The insurance industry is investing heavily in AI, primarily to automate functions across underwriting, claims, fraud detection, and customer experience. However, despite the increase in investment, few carriers have extracted outsize value from AI, largely because enterprise rewiring has been focused solely on speed instead of context.

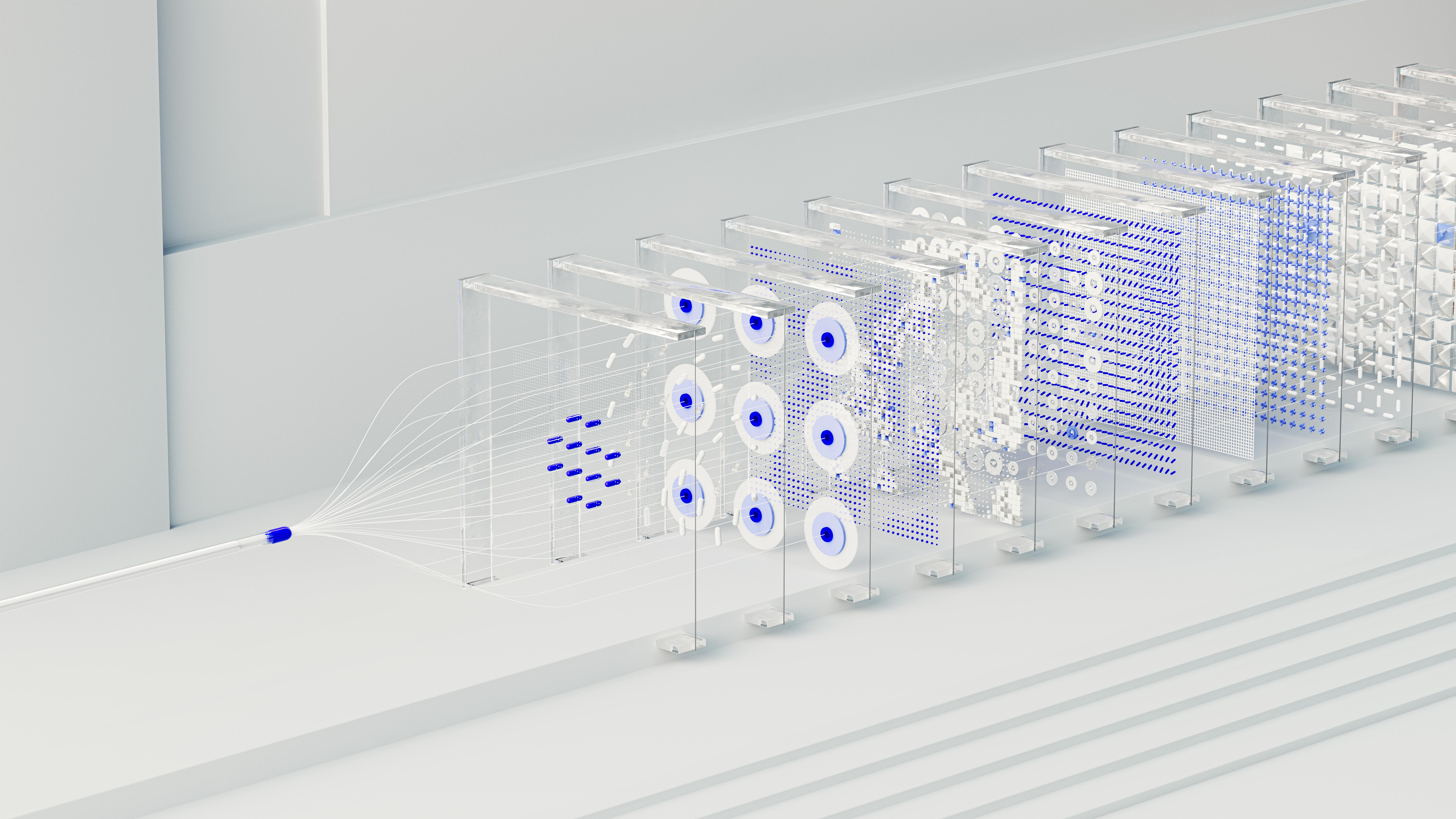

Automation is undeniably on the rise, but automation that prioritizes speed without understanding runs the risk of misfires. And in insurance, misfires are costly. Humans remain essential for nuanced decisions, especially in complex or highly emotional scenarios. Scaling AI responsibly is possible, but it requires a shift from a speed-first to a context-first approach. Models must understand not only the patterns they're analyzing, but the underlying reasons behind them.

The Accuracy Gap

Insurers have made significant progress in developing predictive models that identify probabilities with increasing precision. However, these models are constrained by the need for explainability. Regulatory requirements mean actuarial and underwriting models rely on limited, well-understood variables, creating a gap between what advanced machine learning could predict and what insurers can reasonably deploy. As a result, models often struggle to capture the full nuance behind risk, reinforcing the need for human judgment in complex or exceptional cases.

Generative AI and machine learning systems can support everything from claims triage to fraud detection, yet their decision-making abilities quickly erode when context is missing. Because of this, underwriters and claims professionals continue to shoulder the burden of work, as most cases need manual intervention as "exception" cases from a standard predictive model. For example, adjusting perils for unusual environmental factors or managing emotionally charged claims where customer history, tone, and circumstances matter.

Underwriters are often presented with the promise of "black box outputs" that could materially improve decision quality, even though such models are rarely fully incorporated into production due to transparency requirements. The potential performance gains are compelling, but the lack of explainability introduces governance, compliance, and audit challenges that prevent widespread adoption.

As a result, AI and automation are often used to accelerate modeled decisions, such as automating data gathering processes, rather than to enhance the quality of those decisions. Speed becomes the default measure of progress, while insurers still rely on humans to interpret context and manage high-stakes judgments. In a regulated industry where defensibility is paramount, this focus on efficiency over insight limits the potential value of AI.

Why Context Matters

Context is the cornerstone of trustworthy outputs. Contextual intelligence allows insurers to model the nuances behind decision-making that traditional analytical approaches often miss. Decisions aren't made solely on isolated transactions or entities; they depend on how these elements relate to one another.

Many critical factors remain hidden: loss performance reflects both human behavior and environmental conditions, and while the latter are difficult to influence, the former, like insureds' relationships with other individuals or businesses, are frequently under-modeled. Most insurers evaluate behavior in the context of a specific line of business, but miss signals such as commercial directors' histories at prior firms, social relationships with other stakeholders, or patterns spanning personal and commercial lines. Accessing this kind of data quickly and reliably is challenging, which is where context is often lacking from many decisions.

While horizontal uses of AI, such as summarization or transcription, provide operational support, they rarely deliver transformational change. Vertical, context-aware AI, by contrast, enables true next-best-action guidance. It can prioritize claims based on severity and customer value, evaluate broker behavior over time, or surface hidden relationships across complex books of business. According to Deloitte's 2025 Insurance Technology Trends Report, even as AI systems progress, they will still rely heavily on connected datasets to provide "actionable insights" to both regulators and customers.

Transformative Applications

Insurers are already beginning to explore how contextual AI can reshape core operations. In underwriting, context-aware models can evaluate risk holistically, incorporating nuanced exposures, historical performance, customer behavior patterns, and third-party datasets. These systems support more fair, accurate, and consistent decisions. According to a 2025 CEFPro study, insurers that are already applying contextual AI to underwriting have reduced processing time by 31% and enhanced risk assessment more than 40% while improving overall efficiency.

In claims, AI models paired with human oversight are accelerating adjudication while preserving transparency and auditability. Context helps claims teams identify which cases can move quickly and which require deeper review, improving both cycle time and customer satisfaction without compromising regulatory scrutiny. It also helps more accurately model claim severity and find aggregate recovery opportunities due to recurring third-party fault, something which often goes undetected in claim-centric analyses.

In fraud detection, contextual AI can identify coordinated fraud rings, reduce false positives, and improve straight-through processing rates. Building contextual relationships before flagging anomalies leads to far more accurate decisions, confidently catching the largest threats and letting good customers flow through frictionlessly, improving customer experience while reducing leakage and supporting revenue growth.

Governance and Readiness

Strong data governance is no longer optional; it is a prerequisite for responsible AI adoption. No model, no matter how technically sophisticated, can compensate for weak data foundations. Insurers leading the market are actively investing in robust governance frameworks that include model monitoring, explainability standards, auditable decision trails, and continuing regulatory alignment.

The Evident AI Insurance Index shows that the top-performing insurers prioritize transparency and ethical AI development, linking performance to strong governance and leadership accountability. This demonstrates that AI success is not just about technology; it's about embedding trust and oversight into every stage of deployment.

Meanwhile, the IAIS Mid-Year Insurance Report emphasizes that resilience in AI deployment depends on trustworthy data foundations and consistent oversight. Together, these findings highlight a critical lesson: insurers that invest in robust governance and high-quality data are better positioned to scale AI effectively, reduce risk, and generate measurable business value.

Defining the Next Chapter of Insurance AI

The insurance industry has reached an inflection point. AI's success will not be measured by how many processes it automates, but by how effectively it helps humans make better, more defensible decisions. Insurers that prioritize integrated contextual data, invest in human-AI collaboration, and build systems that are explainable and auditable will be the ones who unlock AI's full potential.

As the industry moves into 2026 and beyond, context will be the competitive currency that determines which insurers lead the market, and which are left trying to explain decisions they can't fully understand.