Out Front Ideas with Kimberly and Mark kicks off yearly with our popular 20 Issues to Watch webinar. While there are certainly more than 20 issues to discuss, we focused on the high-impact matters relating to risk management and employee benefits that need more attention. These are essential issues for every risk manager, HR manager and insurance professional to monitor in 2024.

1. Election watch

This year’s federal election could significantly affect policies for businesses and individuals. One such policy is the Department of Labor’s new guidelines around independent contractor classification, which will take effect on March 11. Based on California’s AB 5, these guidelines will significantly reduce the number of workers classified as independent contractors.

With insurance regulated at the state level, gubernatorial elections tend to bear more significance for the industry. Governors have significant influence over state policy, often including appointing insurance regulators. In 2024, there are 11 gubernatorial elections, in Delaware, Indiana, Missouri, Montana, New Hampshire, North Carolina, North Dakota, Utah, Vermont, Washington and West Virginia. Some of the more notable state reforms expected this year include:

- Georgia – With the state ranked by the American Tort Reform Association (ATRA) as the top “Judicial Hellhole,” tort reform legislation is expected to be introduced.

- Florida – Comprehensive tort reforms were passed last year, but will they survive court challenges and lead to cost savings for consumers and businesses, as expected?

- Louisiana – With some of the highest rates in the country, the state’s insurance commissioner is focused on homeowners and personal auto insurance reforms.

See also: Biggest Business Trends for 2024

2. Economic outlook

According to J.P. Morgan, economic growth is likely to decelerate in 2024 as the effects of monetary policy take a broader toll and post-pandemic tailwinds fade. Inflation, high interest rates and rising consumer debt are contributing to the forecast. Inflation is expected to remain above the federal long-term target of 2%. Mortgage rates are expected to drop under 6.5% by year’s end. For those currently with 3% to 4% interest rates, doubling that with a new property is less than appealing.

The commercial property market continues to have challenges, with office occupancy well below pre-pandemic levels. When leases expire, many companies are downsizing their office footprint, leading to rising commercial vacancy levels. The Financial Times reported last week that $117 billion of commercial mortgages related to offices must either be repaid or refinanced by the end of 2024.

According to KPMG, the mergers and acquisitions (M&A) volume in 2024 will be in the technology, health IT and physician practice sectors. S&P Global suggests creative deal structures and a relentless focus on value creation in private equity portfolios are critical in the year ahead.

3. Geopolitical risks

Active wars in the Middle East and Ukraine and a threat of conflict between the U.S. and China over Taiwan have created a higher geopolitical risk, potentially affecting companies in various ways. Terrorists have been attacking ships in the Red Sea, leading to the Suez Canal, which is responsible for 12% of global trade. These attacks could lead to cargo loss, endanger crews and cause supply chain delays.

Organizations with overseas employees should know where they are and how to evacuate them in the event of unrest. A complicating factor in dealing with these risks is that many insurance and reinsurance contracts have war risk exclusion clauses, which can exclude coverage for bodily injury or property damage deemed to have come from a war risk, in addition to business interruption and cyber incidents. Risk managers should work closely with their brokers to understand potential exposures.

4. Employee benefits

Employers have continued to expand benefit programs to align with the expectations and needs of their workforce, and 2024 is no different. Some of the expanded specialty health solutions include:

- Family planning benefits – Fertility and in vitro fertilization (IVF), pregnancy loss, and maternity management

- Gender-affirming care – Transgender-inclusive benefits

- Age-inclusive benefits – Menopausal care, providing access to virtual specialists and wellness coaches

- Financial wellness – Employee discount programs, money management tools, investment education and financial planning

- No copay healthcare plans – Surest, a new market entrant, offers full price transparency for each service and provider. Insureds can compare treatment options with prices across a network of doctors, hospitals and clinics before visits.

Additionally, benefit managers are grappling with weight loss drugs. Glucagon-like peptide 1 (GLP-1) coverage is expected to double and is projected to be a $22 billion market by 2030. Pharmaceutical costs are expected to worsen with a rise in specialty medications and their associated cost and coverage.

See also: The ABCs of Agency Planning for 2024

5. Frequency rates

Data from the National Council on Compensation Insurance (NCCI) show that workers’ compensation accident frequency rates have trended downward in the last 20 years, resulting in rate reductions for many businesses. However, this trend may be changing. November and December 2022 data from the Bureau of Labor Statistics (BLS) noted that private industry employers saw a 4.5% increase in workplace injuries and a 5.7% increase in fatal injuries. The overall workplace injury rate was mostly unchanged from 2021, but when work-related illnesses were factored in, the rate increased. Additionally, the rate of fatal work injuries increased compared with 2021. Some of this can be attributed to new employees, who carry an increased accident frequency rate. For risk managers, safety training and pre-employment physicals should be a continued priority.

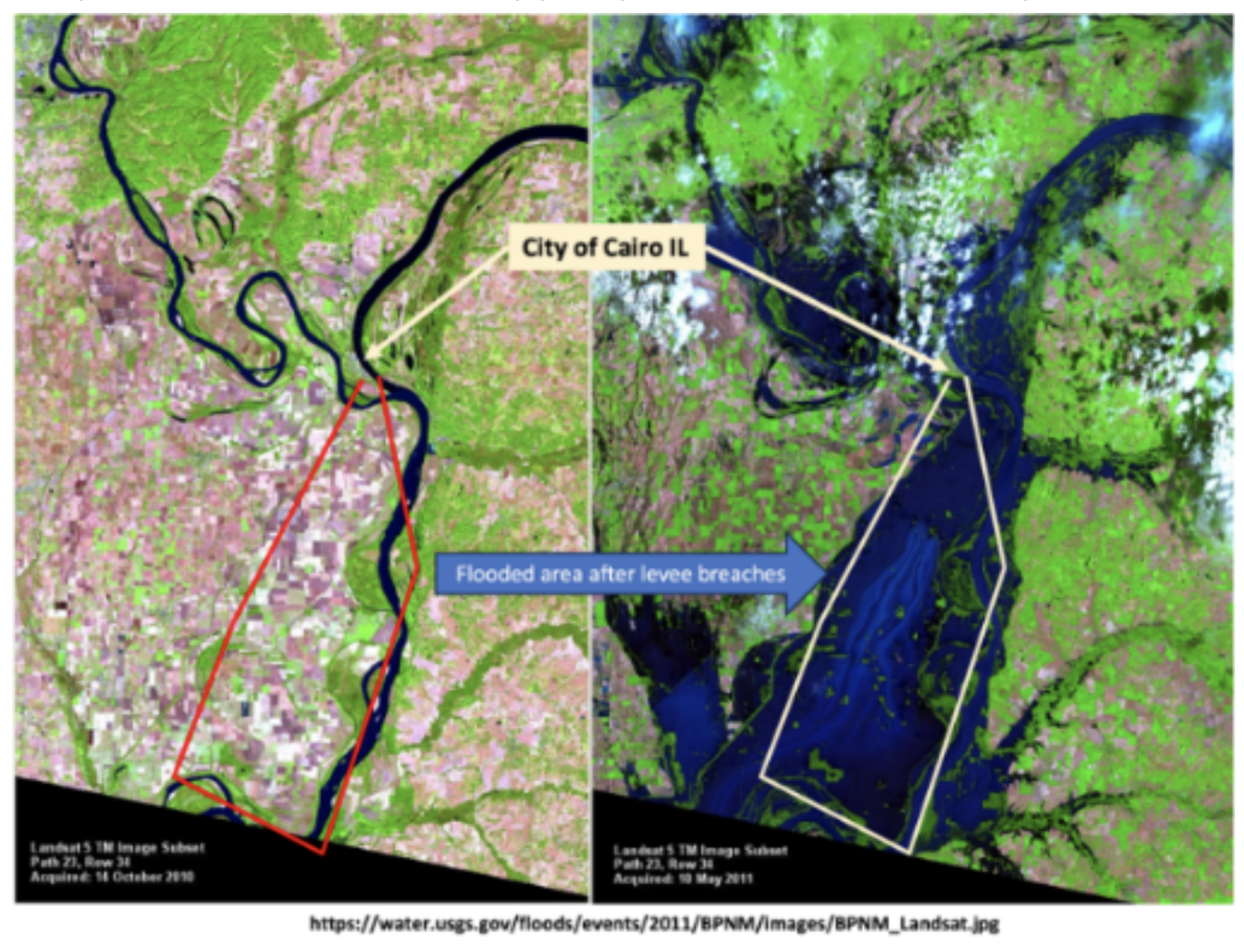

6. Climate change

2023 was the hottest year in recorded history. Across the U.S., cities smashed records for consecutive days with record temperatures, forcing risk managers to reevaluate heat safety for their workforce. Cal/OSHA passed new heat-related prevention guidelines, and federal OSHA is also working on new rules. Risk managers should consider indoor air quality assessments, additional water or rest stations, ventilation and cooling centers.

Additionally, the Panama Canal, which handles approximately 5% of seaborne trade, has been operating at reduced capacity for several months. A 30% decrease in rainfall has reduced water flow into the canal, which is necessary to use it. This leads to shipping delays and significantly higher shipping prices for companies.

7. Medical inflation

Medical inflation in workers’ compensation has recently been lower than overall economic inflation. However, most workers’ compensation medical costs are controlled by fee schedules lacking automatic adjustment provisions, so it can take longer for any increased cost to be reflected during inflationary periods. With rising labor and material costs, providers are pushing for fee schedule revisions. For example, Illinois has an automatic inflation adjustment built into its medical fee schedule, so as of Jan.1, 2024, most workers’ compensation medical service costs increased by 8.3%. Services not covered by fee schedules, such as attendant care, long-term care, transportation and durable medical equipment (DME), are already seeing significant inflation.

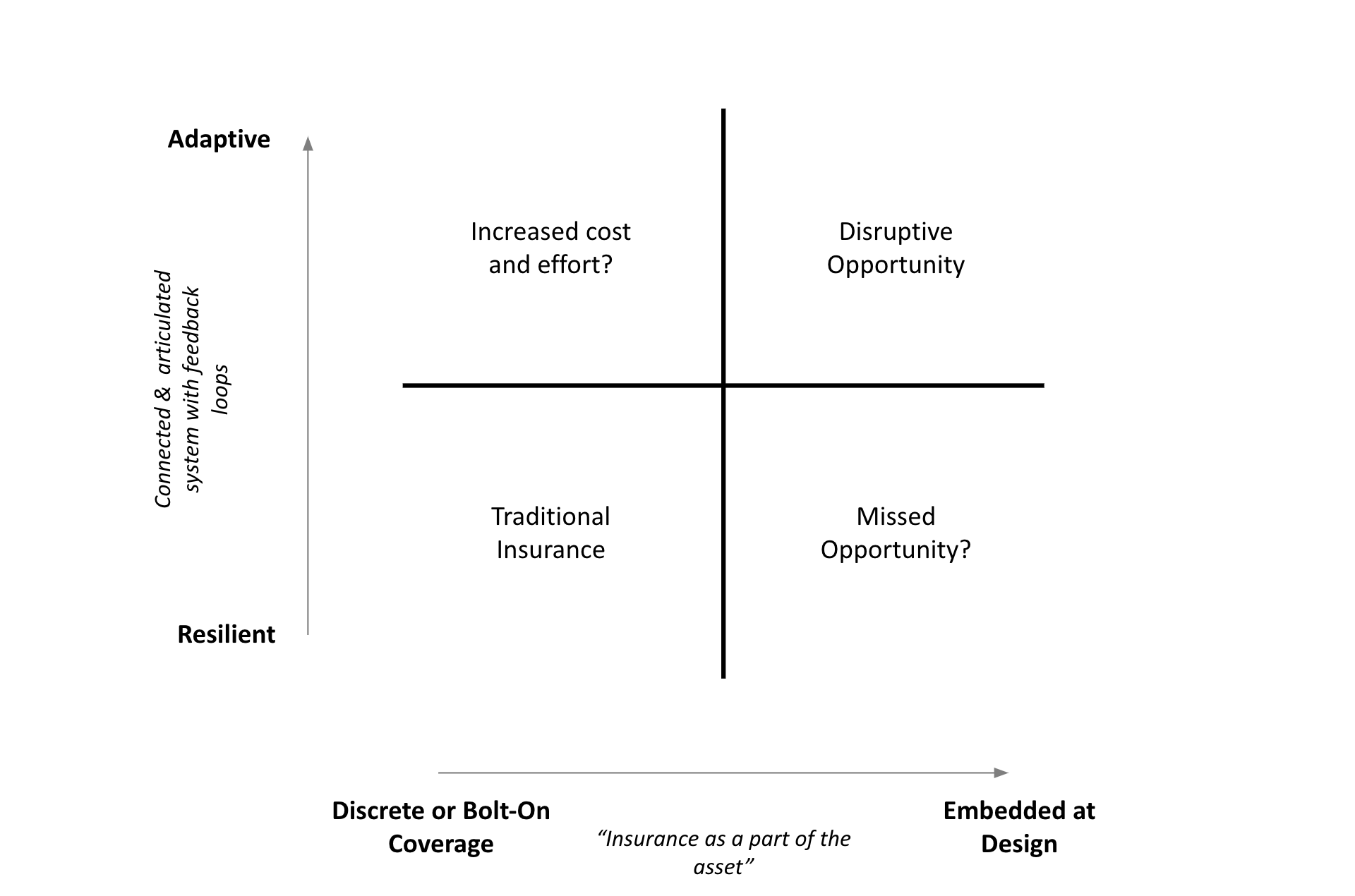

8. Redefined property insurance

Insurance Business America recently said the North American property insurance market will start to see more stability and capacity in 2024, and, barring catastrophes, insureds should expect to receive relief after years of pricing increases. Although the market is improving, risk managers are increasingly seeking property resilience assessments. When considering physical climate risks, an assessment may cover wind, precipitation, drought, wildfire, earthquakes, sea-level rise, extreme temperatures and more. Understanding the risks leads to a mitigation plan and allows a risk manager and their business stakeholders to determine the most meaningful measures.

While carriers may perform similar assessments related to the accuracy of valuations and as an added benefit to their insured, some risk managers and insurance buyers select independent partners to perform this work to obtain an unbiased review. In addition to property insurance, climate risk assessments and mitigation and adaptation recommendations may be helpful for a company’s environmental, social and governance (ESG) initiatives.

Insurtech has become crucial to the property insurance industry, assisting with underwriting, risk mitigation and claims management. Real-time and historical weather data coupled with a suite of tech tools, AI, and machine learning are providing meaningful insights, which assist in streamlining the claims process, restoring property and allowing early detection and communication.

9. Liability verdicts

For several years, the number of commercial liability verdicts above $10 million has been increasing. Juries are increasingly hostile toward large organizations and public entities and desensitized to large dollar awards. This phenomenon is often called social inflation or nuclear verdicts, but in reality it is legal system abuse. According to the U.S. Chamber Institute for Legal Reform, the average household pays more than $3,600 in higher costs annually for goods and services because of unnecessary and abusive litigation.

In addition, third-party litigation funding allows uninvolved investors to cover litigation costs on behalf of the plaintiff in exchange for a portion of the verdict. This encourages plaintiffs and attorneys to take cases to trial rather than settle because of the limited financial downside.

The solution to the challenges of legal system abuse is tort reforms. However, these have been slow to materialize. In the meantime, businesses can expect their insurance and claims costs to rise as the jury awards continue to increase.

See also: In 2024, Change Becomes Non-Negotiable

10. Leave and accommodation landscape

The leave of absence space continues to evolve, resulting in employers implementing new company and state programs. Paid family and medical leave is expanding at the state level. Leave programs may include pregnancy loss, bereavement beyond immediate family and organ donation. Leave laws are complex for multi-state employers and require significant administration, coordination and communication to implement and manage them.

Legislation regarding transparency in drug pricing is beginning to mount challenges to the Employee Retirement Income Security Act of 1974 (ERISA) and the preemption of state pharmacy benefit manager (PBM) laws. Court rulings could have a significant impact on ERISA protections, which will affect short-term disability (STD) and long-term disability (LTD) plans. If the preemption clause is invalidated, group benefit plans could be at risk for lawsuits at the state level.

The Mental Health Parity and Addiction Equity Act (MHPAEA) faces proposed regulation changes and enhanced enforcement, which could significantly affect employers. The changes would limit employer health and disability plans from providing less favorable mental health and substance abuse benefit plans to employees. For example, this change could potentially affect the 24-month limitation of mental health benefits under most LTD benefit plans, leading to a significant cost increase.

The Equal Employment Opportunity Commission (EEOC) has yet to issue the final rules for the Pregnant Workers Fairness Act (PWFA). This new law requires covered employers to provide “reasonable accommodations” for pregnancy, childbirth or related medical conditions. The EEOC noted in its strategic release plan that PWFA enforcement is a top priority, and cases are already being introduced against employers.

11. Liability insurance tower challenges

Another factor increasing costs for businesses, public entities and insurance carriers is the challenge of managing liability insurance towers. Coverage layers above primary may have different terms, conditions and exclusions.

Bad faith exposure is also creating a challenge. Insurance carriers could face a bad faith claim with higher excess/umbrella layers arguing the case should have been resolved within the primary layer. This leaves carriers stuck between their policyholders, who want to take a case to trial, and the excess/umbrella, who threaten bad faith litigation if there is an adverse jury verdict. Brokers and policyholders do not always contemplate bad faith exposure, so they may not understand a carrier’s reluctance to take cases to trial. While the policyholder may only have exposures up to their policy attachment point, bad faith litigation can create exposures well beyond the policy limit for a carrier.

12. Adverse reserve development

There are concerns that the insurance industry may find itself needing to increase tail claim reserves in multiple lines because of a variety of factors, including:

- Increasing commercial general liability and auto jury awards

- Remaining backlog of pending cases in the courts due to COVID

- Jury awards granted now that are related to seven- to 10-year-old incidents

- Inflation rates that are much higher than anticipated on claims prior to 2019

- Extensive losses due to climate change and rates that, while increasing, cannot keep up

- Adverse development on workers’ compensation tail claims due to increased attendant care costs and longer life expectancies for severely injured workers

Risk managers and brokers should pay attention to the carrier earnings calls. If there are comments around the need to strengthen reserves in lines of coverage, this may signal that rates could increase or that the carrier might withhold certain lines of coverage.

13. Sustainability and regulations

For the last few years, ESG has become increasingly important for businesses, with tighter regulations from specific states, the Securities and Exchange Commission, the federal government and the European Union. These far-reaching regulations cover everything from climate emissions to workforce and board demographics and even investments. The regulations mean employers must track all their relevant data, in addition to data from their suppliers and business partners. Publicly traded companies have faced shareholder lawsuits pertaining to some of these issues.

Conflicting rules from state insurance regulators are adding to the confusion for carriers. One state will attempt to restrict carriers from insuring or investing in fossil fuel companies, while others will penalize insurers that refuse to insure these companies. Last year, several states threatened antitrust lawsuits against carriers because of these issues.

14. Human capital

The December 2023 U.S. jobs report indicates more job openings than job seekers. Talent attraction is evolving in how to source candidates into the insurance industry, with efforts to recruit veterans, stay-at-home parents returning to the workforce, people with disabilities and high school graduates. There are growing conversations around skills-based hiring within insurance and, more broadly, across businesses globally. Organizations are also increasingly using artificial intelligence tools to assess competencies and potential among the candidate pool.

Recent labor strikes brought the issue of a four-day workweek to the forefront. Some companies are starting with one day off every other week or a half-day on Fridays. Additionally, many employers are planning a significant average salary increase in 2024 due to inflation and a tight labor market. In December 2023, a Willis Towers Watson survey found that U.S. employers are planning for an average salary increase of 4% in 2024 compared wth 4.4% in 2023 and 3.1% in 2021 and earlier years.

See also: Top Employee Incentive Trends for 2024

15. Evolving presumptions

Presumption laws regarding first responders have been the most common form of workers’ compensation legislation for years and have expanded to include cancers. These presumptions switch the burden of proof so conditions are “presumed” to be work-related unless the employer can prove otherwise. In recent years, post-traumatic stress disorder (PTSD) has emerged as a presumption and now includes dispatchers and other occupations. The presumptions create situations where different workers exposed to the same situation have different claim outcomes. For example, a police officer responding to a workplace shooting could file for a PTSD claim, but those onsite employees where the shooting occurred may not. This year, Connecticut made all employee PTSD claims compensable. Washington also passed a PTSD presumption that applies to nurses, including the private sector. With a legislative blueprint in place, will other states expand presumptions?

16. Cyber preparedness

Cyber attacks have increased exponentially in volume, velocity and effectiveness. The National Cybersecurity Strategy is exploring whether a government backstop is needed for the cyber marketplace. This would resemble the Terrorism Risk Insurance Act (TRIA) and the terrorism risk marketplace. The concerns are that policy limits and exclusions in the cyber marketplace would leave cloud-based companies with inadequate protections in the case of a sustained outage. Also in question is the market’s ability to adequately cover the business interruption costs associated with a widespread attack on the infrastructure, such as the electrical grid.

17. Workplace violence

Workplace violence continues to be a trend year over year. It is a leading cause of injury for healthcare and K-12 education employees. Retailers have also seen an increase, with employees walking off the job due to safety concerns and businesses closing locations due to risks. Law enforcement officers have also been heavily affected. Data from the National Police Association shows 378 officers were shot in 2023, a 60% increase compared with 2018. Employers are increasingly focused on safety in the workplace, including psychological safety, which can hurt employee morale and worker retention.

18. Employee well-being

Mental health and well-being have become an increasingly important area of focus for employers, which are offering benefit models that include virtual and in-person mental healthcare and apps for meditation, mindfulness, deep breathing, stress reduction and coping strategies. Employee resource groups are working to destigmatize mental health discussions. At every opportunity, environments should be created where employees feel safe to seek help.

Corporate and team culture matters, and companies have evaluated mission, purpose and core values to support a positive workplace. Pulse surveys often address well-being, providing meaningful insights across the business.

Mental health and well-being literacy is an opportunity for employers to grow their offerings as a resource for employees to learn about why mental health matters, personally and professionally, about signs and symptoms and about self-care and treatment options, along with easy access to the benefits available.

See also: Investment Outlook for 2024

19. Exclusive remedy

Lawsuits involving exclusive remedy have typically been dismissed on summary judgment because the burden to overcome it is difficult. Throughout the pandemic, there were several challenges to exclusive remedy, with most claiming that an employee brought COVID-19 home to their family. For the most part, these cases were dismissed. Recently, two high-profile cases were allowed to proceed on merits to let a jury decide if the burden to overcome exclusive remedy was met. Both of these cases involve workplace shootings in Virginia, with employees claiming their employer was aware of the risks and did not take appropriate action to protect them. If these plaintiffs prevail, similar suits will likely be introduced in other jurisdictions.

20. Implementing AI

When thinking about implementing AI, companies should contemplate their risk tolerance. Are you a first-to-market company? Are your internal stakeholder’s innovation drivers? Do you have clarity on use case scenarios, costs to implement and maintain and return on investment, and do you have leaders willing to support the short- and long-term investment?

Generative AI, conversational AI, machine learning and the suite of tech tools supporting AI have significant potential to change the way underwriting is performed, claims are lodged and processed, customer service interactions are performed and claims are resolved from start to finish.

AI already supports expedited claims processing for low-dollar, high-frequency claims in the liability, auto and property industries. With AI supporting the review and summarization of medical documents, the process for an adjuster is simplified. Will there ever be low-touch processing of medical-only claims in workers’ compensation? If so, it may develop with early adopter customers and innovative claims payers. AI could help the industry focus on what matters, improve human interaction and provide the claims expertise necessary to get the best outcome.