I can remember back in 2013 when healthcare reform was passed, wellness programs were springing up everywhere claiming to reduce health insurance costs. In theory it sounded great. Healthier employees meant lower insurance claims and showed employees the company valued them and wanted to keep them around. Many companies enrolled their employees into these programs expecting to see health insurance premiums reduced. Flash forward a few years, and many of these companies have dropped their wellness programs. Why? Because the hoped-for results didn’t happen. Instead, there was a. lot of initial interest, but engagement waned over time, and the promised results were not achieved.

Companies that dropped wellness programs discovered their programs weren’t living up to their promises because installing a program was not as easy as recruiting employees and waiting for results. It would take some work!

In today’s uncertain economy, employers are seeking ways to reduce costs, and, after payroll, employee benefits are usually a business’ highest expense. It may be the right time to revisit wellness and see if it could offer cost reductions.

For the companies that had good results, corporate wellness programs were able to offer significant financial advantages that leverage IRS-allowed reductions. Structured properly, these programs can generate a reduction in payroll tax liability while promoting healthy behaviors.

Structuring a Successful Wellness Program:

A successful wellness program is comprehensive, data-driven, and tailored to your organization’s unique needs. Here’s a structured approach based on best practices and expert recommendations:

- Understand employee health needs, stressors, and preferences [1] [2]

- Appoint an executive sponsor and form a cross-functional wellness committee (HR, health & safety, line managers, employee volunteers) to oversee the program [3].

- Develop a holistic, inclusive plan that addresses multiple dimensions of wellness: physical, mental, social, financial, nutritional, environmental, spiritual, and intellectual [4] [5].

- Set clear, measurable goals and objectives (e.g., increase participation rates, reduce stress, lower healthcare costs) [6] [7]. Establish a governance structure to manage and evaluate the program.

- Make programming accessible and engaging, offering a mix of easily accessible activities and interventions that resonate with employees, such as fitness classes, mental health resources, health education, and flexible work options [1] [2] [5] [6]. Use a user-friendly platform for resources, progress tracking, and rewards [6].

- Pilot, communicate, and iterate -Launch a pilot program in one department or location to test effectiveness [7]. Gather feedback through surveys and participation data; adjust programming as needed [7]. Communicate regularly

- and clearly about program benefits, activities, and successes to maintain engagement [4] [6]

- Measure and evolve - Monitor participation, health outcomes, and organizational metrics to assess impact[2] [4] [7].Use data to refine and expand the program, ensuring it continues to meet evolving employee needs[2] [7].

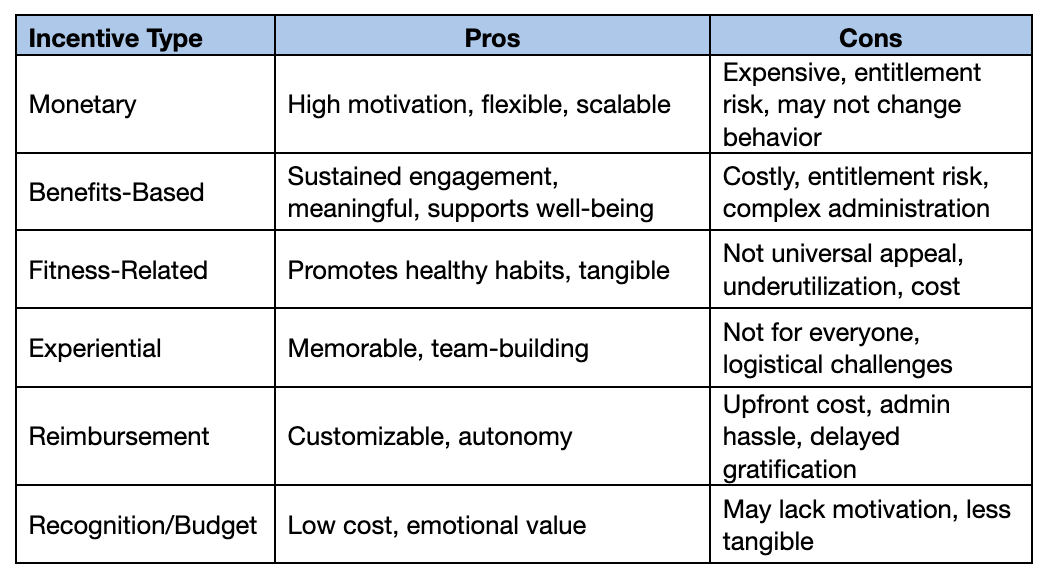

To maximize benefit usage, it is important to make sure the program is structured to keep the employee engaged. No single incentive works for all employees. A mix of monetary, benefits-based, and recognition incentives, tailored to employee preferences, is most effective.

Benefit -- Wellness Program Impact

Engagement -- 3x more likely to be engaged, higher job satisfaction, motivation and loyalty

Turnover/Burnout -- Lower turnover, less burnout, improved retention

Team Dynamics/Culture -- Better collaboration morale and inclusivity

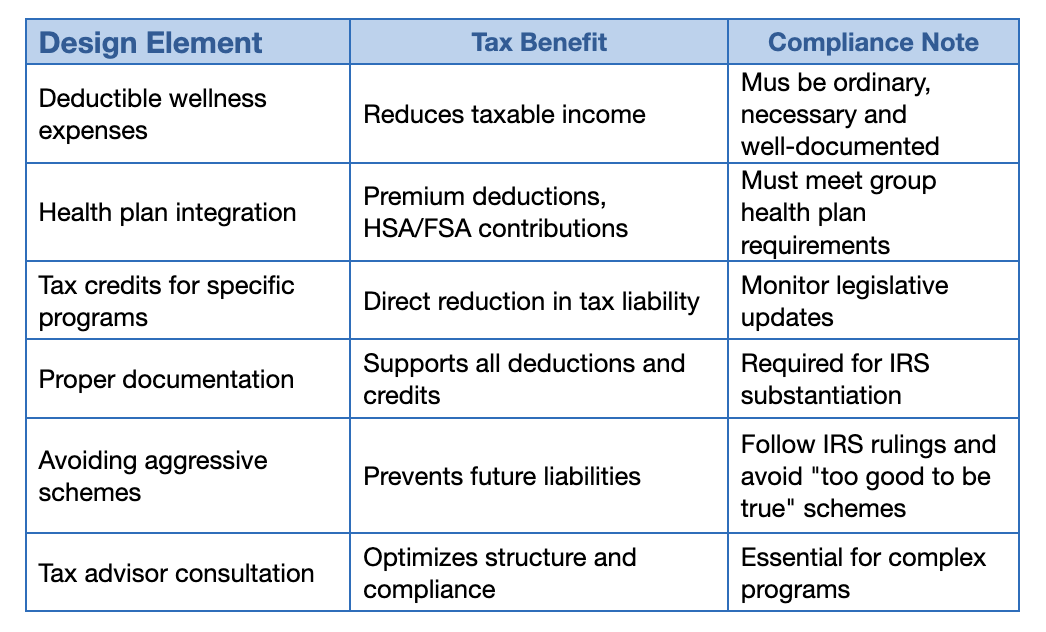

Overview of Tax Incentives for Wellness Programs (see appendix 1)

By strategically implementing and managing wellness programs-while taking full advantage of available tax credits, deductions, and payroll tax reductions-employers may create a healthier, more engaged, and loyal workforce, all while improving their bottom line. There are three types of financial benefits for employers that create and implement wellness programs: Direct Tax Credits and Deductions, Payroll Tax Incentives, and Premium Deductions. Here is an overview of each:

Direct Tax Credits and Deductions: Recent initiatives allow businesses to claim tax reduction or deductions for investing in employee wellness. For example, some programs offer up to $650 per employee as a tax incentive, directly reducing the cost of implementing wellness benefits [9] [11]. Eligible benefits include [12]:

- Health screenings and assessments

- Fitness equipment and facilities

- Preventive care initiatives

- Mental health resources

- Nutrition workshops and fitness challenges

Payroll Tax Incentives: Programs like the Preventative Health Initiative (PHI) enable companies to reduce payroll tax liabilities, freeing funds to reinvest in employee health and wellness without increasing out-of-pocket costs [11].

Premium Deductions: Employers can deduct the portion of health plan premiums that fund wellness programs, further lowering their taxable income [10].

Review of Tax Regulations for Employer-Sponsored Wellness Programs

This review assesses the accuracy of tax regulation statements regarding employer-sponsored wellness programs, focusing on the deductibility of expenses, tax treatment of incentives, and compliance with relevant sections of the Internal Revenue Code (IRC).

1. Tax Deductibility for Employers

- Ordinary Business Expense Deduction: Employers may deduct the costs of implementing and maintaining wellness programs as ordinary and necessary business expenses. This includes expenses such as health screenings, fitness equipment, wellness coordinators’ salaries, and educational materials [16] [15].

- Premium Deductions: Employers can deduct the portion of health plan premiums that fund wellness programs, further reducing taxable income [15] [16].

- Payroll Tax Incentives: Some programs, like the Preventative Health Initiative (PHI), allow employers to reduce payroll tax liabilities, making wellness investments more cost-effective [13].

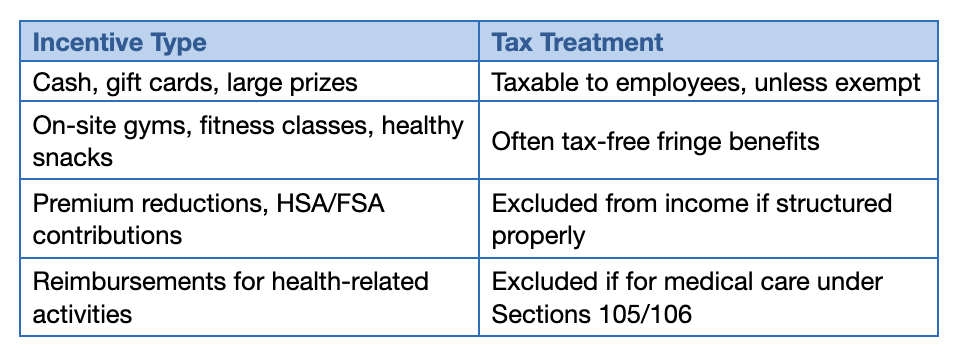

2. Tax Treatment of Wellness Incentives for Employees

- Tax-Free Benefits: Certain wellness benefits can be provided tax-free to employees if they qualify as medical care under IRC Sections 105 and 106. These include:

- On-site fitness facilities.

- Health screenings and preventive care.

- Employer contributions to HSAs, FSAs, or HRAs (if compliant with plan rules and nondiscrimination requirements)[16] [15].

- Taxable Benefits:** Cash incentives, gift cards, gym membership reimbursements (unless prescribed for a diagnosed disease), and other non-medical rewards are generally considered taxable income to employees. These are subject to payroll and income tax withholding unless they qualify as a “de minimis” fringe benefit or meet specific medical care criteria [15] [16].

- Wellness Incentives and Double Dipping: If employees pay wellness premiums via pre-tax salary reductions and later receive reimbursements for those premiums, the reimbursement is generally included in gross income, as this constitutes a “double-dipping” arrangement [15].

3. Individual Taxpayer Deductions (Section 213)

- Medical Expense Deduction: Individuals may deduct unreimbursed medical expenses exceeding 7.5% of adjusted gross income (AGI). Qualified expenses must be for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for affecting any structure or function of the body [17] [18] [19] [13].

- General Wellness Exclusion: Expenses that are merely beneficial to general health (e.g., general gym memberships, nutrition counseling not tied to a diagnosed disease) are not deductible. Only those prescribed for a specific medical condition qualify [17] [18] [19] [13].

- Examples of Deductible Expenses: Physical exams, smoking cessation programs, prescribed nutritional counseling, and gym memberships if prescribed for a diagnosed disease [18].

4. Section 105 and Section 125 Plans

- Section 105 (HRAs): Allows employers to reimburse employees for medical expenses, including premiums, on a tax-free basis. This applies to a wide range of medical, dental, and vision expenses [13].

- Section 125 (Cafeteria Plans): Enables employees to pay for qualified benefits (including wellness-related health insurance premiums and FSAs) with pre-tax dollars. Plans must be nondiscriminatory and properly documented [13].

Key points from IRS guidance:

- Wellness Incentive Payments Are Taxable: If a wellness program provides cash or cash-equivalent benefits (such as gift cards or direct payments) to employees for participating in wellness activities, and those payments are not strictly reimbursements for qualified medical expenses, the IRS considers those benefits taxable wages. Employers must withhold federal income and employment taxes (FICA, FUTA) on these amounts [20] [21] [23] [24]

- No Double Tax Advantage: The IRS has specifically cautioned against programs that attempt to provide both pre-tax premium payments and tax-free benefit payments under fixed indemnity or similar plans, as this would constitute “double dipping.” If premiums are paid pre-tax and benefits are not strictly for unreimbursed medical expenses, the benefits are taxable [20] [24].

- Qualified Medical Expenses Only: Only wellness programs that reimburse employees for actual medical care expenses (as defined by IRC Section 213(d)) can provide tax-free benefits. Payments for general wellness, nutrition, or personal health expenses that do not qualify under Section 213(d) are not excludable from income. Neither do gym and fitness equipment. [21].

Appendix 1

Appendix 2

Appendix 3

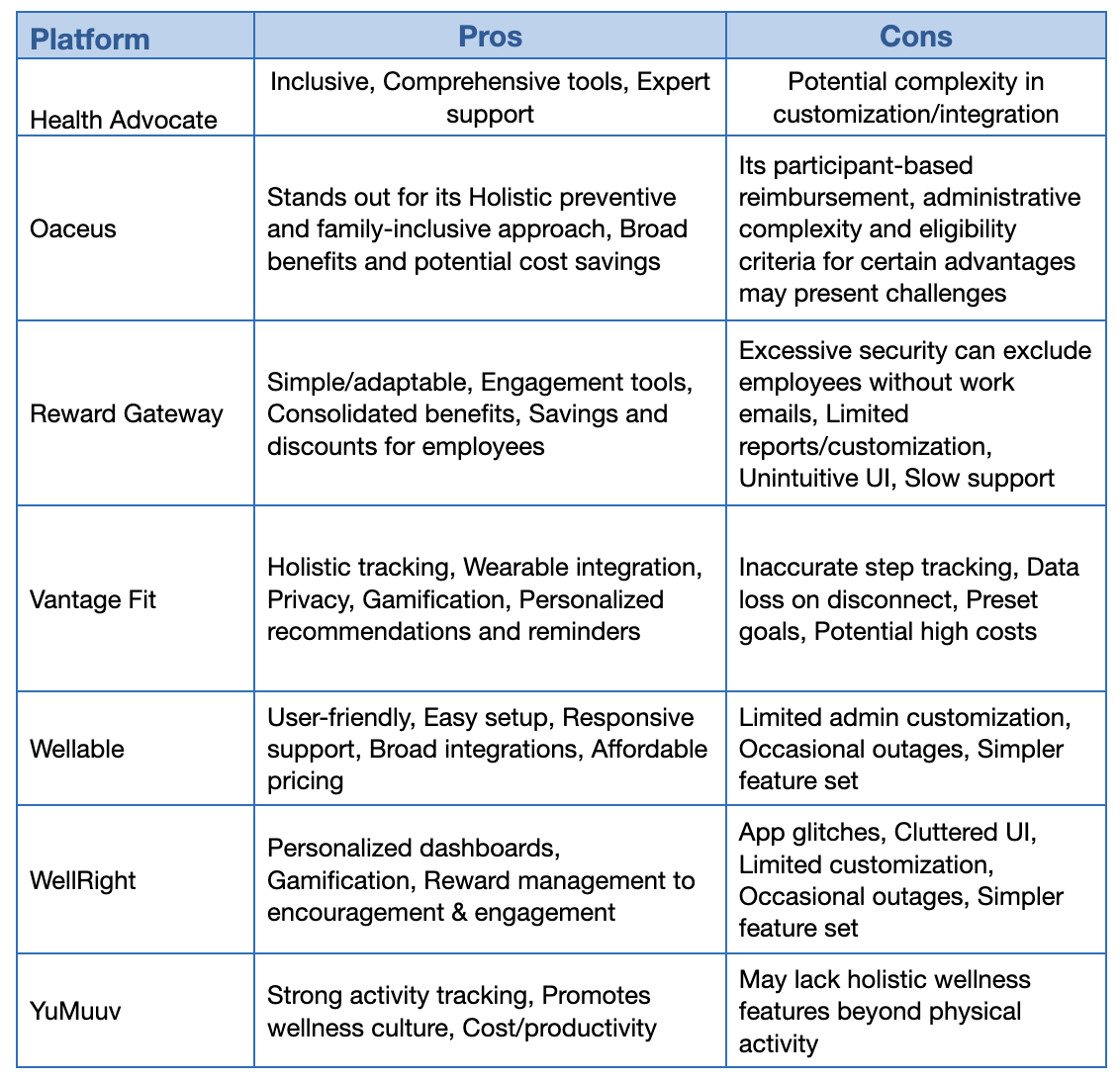

Wellness Platforms

Note: Suitability depends on an organization's specific needs, such as the importance of customization, holistic wellness, ease of use, or integration with existing systems

Appendix 4

Pros and Cons of Wellness Incentives

Appendix 5

The IRS has ruled the following expenses qualify for tax-free reimbursement:

- Acupuncture (excluding remedies and treatments prescribed by acupuncturist)

- Alcoholism treatment

- Ambulance

- Artificial limbs/teeth

- Chiropractors

- Christian Science practitioner’s fees

- Contact lenses and solutions

- Co-payments

- Costs for physical or mental illness confinement

- Crutches

- Deductibles

- Dental fees

- Dentures

- Diagnostic fees

- Dietary supplements with doctor’s le]er of medical necessity

- Drug and medical supplies (i.e. syringes, needles, etc.)

- Eyeglasses prescribed by your doctor

- Eye examination fees

- Eye surgery (cataracts, LASIK, etc.)

- Hearing devices and batteries

- Hospital bills

- Insulin

- Laboratory fees

- Laser eye surgery

- Nutritional counseling, weight-loss programs, and gym memberships if the purpose is to treat a specific disease diagnosed by a physician

- Obstetrical expenses

- Oral surgery

- Orthodontic fees

- Orthopedic devices

- Over-the-counter medication

- Oxygen

- Physician fees

- Prescribed medicines

- Psychiatric care

- Psychologist’s fees

- Routine physicals and other non-diagnostic services or treatments

- Smoking-cessation programs

- Smoking-cessation over-the-counter drugs

- Surgical fees

- Vitamins with doctor’s letter of medical necessity

- Weight-loss programs with doctor’s letter of medical necessity

- Weight-loss over-the-counter drugs with doctor’s letter of medical necessity

- Wheelchair

- X-rays

Appendix 6

Key points from IRS guidance:

- Wellness Incentive Payments Are Taxable: If a wellness program provides cash or cash-equivalent benefits (such as gift cards or direct payments) to employees for participating in wellness activities, and those payments are not strictly reimbursements for qualified medical expenses, the IRS considers those benefits taxable wages. Employers must withhold federal income and employment taxes (FICA, FUTA) on these amounts [20] [21] [22] [23].

- No Double Tax Advantage: The IRS has specifically cautioned against programs that attempt to provide both pre-tax premium payments and tax-free benefit payments under fixed indemnity or similar plans, as this would constitute “double dipping.” If premiums are paid pre-tax and benefits are not strictly for unreimbursed medical expenses, the benefits are taxable [20] [23][24]

- Qualified Medical Expenses Only: Only wellness programs that reimburse employees for actual medical care expenses (as defined by IRC Section 213(d)) can provide tax-free benefits. Payments for general wellness, nutrition, or personal health expenses that do not qualify under Section 213(d) are not excludable from income [21] [24].