If software is eating the world, its last supper might just be insurance. The amount of insurance premium is gargantuan – about $6 trillion globally in 2021. Anyone looking to take a bite out of it is advised to bring patience–lots of it.

Expense ratios (expenses expressed as a percentage of premium) have remained constant for several generations. This either indicates that the massive investment in technology has not yet touched insurance or that technology initiatives have failed to make the bloated industry more efficient.

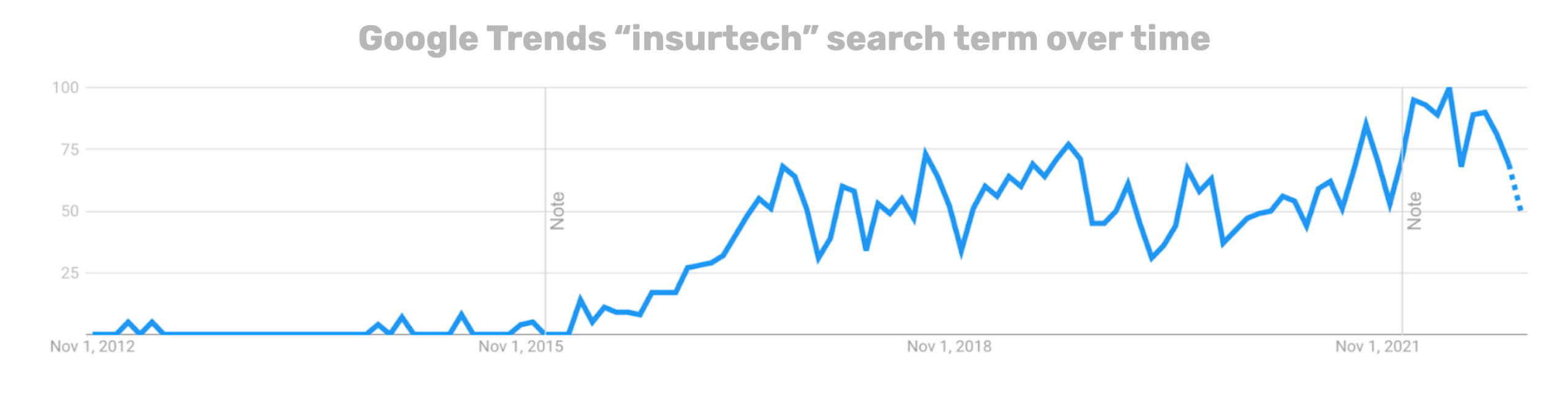

Either way, it’s clear why entrepreneurs and investors gravitate toward insurance, coining the term insurtech for a new breed of startup seeking to disrupt with a fresh, tech-forward approach.

Some argue the birth of insurtech was Karen Clark’s pioneering work in catastrophe modeling in the 1980s. Others say it was in the 1990s, with Progressive’s advanced use of data warehousing technologies, applying a Capital One-like approach to insurance through mass customization. Or maybe it wasn’t really born until it had a label, circa 2016.

What probably matters more to readers is the what. To say an insurtech is any entity that uses tech in the insurance industry seems simplistic; surely legacy insurance players use technology. Maybe we can agree that insurtechs spend a greater percentage of expenses on R&D or IT and that other metrics make them more efficient. A practical consideration is, what does the insurtech do? Does this mean selling to an insurance carrier? What about being a carrier, MGA, independent agent, reinsurer, claims administrator or actuarial consultant? There is no elegant taxonomy of the landscape, nor is one needed.

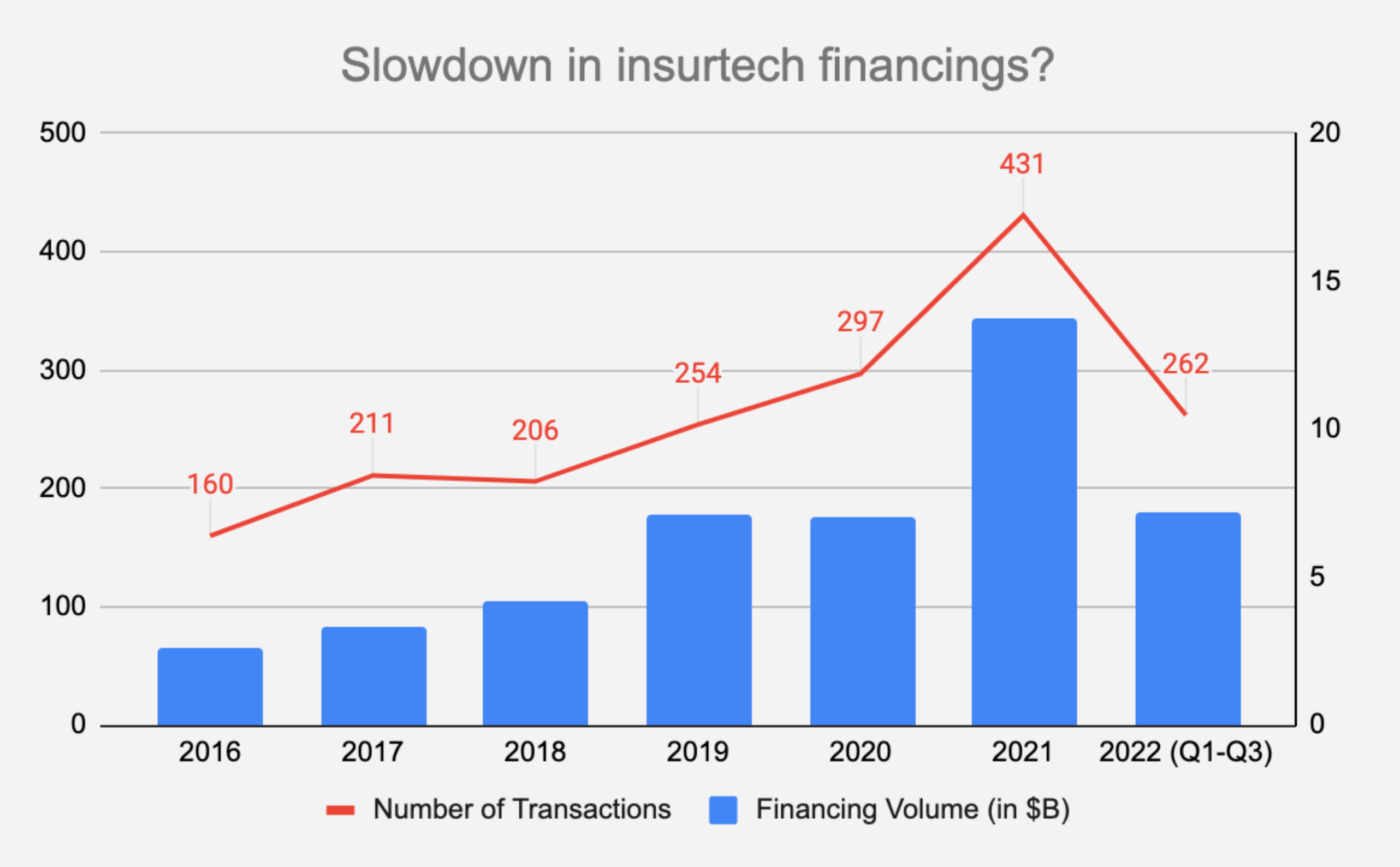

The past few years have seen a surge of interest in all things insurtech: first, we saw cries of disruption, aggressive fundraising and rapid growth. VCs seeded hundreds of companies to identify opportunities across life and health, property and casualty. Investors seemingly multiplied, corporate investors and innovation groups flourished. While this all came to a screeching halt in early 2022, there is much to be written about this first wave of insurance startups.

See also: Insurtech Success Stories: Still Waiting for Godot

Source: FT Partners Q3 2022 Quarterly Insurtech Insights, p9

We call the initial rise of interest in insurance technology Insurtech 1.0. While the origins may be debated, these would-be disruptors executed several common strategies with varying degrees of success. If we seek to improve on what insurtechs can be, it is critical to understand what Insurtech 1.0 strived to accomplish, where it succeeded and where it fell short. Below is a consolidated list of common misconceptions from the first wave:

- Personal lines are the low-hanging fruit. Everyone is a consumer before anything else, so it made sense that investors would initially be attracted to companies building the products they interact with. However, off-the-shelf homeowners, renters and personal auto are commoditized products that are efficiently priced, sold and backed by heavy marketing budgets and entrenched agents. In addition, these products typically become profitable only when bundled. Because monoline personal lines products are relatively low-ticket items with significant acquisition costs, the juice is only worth the squeeze if you can capture all of the customers’ needs over time. While insurtechs have made great strides in creating a buying experience that feels similar to other (non-insurance) customer experiences, this is not sufficient. They have failed to acquire customers more cheaply than incumbents and upset agents in the process– those same agents they now seek as an ironically affordable acquisition channel.

- The strategy should be to capture market share first and turn in profitable results later. In insurance, writing premium without regard for profitability isn’t difficult. While growth at all costs is typically rewarded in venture-backed industries, it is paradoxically a warning sign for insurers playing in efficient markets; binding too many policies at too fast of a clip usually signals an underwriting, rate or coverage issue that the market is taking advantage of. Ignoring or being naive to these signs means you can expect adverse selection and a frightening loss ratio in short order. With a short claims development tail, personal lines can improve, but this likely means churning the very customers that you just spent a pretty penny on to acquire or leaving your fate in the hands of regulators to approve significant rate changes.

- Disrupting insurance requires outside talent and thinking. Simply put, entering a highly regulated and nuanced industry without a key unfair advantage is challenging. While early insurtechs thought of themselves as software companies above all, the reality is that domain expertise in insurance is not only advantageous but essential. Contrary to the mantra of move fast and break things, the legacy of insurance is much the opposite. To be sure, there is a vast and largely unexplored middle ground, but ignore the experience of a 400-year-old industry at your own peril.

- MGA to full stack, stat! Buying a carrier is a good pitch for requiring additional investor capital and was worn as an early badge of honor that an insurtech had “made it.” But adding capital requirements, regulatory compliance and oversight have proven to be a more of a burden than anything else. While this leap is absolutely worth the cost at the right time, trailblazers seemed in a rush to grow up for the wrong reasons. In this new market environment, insurtechs will struggle to get any credit for vanity metrics.

See also: 3 Paths for Insurtechs in 2023

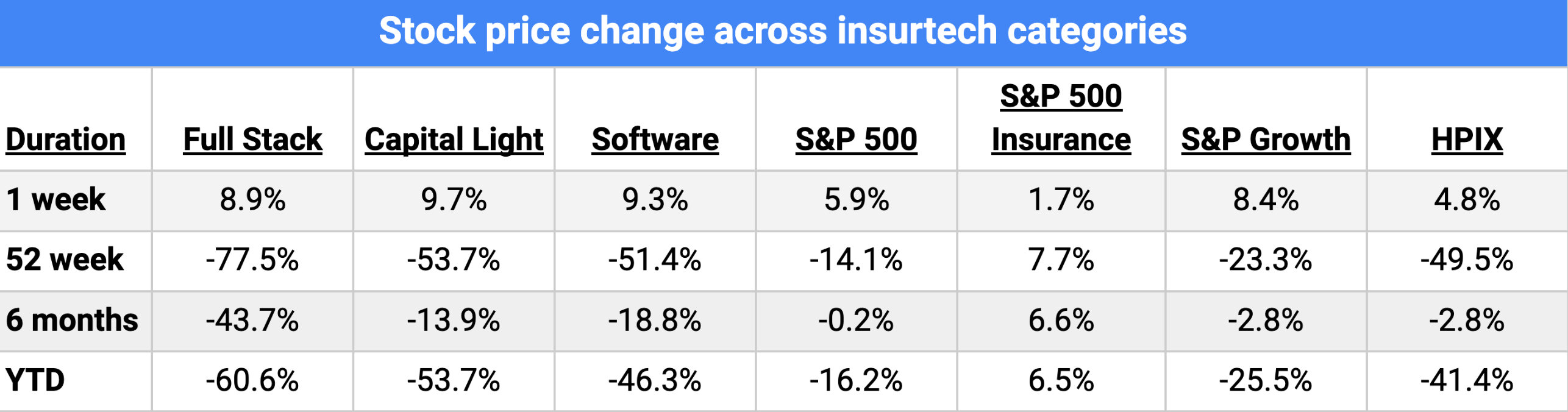

Some of these startups aren’t as enduring as we had hoped. In somewhat ironic fashion, over the last 18 months, the S&P 500 Insurance index has significantly outperformed the S&P 500, full stack carriers, the HPIX insurtech index and others. This is evidence that insurance can be a stubborn industry, one needing more than an infusion of technology and compelling design. It provides incumbents and a next wave of startups a well-worn playbook to define success and avoid the same mistakes.

In sum, the legacy of Insurtech 1.0 may be more enduring than the actual companies. These startups forced incumbents to recognize their intransigence, ushering in a new area of customer-centered development.

Source: Jefferies Insurtech Weekly News Update, November 13, 2022 Jefferies LLC