays a pivotal role in understanding our clients’ businesses and then determining the best strategies and customer experiences to drive their business forward using real-world digital, marketing, and technology tools. Prior to OZ, Murray held senior positions at some of the world’s largest digital agencies, including Razorfish and Sapient, and co-founded and ran a successful digital engagement and technology agency for 7 years.

Sponsored by ITL Partner: OZ Digital Consulting