With 2024 basically at our doorstep, the landscape of artificial intelligence (AI) has evolved tremendously over the past year, heralding transformations across various industries, including insurance. This rapid evolution is marked by a series of disruptive AI trends that are set to redefine the way businesses operate.

From enhancing computing power for advanced data processing to the ethical implications of AI in creative endeavors, these trends present both opportunities and challenges. In the insurance sector, the impact of these advancements ranges from improved risk assessment and efficient claims processing to navigating new regulatory landscapes.

We at InclusionCloud have explored these pivotal AI trends and have identified their implications and the critical considerations for the insurance industry as it stands on the cusp of a technological revolution.

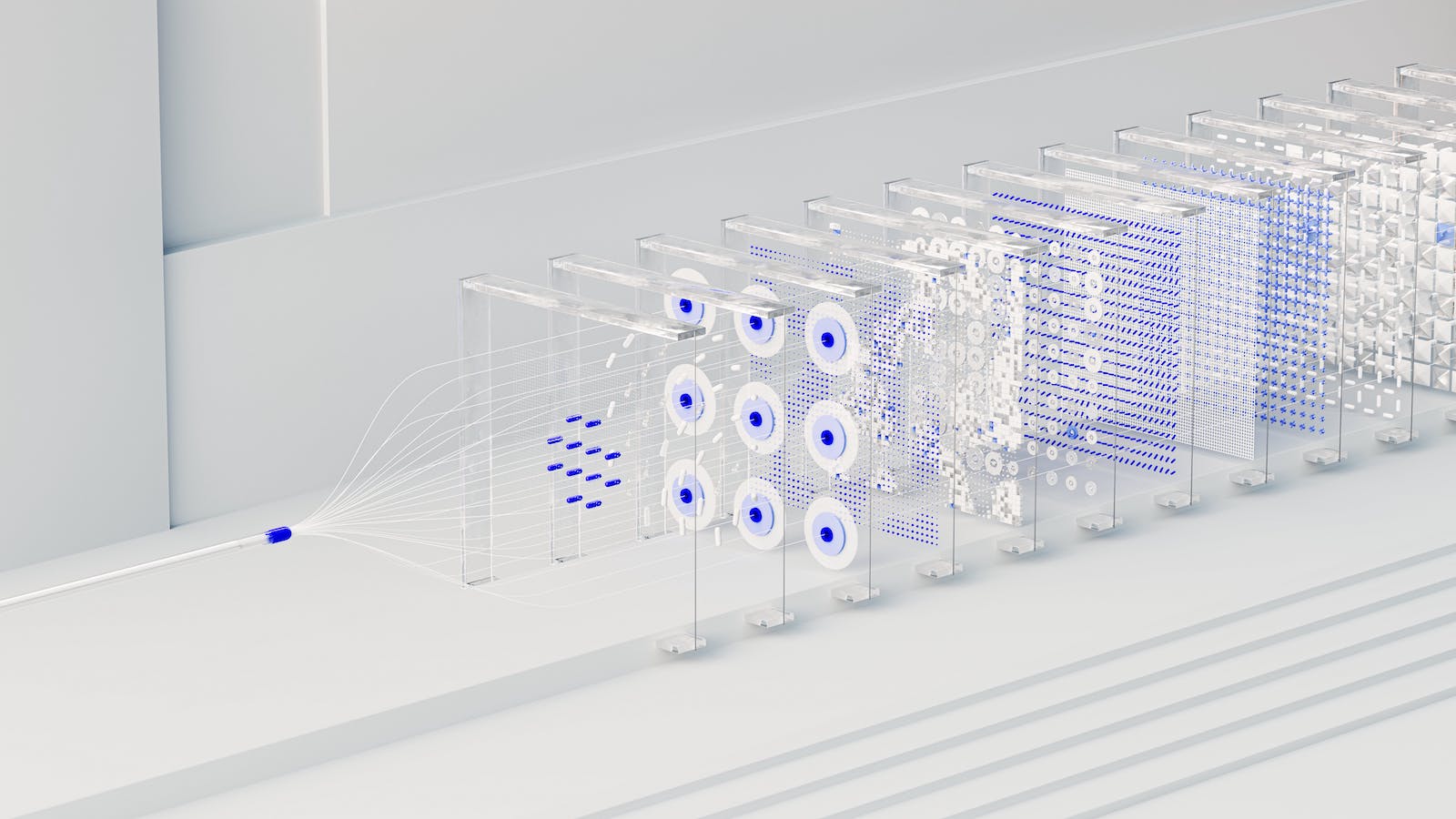

Trend #1: Elevated Computing for Advanced AI

The complexity of AI models is rising dramatically, demanding more robust computing resources than ever before. This advancement in computational power is essential to manage the extensive data processing these sophisticated AI models require. In sectors such as insurance, this translates into quicker, more precise data analysis, enhancing risk assessment and streamlining claims processing, thereby revolutionizing efficiency and accuracy in decision-making.

Trend #2: AI's Foray Into Creative Realms

AI is carving its niche in creative fields, offering innovative tools like DALL-E 2 and ChatGPT that redefine problem-solving and solution design. This incursion is transforming areas ranging from graphic design to copywriting, ushering in a new era of creativity. However, the ethical dimension of AI in creativity, particularly in the context of deep fake potential, calls for stringent guidelines and transparent use to ensure responsible application in these creative ventures.

See also: AI: Beyond Cost-Cutting, to Top-Line Growth

Trend #3: AI as a Collaborative Workforce Ally

Beyond mere automation, AI is integrating into the workforce as a complementary tool to human skills. Applications like Microsoft Copilot are becoming invaluable in saving time for employees, allowing them to dedicate efforts to more important tasks. In the insurance industry, such tools can revolutionize administrative duties by aiding in tasks such as drafting personalized customer communications, scheduling management and client data organization, thereby enhancing operational efficiency.

Trend #4: Navigating the AI Regulatory Landscape

Governmental bodies are now stepping up to frame regulations, ensuring responsible AI usage. For insurance companies, this evolving regulatory environment necessitates a careful approach to harness the benefits of AI while adhering to legal standards. Navigating these laws is crucial for deploying AI ethically and avoiding potential legal complications, marking a pivotal aspect of future AI integration strategies.

Trend #5: Synthetic Data: A New Frontier in AI Training

The use of synthetic data in AI model training is gaining momentum, particularly in sensitive sectors. Predictions indicate that by 2024, a significant portion of AI development data will be synthetic. For the insurance industry, this trend could revolutionize risk assessment and fraud detection models, enhancing accuracy while upholding customer privacy. This shift toward synthetic data represents a significant stride in data management, balancing innovation with privacy concerns.

See also: 5 Ways Generative AI Will Transform Claims

Conclusion

AI is just starting to show its true potential. This technology is not just an incremental change; it's reshaping entire industries, redefining roles and creating new paradigms in business and society.

But with all this exciting change, we also need to be careful. The path of AI disruption is laced with complexities. The ethical implications, including concerns about privacy, job displacement and the potential for biased algorithms, require careful consideration and management.

As these technologies become more integrated into our professional and personal lives, it's crucial to proceed with a balanced approach to maximize benefits while mitigating risks.