Forecasting often seems like a painful and unrewarding exercise. The economic environment and sentiment can be upended at any time in any number of ways by unanticipated events. But as Louis Pasteur remarked, “Chance favors the prepared mind.”

Risk mitigation is critical for insurers’ operations and their portfolio management. Insurance industry portfolios are as varied as the lines of business they support, but they all rely on the benefits of a strong underlying economy. From the demand for insurance that fuels their growth and prosperity to the markets in which they invest, the economic outlook, the path forward for equities and the level and direction of interest rates are pivotal to insurance companies’ successful risk mitigation.

What can we surmise about the future – and which strategies might help insurers navigate it?

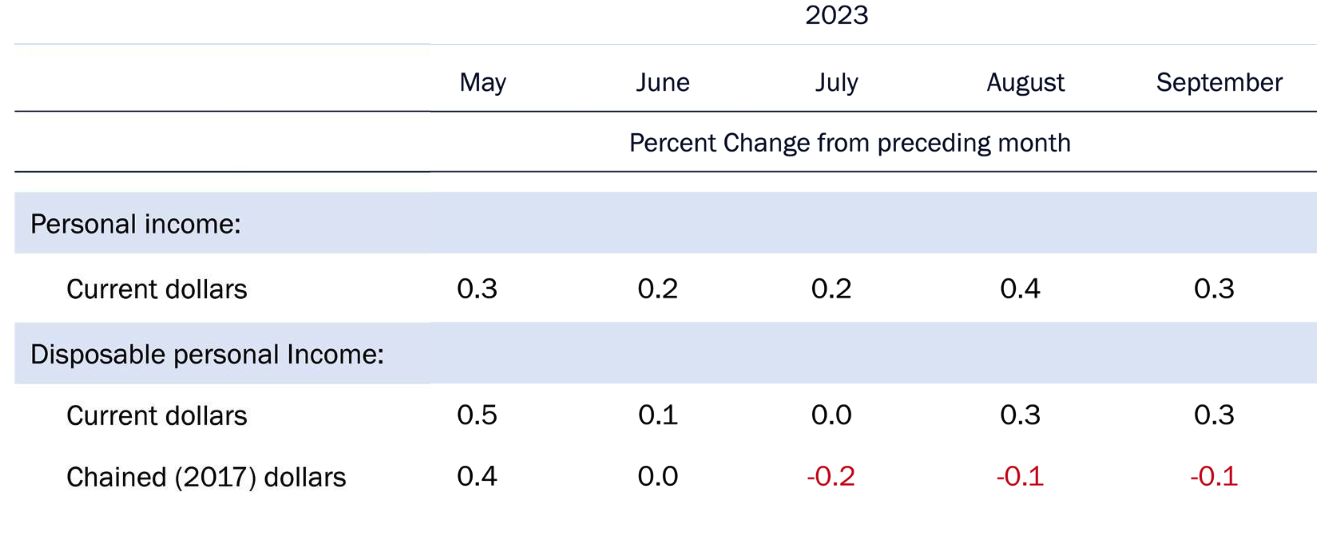

Figure 1: Disposable Personal Income - In Decline?

A Recession in 2024?

Through the third quarter of 2023, the U.S. economy proved quite resilient, helped by the consumer. There are signs that the U.S. consumer might be pulling back (see Figure 1) and that higher rates are beginning to affect at least the lower tier of income earners. We believe that sometime in the first half of 2024, the rolling recession finally will hit consumers more broadly.

To date, though, we have had a Goldilocks economy, with everything just about right - not too hot, not too cold - in labor markets, manufacturing and housing. Stock market returns propped up by steady corporate earnings have supported surplus levels at many insurers. While total returns in bond markets have been nothing short of frightening, the higher interest rates available for newly issued bonds have allowed portfolio yields to rise and portfolio durations to extend to meet their liability targets.

See also: The ABCs of Agency Planning for 2024

Bears Threaten a Goldilocks Economy

There are, however, three major bearish threats that investors face as we move into 2024, each inflationary in the near term and negative for growth over time.

- The first is geopolitical risk that global markets must absorb. It began with Russia’s invasion of Ukraine last year and continued with the Hamas attack on Israel. Energy markets have been the first to react, but the threat of a broader war and the protracted strain on trade will impose costs on domestic and global GDP while putting upward pressure on consumer prices.

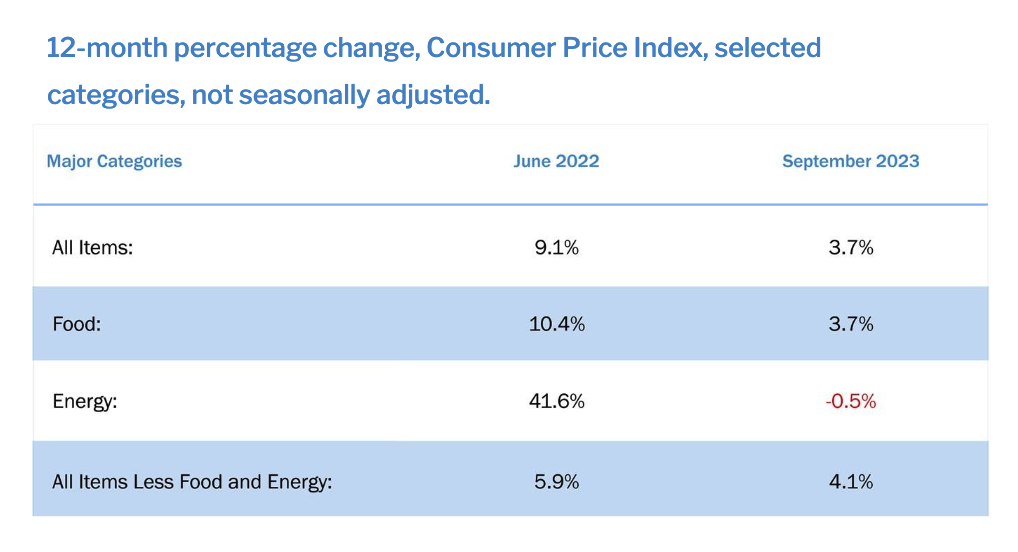

- A second factor is persistent inflation, which is winding down but continues nevertheless (see Figure 2), maintaining upward pressure on rates. This will cause central banks to push back until “something breaks,” which of course will be the economic expansion. Fallout would suggest an end to the decade-long dominance of U.S. markets, a weaker U.S. dollar and opportunities for non-U.S. investors and emerging market issuers.

- Thirdly, U.S. political dysfunction allows unbridled spending to pump up demand without contributing to the supply side of the economy. This condition cannot persist. The House of Representatives was paralyzed for weeks while the narrow Republican majority wrangled over the selection of a speaker, losing precious time in trying to resolve important issues like the federal budget. The concern for investors is that all this is a precursor to another continuing resolution that maintains the unsustainable pace of spending growth and could cause a government shutdown.

We expect markets to look through the short-term disruption and focus on the longer-term persistence of inflation and policy drag on economic growth. For these reasons, we continue to think that the three bears will eat Goldilocks, that believers in a soft landing will be disappointed, and that a shallow and relatively short recession is likely.

Figure 2: Inflation - Down But Not Out

Managing a Late-Stage Credit Cycle

These factors suggest that insurance portfolio durations should approach – but not exceed – liability targets. Equity positions neutral to the guideline range and benchmark exposure are prudent, while the U.S. Federal Reserve, policymakers and the economy decide where to go next.

Corporate credit continues to be the major source of risk in insurers’ general accounts, while providing the investment income critical to the insurance business. Though credit metrics have begun to deteriorate, a natural development late in the credit cycle, the good news is that corporate management teams are responding in ways that support investors, such as being more conservative in capex and debt issuance, maintaining liquidity and financial flexibility and delaying expansion plans.

We’re less than a year away from another presidential election, one that promises no less volatility than 2022 or 2023. High-grade credit is a prudent choice for income and stability in turbulent times.

See also: Biggest Business Trends for 2024

A Lift From AI

One of the reasons we think the slowdown won’t be long or deep is the potential lift from artificial intelligence (AI). AI and chatbots are two of the hottest topics in media these days, both social and traditional. Technologies such as generative AI, large language models, machine learning and natural language processing have enormous potential, certainly for innovative benefits in scientific research, healthcare, industrial processes and, of course, markets and investment analysis.

But as often happens throughout human history, we must temper our enthusiasm for the potential of exciting new technologies with the challenges around us that slow growth. It is only through vibrant markets and a strong global economy that the challenges of today and tomorrow – in whatever shape they take – can be overcome. The insurance industry and its investment activity are critical to that effort.