In part 1, we learned about the origins, motivations and decline of insurtech 1.0, which brought us to early 2022. It’s often during recessions that enduring companies are born. Scarce access to capital forces new entrants to identify compelling opportunities and strive for compelling unit economics. Amazon, PayPal, Airbnb, Slack, Square and many others grew on the heels of a recession. They stand in contrast to the previous 10 years of the place-all-bets approach during a bull market and seemingly unlimited venture funding.

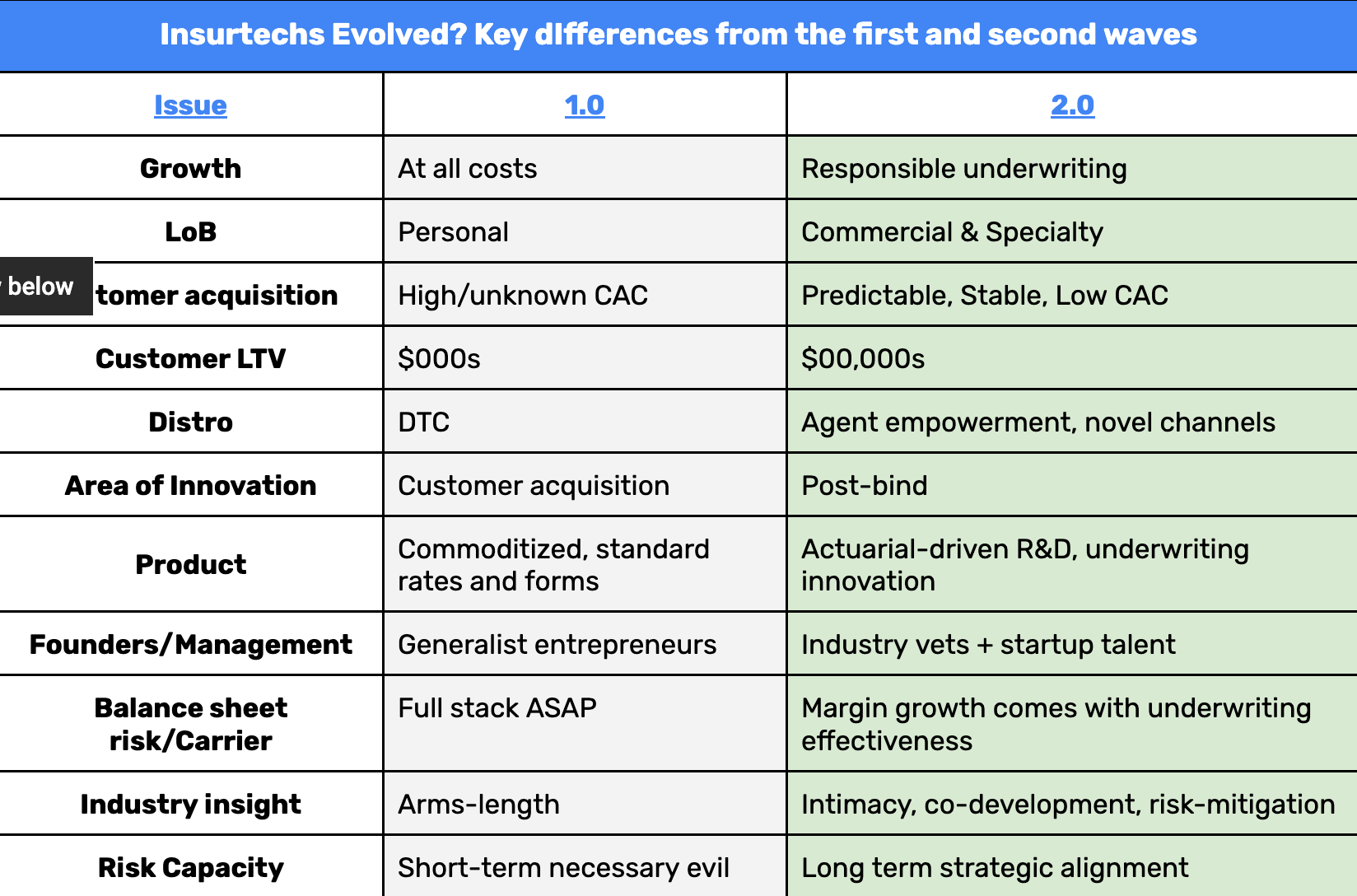

Insurtech 2.0 recognizes the innovators who came before but takes a more nuanced and collaborative approach to disruption, recognizing the structural issues inherent in insurance. For example, insurtech 1.0 sought largely to disintermediate agents, whereas a core focus of insurtech 2.0 is to partner with and enable them. Similarly, insurtech 2.0 companies have gotten smarter about identifying lines of business in need of change and are building solutions that incorporate better data and processes to better underwrite them.

Personal lines of insurance represent a massive premium pool, yet because advertising spending on personal auto alone is upward of $10 billion per year, customer acquisition costs are extremely high. insurtech 2.0 customer acquisition leans heavily on an agent channel and avoids costly GEICO-style Super Bowl advertising. Companies are focused on product and coverage innovation rather than user experience and acquisition.

In short, insurtech 2.0 has moved along the value chain, picking up where insurtech 1.0 ends, leading us into the heart of insurance. This second wave of insurtechs have more in common than appears, bearing many similar characteristics:

- Above all, responsible underwriting. The lesson from insurtech 1.0 is clear: Poor underwriting discipline has a cost on your financial performance, reinsurance capacity and fundamental viability. Reinsurers, in particular, have wised up from 2015 , when they were happy to participate as stand-alone capacity providers. They now expect some of the upside either through warrants or an investment and for their insurtech partner to share in the downside risk.

- Where is the pain? Hint: Look for lines of business with sky-high loss and efficiency ratios indicating something fundamentally upside-down. Insurtech 2.0 has attacked undesirable business lines or products that have lacked investment, innovation and imagination. There is significantly more upside potential here, but it requires insider knowledge and domain expertise to identify.

- Be a specialist. Specialty commercial lines are unsexy to many and understood by few. By definition, these tend to be higher-ticket items and are relationship-driven. B2B/enterprise sales requires a different marketing mix, which will follow less of a playbook than B2C. Also, commercial lines are by no means homogenous, making it much easier for insurtechs to find staying power within multibillion-dollar insurance “niches.”

- Distribution disruption? Despite the promise of digital distribution, insurance has remained stubborn. Between 2015 and 2020, there was a marginal shift to direct channels, with 90% of P&C products sold through agents, branches or brokers. Making traditional distribution channels more efficient while cultivating novel channels of distribution (e.g., at point of sale or “embedded”) can enable new opportunities.

- Manage risk. The best way to mitigate losses is prophylactically, or by avoiding them in the first place. Tech can play a great role in supporting more precise risk selection, pricing and loss control. The Internet of Things (IoT) can play a significant role, but this requires a laser-focused implementation and persistent attention. At long last, the role of rebating is being reviewed by regulators, recognizing how a tech-enabled feedback loop can lead to a virtuous cycle.

- Actuarial-driven R&D. Actuarial staff shouldn’t emerge from the basement fortnightly to make rate filings. With increased connectivity via IoT, we know machine variances are generally less than human behaviors. The days of waiting for five or 10 years of tabular data are unnecessary. Risk profiles are evolving too fast, and the industry is increasingly competitive; a process for modifying pricing and managing coverage forms to keep pace is a necessity. To be clear, actuarial skills need to keep pace with broader trends, but industry can only advance as regulators permit.

- Intimately understand the risk you insure. Gone are the days of an arms-length relationship between insured and insurer. Partner with industry to co-develop and collaborate. Underwriters, actuaries and software engineers need to become increasingly expert to help refine models and pricing.

See also: 4 Technology Trends for 2022-2023

The table below illustrates key differences between the first two generations of insurtechs. We are clearly in early innings of insurtech 2.0, but some commercial lines of business are already showing maturity. As the economy teeters on the edge of a recession, investors and business leaders continue to look for a path to profitability with less patience for vanity metrics, so it’s entirely possible we haven’t begun to see heroes emerge from the current wave of startups.